- Exchange Traded Derivatives User Guide

- Portfolio Products and Portfolios Creation

- Process Portfolio Definition Maintenance

5.6 Process Portfolio Definition Maintenance

This topic describes the systematic instruction to process Portfolio Definition Maintenance screen.

It is necessary to maintain a mandatory program, to run Portfolio Definition Maintenance Screen.

- On the Home page, type EDDPFMNT in the text box, and then click next arrow.

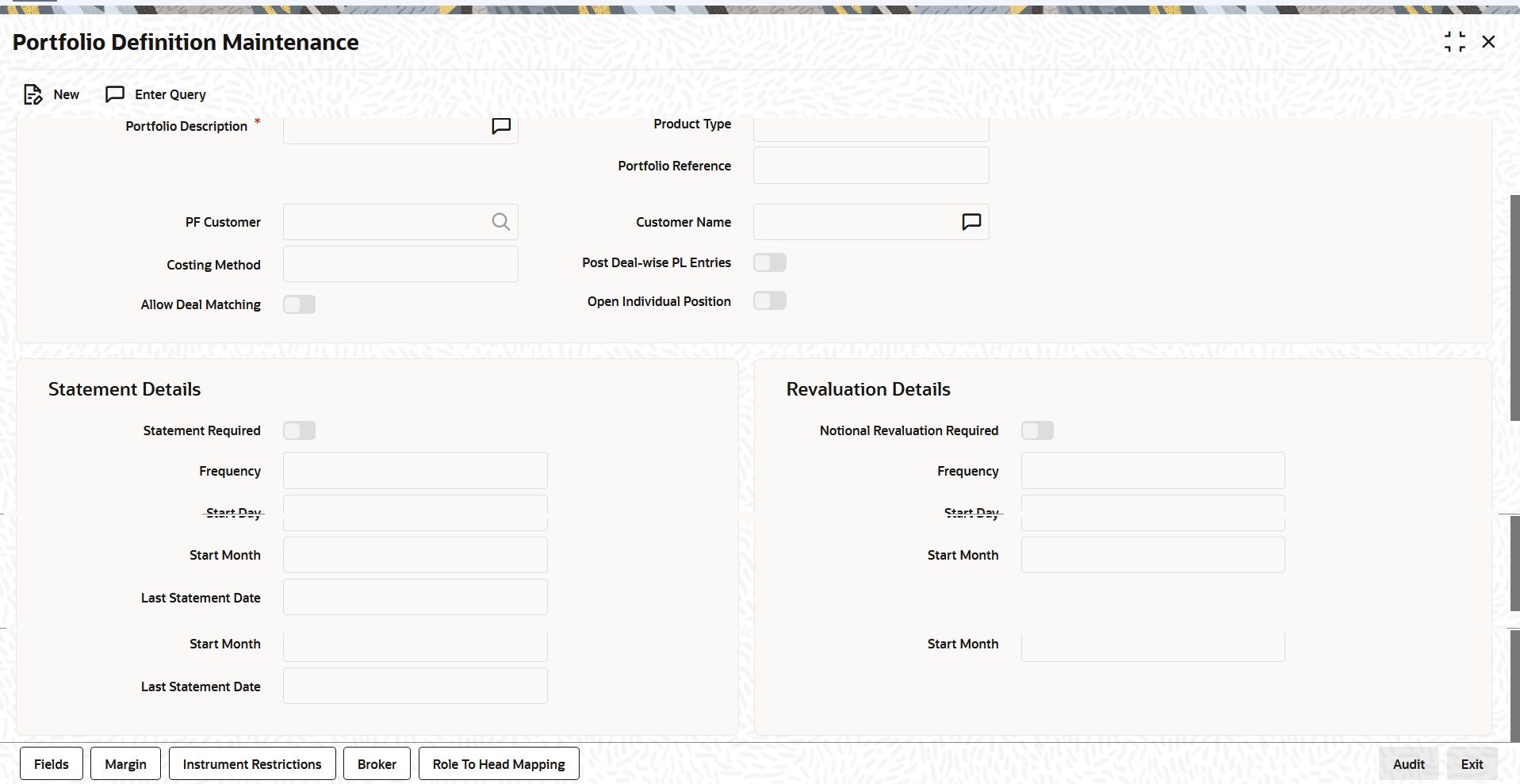

The Portfolio Definition Maintenance screen is displayed.

