- Exchange Traded Derivatives User Guide

- General Maintenance

- Treasury Broker Commission Setup

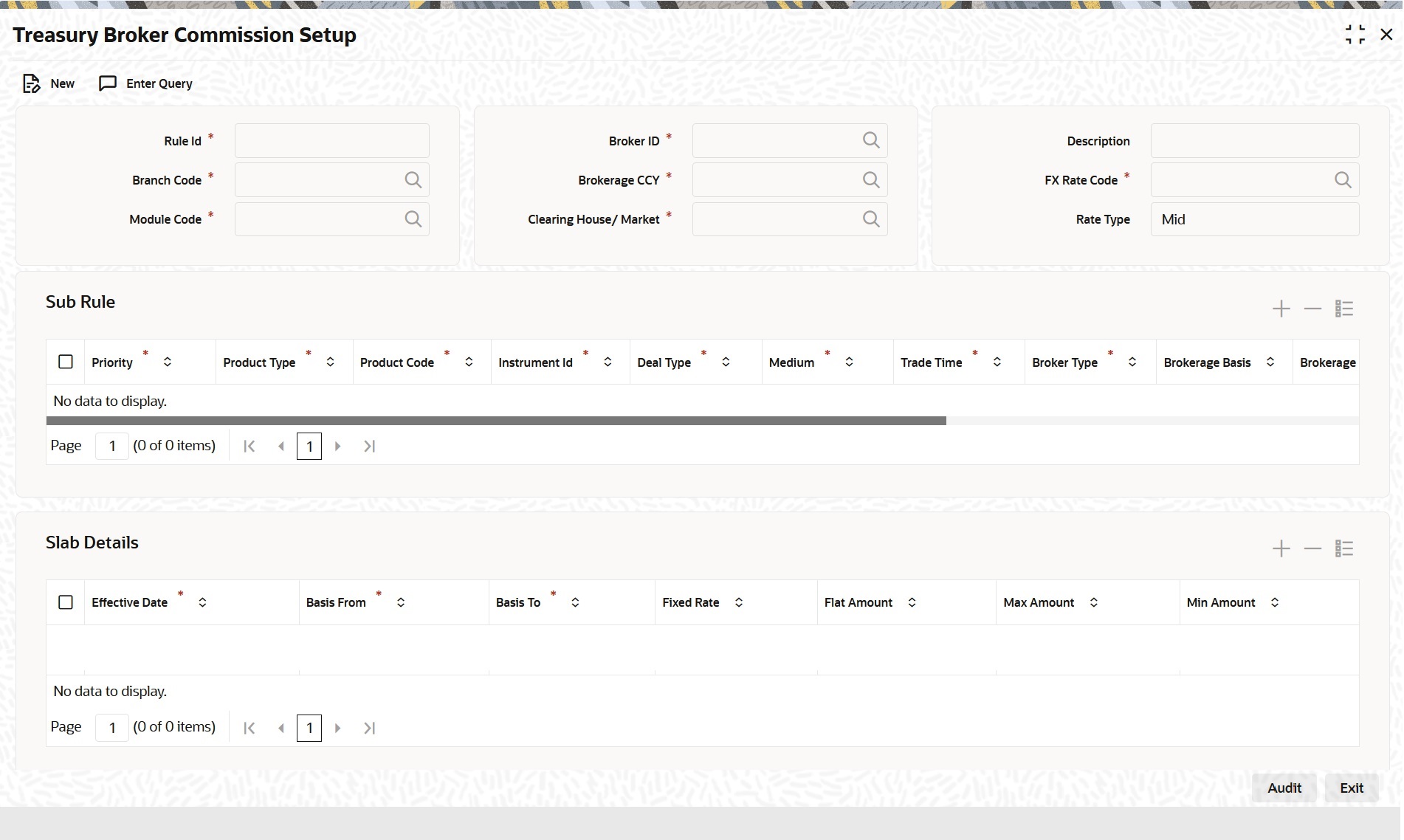

8.10 Treasury Broker Commission Setup

This topic describes the systematic instruction to set up Treasury Broker Commission details.

You can capture the different values applicable for arriving at brokerage for Exchange Traded Derivatives

- On the Home page, type TRDBKRUL in the text box, and then click next arrow.The Treasury Broker Commission Setup screen is displayed.

Figure 8-7 Treasury Broker Commission Setup

Description of "Figure 8-7 Treasury Broker Commission Setup" - On the Treasury Broker Commission Setup screen, click New.

- On the Treasury Broker Commission Setup screen, specify the field details and then click Enter Query.

Table 8-7 Treasury Broker Commission Setup - Field Description

Field Description Rule ID Specify a unique Rule ID for the Broker ID-brokerage currency-branch code-module code-clearing house/market combination.

