- Securities Repo User Guide

- Securities Financial Transaction Regulation

- Static Type Maintenance

Static Type Maintenance

This topic describes the systematic instruction to maintain static type.

This topic provides the instruction to maintain static types which are used to parameterize the SFTR reporting.

Note:

All fields marked with an asterisk (*) are mandatory.

- On the Home page, enter CODTRTYP in the text field and then click the next arrow.

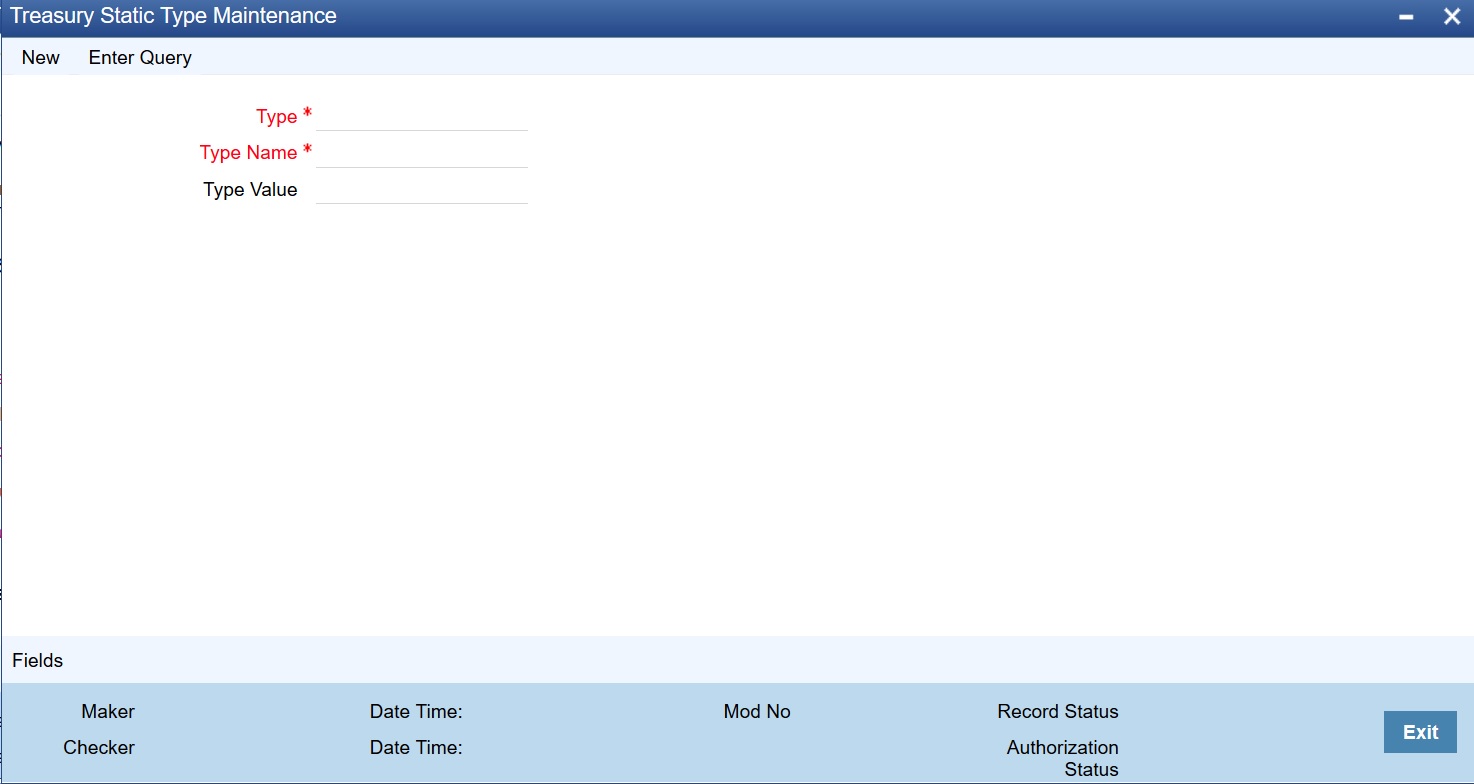

Treasury Static Type Maintenance screen is displayed.

Figure 4-1 Treasury Static Type Maintenance

Description of "Figure 4-1 Treasury Static Type Maintenance" - On the Treasury Static Type Maintenance screen, specify the details, and click Save to record the new maintenance.

xref describes the static maintenance types.

Table 4-1 Static Maintenance Types

Type Description SECTOR Sector of a counterparty

ADD SECTOR Additional sector of counterparty

TR VENUE Trading venue

AG TYPE Master agreement type

COLL METHOD Collateral transfer method

COLL TYPE Collateral type

For more information on the fields and combination of parameters to use in Treasury Static Type Maintenance screen, refer to below table. We recommend you use the parameter combination as shown in the below table.

Table 4-2 Field- Parameters Combination

Type Type Name Type Value SECTOR REIN

Reinsurance Undertaking

- CSDS

Central Securities Depository

- UCIT

UCITSS

ADD SECTOR ETFT

ETF

- MMFT

MMF

- REIT

REIT

- OTHER

OTHERS

TR VENUE XOFF

MIC-Admitted

- XXXX

MIC-Unadmitted

AG TYPE GMRA

GMRA

- CARA

Investment Industry

- CNBR

China Bond Repo

- OTHR

Others

COLL METHOD TTCA

Title transfer

- SICA

Securities financial collateral arrangement

- SIUR

Securities financial collateral arrangement with right of use

COLL TYPE GOVS

Government Securities

- FIDE

Debt Securities

- SEPR

Securitized Products

Parent topic: Securities Financial Transaction Regulation