- Securities User Guide

- Process Security Deal

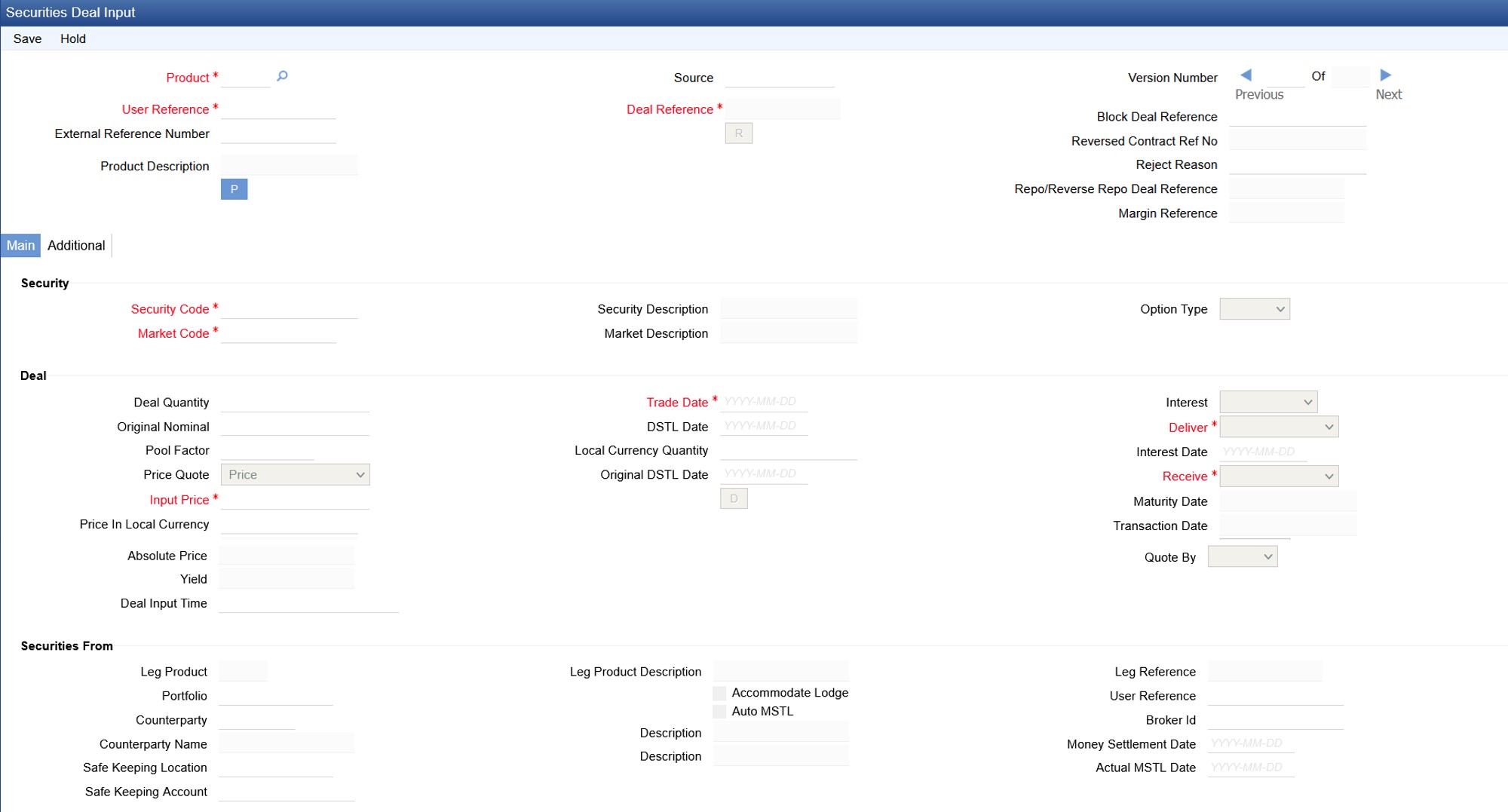

- Securities Deal Input Screen

- Process Securities Data Input Screen

21.1.1 Process Securities Data Input Screen

This topic describes the systematic instruction to process security data input screen.

- On the Home page, specify SEDXDLNL in the text box, and click next arrow.

Securities Deal Input screen is displayed.

If you are calling a deal that has already been created, choose the Deal Input Summary option. The details of all the deals that you entered earlier will be displayed in a tabular form. From the summary screen, you can open an existing deal by double clicking it.

- On the Security Deal Input screen, specify the fields.

The securities deal input screen, as it appears contains a header and a footer containing fields that are specific to the deal you are entering. Besides these, you will also notice two tabs and an array of icons, along the lines of which you can enter details of a securities deal.

