- Money Market User Guide

- Process an MM Deal

- Split Settlements

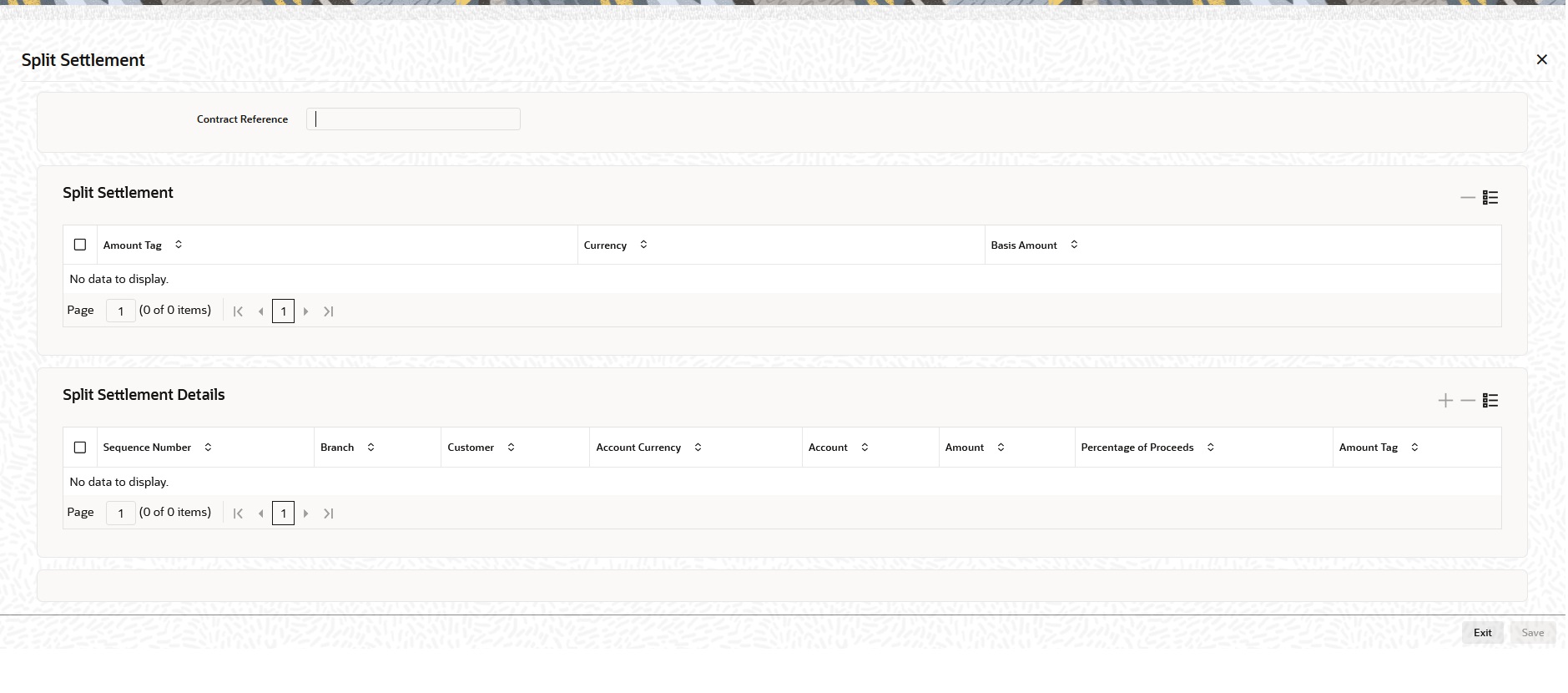

3.7 Split Settlements

This topic provides the instructions to capture the split settlement details for a deal.

System supports the settlement of the components (Placement / Liquidation of Borrow / Outgoing) through multiple split accounts for a contract.

Note:

This Split is not applicable for the incoming contracts.

- On the Money Market Contract Input screen, click

Split.

Split Settlement screen is displayed.

- From the displayed list, select a contract.