Branch Code Specify the branch code. The adjoining option list displays the branch codes maintained in the system. You can choose the appropriate one. You can choose ‘ALL’ if it is applicable for all branches.

Module Code Specify the module code for which the maintenance is applicable. The adjoining option list displays the module codes maintained in the system. You can choose the appropriate one. You can choose ‘ALL’ if it is applicable for all modules.

Broker ID Specify the required Broker ID. The adjoining option list displays the brokers maintained in the system. You can choose the appropriate one.

Brokerage CCY Specify the brokerage currency. The adjoining option list displays the currencies maintained in the system. You can choose the appropriate one. You can choose ‘CCY’ if it is applicable for all currency deals.

Clearing House/Market Specify the clearing house or market for the treasury broker. The adjoining option list displays the clearing houses (markets for trade) maintained in the system. You can choose the appropriate one. You can choose ‘ALL’ if it is applicable for all clearing houses.

Only one rule can be maintained for a particular Branch code+Module Code+Broker ID+Brokerage CCY+ Clearing House/Market combination.

Description Specify an appropriate description for the Rule

FX Rate Code Specify the FX rate code to be used from the adjoining option list.

Rate Type Select the rate type from the adjoining drop-down list. The list displays the following values:

- Mid

- Buy

- Sell

Priority Specify the priority for the rule. This needs to be a unique number. The system will not allow duplicate priority.

Product Type Specify the product type. The adjoining option list displays the product types maintained in the system. You can choose the appropriate one. You can choose ‘ALL’ if it is applicable for all product types.

Product Code Specify the product code for the instrument. The adjoining option list displays the relevant product codes. You can choose the appropriate one. You can choose ‘ALL’ if it is applicable for all product codes.

Instrument ID Specify a valid Instrument ID. The adjoining option list displays the relevant Instrument IDs. You can choose the appropriate one. You can choose ‘ALL’ if it is applicable for all Instrument IDs.

Deal Type Specify the deal type. The adjoining option list displays all deal types maintained in the system. You can select the appropriate one.

The respective deal type is applied for deals booked in Long Short Deal screen and the Liquidation Deal screen.

Medium Select the preference for medium from the adjoining drop-down list. The list displays the following values:

- Online

- Voice Trade

- ALL

Trade Time Select the trade time preference from the adjoining drop-down list. The list displays the following values

- After Hours Trade

- Day Trade

- ALL

Broker Type Select the broker type from the adjoining drop-down list. The list displays the following values:

- Clearing

- Execution

- Both

Brokerage Basis Select the basis to compute brokerage from the adjoining drop-down list. The list displays the following values:

- Contract Amount

- No. of Contracts

- Premium Amount (Options Only)

Brokerage Type Select the brokerage type from the adjoining drop-down list. The list displays the following options:

- Round Turn

- Half turn

For Half-Turn Commission, all Long/ Short Deals and liquidation deals booked will process commission as part of ‘EBOK’ Event.

Pro-rate Select the preference for split slab rule from the adjoining drop-down list. The list displays the following values:

- Yes

- No

If 'Yes' is selected, the split slab rule is picked up and used for calculating the brokerage amount.

Active Check this box to indicate that the Rule is active. If this box is unchecked, the sub-rule will not be picked up for calculation of brokerage.

Sequence Number Specify the sub-rule sequence number

Effective Date Specify the effective date for the rule

Basis From Specify the starting amount for the slab

Basis To Specify the ending amount for the slab

Fixed Rate Specify the fixed rate to be used. If the brokerage is a combination of ‘Fixed Amount + Fixed Percentage’ then both ‘Flat Amount’ and ‘Fixed Rate’ should be specified.

Flat Amount Specify the flat amount. If the brokerage is a combination of ‘Fixed Amount + Fixed Percentage’ then both ‘Flat Amount’ and ‘Fixed Rate’ should be specified.

Max Amount Specify the maximum amount. While creating the record in this screen, Max amount is considered only for Flat amount.

Min Amount Specify the minimum amount for the slab. While creating the record in this screen, Min amount is considered only for Flat amount.

You can also upload multiple rules into this screen using an excel.

For cross-currency deals where the deal currency and the rule currency are different, the system converts the deal amount into the rule currency amount to calculate brokerage. It uses the Rate Code and Rate Type maintained here to perform the conversion. If the rule has multiple slabs too, the system derives the slab using the Rate Code and Rate Type maintained here. If the deal currency and rule currency are different and the brokerage basis is No. of Contracts, the system does not allow currency conversion. This derivation for slabs and calculating brokerage is applicable for deal booking and deal liquidation.

Parent topic: General Maintenance