Table 21-1 Field Description

Field Description Main

Click this tab to enter the essential terms of a deal. This screen, along with its fields have been detailed under the head ‘Entering the details of a deal’.

Additional

In the screen that corresponds to this tab, you can enter additional details that are required to process the deal. The screen also displays price-related details, calculated on the basis of the amounts that you specified in the Main screen. The features of this screen have been detailed under the head ‘Entering additional details of a deal’.

On the Securities Deal Input screen, you will also notice a toolbar with icons. The same set of icons is available for each leg of a deal. The buttons on this toolbar enable you to invoke several functions that are vital to processing a deal. These buttons have been briefly described below:

Advices

Click this icon to invoke the advices screen. In the screen corresponding to this icon you can view, suppress and prioritize the advices that are to be generated for each leg of the deal. This screen along with its fields has been detailed under the head ‘Specifying Advices for a deal'.

Brokerage

Click this icon to indicate brokerage details applicable to the deal leg.

Charges

This button process the Charge service of Oracle Banking Treasury Management. On invoking this function you will be presented with a screen where the charge rate, amount, currency, and the waive charge parameter can be specified.

The procedure for making charge components applicable to a deal leg is discussed under the head 'Levying charges on a deal'.

Deal Match

If you are trading in a portfolio that involves deal matching, you can indicate deal-matching preferences. Click this button to match earlier buys in a portfolio, to the deal you are processing.

Events

Click this icon to view details of the events and accounting entries that the deal involves. The screen also displays the overrides that were encountered for the deal.

Limits

Click this icon to view the forward profit that you have made or the loss that you have incurred on account of the deal.

WalkIn

In the screen that corresponds to this button, you can indicate the credit lines under which your liability to the deal should be tracked. The details of this screen are discussed under the head ‘Specifying credit administration details’.

MIS Details

Click this icon to define MIS details for the deal.

Netcons

Click this icon to view your net consideration in the deal.

Parties

In the screen that corresponds to this button, you can indicate the parties involved in the deal.

Settlements

Click this icon to invoke the settlement screens. Based on the details that you enter in the settlement screens, the deal will be settled. The details of these screens have been discussed in the section titled ‘Maintaining Settlement Instructions.

Tax

This screen process tax. The application of tax on a deal is discussed under the head 'Levying tax on a deal'.

Product

You should necessarily use a product or a product combination that has already been created to enter the details of a deal. Based on the type of deal you are entering, you can select a product or a product combination from the list of values available at the 'Product' field. You must use a product combination to process the following deal types that involve two legs (a buy and a sell):

- Bank portfolio buys and sells

- Customer buys and sells

- Accompany lodge and withdraw

You can use a deal product to process a:

- Deal that involves only one leg (either a buy or sell)

- Safe keeping location (SKL) to SKL transfer and

- To Block securities

A deal will inherit all the attributes defined for the product to which it is associated. For deals that are associated with a product combination, the preferences specified for the preferred leg of the product combination will be applied. You can further add details that are specific to the deal like the deal amount, details of the buyer, the seller, etc. and process the deal.

Block Deal Reference

This is a system generated deal reference for the sub-deals, created by way of a block deal product.

Reversed Contract Reference Number

The reference number of the contract that is being reversed and rebooked is displayed here.

User Reference

You can enter a reference number for the deal. A deal will be identified by this number in addition to the ‘Deal Reference No’ generated by the system. This number should be unique and cannot be used to identify any other deal. By default, the Deal Reference Number generated by the system will be taken as the User Reference No. While reversing a deal the tag 23Gis populated as CANC. In this case tag 20C:: INGENL should be populated with the value DCN. For the subsequent A1 (Linkages) block, the value for the tag 20 C will be populated as '20C::PREV//' followed by the reference number.

Deal Reference

In Oracle Banking Treasury Management, reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the deal you are entering, it is also used in all the accounting entries and transactions related to this deal. Hence the system generates a unique number for each deal. The deal reference number is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date and a four-digit serial number.

The Julian Date has the following format:“YYDDD”Here, YY stands for the last two digits of the year and DDD for the number of day (s) that has/ have elapsed in the year. For example, January 31, 1998 translates into the Julian date: 98031. Similarly, February 5, 1998 becomes 98136 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those elapsed in February (31+5 = 36).

External Reference

If the transaction is being uploaded from an external source, you can specify the identification for the transaction in the external source, as the external reference number.

Source

Indicate the source from which contracts have to be uploaded.

Security Code

While entering the details of a deal, you should indicate the security that the deal involves and the market in which it is traded. You can select a security code from the pick-list. The pick-list contains a list of all the securities that you maintained in the Securities Definition screen. The trading in the security should be allowed for the portfolios involved in the deal.

