4.6 Exercise Option

This topic describes the systematic instruction to exercise specific styles of interest and currency options.

You can manually exercise specific styles of interest rate and currency options. Automatic exercise of an option, if the option is marked for auto-exercise, is handled by a system batch process if the option is in-the-money at maturity.

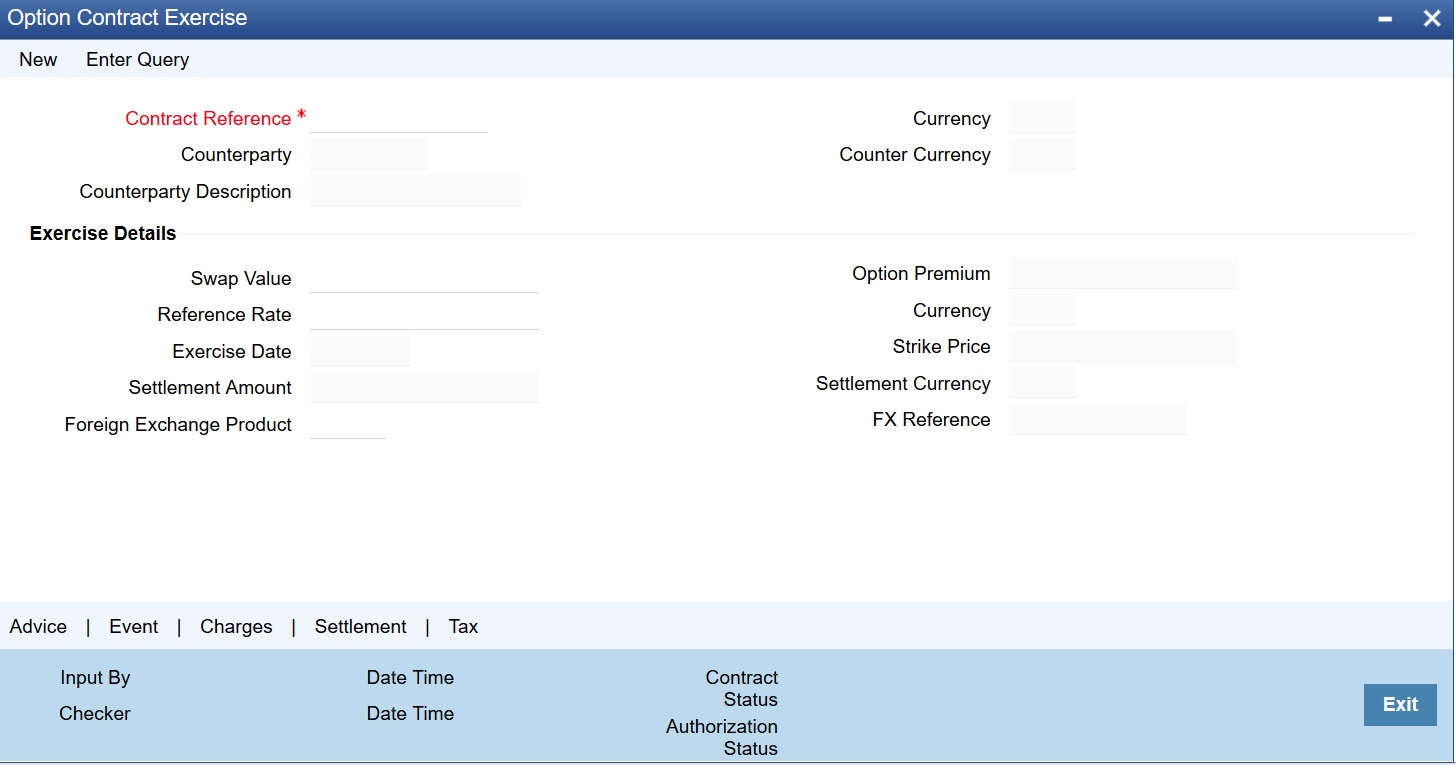

- On Home page, type OTDXCXER in the text box, and then click next arrow.

The Option Contract Exercise screen is displayed.

- On the OT Contract Termination screen, click New and specify the fields.

For more information on the fields, refer to the below Field Description table.

Table 4-27 OT Contract Termination - Holiday Details - Field Description

Field Description Contract Reference Number Specify the contract reference number . Settlement Date The settlement date is the date when you enter the application for manual exercise of the contract. This is populated automatically by the system. Reference Rate The reference rate is also automatically picked up by the system based on your specifications for the contract. You can modify it. This is used for calculating the settlement amount. Swap Value For swaption trade deals, you have to enter the swap value. This field is disabled for other types of options. FX Product Code For external currency option contract, the FX contract is separately uploaded with Oracle Banking Treasury Management reference number. While uploading the contract, the validation is done between maturity date of currency option contract and value date of FX contract. During EOTI process, the system will run a validation to check whether the creation of DV contract is pending for any IRO contract with its Swaption style as External.

Key details pertaining to the option – counterparty, contract currency, premium, premium currency, counter currency and strike rate – are automatically populated by the system.

A foreign exchange spot contract is created by the system on the exercise of physically settled currency options. For such contracts, the FX spot product under which the FX contract is to be created has to be specified. This is defaulted from your specifications at the product level. For such contracts, the contract reference number of the uploaded FX product is also displayed on the screen.

Manual exercise of an option contract is subject to the following conditions:

- Manual exercise is possible for all expiration styles for all types of options, except for non-swaption IROs – caps / collars / floors / corridors. These IROs can only have European style expiration. These IROs are automatically exercised as part of end-ofday or beginning-of-day batch process if they are in-the-money on maturity.

- For digital and no touch currency options, and for binary and plain vanilla currency options with European expiration style, auto exercise is done on the maturity date of the contract during end-of-day or beginning-of-day batch process if the option is in the money. These options can also be exercised manually, but only on the maturity date

- Swaptions can only be manually exercised. If a swaption is not exercised manually, it expires worthless on maturity. In case of manual exercise, revaluation at swap value is triggered. In case of a cash settled swaption, swap value is the settlement amount.

- For a physically settled swaption, the interest rate swap contract remains uninitiated until the manual exercise of the swaption is authorized.

- Manual exercise is permitted only if an option is in the money.

Parent topic: Process Over the Counter Option Instruments