- Derivatives User Guide

- Process a Derivatives Contract

- Maintain the Derivative Contract Input Screen

- ESMA Details Maintenance

5.1.3 ESMA Details Maintenance

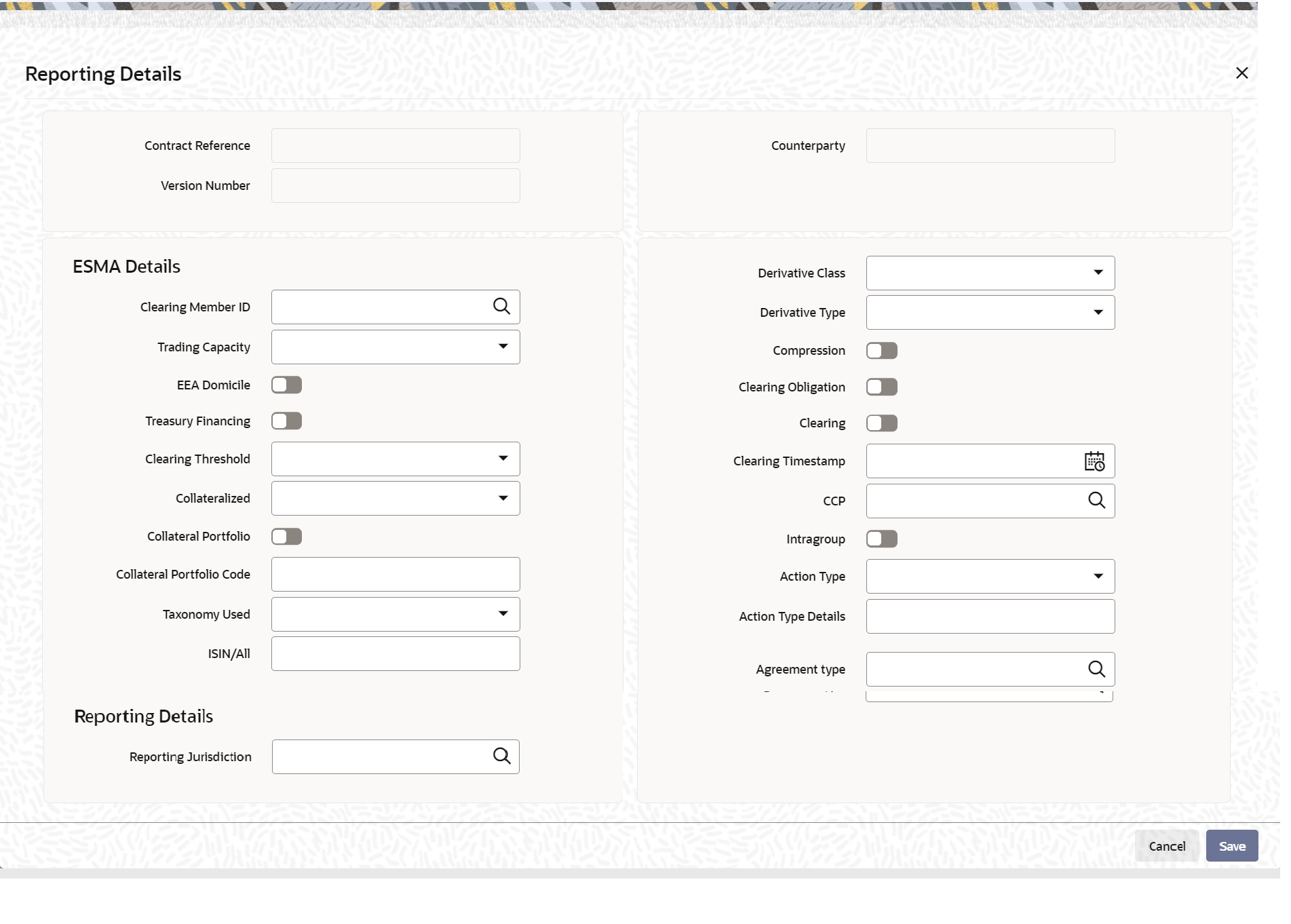

- On the Contract Input screen, click the Reporting Details tab.

The Reporting Details screen is displayed.

- On the Reporting Details screen, specify the details as required, and click Ok.For more information on the fields, refer to the below table.

Table 5-28 European Market Infrastructure Regulation - Field Descriptions

Field Description Clearing Member ID

Click the search icon and select the unique code from the displayed list for identifying the responsible clearing member ID of the reporting counterparty.