Figure 5-9 Portfolio Definition Maintenance

Description of "Figure 5-9 Portfolio Definition Maintenance" - On the Portfolio Definition Maintenance screen, click New.

- On the Portfolio Definition Maintenance screen, specify the following details, and then click Enter Query.

For more information on the fields, refer to the below Field Description table.

Table 5-19 Portfolio Definition Maintenance - Field Description

Field Description Portfolio Product You should necessarily use a product that has already been created to enter the details of a portfolio. Depending on the type of portfolio you are creating, you can select an appropriate product code from the option list available.

A portfolio inherits all the attributes defined for the product associated with it. You can also add details that are specific to the portfolio depending on the portfolio type you are creating. For instance if you are setting your own portfolio you can indicate the following:

- Option costing method that is to be used

- Whether notional revaluation is required.

If you are maintaining the details of your customer’s portfolio, you must specify the customer involved in the portfolio along with the other details.

Reference Number In Oracle Banking Treasury Management, reference numbers are generated automatically and sequentially by the system. This number tag is used to identify the portfolio you are defining. Hence the system generates a unique number for each portfolio.

The portfolio reference number is a combination of a three-digit branch code, a four-character product code, a five-digit Julian Date, and a four-digit serial number.

Portfolio Identification Enter a unique reference ID for the portfolio. This ID, in addition to the Reference Number generated by the system, will be used to identify the portfolio. This ID should be unique and cannot be used to identify any other portfolio. It cannot exceed 16 characters.

Portfolio Description In addition to the ID, you can also capture a brief description that is to be associated with the portfolio. The description that you enter cannot exceed 35 characters.

Portfolio Type The product type is defaulted depending on the portfolio product that you associate with the portfolio. For instance, if you are setting up a portfolio o manage your banks own trades and investments you will associate the portfolio with the appropriate portfolio product meant for your banks use. Upon association, the value in the Portfolio Type field will be defaulted as Own.

Similarly, if you are defining a customer portfolio the value in the Portfolio Type field will be defaulted as Customer.

Note:

For each product type you can set up multiple portfolios.

Customer Number Indicate the ID of the customer involved in the portfolio. You can select the respective CIF ID from the available list.

Note:

CIF IDs are assigned to customers of your bank through the Customer Information File Definition screen of the Core Services module of Oracle Banking Treasury Management.

Fund Identification You can identify and define specific branches of your bank as Fund Branches. In fund branches, only the banks own portfolios can be defined.

When the branch for which you are setting up a portfolio has been defined as Fund Branch, you must associate the portfolio with a Fund ID. Since there might be multiple funds define in the branch, you must select the appropriate Fund ID from the available list. The portfolio that is associated with the Fund ID becomes the fund’s portfolio.

Costing Method A costing method is used to determine your holding cost in a portfolio. Since futures and options with future style of premium are revalued on a cash basis (Variation Margin) everyday, the system automatically uses the Weighted Average method as the basis for costing these instruments.

While setting up a bank portfolio for options with option style of premium, you have to indicate the costing method that is to be used. Based on the preference of your bank you can select an option from the option list:

The costing methods for options are as given below:

- Weighted Average Cost (WAC)

- Last in first out (LIFO)

- First in first out (FIFO)

- Deal matching (DMAT)

The costing method for futures will only be WAC.

Note:

In Oracle Banking Treasury Management profit and loss calculations are maintained only for the bank’s own portfolio. Therefore, you can specify this preference only while setting up your own portfolios.

Note:

If the costing method is LIFO or FIFO, at the time of processing EOLG, EOSH and Exchange of physicals, the system will automatically do a matching of deals based on deal time stamp to arrive at the closure and EFP gain or loss.

