- Money Market User Guide

- Roll Over a Deal

- Specify Rollover for a Product

- Impact of Liquidation Mode on Rollover

- Rollover Details

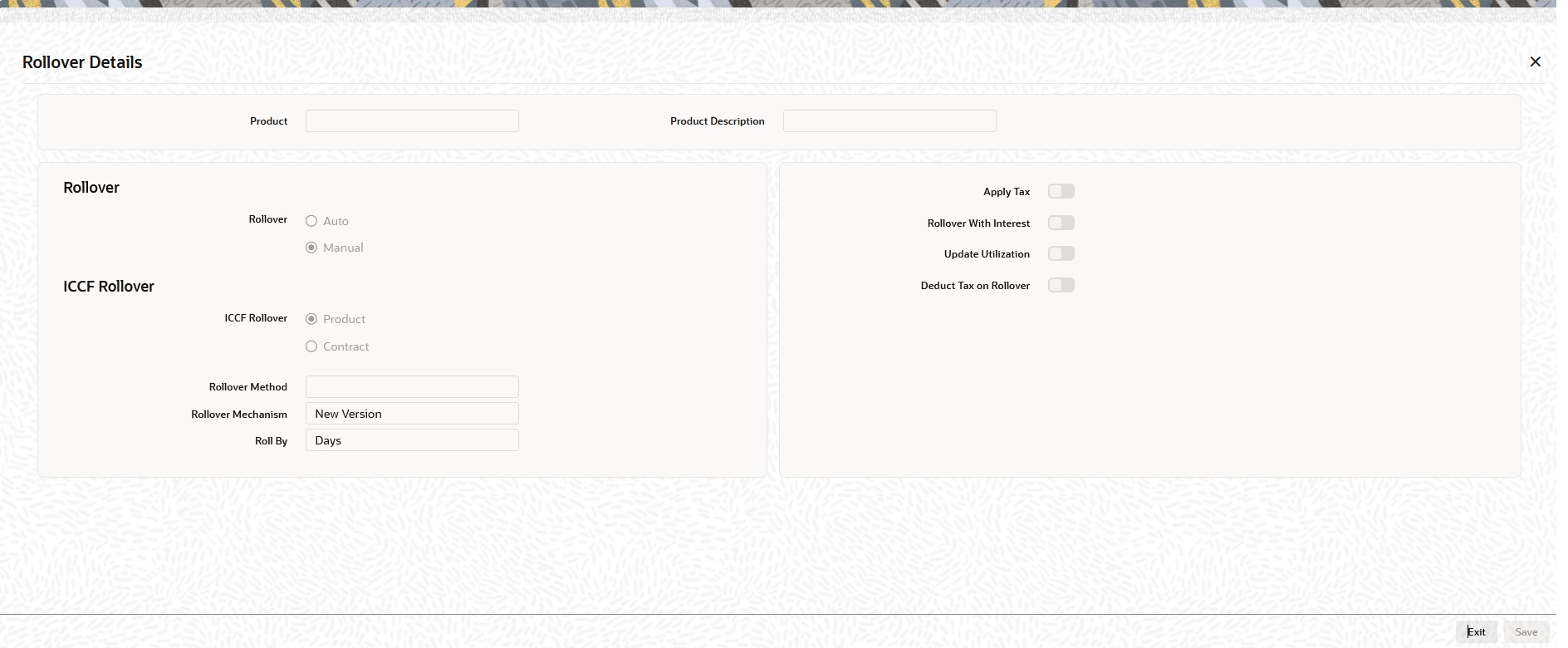

7.1.2.1 Rollover Details

This topic provides the instructions to capture the Rollover Details.

- On the Product Preferences screen, click Rollover.

Rollover details screen is displayed.

- On the Rollover details screen, specify the details as required.

- Click Ok to save the details or click Exit to close the screen.

For information on the fields, refer to the below table.

Table 7-1 Rollover details - Field Description

Field Description Mode of Rollover

For deals involving a product for which a rollover is allowed, you should specify the mode of rollover - automatic or manual - during processing.

A deal is automatically rollover on the maturity date if ‘Auto’ is selected at the product level.

If you choose ‘Manual’, on the maturity of a deal, you will need to indicate for rollover manually.

ICCB Rollover

The interest, charge and fee components of the new (rolled over) deal is picked up either from the old deal or from the product involving the old deal.

Choose the option:

- Product if you want the system to pick up the components from the product involving the old deal.

- Contract if you want the system to pick up the components from the old deal.

The following example illustrates this point:

For example, when defining a placement product, you specified that all placements involving it would have interest schedules every month and a processing fee.