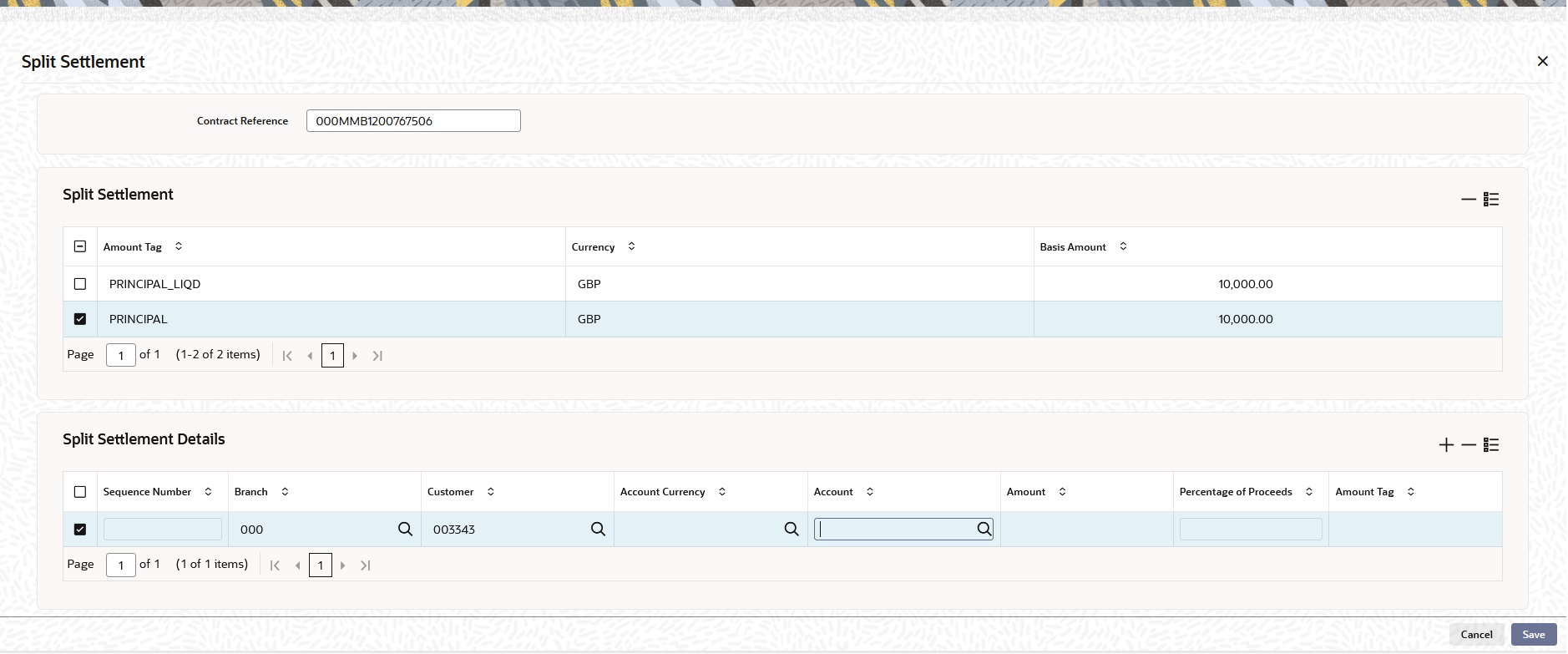

- On the Split Settlement screen, under the Split Settlement Details, click the Plus symbol.

A new row is added under Split Settlement Details as shown in below.

Figure 3-12 Split Settlement with a new row added

Description of "Figure 3-12 Split Settlement with a new row added"Note:

This process of splitting the settlements for a contract is allowed on the principal, Interest (Anticipated Interest for new contracts), and charges.

- Choose the Account Currency, Account, and other necessary details, to create a

split.

- For every Settlement contract the system allows a maximum of twelve splits.

- In case of auto-liquidation, you must unlock the contract and register the split, upfront, that is prior to auto-liquidation. The provision to update, 'split settlement' for interest component, is available only after save and first authorization. SGEN is generated for each split amount. System will suffix the reference number in field 72(Sender to Receiver Information) of MT202 and MT202COV for the code ‘/BNF/’(Beneficiary). The format will be “/BNF/ <16 Digit Contract Ref> -(hyphen) two digit running number of split / count of splits.

- Only if split settlement details are available, system will process the transaction accordingly, else the payment/settlement is treated as a single payment transaction.

- If you are splitting the contract during the rollover, the application considers the latest available split details and process the liquidation amount, if any. If split settlement details are not available, the transaction (partial (liquidation as part of rollover) is treated as normal/regular/non-split liquidation. The split is allowed in manual rollover as well.

- For a single component, you can split the settlement amount and use the same settlement account more than once. There is no restriction on the repetition of split settlement amount for the same NOSTRO/settlement account.

- Cross currency split settlement is supported. The 'Amount' field/column in the 'Split' tab is, by default, in the contract currency (though not evident in the User Interface). The currency of the settlement account can be in a different currency. The converted amount has to be viewed in the accounting entries as part of Events tab only.

- Appropriate Amount tags, for each component like principal, interest and charges, are made available at the relevant event(s) for enriching the split settlement details.

Note:

MM manual rollover operation though needs authorization, for rollover mechanism Spawn contract. it is auto-authorized (parent & child contract). Only if it is a New version, then the child/new version shows up as unauthorized.

Table 3-8 Contract Booking

Master Component

Basis Amount

MMINTCLS_LIQD

100

Split Component

Split Amount

MMINTCLS_LIQD_S01

60

MMINTCLS_LIQD_S02

30

MMINTCLS_LIQD_S03

10

Test Cases

Test Case 1

During LIQD Calculated Interest Liquidation = 110 (i.e) actual calculated amount is greater than amount given on booking 110 - 100 = 10 Accounting entry posting MMINTCLS_LIQD_S01 60 MMINTCLS_LIQD_S02 30 MMINTCLS_LIQD_S03 10 + 10=20 When the difference amount is greater it will be added to last account always

Test Case 2

During LIQD Calculated Interest Liquidation = 95 (i.e) actual calculated amount is lesser than amount given on booking 95 - 100 = -5 Accounting entry posting MMINTCLS_LIQD_S01 60 MMINTCLS_LIQD_S02 30 MMINTCLS_LIQD_S03 10 - 5 = 5 When the difference amount is lesser it will be subtracted to last account

Test Case 3

During LIQD Calculated Interest Liquidation = 70 (i.e) actual calculated amount is lesser than amount given on booking 70 - 100 = -30 Accounting entry posting MMINTCLS_LIQD_S01 60 MMINTCLS_LIQD_S02 30 - 20 =10 MMINTCLS_LIQD_S03 10 - 10 = 0 Will not be posted in accounting entry. When the difference amount is lesser it will be subtracted from last account in descending order

Parent topic: Process an MM Deal