As you have already maintained details of the security, all the features of the security like its price, the quotation method, the corporate actions that it involves and several other details of the security will be processed based on these details. After you indicate the securities that are being traded in the deal, you can indicate the market in which they are traded. The market in which the security is traded is defaulted from the Security Definition screen. You can change the default and select a market code from the pick-list available. The pick-list contains valid market codes maintained in the Market Definition screen.

Market Code

Indicate the market in which the security involved in the deal is traded. Select a market code from the option list. The option list contains valid market codes maintained in the Market Definition screen. The market in which the security is traded is defaulted from the Security Definition screen. You can change the default.

Rules for amendment

The entries made in this field can be amended before the deal is authorized. However, if amendment is required after authorization, you should reverse the deal and enter it again.

Deal Type

Indicate the type of deal you are processing. Using the Securities module of Oracle Banking Treasury Management, you can enter spot or forward deals. You can choose the appropriate option from the option list. A spot deal is one that settles on or before the spot date of the deal. A forward deal is one that settles on a date after the spot date of the deal.

Deal Quantity

Securities that are traded can be quoted in terms of:

- Units (100 units of a security), or

- As a Nominal (securities worth USD 5000).

The system will automatically compute the Deal Quantity for instruments with ‘Asset Backed Security’ checkbox checked.

Deal Quantity = Original Nominal * Pool Factor

The system will validate whether ‘Deal Quantity’ is the product of ‘Original Nominal’ and ‘ Pool Factor’. Otherwise, it will display an error message.

The price quotation method defined for the security in the security definition screen is defaulted. You can change the quotation method that is defaulted. The deal quantity that you specify should be expressed in the security quotation method.

Original Nominal

Specify the Original Nominal value. It indicates the basis for deal quantity or nominal for deals involving Asset Backed Security instruments.

Pool Factor

Specify the pool factor. It should be less or equal to one and should be lesser than the previous redemption factor and greater than the following redemption factor.

If the ‘Pool Factor’ is not provided, then the system will default the ‘Redemption Quantity’ as the ‘Pool Factor’ in the deal. If either of ‘Deal Quantity’ or ‘Original Nominal’ is not provided, then the system will derive the same using the ‘Pool Factor’.

Reject Reason

Specify the reject reason code for payment reversal message. The option list displays all valid codes maintained in the system. Choose the appropriate one.

Repo/Reverse repo reference number

This field captures the Repo/Revere repo booking or liquidation.

Note:

When a deal is linked to a repo/reverse repo or margin, system does not allow you to reverse, manually liquidate, delete, amend, close, cancel, or hold the deal.

Margin Reference

Margin Reference number is displayed as required.

- On the Security Deal Input screen, click Holiday Preferences.

For more information on Holiday Preferences, see the section Holiday Preference.

