- Exchange Traded Derivatives User Guide

- Define Deal Products

- Process Exchange Derivatives Deal Product Definition

6.1 Process Exchange Derivatives Deal Product Definition

This topic describes the systematic instruction to process Exchange Derivatives Deal Product Definition screen.

The information about the deal product is captured through the Exchange Derivatives Deal Product Definition screen.

- On the Home page, type EDDDLPRD in the text box, and then click next arrow.The Exchange Derivatives Deal Product Definition screen is displayed.

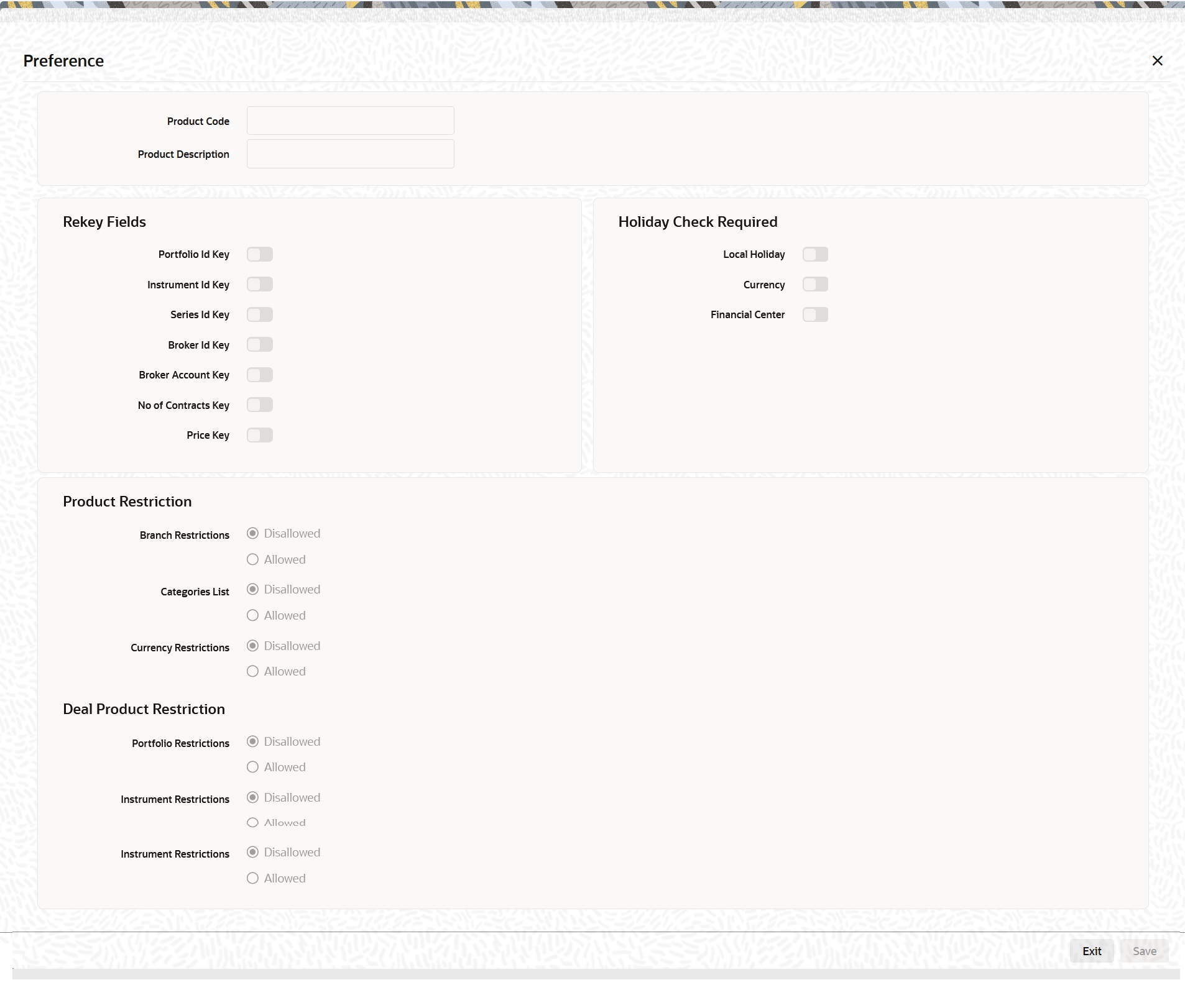

Figure 6-1 Exchange Derivatives Deal Product Definition

Description of "Figure 6-1 Exchange Derivatives Deal Product Definition" - On the Instrument Definition screen, click New.

- On the Instrument Definition screen, specify the following details, and then click Enter Query.

The basic details about the product are common for every product that you capture in the ETD module of Oracle Banking Treasury Management. However, while defining a deal product you need to specifically indicate the exchange rate variance that is to be associated with the product.

