5.18 Limit

This topic provides the systematic instructions to pass liability number to ELCM in utilization/block request.

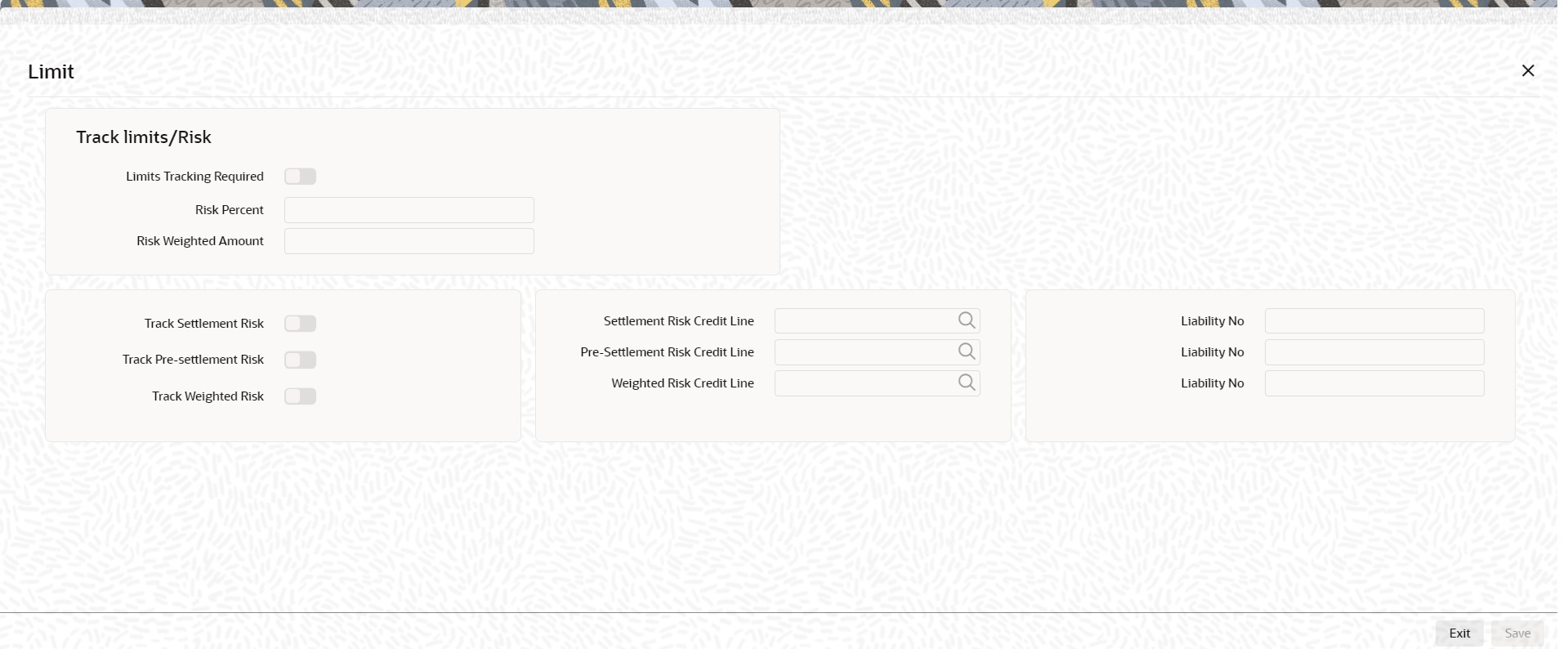

- On the Foreign Exchange Contract Input screen, click Limit.The Limit screen is displayed.

- On Limit, specify the fields.For more information, refer to the below table.

Table 5-14 Field Description

Field Description Limits Tracking Required

Select this option to enable the limit tracking for settlement risk, pre-settlement risk and weighted risk should be done for FX contracts. When this option is selected, the risk tracking option will also be enabled.

By default this field is checked.

Risk Percent

The risk percentage for the contract is displayed here. The risk percent is fetched from risk percent maintenance for combination of risk category+ ‘FX’+ product combination or risk category+ ‘FX’+ ‘ALL’ combination using original tenor of the contract.

Risk Weighted Amount

The risk-weighted amount is displayed here. The risk percent is applied on the bought amount to arrive at risk weighted amount.Note:

When a contract is copied, the limit tracking, risk tracking options and credit lines are copied from the contract. The risk percent and risk weighted amount will be zero.Whenever the counterparty is changed, the credit lines are made NULL as the credit lines are dependent on the counterparty. If credit lines are changed during amendment then the existing utilization is transferred to the new credit line and the utilization for the old credit line will be made Zero. If limits tracking option is unchecked during amendment, the utilizations will be nullified for the credit lines. The tenor for calculation of risk weighted amount will be calculated based on tenor type (‘Fixed’ or ‘Rolling’) maintained at the product.

Track Settlement Risk

Select this option to enable limit tracking on bought amount of FX Contracts. This option is enabled only when the Limits Tracking option is selected.

Track Pre-Settlement Risk

Set the revaluation to Y at the product level and check the limits tracking option to enable this option. Select this option if limit tracking on the revaluation gain for FX contracts is required.

Track Weighted Risk

Select this option to specify that limit tracking on the risk-weighted amount for FX contracts under this product.

Settlement Risk Credit Line

Settlement risk is the risk that one party fails to deliver the terms of a contract with another party at the time of settlement. Select the credit line to be used for netted settlement risk tracking from the option list. The list displays all valid credit lines applicable for the counterparty.

Pre-Settlement Risk Credit Line Pre-settlement risk is the risk that one party of a contract fails to meet the terms of the contract and default before the contract's settlement date, prematurely ending the contract. This field is enabled only if the Limits Tracking option and Risk Tracking option is selected else it is made NULL and disabled. Select the Credit line to be used for tracking revaluation gain/ loss from the option list. The list displays all valid credit lines applicable for the counterparty and product Weighted Risk Credit Line Select the credit line that should be used for netted risk weighted limit tracking from the option list. The list displays all valid credit lines applicable for the counterparty.

Liability No The first Liability No field displays the liability number linked to the Settlement Risk Credit line.

Liability No The second Liability No field displays the liability number linked to the Pre-settlement Risk line. Liability No The third Liability No field displays the liability number linked to the Weighted Risk Credit line.

Parent topic: Processing of Contract