1.1.1 Define Money Market schemes as Products

This topic describes the product definition of a money market schemes.

A product is a specific type of deal that a bank enters into, or a scheme that a bank offers its customers. An MM product can imply a particular type of placement/borrow deal that a bank enters. For example, your bank may provide customers with an overnight borrow facility. This facility can be defined as a product in Oracle Banking Treasury Management. (If your bank offers several types of overnight borrow schemes, each of these schemes can be defined as a product.)

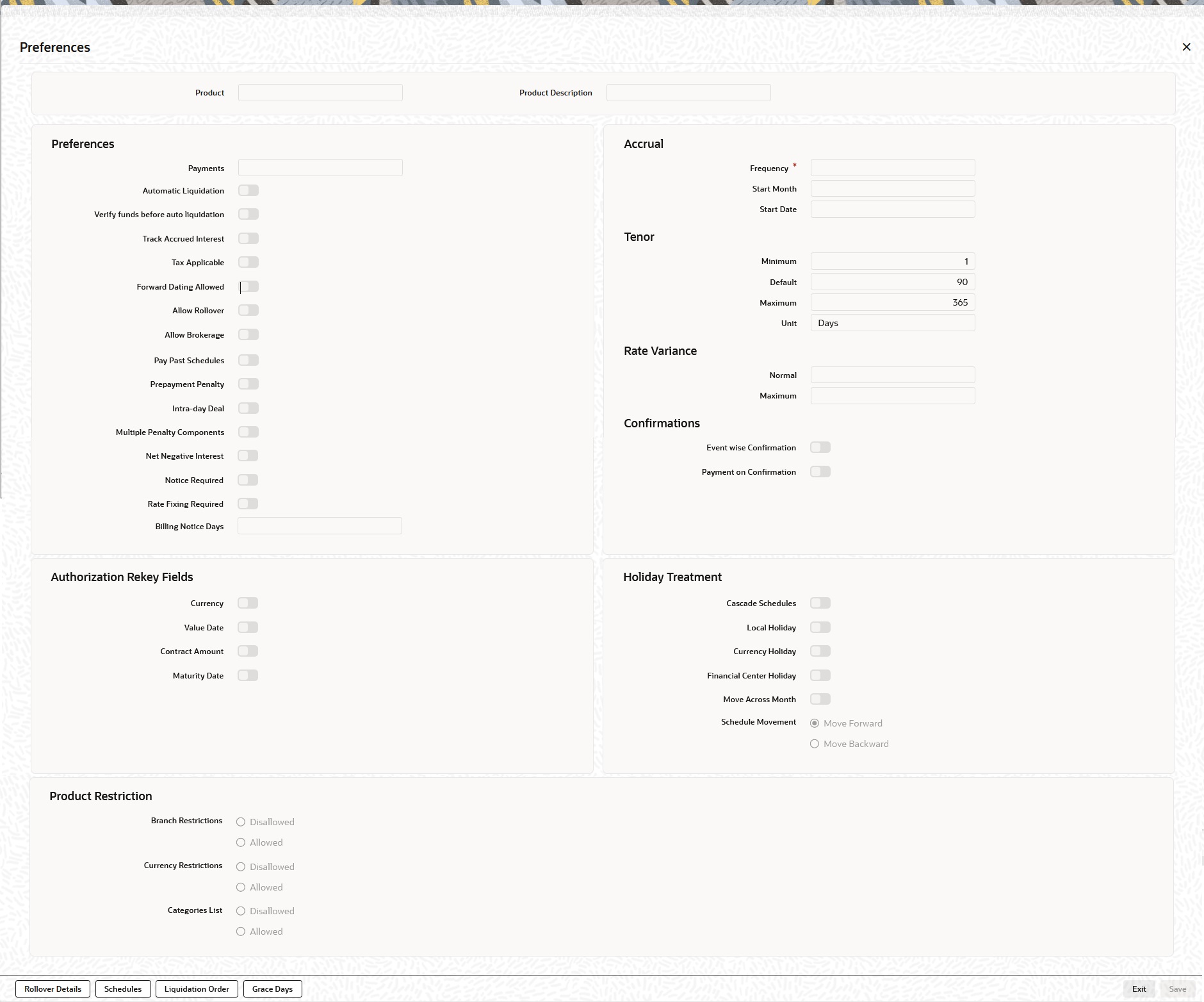

When setting up the module, define the various types of deals you enter into as products. For each product, define attributes such as interest, interest accrual, liquidation, rollover, tax, brokerage details, etc. When you enter into a deal, the deal acquires the attributes defined for the product that it involves.

For information on fields, refer to Preferences Field Description table.

Parent topic: The Product Definition Facility