Table 6-1 Instrument Definition- Field Description

Field Description Product Code and Product Description

Specify the product code and product description.

Product Type

Specify the product code.

Product Slogan

Type a slogan for the product that you are creating.

Product Group

Grouping products according to the common features they share helps you organize information relating to the services you provide. This helps you retrieve information easily.

Product Start Date and End Date

When you create a product, you must also specify a date from which it can be offered. You may also specify the date up to which you would like to offer the product. Enter these dates in the Start Date and End Date fields.

Note:

You cannot offer a product beyond the specified end date. If you do not specify an end date for a product, you can offer it for an indefinite period.

Remarks

If you want to enter any remarks regarding the product, do so in the Remarks field.

Exchange Rate Variance

For a special customer, or in special cases, you may want to use an exchange rate (a special rate) that is greater than the exchange rate maintained for a currency pair. The variance is referred to as the Exchange Rate Variance.

When creating a product, you can express an Exchange Rate Variance Limit in terms of a percentage. This variance limit would apply to all deals associated with the deal product.

Override Limit

If the variance between the default rate and the rate input varies by a percentage between the Rate Override Limit and the Rate Stop Limit, you can save the deal by providing an override.

Stop Limit

If the variance between the defaulted rate and the rate that is entered varies by a percentage greater than or equal to the Rate Stop Limit, you cannot save the deal.

Rate Code

While settling charges for cross-currency settlements, you can choose to debit the customer by applying the mid-rate or by using the buy/sell spread over the mid-rate.

Rate Type

Indicate the Rate Type which should be picked up for exchange rate conversions involving settlement of charges for cross currency deals. You can maintain any one of the following as the Rate Type:

- Cash Rate

- TT Rates

- Bill Rates

Note:

Information about specific attributes of a product has to be defined in the sub-screens within the Product Definition Main screen.

