- Exchange Traded Derivatives User Guide

- General Maintenance

- Process Underlying Asset Definition

8.6 Process Underlying Asset Definition

This topic describes the systematic instruction to process Underlying Asset Definition screen.

In Oracle Banking Treasury Management, the underlying assets or commodities can be categorized and maintained through the Underlying Asset Definition screen.

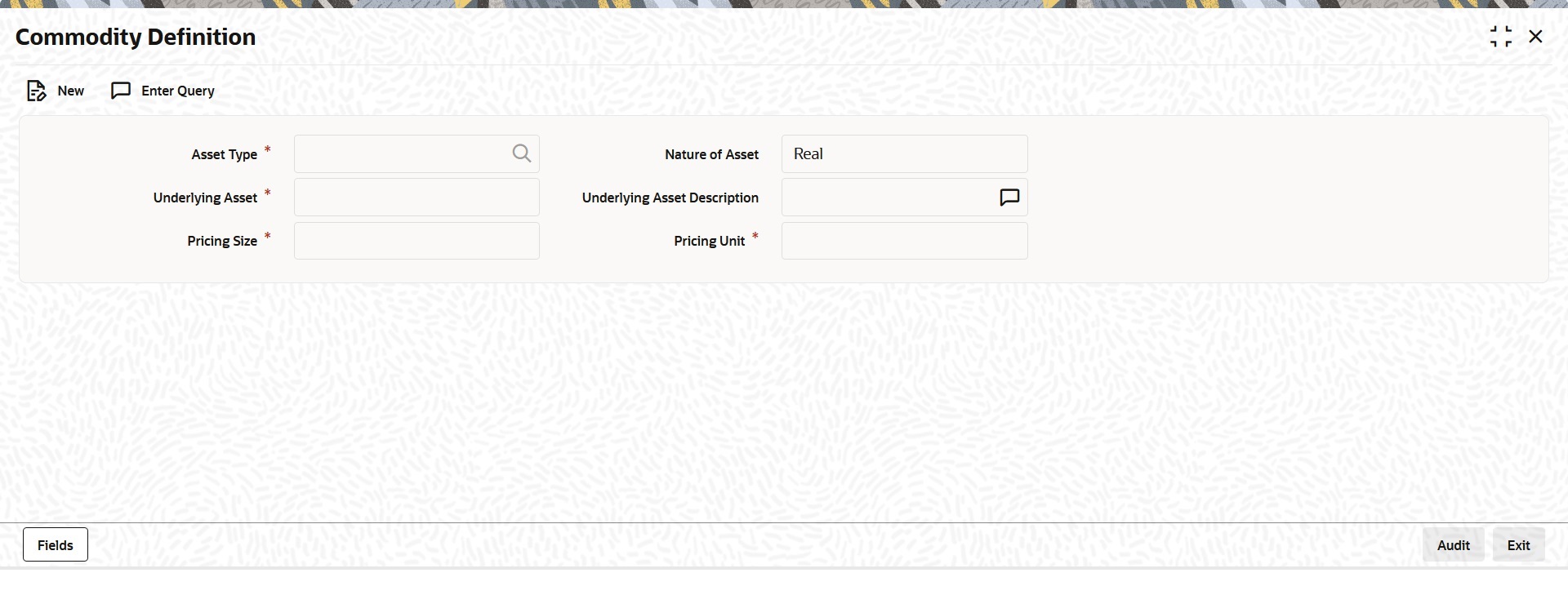

- On the Home page, type EDDCOMDF in the text box, and then click next arrow.The Commodity Definition screen is displayed.

- On the Commodity Definition screen, click New.

- On the Commodity Definition screen, specify the fields, and then click Enter Query.

For more information on the fields, refer to the below Field Description table.

Table 8-3 Commodity Definition - Field Description

Field Description Underlying Asset

Specify a name for the underlying asset here. This name that you give to an underlying asset identifies the underlying asset throughout the module. Ensure that the name assigned to the underlying asset is unique.

You can follow your convention for naming the commodity. However, the name should not exceed 16 characters.

This field is mandatory.

Underlying Asset Description

You can provide additional details of the underlying asset here. Your description for the underlying asset can be in no more than 255 characters. This description is associated with the underlying asset for information retrieval purposes only.

Asset Type

Type the Asset Type under which your asset should be grouped. Although you can define as many asset types as required, a list of predefined asset types is available in Oracle Banking Treasury Management. This list includes:

- Bond

- Commodity

- Currency

- Derivatives

- Equity

- Index

- Interest rates

Select the appropriate asset type from the adjoining list of options.

Note:

Individual underlying assets can be mapped to any one of the above asset types. However, while defining currency assets (like US Dollar, Great British Pound, Japanese Yen, to name a few) you have to strictly map them to the Asset Type – Currency. Similarly, while defining indices (such as the BSE Sensex, NYSE, LSE, and so on) you must map them to the Asset Type – Index.For example, while maintaining USD (U.S Dollar) as a commodity, you must group it under the Asset type – Currency. Similarly, if you create a commodity titled – BSESENSEX, it should be grouped under the asset type – INDEX.

This field is mandatory.

Nature of Asset

Select the nature of the asset under which the underlying asset is categorized. This indicates the basic nature of the underlying asset. The available options are:

- Real

- Contingent

Indicate whether the nature of the underlying asset is Real or Contingent depending on the physical holding of the underlying. Let us assume that you are identifying a particular currency in Oracle Banking Treasury Management as an underlying asset. In this case, the nature of the asset will be Real. However, if you are maintaining an option on a currency swap as an underlying asset, then the underlying asset or commodity is not the currency but the currency swap itself. Therefore the underlying asset becomes a contingent asset.

Pricing Size and Underlying Pricing Unit

You can indicate how the underlying asset is priced in the market by specifying the market price per unit of the underlying. Since every instrument that is processed in the system automatically inherits the characteristics of the underlying asset, the pricing size and the unit will be defaulted to the Instrument.

This field is mandatory.

Parent topic: General Maintenance