Trading Capacity

Select the Trading Capacity from the drop-down list.

The available options are:

- Principal

- Agent

Indicates whether the reporting counterparty has concluded the contract as principal on its account or as an agent for the account on behalf of a client.

EEA Domicile

Select the EEA Domicile check box, if the other counterparty is domiciled in the European Economic Area (EEA).

Treasury Financing

Select the Treasury Financing check box, if the contract is objectively measurable as directly linked to the reporting counterparty’s commercial or treasury financing activity, as referred to in Art. 10(3) of Regulation (EU) No 648/2012.

Indicates whether the contract is objectively measurable as directly linked to the reporting counterparty’s commercial or treasury financing activity, as referred to in Art. 10(3) of Regulation (EU) No 648/2012.

Note: Leave the check box unchecked, if the reporting counterparty is a financial counterparty as referred to in Art. 2 (8) Regulation (EU) No 648/2012.

Clearing Threshold

Select Clearing Threshold from the drop-down list. The available options are:

- Above

- Below

Indicates the information that the reporting counterparty is above the clearing threshold as referred to in Art. 10(3) of Regulation (EU) No 648/2012 or below the clearing threshold as referred to in Art. 2(8) Regulation (EU) No 648/2012.

Collateralized

Select the Collateralized value from the drop-down list. The drop-down list shows the following options:

- Uncollateralized

- Partially Collateralized

- One way Collateralized

- Fully Collateralized

Collateral Portfolio

Select the Collateral Portfolio check box, if the collateralization was performed on a portfolio basis.

Indicates whether the collateralization was performed on a portfolio basis. A portfolio means the collateral is calculated based on net positions resulting from a set of contracts, rather than per trade.

Collateral Portfolio Code

Click the search icon and select the unique code of the Collateral Portfolio in this field.

Note:

If the collateral is reported on a portfolio basis, the portfolio should be identified by a unique code determined by the reporting counterparty.Taxonomy Used

Select the Taxonomy Used for the contract from the drop-down list. The drop-down list shows the following options:

- Product Identifier

- ISIN/ALL

- Interim Taxonomy

ISIN/All

Specify the ISIN/All number, if ISIN/All option is selected in the Taxonomy Used field.

Derivative Class

Select the Derivative Class from the drop-down list, if the Interim Taxonomy option is selected in the Taxonomy Used field.The drop-down list shows the following options:

- Commodity

- Credit

- Currency

- Equity

- Interest Rate

- Others

Derivative Type

Select the Derivative Class from the drop-down list, if the Interim Taxonomy option is selected in the Taxonomy Used field. The drop-down list shows the following options:

- Contract for Difference

- Forward Rate Agreement

- Futures

- Forward

- Options

- Swap

- Others

Compression

Select the Compression check box to indicate whether the contract results from a compression exercise.

Clearing obligation

Select the Clearing obligation check box to indicate whether the reported contract is subject to the clearing obligation under Regulation (EU) No 648/2012.

Clearing

Select the Clearing check box to indicate whether clearing has taken place.

Clearing timestamp

Enter the time and date when clearing took place.

CCP

Click the search icon and select the unique code from the displayed list for identifying the reported contract is subject to the clearing obligation under Regulation (EU) No 648/2012.

Intragroup

Select the Intragroup check box, to Indicate whether the contract was entered into as an intra-group transaction, defined in Article 3 of Regulation (EU) No 648/2012.

Action Type

Select the Action Type from the drop-down list. The available options are:

- New

- Modify

- Error

- Cancel

- Compression

- Valuation Update

- Others

Indicates the action on the contract.

Action Type Details

Specify the details of the amendment, if the previous Action Type field is selected as Others.

Agreement Type

Select the agreement type from the displayed list of values or enter the type of agreement directly in the field.

This field specifies the type of the agreement covering the transaction. The Agreement Type cannot be overwritten, as Master Agreement is maintained, default value from Agreement will be picked.

Reporting Jurisdiction

Select the supervisory party from the displayed list of values. This field specifies the supervisory party to which the trade needs to be reported.Note:

if Reporting jurisdiction is selected as OTHR, the Additional Reporting Details are required by the regulator. For more information, refer to Step 6 in section 2.5.1 Settlement details of Settlement User Guide. Reporting Jurisdiction cannot be overwritten as Master Agreement is maintained, default value from Agreement will be picked.

Parent topic: Maintain the Derivative Contract Input Screen