If the costing method is DMAT, you will have to carry out a manual matching based on which, the system will compute the closure gain or loss at the end of the day.

If the costing method is DMAT and deal matching has not been done, the EOD Batch will skip the basket

For a Non WAC Portfolio, the Closure and EFP gain or loss is computed as follows:

(Number of contracts * Cost per contract of closing / expiry deal) – (Latest WAC for the basket)

The total deal cost is computed as follows:

Cost per contract * No. of matched contracts for deals that are matched with the closing deal.

During EEPL/ EEPS the closing deal will be the liquidation deal booked manually or automatically at expiry.

For a WAC Portfolio, the Closure and EFP gain or loss is computed as follows:

(Number of contracts * Cost per contract of the closing/expiry deal) – (Total deal cost)

Notional Revaluation required Check the box Notional Reval Reqd. to indicate the portfolio has to be revalued notionally.

Frequency If you have indicated that the portfolio has to be revalued notionally, you have to specify the frequency at which it has to be revalued. The options available are as follows:

- Daily

- Monthly

- Yearly

In the case of monthly, quarterly, half yearly or yearly revaluation, you should specify the date on which the revaluation should be done during the month. For example, if you specify the date as ‘30’, revaluation will be carried out on that day of the month, depending on the frequency.

If you want to fix the revaluation date for the last working day of the month, you should specify the date as ‘31’ and indicate the frequency. If you indicate the frequency as monthly, the revaluation will be done at the end of every month -- that is, on 31st for months with 31 days, on 30th for months with 30 days and on 28th or 29th, as the case may be, for February.

If you specify the frequency as quarterly and fix the revaluation date as 31, the revaluation will be done on the last day of the month at the end of every quarter. It works in a similar fashion for half-yearly and yearly revaluation frequency.

If you set the revaluation frequency as quarterly, half yearly or yearly, you have to specify the month in which the first revaluation has to begin, besides the date on which the revaluation should be done.

For example, let us assume that the revaluation date falls due on 31 June, which happens to be a holiday. The system completes the revaluation on the 30 June, which happens to be a working day.

Statement Details Specify the Statement Details. Frequency

If you have indicated that a Statement of holdings and transaction should be generated for the customer portfolio, you have to indicate the frequency with which a statement should be generated.

The frequency that you specify can be:

- Daily

- Monthly

- Quarterly

- Half-yearly

- Yearly

Based on the frequency that you specify you can also indicate the start date and month for the generation of the statement. The system generates a statement of holding and transactions automatically, as part of the end of cycle processing based on the preferences that you specified here.

When the statement generation date falls on a holiday, the statement is generated on the next working day after the holiday.

You have selected the half-yearly option and specified the start date as 31 and the start month as June.

The first revaluation will be done on 30 June for the period from January 1 to June 30, and the second one on 31 December for the period from 1 July to 31 December.

If the revaluation date falls on a holiday, the system does the revaluation on the previous working day before the holiday.

For example, let us assume that the revaluation date falls due on 31 June, which happens to be a holiday. The system completes the revaluation on the 30 June, which happens to be a working day.

