- Exchange Traded Derivatives User Guide

- Define ET Instruments

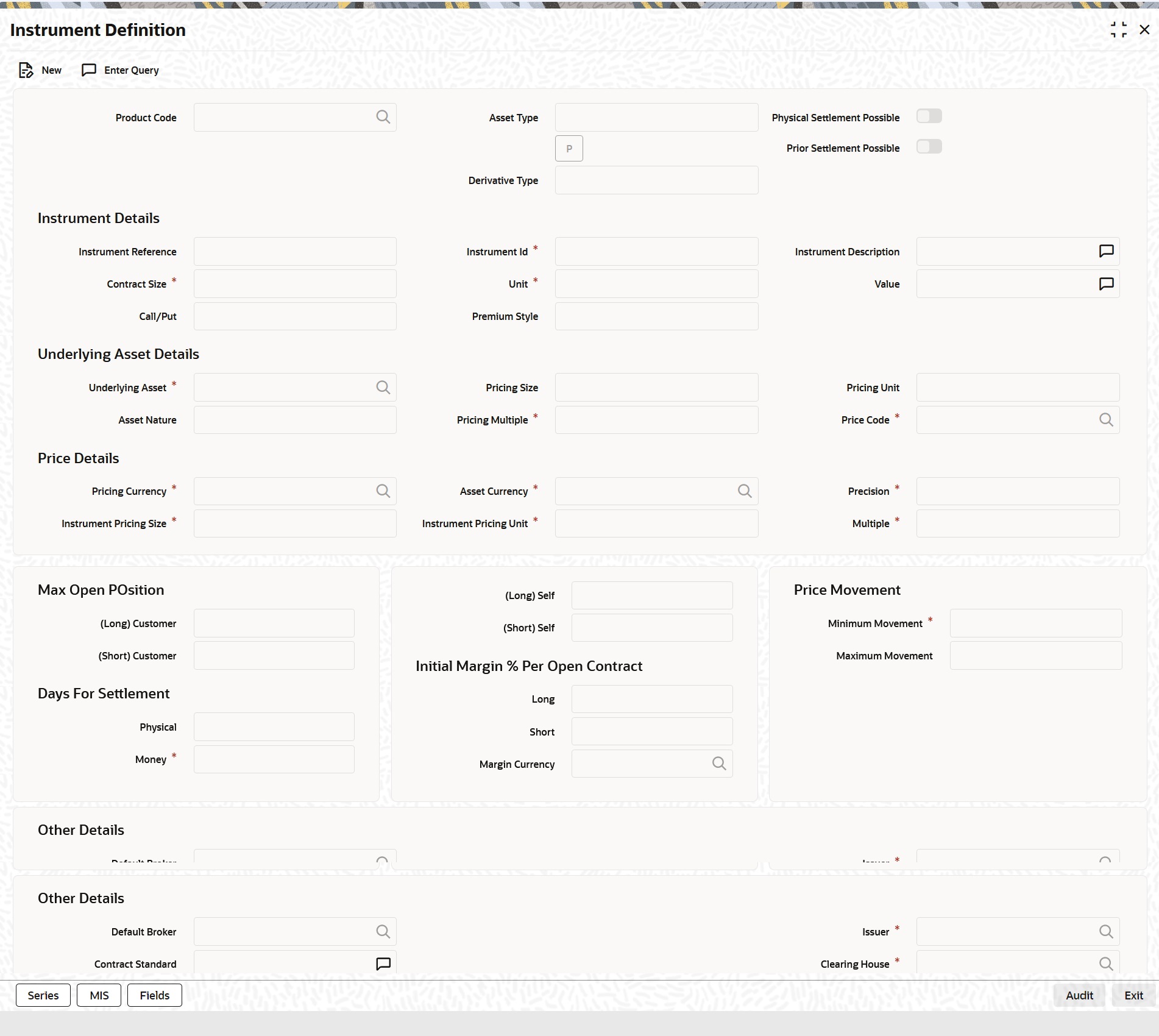

- Instrument Definition

- Process Instrument Definition

4.1.1 Process Instrument Definition

This topic describes the systematic instruction to process the Instrument Definition screen.