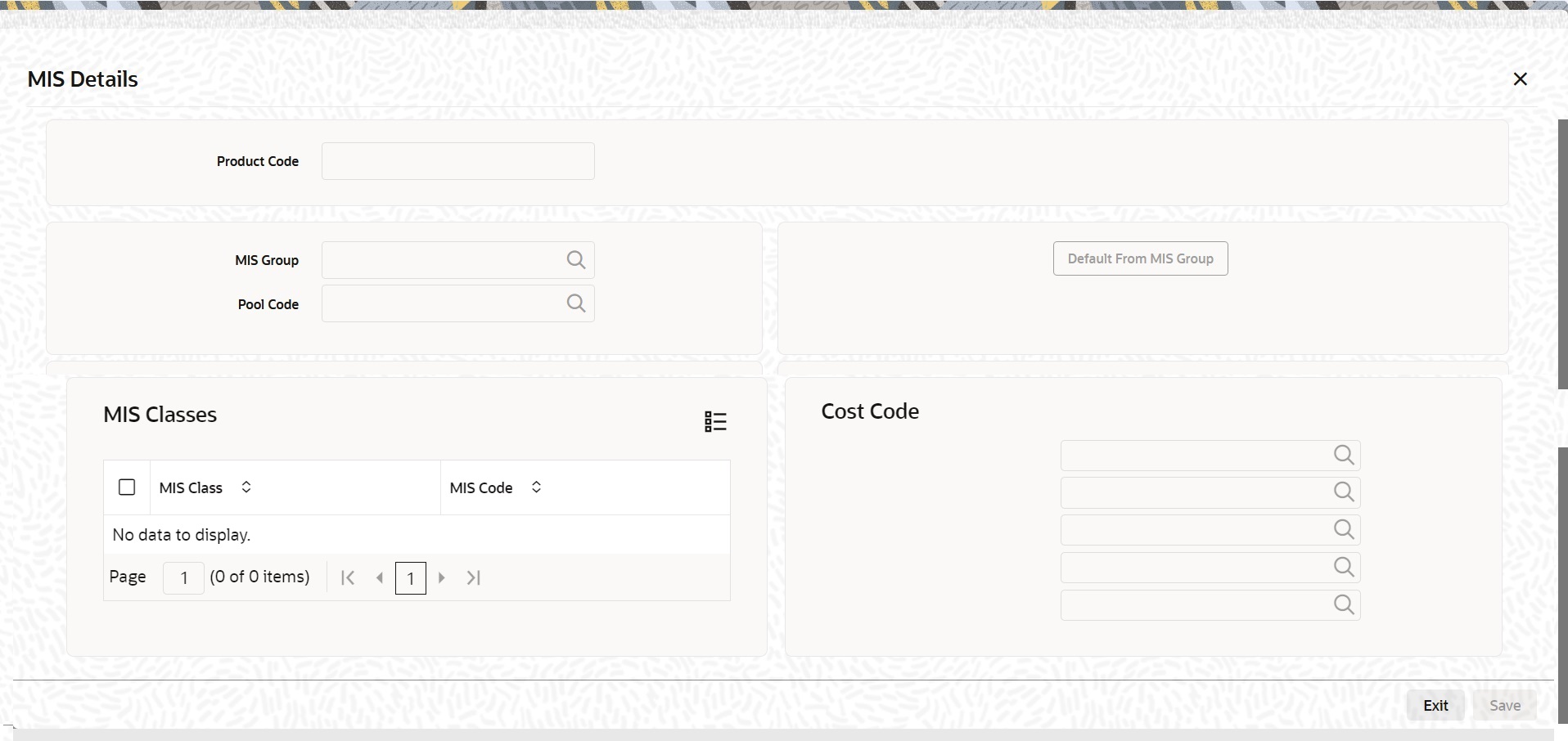

- On the Exchange Derivatives Deal Product Definition screen, click the Preferences tab.

The Preference screen is displayed.

- Specify the fields in the Preferences screen.

Table 6-2 Preference - Field Description

Field Description Product Code

System displays the product code.

Product Description

System displays the product code description.

Rey-key Fields

In Oracle Banking Treasury Management, all operations on a deal (input, amendment, modification, etc.) have to be authorized by a user other than the one who entered the deal details. These operations have to be carried out before the end-of-day activities have begun. Authorization is a way of checking the entries made by a user.

Indicate that details of certain fields should be re-entered when a deal is invoked for authorization. The complete details of the deal is displayed only after the values to these fields are entered. The fields for which the values have to be given are called the Re-key fields.

You can specify any or all of the following as re-key fields:

- Broker Account

- Instrument ID

- Portfolio ID

- Series ID

- Broker ID

- Number of Contracts

- Price

If no re-key fields are defined, the details of the deal involving the product will be displayed immediately when the authorizer calls the deal for authorization. The re-key option also serves as a means of ensuring the accuracy of inputs.

Currency Restrictions

Indicate whether you want to create a list of allowed currencies or disallowed currencies by selecting one of the following options:

- Allowed

- Disallowed

Categories List

Indicate whether you want to create a list of allowed customers or disallowed customers by choosing one of the following options:

- Allowed

- Disallowed

Currency Restrictions

Indicate whether you want to create a list of allowed currencies or disallowed currencies by selecting one of the following options:

- Allowed

- Disallowed

You can specify the authorization re-key fields through the Deal Product Preferences screen.

Local Holiday

Select this check box, to execute the local holiday validation of the date and movement of schedules.

Currency

Select this check box, to execute the currency holiday calendar validation of the dates and movement of schedules.

Financial Center

Select this check box, to execute the financial center holiday calendar validation of the dates and movement of schedules.

- On the Exchange Derivatives Deal Product Definition screen, click the Charges tab.

- On the Charges Details screen, specify the charge details.

In the ETD module of Oracle Banking Treasury Management, charges can be associated and accounted for, only with the Booking of the deal. You can calculate and deduct charges as a percentage of the deal amount.

You can specify the charge components applicable to a product, when your bank has to;

- Collect money from the Customer/Broker

- Pay money to the Customer/Broker

Table 6-3 Deals

Deal Value Futures Deals

Future Price X Number of Contracts.

Options Deals

Option Premium X Number of Contracts.

Table 6-4 Deals

Deal Value Futures Deals

Underlying Spot Price X Number of Contracts.

Options Deals

Underlying Spot Price X Number of Contracts.

You should necessarily use a charge class to indicate the charge components applicable to the product. A charge class is a specific type of component that you can build with certain attributes. You can build a charge class, for instance, with the attributes of a specific type of charge component, such as Charges for booking an LS deal. The charges that you link to the deal product will be made applicable to all the deals involving the product.

You can link charge components with the deal product through the Deal Charge Definition screen.

- On the Exchange Derivatives Deal Product Definition screen, click the Events tab.

- On the Event Details screen, specify the event details.

The different stages in the life cycle of a deal are referred to as Events. In the ETD module, the following events are possible for a deal:

Table 6-5 Event Code - Description

Event Code Description EBOK

Booking a deal

EAMD

Amendment of trade time stamp of a deal that is yet to be booked

EMAT

Deal Matching

EREV

Reversal of a deal

At an event, you may want to generate advice or post accounting entries. For instance, while booking a deal in your customer portfolio, you would:

- Pass the requisite charge related entries

- Print a confirmation advice for the benefit of your customer

When defining a deal product, firstly, you have to identify the accounting roles and heads for the product in the Product Accounting Role to Head Mapping screen. Similarly, you have to specify the different event details in through the Product Event Accounting Entries and Advices screen, by either of the following ways:

- Associating the product with an appropriate Role to Head Mapping class and an Events Class

- Mapping accounting roles to heads and defining event details specifically for the product.