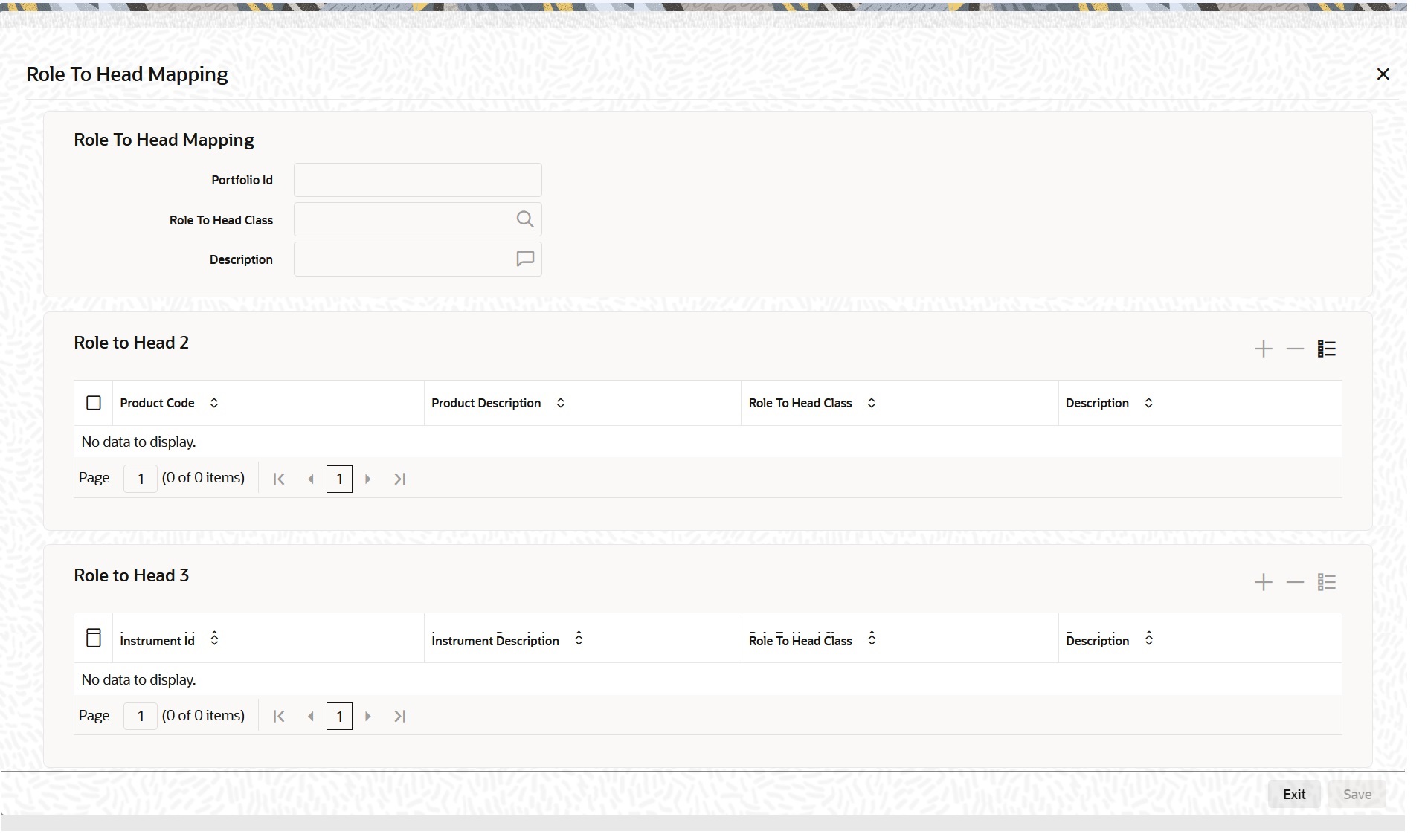

- On the Portfolio Definition Maintenance screen, click the Role to Head tab.

The Role to Head Mapping screen is displayed.

In the Portfolio Role to Head Mapping screen, you can link accounting Role to Head mapping classes with any of the following:

- Portfolio and an Instrument ID

- Portfolio and an Instrument Product

- Portfolio ID

Note:

For a detailed procedure on:

- How to map Accounting Roles to Account Heads, or

- How to link an accounting class with any of the three levels.

Refer to the Common Procedures User Manual of Oracle Banking Treasury Management.