- On the Home page, type ENDUINST in the text box, and then click next arrow.

The Instrument Definition screen is displayed.

All ET instruments must be designated at inception either as Future or as Option instruments. At the time of product definition, you would have indicated whether the product being defined is meant for future instruments or options. When you associate an instrument with a product, the specifications you made for the instrument product default to the instrument. You will not be allowed to change the defaulted specifications.

- On the Instrument Definition screen, under Instrument Details section, specify the fields.

For more information on the fields, refer to the below table.

Table 4-1 Instrument Details - Field Description

Field Description Reference In Oracle Banking Treasury Management, the system generates instrument reference numbers automatically and sequentially by the system. This number tag is used to identify the instrument that you are entering. It is also used in all transactions related to this instrument. Here the system generates a unique 16 digit alphanumeric reference value for each instrument.

Instrument Identification Type the reference number or value for the instrument here. This is called the ‘Instrument Identification’. The ‘Instrument Identification’ in addition to the ‘Reference’ generated by the system identifies the instrument.

The ‘Instrument Identification’ should be unique and cannot be used to identify any other instrument. It also cannot exceed 16 characters. By default, the system generates an Instrument Reference number which is taken as the Instrument ID.

Description Here you can provide a brief description for the instrument. This description cannot exceed 35 characters.

Contract Size and Unit Indicate the number of the units of the underlying asset that makes this instrument as part of specifying the instrument details. Refer to the below field values table.

Value You can capture additional details pertaining to the instrument or the underlying.

The details that you capture in this field are meant for your bank’s internal reference and will not be used for processing the contract.

Call/Put Select Call/Put option from the Call/Put list. While capturing the details of an Option instrument, you need to indicate whether the option is a Call or a Put option. In the ETD module the Call and Put Options are treated as two separate instruments in all respects.

Therefore, when an Exchange issues Call and Put options on the same underlying assets, you need to have defined two instruments to take care of the two Options.

Premium Indicate the premium style, which should be picked up for the particular option.

You can choose one of the following options here:

- Select Option Style for booking the Premium Amount for the Deal during the Opening/Closing of the Position, along with the deal. This means there is no Variation Margin (Cash Settlement of Revaluation Differences based on Daily Closing Price of the Instrument) to be processed for such instruments. For your portfolios, you are allowed to do a Notional Revaluation for such Instruments.

- Select Futures Style for not booking the Premium Amount during the Opening/Closing of Position, that is, there is no exchange of Cash during the deal. But based on the every day closing prices of the Instrument, there will be a variation Margin Computation that has to be exchanged between the Portfolio and Broker (Revaluation based on Cash Basis).

For instance, let us assume that the underlying asset for an instrument is Wheat. Each instrument entitles the holder to buy or sell 100 Kilograms of Wheat. Your entries in the Contract Size and Unit fields will be as follows:

Table 4-2 Field Value

Field Value Contract Size

100

Unit

Kilo-grams

Table 4-3 Field Value

Field Value Contract Size

1,000,000

Unit

DEM

- On the Instrument Definition screen, under Underlying Asset details section, specify the fields.

For more information on the fields, refer to below Field Description table.

Table 4-4 Underlying Asset details - Field Description

Field Description Underlying Asset After you have indicated the instrument details, you must specify the underlying asset, which is to be linked to the instrument being defined. The option list available for this field is populated based on the Asset Type linked to the product involving this instrument. You can select an appropriate underlying code.

Pricing Multiple Specify the Pricing Multiple of the underlying. The Pricing Multiple is the multiplication factor that should be applied to the Price of the Underlying to arrive at the price per contract. Refer to the below field value table.

Price Code A single underlying can be linked to several instruments issued at various exchanges. As a result, there might be slight price variations in the closing price of the same underlying in each exchange where the instrument is traded.

Since the system automatically picks up all open position contracts for auto Expiry/Exercise, on the expiry date of the instrument, the closing price of the underlying is required for triggering this process. Therefore, if each of the exchanges where the underlying trades is identified by a unique price code, it becomes possible to associate the price code to be used to pick up the closing price of the underlying for processing the Expiry/Exercise event.

