- Foreign Exchange User Guide

- Define Attributes Specific to FX Products

- FX Products

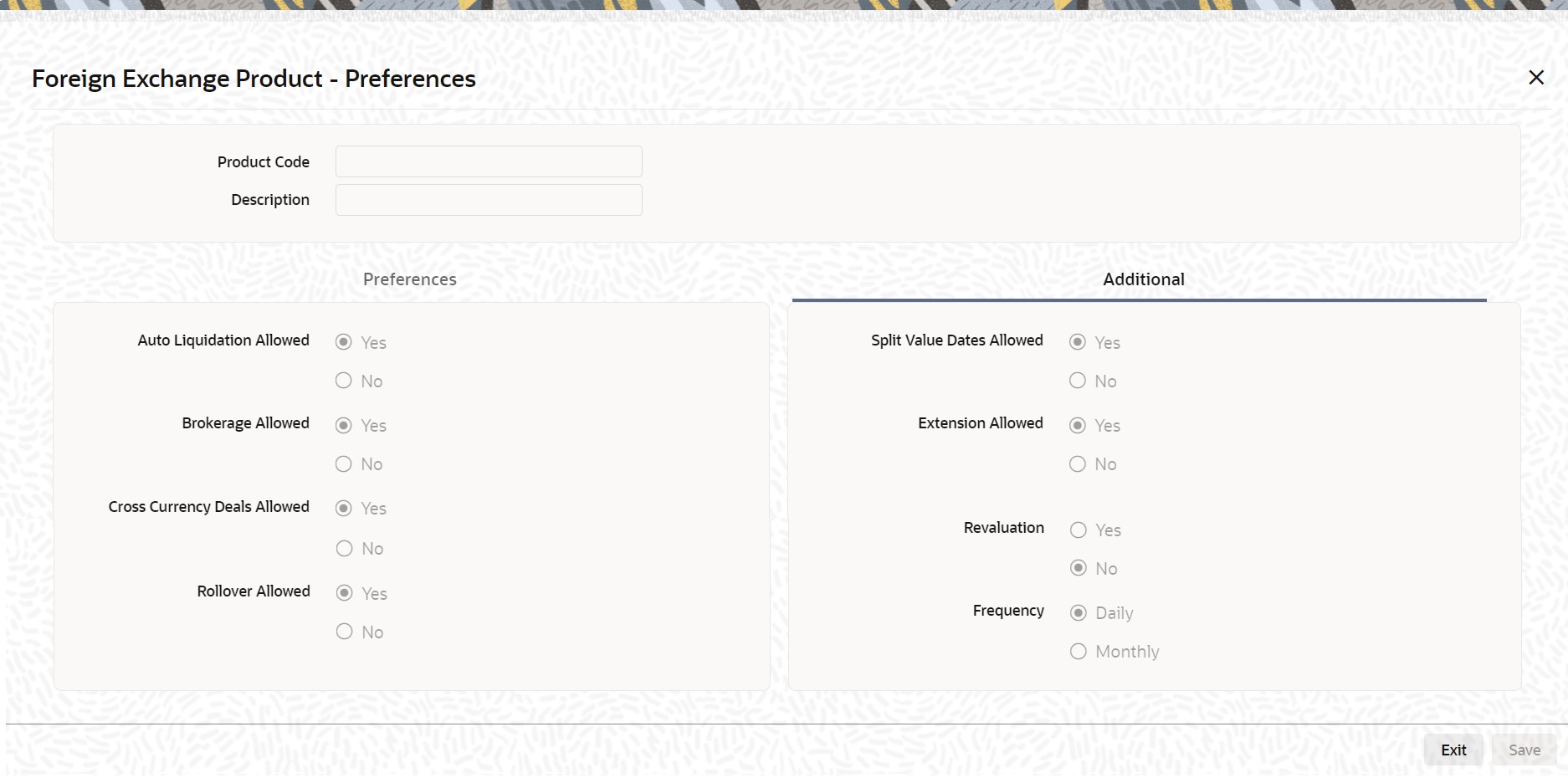

- Additional tab

- Define Additional Details

3.2.2.1 Define Additional Details

- On the Preference screen, click the Additional tab.

The Additional tab is displayed.

- Specify the details as per the requirement and click Ok to

set the parameters in additional tab.

For more information on the fields, refer to the below table.

The details in the additional tab is specified as per the requirement.

Table 3-3 Additional tab - Field Description

Field Description Revaluation

- Yes: Choose Yes, to allow revaluation of deals involving the product.

- No: Choose No to disallow revaluation of deals involving the product.

Frequency

If you allow revaluation of your foreign currency liabilities for a product, all deals involving the product will be revalued regularly. Opt to revalue deals related to a product:

- Daily: To revalue deals daily click the button adjacent to Daily in the Frequency field.

