2.4 Maintain Derivative Types

This topic explains the systematic instructions to Maintain Derivative Types.

The difference between this module and the other modules in Oracle Banking Treasury is that before maintaining the products it is required to define Derivative Types. The derivative instruments are classified as an FRA, CCS or IRS in maintaining derivative types. Additionally, it is possible to capture relevant information about the instrument. For instance, indicating whether schedules are allowed or whether interest is to be paid in advance or arrears and so on. The advantage of defining derivative types is that at the time of creating a product you need to specify the code assigned to the derivative type. The basic details you have specified for the derivative type will be automatically inherited by the product and consequently by any contract entered using that product.

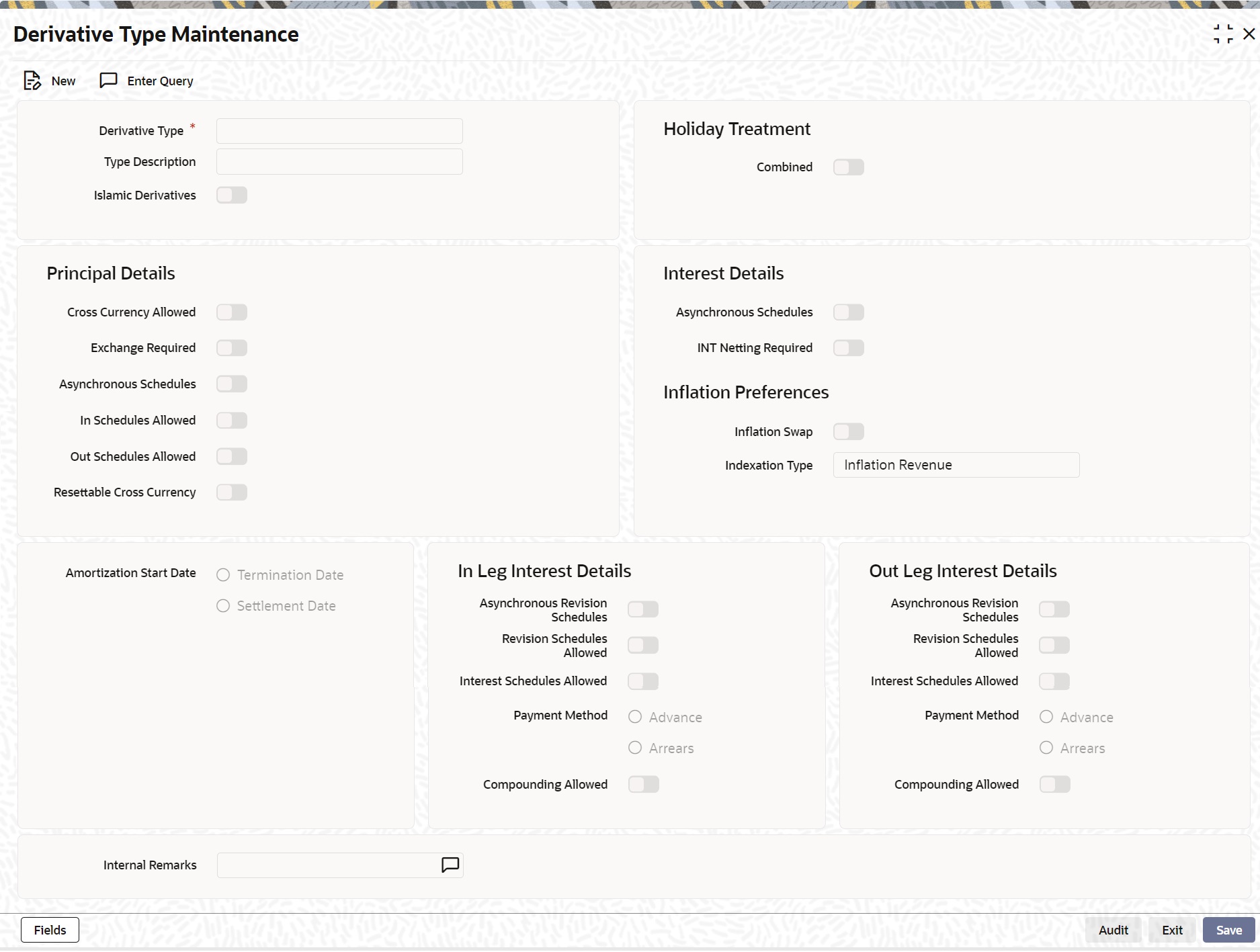

- On the Home page screen, type DVDDTMNT in the text box, and click the next arrow.

The Derivative Type Maintenance Screen is displayed.

- Select New from the Actions menu in the Application tool-bar or click the new icon, to maintain details of New Derivative Type. For more information o fields, refer to field description table.

For more information on the fields, refer to the below table.

When calling already defined derivative type maintenance record, choose the Summary option under Derivative Type. From the Summary screen, double click a record of your choice to open it.

The Derivative Type Detailed Maintenance screen is displayed.

Table 2-1 Derivative Type - Field Description

Field Description Derivative type

The first attribute that you define for the derivative is its type. A type defines the basic characteristics of the instrument. It indicates whether the:

- Deal involves a single currency or two currencies.

- Deal involves multiple interest schedules.

- Interest will be liquidated in a single payment.