On saving the record, the other details of the underlying - such as the Pricing Size, the Pricing Unit and the Nature of the Asset - are defaulted from the Underlying Asset Maintenance screen, depending on the underlying that you link with the instrument. You cannot change them.

Table 4-5 Field Value

Field Value Contract Size

100

Unit

Kilo-grams

The underlying you have linked to this instrument is Gold and it is priced in terms of 10 grams.

The Pricing Multiple that you define for this contract will be:

10 kilograms of gold/10 grams of gold = 1000.

Thus, on the option Exercise Date if the Spot Price of Gold is 50 USD for 10 grams of gold, the instrument will be considered to be at the money, if it has a Strike Price of 50000 USD (50 USD X 1000) per contract.

Indicate the multiplication factor that should be applied to the commodity price of the underlying.

- On the Instrument Definition screen, under Price Details section, specify the fields.

For more information on the fields, refer to below Field Description table.

Table 4-6 Price Details - Field Description

Field Description Pricing Currency and Asset Currency Indicate the currency in which the instrument is to be priced in. The asset currency of the product involved in the instrument defaults as the pricing currency.

Precision Specify the maximum decimal places that can be allowed for quoting the Instrument price.

Pricing Size, Pricing Unit and Instrument Pricing Multiple While specifying the contract size of the Gold Option instrument you have indicated that the contract size was 10 kilograms of Gold. Now, as part of specifying the premium of this option if we were to specify that it should be quoted per every gram of gold, the instrument pricing size and unit are given in the below table.

For Instrument Pricing Size, value is 1 and Instrument Pricing Unit, the value is in Gram

Consequently, the multiplication factor to arrive at the Cost Per Contract (Pricing Multiple)equals 10000.

Table 4-7 Instrument Pricing Size and Unit

Field Value Instrument Pricing Size

1

Instrument Pricing Unit

Gram

You can change the pricing currency only if the underlying asset also happens to be a currency. In such a case, since the asset currency differs from the pricing currency you have to change it manually.

For example, Scenario I

Let us carry forward the earlier example of the Gold Option. In this example the Pricing Currency is USD. The Asset Currency will also be USD. Therefore, if you were to take a long Position (Call), the system will pass Contingent Entries to the Continent Bought and Contingent Bought Offset GLs. Both the entries will be posted in USD.

Scenario II:

You are processing a DEM Call Option priced in USD. In this case the Pricing Currency will be USD and the Asset Currency will be DEM. Therefore, if you were to take a long position (Call), the system will post Contingent Entries to the Contingent Bought and Contingent Bought Offset GLs. In this case, the Contingent Asset entry will be posted in DEM (asset currency) and the Contingent Bought Offset will be posted in USD (pricing currency).

- On the Instrument Definition screen, specify the following price movement details.

For more information on the fields, refer to below Field Description table.

Table 4-8 Price Movement Details - Field Description

Field Description Minimum Movement Specify a certain minimum movement in the price of the instrument to trade in the instrument the exchange. The price that you enter in this field is merely for informational purposes and is not used during contract processing. This value is also referred to as the Tick Size of the Instrument.

Maximum Movement Specify the maximum movement value. The value that you capture in this field is meant for your internal reference only. No processing is done in Oracle Banking Treasury Management based on this value. This price is set at the exchange and is indicative of the forward movement in the instrument price. When the instrument price reaches this limit, trading in this instrument will be suspended for the particular day by the exchange.

- On the Instrument Definition screen, under Maximum Open Positions Detailssection, specify the fields.

Certain exchanges you deal in may place restrictions to mitigate the default risk by the various investors. Irrespective of the exchange having this restriction, your bank may want to restrict the open positions held by your portfolio customers. You can do this by specifying the maximum open long and short positions.

Your entries in this field are meant purely for information purposes. Oracle Banking Treasury Management being a back end processing system will not perform any validations against these values that you capture in these fields.

- On the Instrument Definition screen, under Day for Settlement section, specify the fields.

For more information on the fields, refer to below Field Description table.

Table 4-9 Days for Settlement - Field Description

Field Description Money Specify the Money settlement days When a particular deal involves money settlement, (Option Premium in case of an Open Deal for an Option or an Exercise deal) the money settlement days are used to arrive at the date on which the money settlement should take place.