- Monthly: To revalue deals on a monthly basis, click the button adjacent to Monthly in the Frequency field.

Note:

Spot contracts can only be revalued on a daily basis. Revaluation frequency as 'Monthly' is not allowed for Spot contracts

When you run the End of Day processes in your bank, deals involving products specified for daily revaluation will be revalued. In case of products specified for monthly revaluation the deals involving the products will be revalued during the End of Month processes. Typically, the End of Day operator would perform the revaluation process.

Revaluation

Interest in both the currencies is accrued separately on a daily basis, starting from the spot date till the maturity date of the contract. The local currency equivalent of the FCY accrual entries is calculated at prevailing rates. Also the previous FCY accrual entries are revalued when you run the account revaluation batch function as part of the EOD operations. Contract level revaluation of the Discounted Amounts (Contingent Amounts) is done starting from the booking date till maturity of the contract.

These revaluations may result in a profit or a loss for your bank on the contract.

The revaluation entries are passed depending on the frequency you specify.

On the maturity date, the contingent entries are reversed; settlement entries are passed into the Nostro accounts for the full deal amounts and the interest receivable and the interest payable are booked into the FX gain/loss GLs.

You can indicate the method of revaluation by clicking on the button against the respectivemethods.

Revaluation method for Spot Contracts

None of the above-mentioned revaluation methods are available for Spot FX contracts. The revaluation of Spot FX contracts simply involves marking them to market.

Auto Liquidation Allowed

You can liquidate Foreign exchange deals automatically or manually. In the Product Preferences screen, indicate whether the mode of liquidation of deals, involving a product, is Manual Automatic.

If you specify the automatic mode of liquidation, deals involving the product will liquidate automatically on the Settlement Date during the Beginning of Day processing (by the Automatic Contract Update function).

If you do not specify auto liquidation for a product, you have to give specific instructions for liquidation, through the Manual Liquidation screen, on the day you want to liquidate a deal.

Note:

If the Value Date of a deal is a holiday, the deal will be liquidated depending on your specifications in the Branch Parameters table. In this table.

If you have specified that processing has to be done on the last working day (before the holiday), for automatic events, the deal falling on the holiday will be liquidated during the End of Day processing on the last working day before the holiday.

If you have specified that processing has to be done only on the system date, for automatic events, the deal falling on a holiday will be processed on the next working day after the holiday, during Beginning of Day processing.

Brokerage Allowed

You may opt to allow or disallow brokers while creating a product. If you allow brokers for a product, you can enter into deals that may or may not involve brokers. If you disallow brokers, you cannot enter deals involving brokers, for the product.

To allow brokers, Choose 'Yes' by clicking on the button against it.

To disallow brokers choose 'No' by clicking on the button against it.

When a deal involving a broker is processed, the brokerage applicable to the broker will be picked up from the Brokerage Rules table.

Cross Currency Deals Allowed

If a deal involves currencies other than the local currency, it is referred to as a cross-currency deal. For a product that you create, you can opt to allow or disallow cross-currency deals.

If you opt to disallow cross-currency deals for a product, you cannot enter a deal that does not involve the local currency.

If you opt to allow cross-currency deals, you can enter a deal involving or not involving the local currency.To allow cross currency deals, choose 'Yes' by clicking on the button against it. To disallow cross currency deals choose 'No' by clicking on the button against it.

Rollover Allowed

Specify whether foreign exchange deals, involving the product that you are defining, can rolled over into a new deal if it is not liquidated on its Value Date. If you specify that rollover is allowed for the product, it will apply to all the deals involving the product. However, at the time of processing a specific deal involving the product, you can choose not to rollover the deal.

If you specify that rollover is not allowed for a product, you cannot rollover a deal involving the product.

When a contract is rolled over, the terms of the original contract will apply to the new contract. If you want to change the terms of a rolled over contract do so during contract processing.

Note:

The rolled over contract will retain the reference number of the original contract.

Split Value Dates Allowed

For a product, you can indicate whether the Value Date (settlement date) of the Bought and Sold legs of FX deals, linked to the product, can be different.

If you select Yes, you can specify different value dates for the Bought and the Sold legs of the contract during deal processing. However, the enter deals with the same Value Date for the product.

If you select No, the Value Date (settlement date) should be the same for both legs of the deal.

Extension Allowed Choose to allow extension of the Value Date of FX deals involving a product.

If you disallow the extension of value dates for a product, you cannot extend the Value Date of deals involving the product.

Local Holiday Check

After you have specified all your preferences on this screen, click Yes to store them in the system. Click No, if you do not want to save your preferences in the system.

On Booking an FX deal

If it is an LCY-FCY deal, take the discounted amount of the LCY leg as the LCY Equivalent of contract.

Note:

System passes Contingent booking entries for the discounted amounts.

Parent topic: Additional tab