- Exchange Traded Derivatives User Guide

- Define Deal Products

- Deals Matching

- Process exchange derivatives deal matching

6.5.1 Process exchange derivatives deal matching

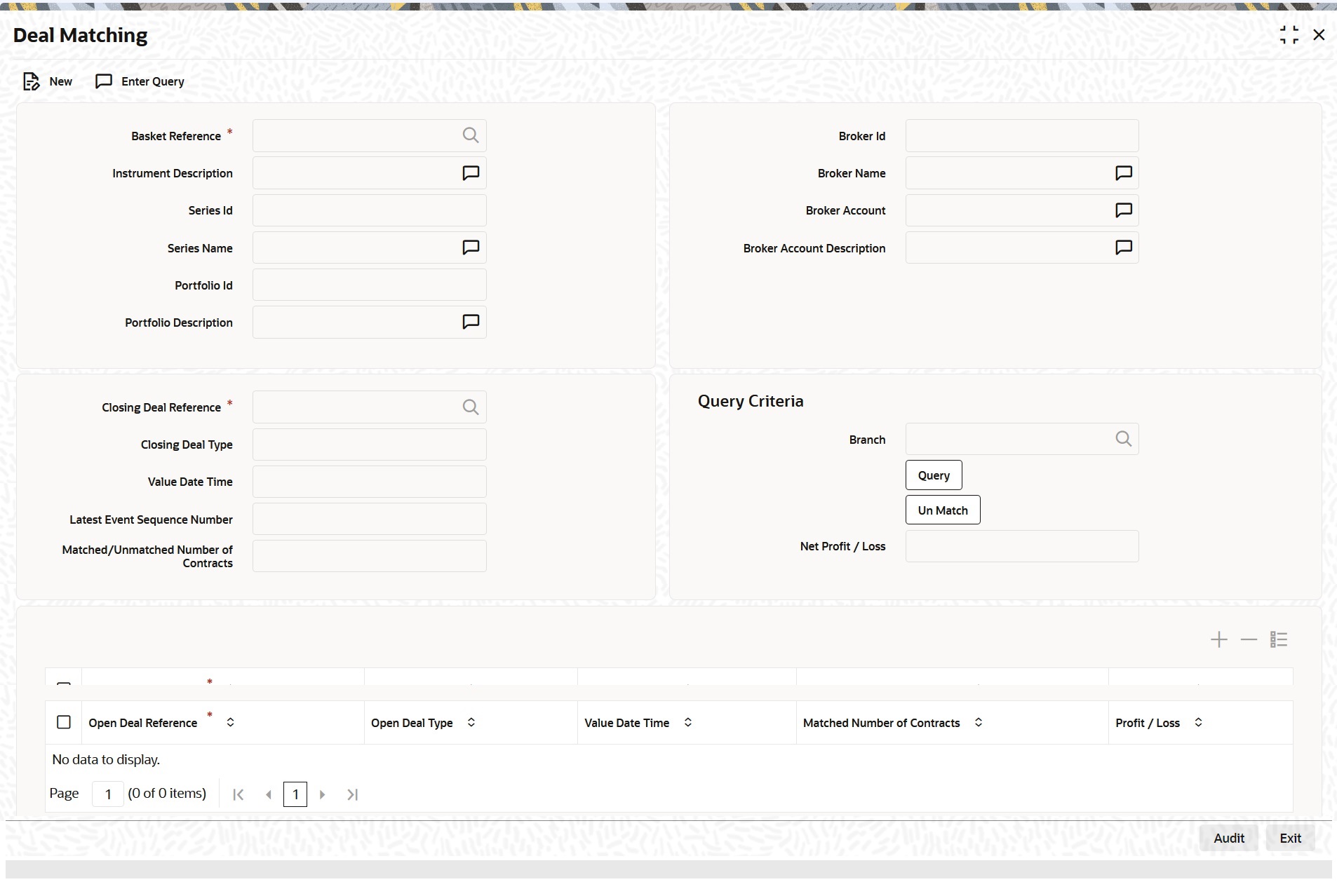

You can match deals for your bank’s own portfolios through the ETD module of Oracle Banking Treasury Management. If the portfolio from which you are buying or selling is priced using the Deal Matching methodology, you should identify the buy deal against which the sell/liquidation deal is to be matched. You can do this through the ‘Deal Matching’ screen of the ETD module.

- On the Home page, type EDDMATCH in the text box, and then click next arrow.