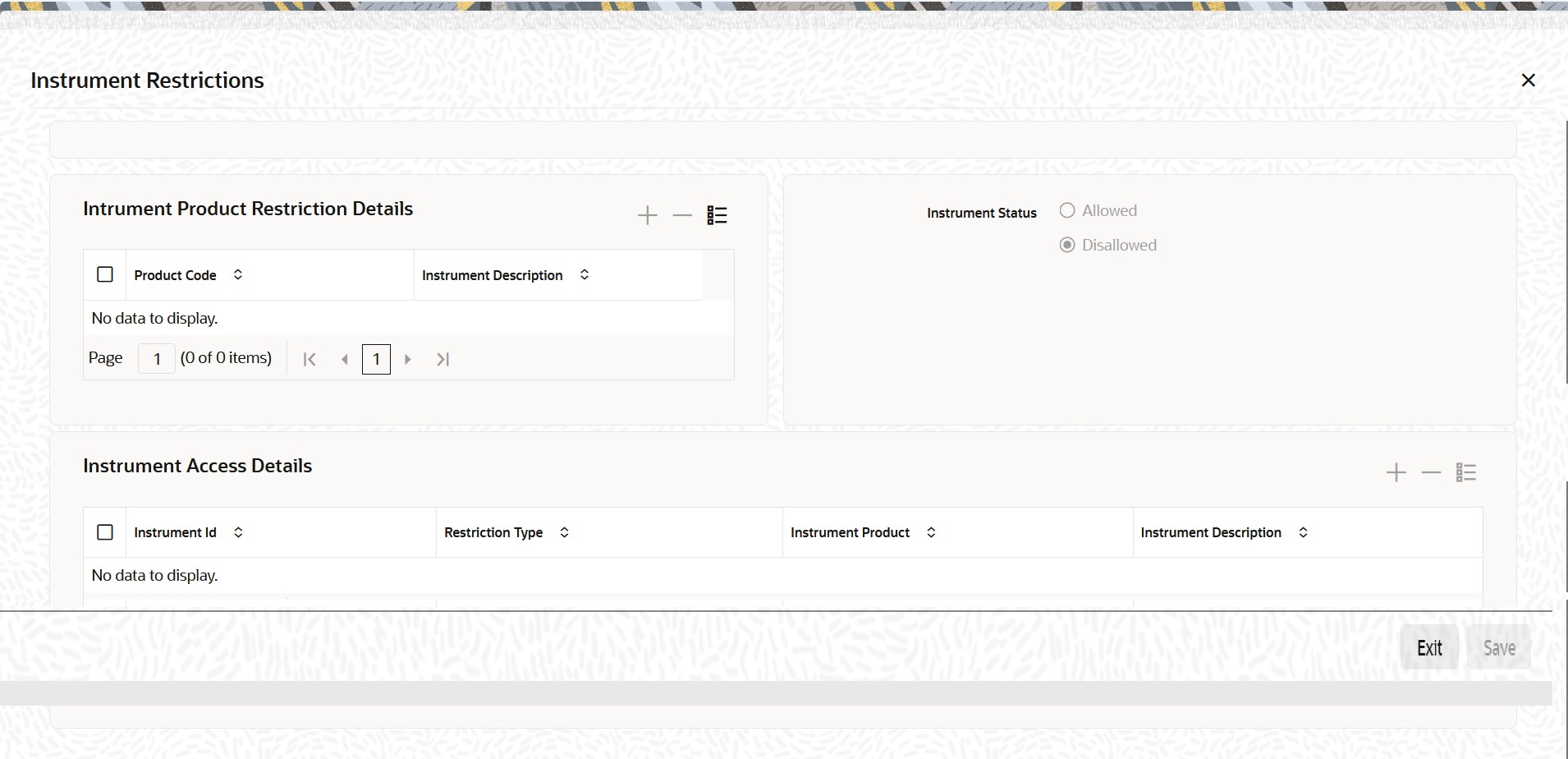

- On Portfolio Definition Maintenance screen, click the Instrument Restrictions tab.

The Instrument Restrictions screen is displayed.

In this screen, you can identify the Instruments or Instrument Products the portfolio can trade in. As a result, the portfolio will not be allowed to trade in those instruments/instrument products that you restrict in this screen.

You can establish certain controls over the instruments and instrument products that a portfolio can trade in. You can achieve these controls by specifying restrictions through the Instrument Restrictions screen.

Note:

For a detailed procedure on how to restrict specific instruments or instrument products refer to the Common Procedures manual of Oracle Banking Treasury Management.