Assume you have processed a placement involving this product, with the following attributes:

- Interest payment only on Maturity Date

- No fees

When rolling over this placement, you have two options:

You can indicate that the interest and fee details specified for the product are to be applied to the new (rolled over) placement. In such a case, the new placement will have interest payment schedules every month and a processing fee.

You can specify that the interest and fee details defined for the placement being rolled over (old placement), be made applicable to the new one. In this case, the new placement will have only one interest payment schedule on Maturity Date and will have no fee.

In addition, you have to specify the following details for a product for which rollovers are permitted:

Update Utilization

Whether the credit limit utilization is to be updated when a placement is rolled over, that is, the interest that has been accrued on placement is also considered as a part of the ‘utilized amount’ for the purpose of risk tracking. The following example illustrates how this concept works.

This option applies only if you want to roll over a deal with interest.

Apply Tax

For tax to be applicable on a rolled over deal:

- It should be applicable to the product involving the dealIt should not have been waived for the old deal

You should indicate whether tax has to be applied on the rolled over deal.

Rollover with Interest

You have to specify whether the deal that you are rolling over should be rolled over along with the outstanding interest. If you so specify, the principal of the new deal is the sum of the outstanding principal and the outstanding interest on the old deal. This applies only to deals with a bearing (add-on) method of interest liquidation.

If all the outstanding interest is paid out, then the deal is renewed without the interest. If not, it is rolled over with the interest that is still outstanding on it.

A deal is rolled over with only the main interest that is outstanding. The main interest is that interest component which you specify as the ‘main interest’ in the ICCB Product Details screen (this is displayed in the Contract Main screen). Other interest components and the penalty interest if any will not be rolled over.

Deduct Tax on Rollover

When a deal is initiated, tax is applied to the principal of the deal. Now, when this deal is rolled over or renewed, you have two choices (depending on the tax laws of your Government):

Apply tax on the principal, (outstanding principal + outstanding interest or only the outstanding principal depending on your specifications), of the new deal, or,

Since the principal of the old deal has already been taxed once, you can choose to waive the tax on the principal of the rolled over deal. However, if this principle has the outstanding interest from the old deal incorporated, then only this portion is taxed.

This option applies only to tax on the principal and not to tax on interest.This field assumes importance, only if:

- Tax (for the principal as well as interest) has not been waived on the old deal

- The tax has not been waived on the rolled over deal

If this tax is not waived for the old deal, it is applied on the new deal; if it is waived on the old deal, it will not be applied on the renewed deal.

Specify Deduct Tax on Rollover, if the tax on the old deal has to be liquidated before it is rolled over.

Note:

If Rollover is of type P (Principle), P+I (Principle + Interest) and P+I-T (Principal + Interest - Tax), the tag 32H in MT 320 is populated with a value 0 (Zero).

If Rollover Type is Special Amt the tag 32H is populated with difference in Principal+/- Interest liquidated in the same cash flow.

Roll By

Indicate the tenor basis upon which the maturity days specified for the rolled-over contract is reckoned. The options are Days, Months, Quarters, Semi-annuals and Years.

If you specify the ‘days’ maturity basis, and do not specify the maturity days, the system ‘rounds’ the tenor of the original contract to the nearest maturity days basis. The rounded tenor is considered as the new tenor of the rolled-over contract.

Rollover Mechanism

This indicates whether rolling over a contract using the product must create a new version of the existing contract, a new contract or a chills contract that is linked to the parent contract. You can choose from the following options:

- New Version - A new version will get created in existing MM deal as part of a rollover, with the same details specified in the contract ‘Rollover Details’ screen.

- Spawn Contract - In this mechanism, the existing contract will get liquidated, and the system will book a new contract as part of a rollover, with the details specified in the contract ‘Rollover Details’ screen. Booking of the new contract happens through the MMAUTDLY batch.

- Linked Contract - In this mechanism, a new MM deal is created manually and linked to the parent deal. On the maturity date of the parent contract, the contract will get liquidated into a rollover wash GL, and the new contract that was input will get initiated automatically.

You can select ‘Linked Contract’ only in case you have checked the option ‘Auto’ for rollover.

Rollover Method

If you have indicated the rollover mechanism applicable for contracts using the product in the Rollover Mechanism field as ‘Spawn Contract’, use this field to indicate whether a single new contract must be created for the rolled over amount, or whether the original contract must be split into multiple contracts, or consolidated with other contracts into a single new contract, when rolled over using the rollover operation. Accordingly, select any of the options, ‘Normal’, ‘Split’ or ‘Consolidated’, in this field, as applicable.

Parent topic: Impact of Liquidation Mode on Rollover