The Deal Matching is displayed.

- On the Deal Matching screen, click New.

- On the Deal Matching screen, specify the following Liquidation Deals, and then click Enter Query.

For more information on the fields, refer to the below Field Description table.

Table 6-16 Deal Matching - Field Description

Field Description Basket Reference

In this screen, first you specify the Basket Reference for which you intend to do the Deal Matching. The Basket Reference number available in the option list is displayed based on the following criteria:

- The Portfolio involved in the basket should be your Bank’s own portfolio.

- The Baskets which are booked in the portfolios with either ‘Costing Method’ as DMAT or ‘Allow Deal Matching’ checkbox checked (toggled on) will be eligible for matching

- The Instrument involved in the Basket should be Futures, Future Style Options and Option Style Options deals.

You can select a valid Basket Reference Number from the available list. The other details involved in the Basket are displayed in the respective fields on saving your entries. These details include:

- Instrument ID

- Series ID

- Portfolio ID

- Broker ID

- Broker Account

Closing Deal Reference

After having specified the Basket Reference, you should indicate the closing deal reference number. The Closing Deal can either be a Long and Short type of a deal or can be an Exercise/Assignment Deal.

This closing deal has to be matched to one or more opening deals.

Also, the total number of contracts of the Closing Deal that should be matched should be equal to the number of contracts that you wish to close.

Open Deal Reference

Specify the number of deals for Opening Deals. The system will allow you to specify multiple Open Deal input against a single Closing Deal

Profit / Loss

The system will display the PL calculated for the matched pair of deals for each Open deal in the grid

Net Profit / Loss

The system will display the Net PL calculated across all open deals matched with the closing deal

For Example:

Scenario I

Let us assume, you are 20 Contracts long in a particular instrument where the instrument details are as follows:

Strike Price = 10 USD.

Contract Size is 1 Unit of the Underlying Asset.

The balance of 20 Contracts have been built up by the following deals.

Table 6-17 Deal Matching

No. of Contracts Long/Short Deal Value 10 Contracts

Long

Deal001

Premium Paid= 2 USD per Contract

4 Contracts

Long

Deal002

Premium Paid= 3 USD per Contract

6 Contracts

Long

Deal003

Premium Paid= 4 USD per Contract

Let us assume you are doing an Exercise Deal for 12 Contracts (Deal004 – Underlying Price = 12 USD). You would like to match this Exercise Deal of 12 Contracts partially to Deal001 and Deal003.

Your deal matching preferences in the Deal Matching screen will read as follows:

Table 6-18 Deal Matching Preferences

Deal Matched Deal No. of Contracts Deal004 matched to

Deal001

6 Contracts

Deal004 matched to

Deal003

6 Contracts

After, this matching

- Deal001 will have unmatched number of Contracts as 4.

- Deal002 will have unmatched number of Contracts as 4.

- Deal003 will have unmatched number of Contracts as 0.

- Deal004 will have unmatched number of Contracts as 0.

The system will compute the Exercise Gain / Loss as follows:

- Cost of Deal001 for 6 Contracts = 6 x 2 = 12 USD

- Cost of Deal003 for 6 Contracts = 6 x 4 = 24 USD

Total Cost = 36 USD.

The difference between the Underlying Price and Strike Price will be computed as:

- 12 – 10 = 2 USD per Contract

- 2 x 6 = 12 USD for 6 Contracts

Thus, the Exercise Loss will be computed as 36 USD – 12 USD = 24 USD

In the above example, the number of Contracts matched were equal to the Number of Contracts of the Closing Deal (exercise deal) i.e. 12.

Now, consider this scenario.

Scenario II

You are long in an Option for 5 Contracts - Deal001

Subsequent to that, you do a Short Deal for 10 Contracts - Deal002

Since, Deal002 is subsequent to Deal001, deal matching should be done as follows:

Table 6-19 Deal Matching Preferences

Deal Matched Deal No. of Contracts Deal004 matched to

Deal001

6 Contracts

Deal004 matched to

Deal003

6 Contracts

This will result in,

- Deal001 having ‘0’ unmatched number of Contracts.

- Deal002 having ‘5’ unmatched number of Contracts.

Deal002 will be processed for the following events:

- ECLG - Closing of Long Position for 5 Contracts.

- EOSH - Opening of Short Position for 5 Contracts.

The Basket will now result in a balance of 5 Short.

Parent topic: Deals Matching