- Money Market User Guide

- Automatic Processing

- Specify the Branch Parameters

8.2 Specify the Branch Parameters

This topic provides the instructions to capture the Branch Parameter Details.

A set of rules that govern the deals that a particular branch (of your bank) enters into are defined through the Branch Parameters screen.

- On the Home page, type MMDBRMNT in the text box, and click the next arrow.

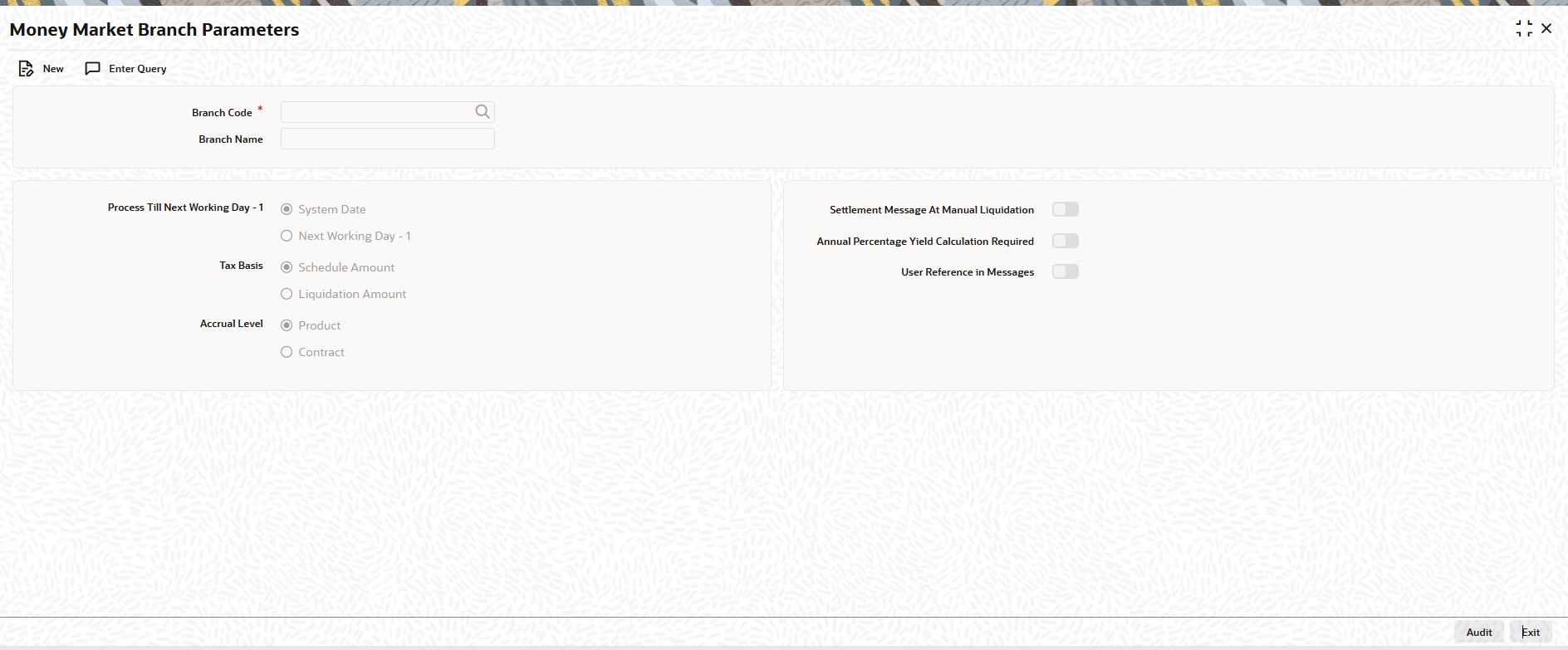

Money Market Branch Parameters screen is displayed.

Figure 8-1 Branch Parameters

Description of the illustration lddbrmnt__cvs_main.jpg - On the Branch Parameters screen, click New.

- On the Branch Parameters - New screen, specify the details as required.

- Click Ok to save the details or Exit to close the screen.

For information on fields, refer to the below table.

Table 8-1 Branch Parameters Field Description

Field Description Branch Code Specify the Branch code here. Branch Name Specify the branch name in this field. System Date If you specify that processing of automatic events should be done upto the System Date, automatic events scheduled till (inclusive of) the current system date is processed. Next working day - 1 Indicate whether events should be processed until the day before the next working day when the Automatic Batch Update function is run. If you do so, all the events that fall on days between the current system date and the next working date is processed. Tax basis On a deal, you may have to pay tax to the Government on the interest earned. The tax are paid on the basis of the following: - On the liquidated amount

- On the scheduled amount

Accrual level To recall, at the time of creating a product, you specify: - Whether accrual of interest is allowed for the product

- The accounting entries that should be passed for the accrual event

- The frequency at which the accrual entries should be passed

- An entry for each deal. The same accrual and income account is involved for each entry, with the Reference Number of the deal indicated for each deal.

- A single consolidated entry for all deals involving a product. Since the same accrual and income account is involved in all accrual entries, a single consolidated entry is passed, with a unique reference number generated for each product.

Note:

This specification is applicable only for automatic periodic accrual entries. When there is an accrual necessitated by a payment or a change in the terms of a deal, the entries is for the specific deals affected by the change.Settlement Message At Manual Liquidation For all the contracts that are marked for manual liquidation, you can specify whether you want to generate settlement messages. To do this you need to check the ‘Settlement Msg at Manual Liquidation’ box. Settlement messages is generated for all the contracts with manual liquidation according to the parameters you have specified in the Money Market Branch Parameters screen. These messages are generated on the settlement message days prior to the date of repayment of the contract. Each account that is affected by the payment will receive a settlement message. Annual Percentage Yield Calculation Required Oracle Banking Treasury Management allows you to calculate the Annual Percentage Yield so as to enable your customer to compare interest rates offered by different banks. To do this, you need to check the ‘Annual Percentage Yield Calculation Required’ box. For a contract, Annual Percentage Yield is calculated during take-down, or during Value Dated amendments or contract amendments resulting in change of cash flows (change of schedule) only if this parameter has been enabled at the Branch as well as the Product level. The rates would also be re-calculated whenever there is either liquidation (partial, prepayment or full liquidation) or rollover. User Reference Number in Messages If this option is checked then the user reference number is used instead of the contract reference number in the following messages. SWIFT Field22A - If the event is BOOK and the parent FCC ref no is not null and the counterparty of the parent and child contracts are same, then type of operation is set as ‘AMND” and Field 21 is populated as the user reference number of the contract. This is applicable to both MT320 and MT330

Field21 - In case of reversed Contract, if the confirmation (for CANC) is not suppressed then the user reference no is picked up from the child contract and populated.

Field34E - The currency and interest amount is populated as (Sign) (Currency) (Amount). The net amount considering both main interest component and negative component is displayed here.This is applicable to both MT320 and MT330

Field37G - In this field the interest rate is in the format (Sing) (Rate). Interest rate is picked up based on active component from main interest /negative interest components. This is applicable to both MT320 and MT330

Mail User ref no - In case of reversed Contract, if the confirmation (for CANC) is not suppressed then the user reference no is picked up from the child contract and populated.

Event text - If the event is BOOK and the Reversed FCC ref no is not null and the counterparty of the parent contract and child are the same then type of operation is set as ‘AMND’.

Parent topic: Automatic Processing