For instance if you indicate that the money settlement date is two days, the system calculates the money settlement date in the following manner:

Deal Date + 2 Working Days

Your entry in this field determines the Value Date for Money Settlement.

Physical When a particular deal involves the physical settlement of the underlying asset, (Exercise of Stock Options or Interest Rate Options) you need to indicate the physical settlement days. The system calculates the Value Date of the Physical Settlement based on the number of days that you specify in this field.

For instance, if you specify the number of days as one, the value date for physical settlement of the underlying asset will be done in the following manner:

Deal Date + 1 Working Day

- On the Instrument Definition screen, under Initial Margin Details section, specify the fields.

For more information on the fields, refer to below Field Description table.

Table 4-10 Initial Margin Details - Field Description

Field Description Long and Short In certain exchanges, it is mandatory that you deposit as collateral (Initial Margin), a fixed percentage of the Contract Value. You need to specify the percentage of initial margin for every open contract held by the investor. The percentage that you specify can change on a day-to-day basis. Similarly, the percentage per Open Short Contract may differ from the percentage per Open Long Contract

Since the ETD module does not calculate the Initial Margin Requirements, the value that you specify in this field represents an approximate percentage that will be required as Initial Margin. The percentage of the contract amount that you enter in these fields will not be considered for processing.

Currency Indicate the currency in which the percentage amount is to be paid. This field assumes significance only when the margin amount is paid in cash. A list of currencies maintained in Oracle Banking Treasury Management is displayed in the available option list. You can choose the appropriate currency.

- On the Instrument Definition screen, under Other Details section, specify the fields.

For more information on the fields, refer to the below Field Description table.

Table 4-11 Other Details - Field Description

Field Description Default Broker

Your bank can trade-in instruments involving brokers and clearinghouses. You have to indicate the ID of the broker/clearing member involved in the deal. A list of all customers categorized as brokers and clearing members through the Customer Information maintenance screen are available in the list of options. You can choose the appropriate ID.

Subsequently, whenever this instrument is chosen in the deal, the broker for the deal defaults from this value. You can change the broker ID if necessary.

Issuer

This is the ID of the exchange that has issued the particular instrument. The list of options available for this field contains a list of all customers categorized as Issuers through the Customer Information File details screen. You can associate the appropriate issuer ID with this instrument.

Clearing House

You can capture the ID of the clearing house where the settlement of trades is to take place.

The daily settlement of trades is Oracle Banking Treasury Management will be carried out, based on your holiday specifications in the Holiday Calendar maintenance screen. Processing for a day is skipped, if both the branch and the clearing house are configured for a holiday as of the processing date.

Contract Standard

You can capture additional information about the ETD instrument that you are processing. The additional text that you capture should not exceed 255 characters. The details that you capture in this field can pertain to any of the following:

- Instrument involved in the deal

- Underlying asset

- Physical settlement of the deal

- Money settlement of the deal

This information will be printed on all the advices that are sent to your portfolio customers if you identify Contract Standard as an Advice Tag, while specifying message formats in the Messaging sub-system.

