- Securities User Guide

- Define a Product Combination

- Process a Combination Product

17.1 Process a Combination Product

This topic describes the systematic instructions to process a combination product.

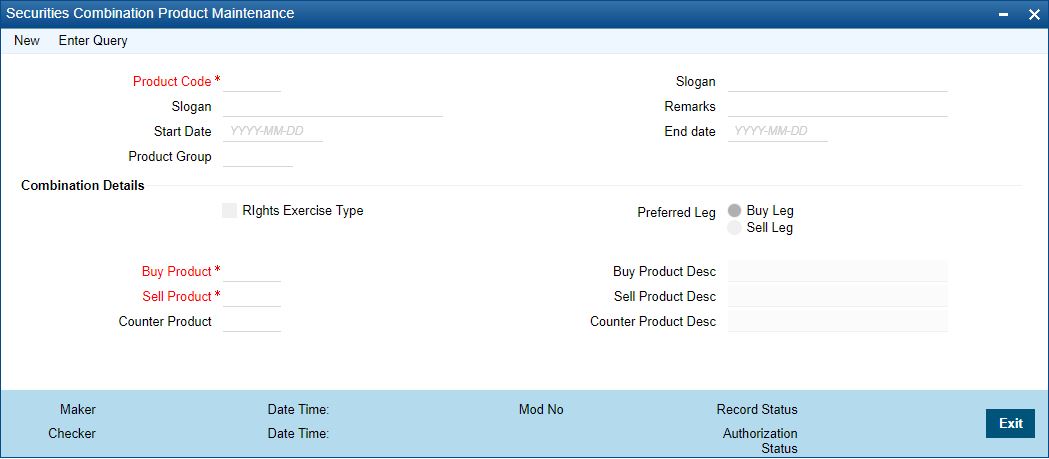

- On the Home page, specify SEDXCMBP in the text box, and click next arrow.

Security Combination Product Maintenance screen is displayed.

Figure 17-1 Security Combination Product Maintenance

Description of "Figure 17-1 Security Combination Product Maintenance" - On the Security Combination Product Maintenance screen, specify the fields.

The Securities Combination Product Maintenance screen is invoked from the Application Browser. To enter the details of a new deal, click new icon from the tool bar.

From the Summary screen, you can to open an existing product combination, by double clicking on it.

Table 17-1 Security Contract Product Maintenance - Field Description

Field Description Product Code

In Oracle Banking Treasury Management, each product combination that you create is identified by a unique four-character code called a product code. You can follow your convention for devising this code, however, one of the characters of the code should necessarily be a letter of the English alphabet.

Description

Specify a short description that will enable you to identify the product combination easily.

The short description specified is for information purposes only and will not be printed on any customer correspondence.

Product Group

Each product combination is classified under a specific group. The different groups are defined in the Product Group Definition screen. To indicate the group to which a product belongs, select a group code from the list.

Product Slogan

Specify a marketing punch line to be associated with the product combination. This slogan will be printed on all the advices that are sent to the customers involved in a deal involving this product combination.

Specifying the life-span of a product

A product combination that is defined can be used over a specific period by defining a start and an end date. The settlement date of a deal involving a product should be:

- The same as or later than the Start Date

- The same as or earlier than the End Date of the product

The start and end date of a product combination is useful when you are defining a product combination for a specific period.

Note:

If you do not specify an End Date, a message is displayed prompting you to indicate whether you are creating an open-ended product combination. In this case, the product combination can be used until it is closed.

Product Remarks

Specify information about the product combination, intended for the internal reference of your bank. Your remarks will not be printed on any correspondence with the customer.

Combining two deal products into a combination

When you create a product combination, you should only associate two unique deal products. One, catering to the buy leg and the other to the sell leg of a deal. The combination could be between any of the types listed below:

- Bank buys

- Bank sells

- Customer buys

- Customer sells

For instance, you could create a combination for a bank buy and a customer sell. After this, indicate the sold product that constitutes the combination.

Indicating the preferred leg

When creating a product combination, indicate the Preferred Leg of the combination, under the preferred leg option. The attributes defined for the preferred leg will be inherited by all deals associated with the product combination.

Indicating that a product combination can cater to rights and warrants exercise

Create a product combination to cater to the exercise of rights or warrants. When you choose to exercise rights that arise out of your holding, you should make a combination product, with the rights exercise option applicable to the deal. If you select the rights exercise option, you should also indicate the counter product that should be used, when rights are exercised. A counter product is a product combination (with a buy and sell leg) that will be applicable when rights are exercised. You can select a counter product from the option list available.

In Oracle Banking Treasury Management, the exercise of rights involves four steps:

- The selling of rights

- The buying of rights

- The buying of the resultant securities

- The selling of resultant securities

The buy leg of the combination product will cater to the buying of resultant securities and the sell leg to the selling of the resultant securities by the SK location. The sell leg of the counter product caters to the selling of rights from the portfolio, which is doing the exercise and the buy leg to the buying of rights from the SK location of the holding.

For example, suppose that you hold 100 units of equity in a bank portfolio. To the equity is attached 100 rights that can be exercised on 15, June to purchase 100 units of shares.

When you exercise the rights, you should associate with the deal, a product combination that caters to the exercise of rights. All the details that you specified for the product combination will apply to the deal.

Parent topic: Define a Product Combination