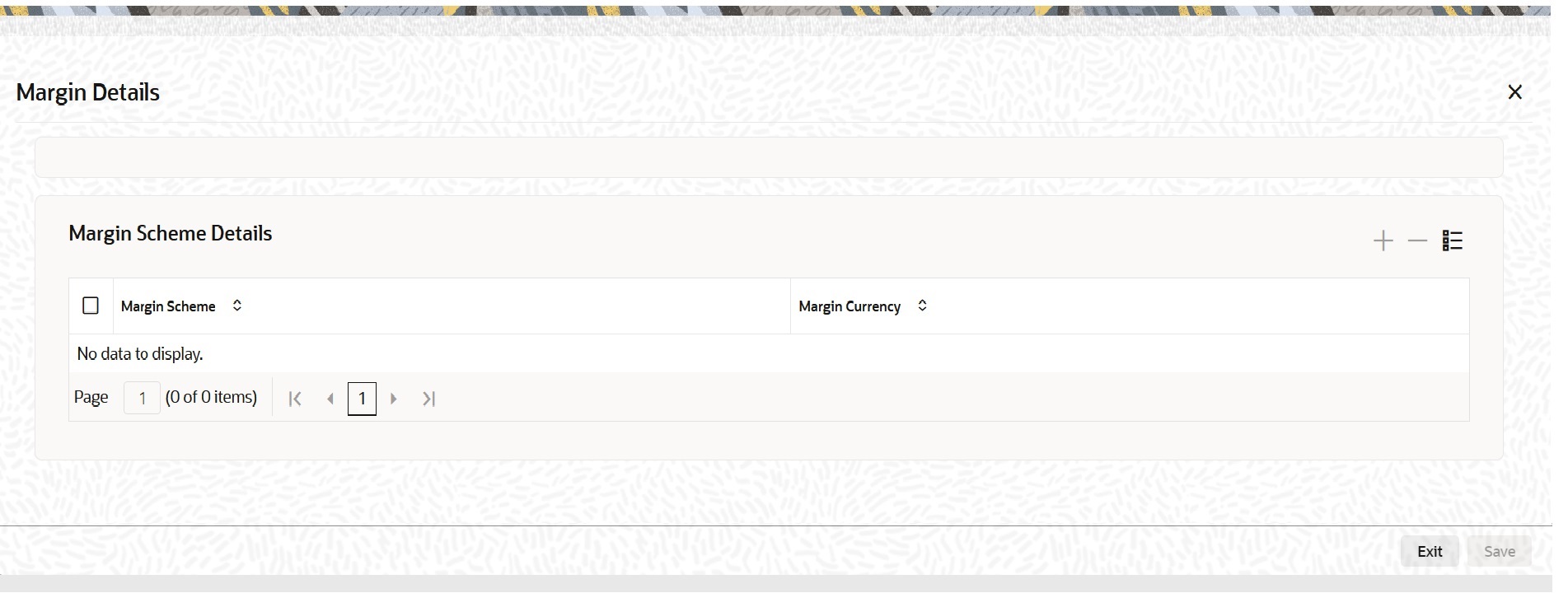

- On Portfolio Definition Maintenance screen, click the Margin tab.

The Margin Details screen is displayed.

The different stages in the life-cycle of an ET deal are called events. All of these events involve money settlements either with the broker involved in the deal or with the portfolio customer. In the case of customer portfolios you may have to do money settlements with the broker as well as with the portfolio customer.

In Oracle Banking Treasury Management, you have the option of netting settlements for the broker and the portfolio customer across events and portfolios. You can do this by linking the portfolio and the broker account with a margin scheme.

A margin scheme is a pool of balance maintaining a net receivable or payable position for a broker or a Customer. You can choose to liquidate the scheme either partially or wholly at any given point in time.

While defining a customer portfolio you can link a margin scheme for every currency that the customer holds positions in. To link a margin scheme with a portfolio you can click the Margin button in the Product Definition screen.