By suitably defining a derivative type, you will be able to define the following basic instrument types and their variants:

- Forward Rate Agreements (FRA)

- Cross Currency Swaps (CCS)

- Interest Rate Swaps (IRS)

Type Description

Assign a brief description of the derivative type that you are defining. This description will be associated with the type only for information purposes. Under each Derivative Type, you can create any number of products.

Principal Details

As part of specifying the principal details, you have to indicate whether two separate currencies can be maintained for both the inward and outward legs of all the contracts linked to the derivative type you are creating. If you choose to allow cross currencies for the in and out legs of contracts linked to the derivative type, then you have to also indicate whether the contract principal has to be exchanged upon initiation and maturity.

Apart from this, you also have to indicate whether multiple schedules can be defined for the principal component. If you choose to define multiple schedules, then the frequency of these schedules can be indicated at the time of specifying the product preferences. You can select anyone as the frequency for the principal schedules:

- Daily

- Weekly

- Monthly

- Quarterly

- Half-yearly

- Yearly

But if you choose not to define multiple schedules, then the principal liquidation for all the contracts linked to this type will be done on contract maturity.

Also, in the leg and out leg principal schedules, that you define for a contract need not be in sync with each other. You can choose to have asynchronous schedules for both the in and out legs of the contract.

Amortization Start Date

In the case of termination of hedge deals, indicate the date from which the amortization of gains and or losses should start. While terminating swaps, amortization should start as of the termination date, and in the case of FRAs, amortization must start as of the settlement date.

Holiday Treatment

You can indicate how a particular scheduled date must be treated if it falls due on a holiday. The holiday movement of the principal, interest and revision schedules for each of the in and out legs can be based on:

- The holiday table maintained for a single financial center or single currency specified at the leg level, or

- The combination of holiday tables of multiple financial centers/currencies.

Select the Combined option on this screen if you want the movement of schedules to be based on the combination of holiday tables maintained for multiple financial centers/currencies at both the legs of the contract. This will be applicable if the holiday treatment (specified at the contract level) is based on the holiday calendars of the currencies or financial institutions involved in the contract. Your specification will be automatically inherited by the product associated with the derivative type and consequently by any contract entered using the respective product.

Resettable cross currency

Select this box to Identify the derivatives product is plain or a resettable swap.

Interest Details

Specify the following details.

Netting Required

If two or more accounting entries for an interest schedule payment are to be passed in the same currency on the same Value Date, then in Oracle Banking Treasury you are allowed to net these entries. However, netting of entries is allowed only in the case of single currency derivative types. If you are maintaining details of a cross-currency type, you will not be allowed to net entries. If you are maintaining details of a cross-currency type, you will be allowed to net Principal and Interest of same currency during Manual Payment.

Netting of In leg and Out leg interest schedules is allowed for synchronous schedules. But for asynchronous schedules of In leg and the out leg, the netting is applied only for the interest schedules which have the same value dates. Netting is applicable for all derivative type contracts.

Inflation Preferences

Specify the following fields.

Inflation Swap

Check this box to indicate that the product type must be Inflation swap.

Indexation Type

Select the indexation type from the adjoining drop-down list. The list displays the following values:- Inflation Revenue

- Zero Coupon

- Year on year

In/Out Leg Interest Details

Specify the Fields.

Interest Schedules Allowed for the leg type

While maintaining the derivative type, it is required to indicate whether contracts linked to the derivative type can have multiple schedules, or whether the schedules have to be bulleted.

In Oracle Treasury Banking application, you can choose to have multiple schedules for one leg and bullet schedules for the other leg. For instance, you can indicate that the in leg schedules have to be bulleted and the out leg schedules have to be multiple. Consequently, for all contracts linked to this type, the in leg schedules will be bulleted while the out leg can have multiple schedules.

Choose to define multiple schedules for both the inward and outward legs and indicate that the frequency of repayment should differ.

Revision schedules allowed for the leg type

Just as in the case of interest schedules so also revision schedules too can either be multiple or bulleted, depending upon your specification.

A revision schedule is a period for which a floating interest rate is to be used. Normally, this would be the same as the interest schedule but in Oracle Banking Treasury you are allowed to maintain separate interest and revision schedules. Therefore, you have to specify whether the revision schedules defined for the particular (In or Out) leg of the contract need to be in sync with the interest schedules, or whether they can be asynchronous. For instance, you may like to permit contracts with semi-annual interest payments with quarterly revision in interest rate

Payment Method

Interest amount repayments for both the inward and outward interest legs can be made either at the start of the interest period or the end of the interest period. For instance, a typical FRA would require a discounted cash-flow to be paid at the commencement of the period while an interest rate swap would require cash-flows to be exchanged at the end of each interest period.

Your choice of the payment method at the derivative type definition level, will have defaulted to all the contacts linked to the derivative type.

Compounding Allowed

Check this box to indicate that the compounding preference must be allowed for the relevant leg.

Internal Remarks

When creating the derivative type, you can capture additional information about the type intended for the internal reference of your bank. Your remarks will not be printed on any correspondence with the customer.

However, you can choose to include these remarks in the reports that you generate.

Note:

You will not be allowed to change the details of an existing derivative type except change the Description Type and the Internal Remarks.

- On the Derivative Type screen, click Fields

You can associate values to all the User Defined fields created and attached to the Derivative Type Maintenance screen.

You can specify the value for the UDFs listed here in the Value column.

For more details on how to create user Defined fields, refer chapter Creating custom fields in Oracle Banking Treasury in the User Defined Fields User Manual under Modularity.

The User Defined Fields screen is displayed.

Parent topic: Derivative Modules - General Maintenance