Figure 4-2 Treasury-Intra Day Batch Start - Login Page

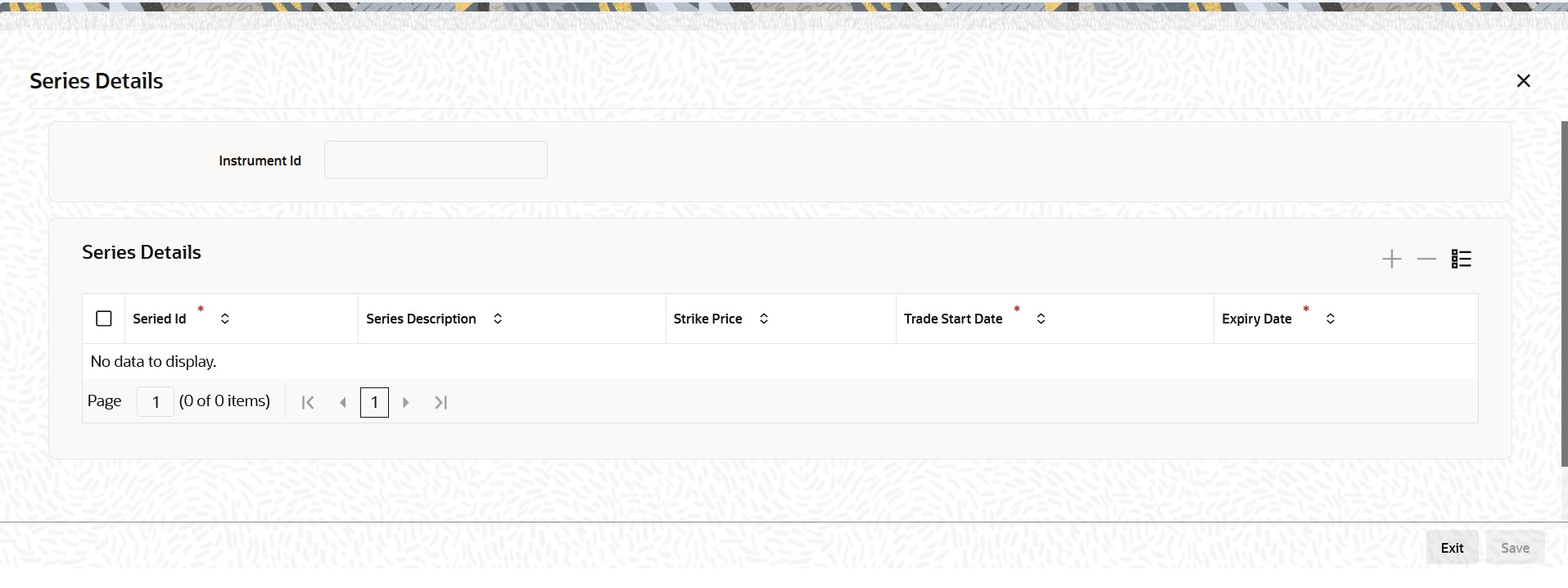

Description of "Figure 4-2 Treasury-Intra Day Batch Start - Login Page" - In the Instrument Definition screen, click Series.The Series Details screen is displayed.

Each time the exchange introduces a new series for the instrument, the instrument maintenance record should be unlocked and the details of the new series captured.

- On the Series Details screen, specify the fields.

For more information on the fields, refer to the below Field Description table.

Table 4-12 Instrument Series - Field Description

Field Description Series ID To identify the series, you need to assign a unique 16 character code to the series. After you associate a code with the series, you have to capture a brief description of the series. This description will be associated with the series for information retrieval purposes.

Strike Price While capturing the details of an option instrument, you need to indicate the price at which the option buyer can purchase the asset for a call option or sell the asset in the case of a put option.

The Strike Price is specified in terms of the Pricing Size and Unit maintained for the Instrument. Therefore, it is multiplied by the instrument pricing multiple to arrive at the contract value.

Trade Start Date and Expiry Date You can indicate the time period for which the series can be traded in the market by specifying the following:

- Trade Start Date

- Expiry Date

The Trade Date is the first date on which the series can be traded in the market. The value dates of deals involving the particular series cannot be earlier than the Trade Date.

The Expiry Date is the date on which the series expires. The value dates of any of the deals involving the series cannot be later than the expiry date. The automatic Expiry/Exercise liquidation of all open positions for a series is done as part of the End of Day activities on the expiry date of the series.

A single instrument can have multiple series attached to it. At a given point in time multiple series of the same instrument can be traded simultaneously depending on the expiration months for each series.

Let us assume, you are maintaining the details of Wrought Iron Futures, traded in the London metal exchange. The instrument has two series attached to it.

Table 4-13 Series I

Series Description Series ID

LME – Wrought Iron Futures – DEC 2000 series

Opening Day

01 Dec 2000

Lifetime

6 months

Table 4-14 Series II

Series Description Series ID

LME – Wrought Iron Futures – JAN 2001 series

Opening Day

01 Dec 2001

Lifetime

5 months

Parent topic: Instrument Definition