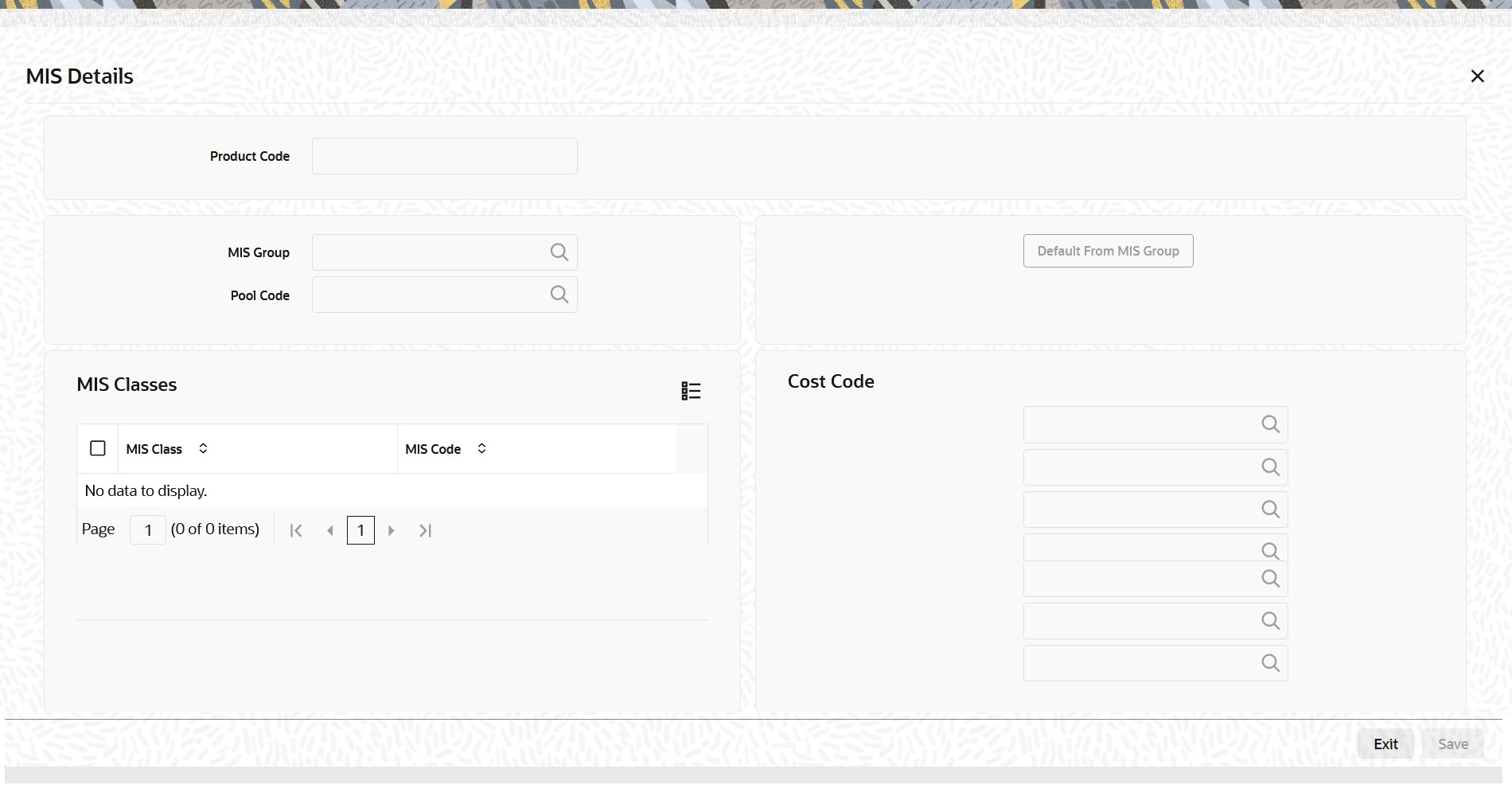

- On the Portfolio Definition Maintenance screen, click the MIS tab.

The MIS Details screen is displayed.