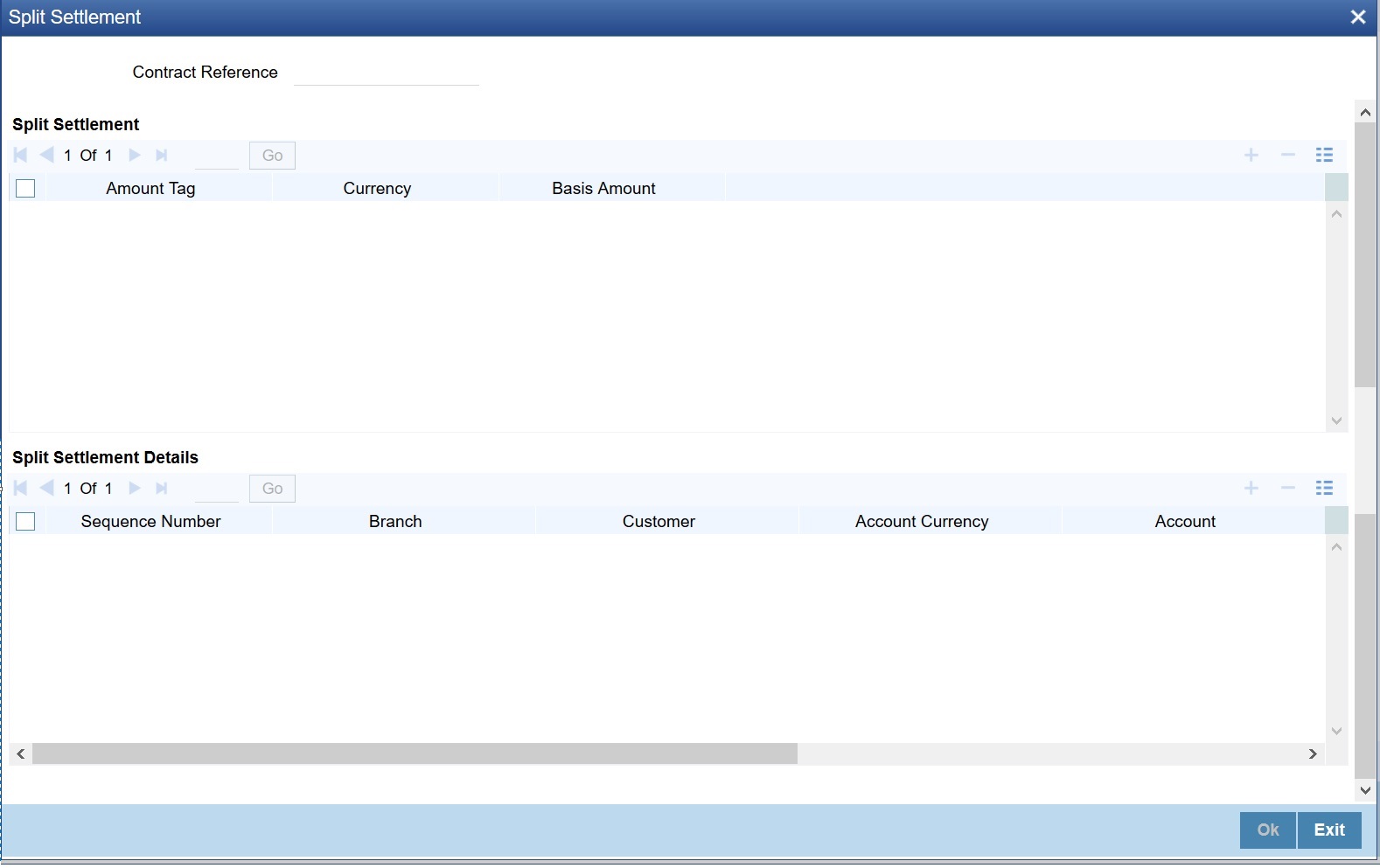

- On the Security Deal Input screen, click Split.

Split Settlement screen is displayed.

- On the Split Settlement screen, select a contract.

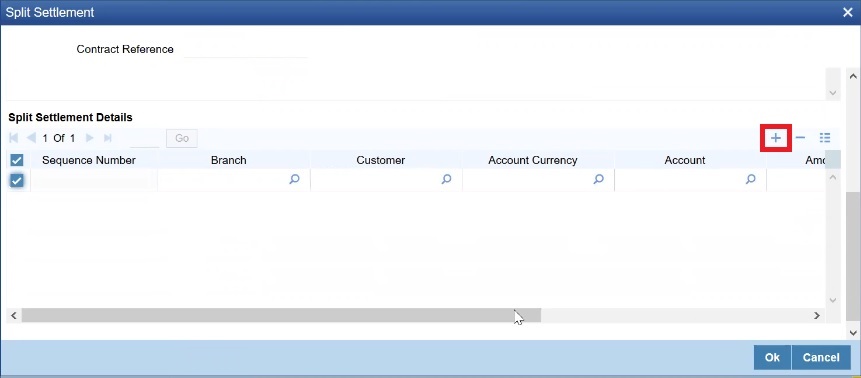

- On the Split Settlement screen, under the Split Settlement Details, click the + Icon.

Split Settlement screen with New Row added is displayed.

Figure 21-3 Split Settlement with a New Row

Description of the illustration splitsettlements_plus_symbol.jpgNote:

This process of splitting the settlements for a contract is allowed on the principal, Interest (Anticipated Interest for new contracts), and charges.

- On the Split Settlement screen, Select the Account Currency, Account, and, other necessary details as required to create a split.

- For every settlement contract the system allows a maximum of twelve splits.

- In case of auto-liquidation, you must unlock the contract and register the split, upfront, that is prior to auto-liquidation. You can update the split settlement for interest component after you save and authorize. SGEN is generated for each split amount. System will suffix the reference number in field 72 of MT202 and MT202COV with a hyphen followed by a running sequence number for each SGEN.

- Only if split settlement details are available, system will process the transaction accordingly, else the payment/settlement is treated as a single payment transaction

- If you are splitting the contract during the rollover, the application considers the latest available split details and process the liquidation amount, if any. If split settlement details are not available, the transaction (partial (liquidation as part of rollover) is treated as normal/regular/non-split liquidation. The split is allowed in manual rollover as well.

- For a single component, you can split the settlement amount and use the same settlement account more than once. There is no restriction on the repetition of split settlement amount for the same NOSTRO/settlement account.

- Cross currency split settlement is supported. The Amount field/column in the Split tab is, by default, in the contract currency (though not evident in the User Interface). The currency of the settlement account can be in a different currency. The converted amount has to be viewed in the accounting entries as part of Events tab only.

- Appropriate Amount tags, for each component like principal, interest and charges, are made available at the relevant event(s) for enriching the split settlement details.

This topic has the following sub-topics: