|

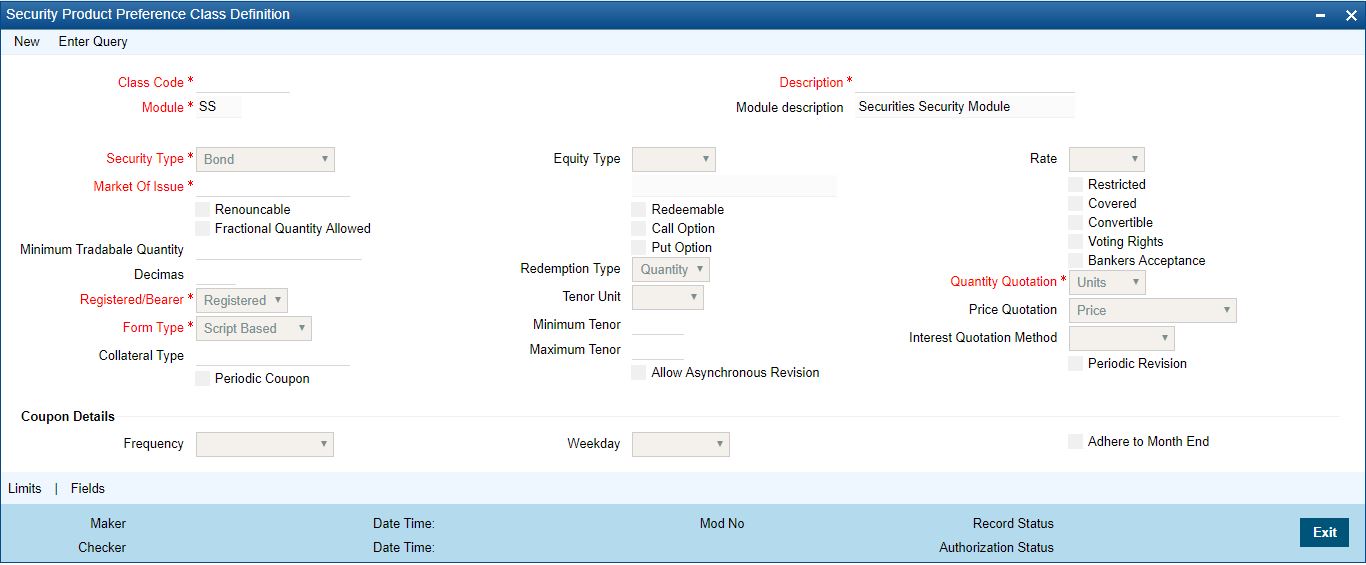

Class Code

|

Identify a security preference class that you build with a unique ten-character Class Code. You can follow your convention for devising the code.

|

|

Description

|

Briefly describe the Security Preference Class that you are defining. The description that you specify is for information purposes only and will not be printed on any customer correspondence.

|

|

Market of Issue

|

For a Securities Preference class, you can identify a Market of Issue. Only a market maintained in the Markets Maintenance screen can be specified. Your specification here will default to the security products associated with the class. However, when defining a product, while retaining the other preferences that default from the associated class, you can change the default market.

All securities maintained under a product, by default, will also be associated with the market specified for the product. However, when maintaining securities under a product, in the Securities Definition screen, you can identify different markets.

|

|

Security Type

|

The first preference defined for a class is the Security Type. Securities can be broadly classified into the following types:

- Bonds

- Zero Coupon Bonds

- Equities

- Rights

- Warrants

By indicating the security type, you restrict the application of a class on the products of a particular type. For instance, you can associate a Security Preference Class with the Security Type defined as Bonds, only on products maintained for bonds. The security type specified also determines the other references that you can define, for a preference class. For example, if you indicate the security type as Bond, you can also define details relating to interest.

|

|

Interest Details of bond

|

When maintaining a preference class for bonds, you must define interest-related details. These interest details will default to the security (bond) product with which you associate the class. These default interest details can be modified to suit the product.

|

|

Interest type

|

If you have indicated the security type for a preference class as Bond, you should also indicate the Type of Interest. It could be one of the following:

After defining the interest details, you can indicate the Coupon and Interest Rate Revision details.

|

|

The Interest Quotation Method

|

The Interest Quotation Method for a bond can be either of the following:

When the interest component is included in the market price of a security, the quotation method is referred to as Flat. A flat price of a security is also referred to as the Dirty Price. When the interest component is excluded from the market price of a security, the quotation method is referred to as Plus Accrued.

|

|

Coupon Frequency

|

When building a class of preferences, you can indicate if the coupons due for a bond are periodic. Coupons for bonds (maintained under the products with which you associate the preference class) will be calculated according to the periodicity that you specify. For an interest-bearing bond, with a periodic coupon, you must indicate the Coupon Frequency. Some coupon frequencies are listed below:

- Weekly

- Monthly

- Once in two months

- Quarterly

- Once in four months

If you indicate that the coupon frequency is weekly, you should also indicate the day on which the coupon is due. For instance, you can have a bond with a weekly coupon that is due on Wednesdays. If the coupon frequency is in terms of a month, you can choose to indicate that the coupon days should adhere to Month Ends. The implication of this option is explained in the following example.

You would like to maintain a product for Periodic Interest-bearing Bonds. The coupon frequency for securities maintained under this product is Half-yearly. You are defining a preference class that you would like to associate with this product, amongst others. In the Product Preference Class Definition screen, in the Security Type field, choose the Bonds option and the Periodic Coupon option. Now, you can specify the Coupon Frequency, as Half-yearly. You can opt to indicate that the coupon dates should adhere to month ends. Let us study the impact of the Adhere to Month End option, with relation to a security that you have maintained under the product. Assume the Issue Date of the Security is 30 June 2000, and the Maturity Date is 30 June 2002. The coupon frequency is half-yearly.

If you choose the Adhere to Month End option:

- 31 December 2000

- 30 June 2001

- 31 December 2001

- 30 June 2002

If you do not choose the Adhere to Month End option:

The coupons for this security would be due on the following dates:

- 30 December 2000

- 30 June 2001

- 30 December 2001

- 30 June 2002

The coupon due dates for all securities maintained under the product (with which you associate the preference class) will be calculated similarly, depending on the option you choose.

|

|

Interest Rate Revision Frequency

|

You can revise the interest rates for bonds with floating interest. The revision frequency can be different from the coupon frequency and is referred to as an Asynchronous (interest rate) Revision.

Asynchronous revision can be:

As part of your preferences for a Security Class, you can indicate Interest Rate Revision details. The revision details defined for the class will apply on all securities maintained under a product (with which you associate the class).

10-5 By default, interest rates will be revised according to the coupon frequency defined for a bond. If you would like to revise the interest rates at a different frequency, choose the Allow Asynchronous Revision option. If the asynchronous revision of rates is periodic, click on the Periodic Revision option, and specify the Revision Frequency. For a frequency that is weekly, indicate the day on which the revision is due. (For instance, you could indicate that the interest rates for securities should be revised every Monday.) If the revision frequency is in terms of a month, you can choose to indicate that the revision days should adhere to Month-Ends. The implication of this option is explained in the following example.

|