As part of specifying the portfolio product details you would have identified the MIS transaction codes under which portfolios within the product are to report to. These transaction codes will be defaulted to portfolio. You can choose to change the defaults specifically for a portfolio. Click ‘MIS’ button in the Portfolio Definition screen. The Transaction MIS Maintenance screen will be displayed.

You can Identify the transaction code (s) under which you would like to report the portfolio.

Refer to the Common Procedures manual for a detailed procedure.

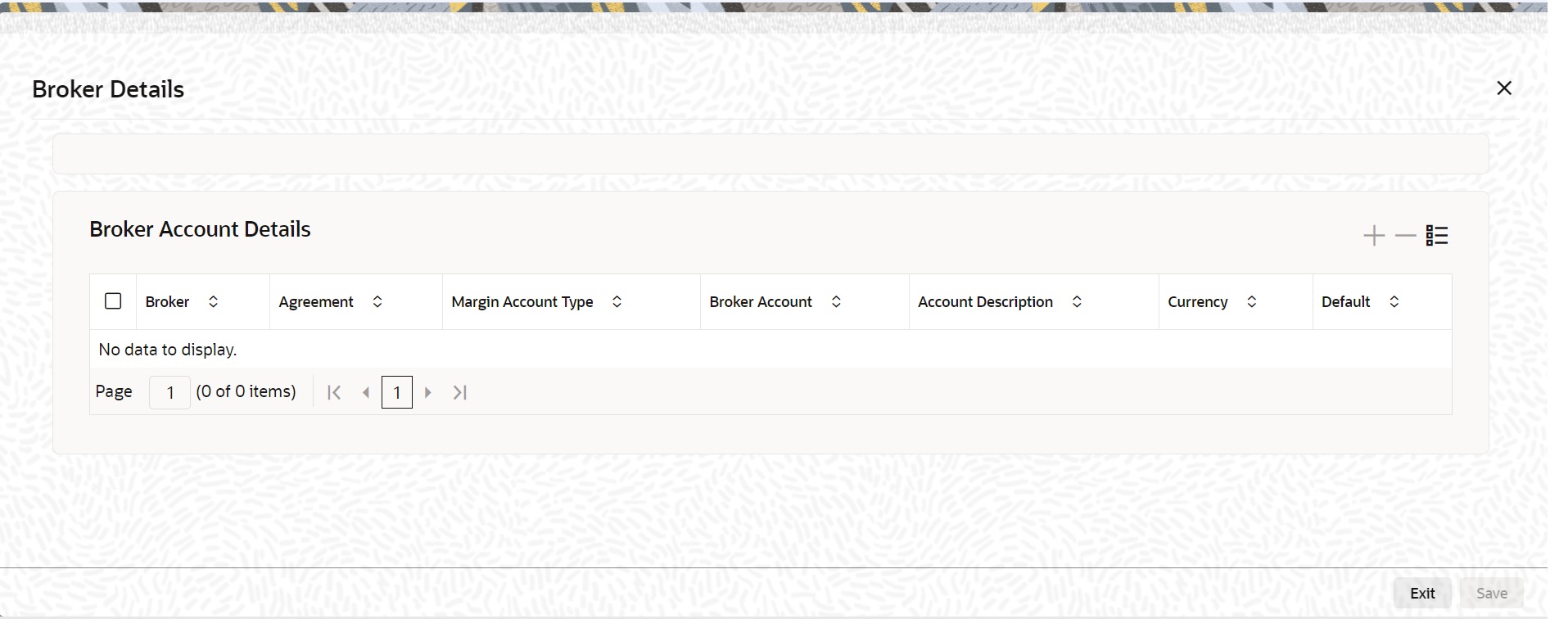

- On the Portfolio Definition Maintenance screen, click the Broker tab.

The Broker Details screen is displayed.

Annexure A lists all the possible accounting entries for your banks and customer portfolios.

Through the Portfolio Broker Account Linkage screen you can:

- Identify the brokers that are to be associated with the portfolio.

- Identify broker accounts and map them to relevant Broker codes.

Parent topic: Portfolio Products and Portfolios Creation