The appropriate accounting entries will be posted and the relevant advices can be generated only while booking a deal (EBOK event). During the amendment of trade time stamp of a deal that is yet to be processed in the system, (EAMD) and for deal matching (EMAT), the system will not post any accounting entries. Neither will you be allowed to generate any advices for these events.

For reversing a deal (EREV), the system does an automatic reversal of all the accounting entries that were passed when the particular deal was booked (EBOK).

For further details on maintaining Accounting Entries and Advices, refer Product Definition User Manual under Modularity.

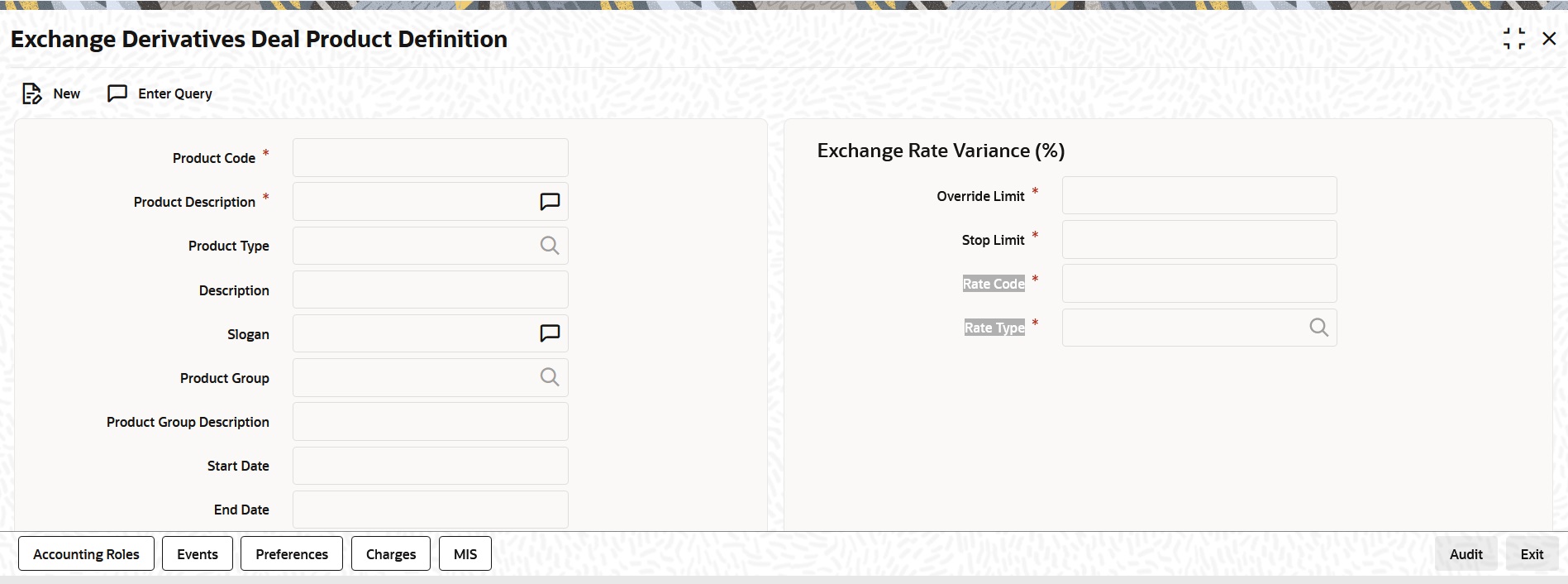

- On the Exchange Derivatives Deal Product Definition screen, click the MIS tab.The MIS Details screen is displayed.

- Specify the fields details in the MIS Details screen.

For more information on the fields, refer to the below Field Description table.

Table 6-6 MIS Details - Field Description

Field Description MIS Group

You should link a product to an MIS group. By doing so, you indicate the MIS group under which all deals linked to the product should be tracked.

Pool Code

On linking the product to an MIS group, you should also indicate the Pool code from the product will borrow and lend.

Transaction Codes

If you have linked a product to an MIS Group, the Transaction MIS Codes defined for the group will be displayed by default.

If you have not linked an MIS Group, you can specify the applicable Transaction Codes here. The number of transaction codes displayed depends on the number of transaction MIS codes maintained for your bank.

Cost Codes

Similarly, if you have linked an MIS Group to the product, the cost codes defined for the group will be displayed. You have the option to change them. If you have not linked an MIS Group with the product, you can indicate the applicable cost codes.

After you make the specifications, click OK to save them. On saving your entries, you are returned to the ET Product Definition screen.

For further details refer to the MIS user manuals.

Parent topic: Define Deal Products