- Over the Counter Options User Guide

- Credit Default Swap

- Deal Product Maintenance

6.2 Deal Product Maintenance

This topic describes the systematic instruction to maintain deal product.

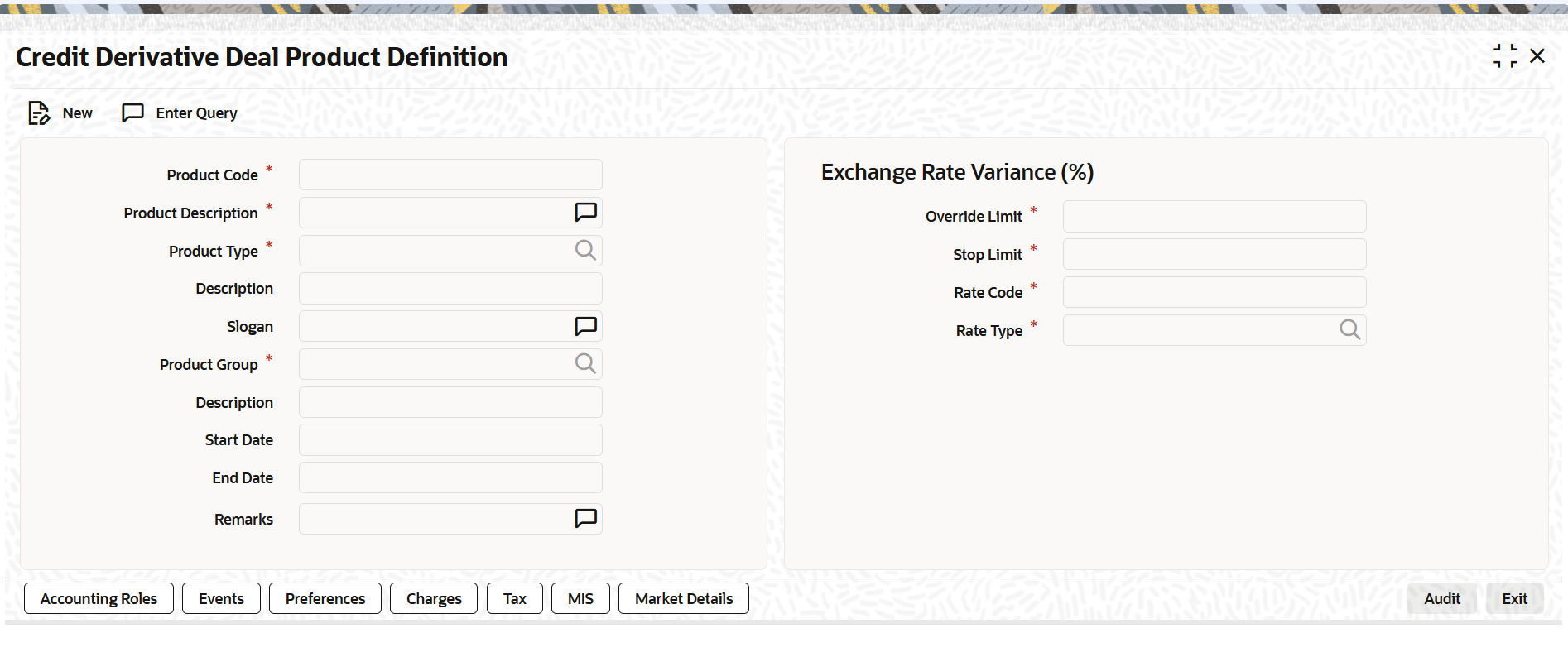

The credit deal product is maintained at the Credit Derivative Deal Product Definition screen.

Note:

All fields marked with an asterisk (*) are mandatory.- On the Home Page, enter DCDDLPRD in the text field, and then click the next arrow.

The Credit Definition Deal Product Definition screen is displayed.

Figure 6-1 Credit Definition Deal Product Definition

Description of "Figure 6-1 Credit Definition Deal Product Definition" - On the Credit Derivative Deal Product Definition screen, specify the details as required. For more information about credit derivative deal maintenance, see “Credit Derivative Deal Product Definitions” in Securities User Guide.

Note:

To use CDS option, ensure to select the unique CD code for CDS option. - On the Credit Derivative Deal Product Definition screen, click Preferences.

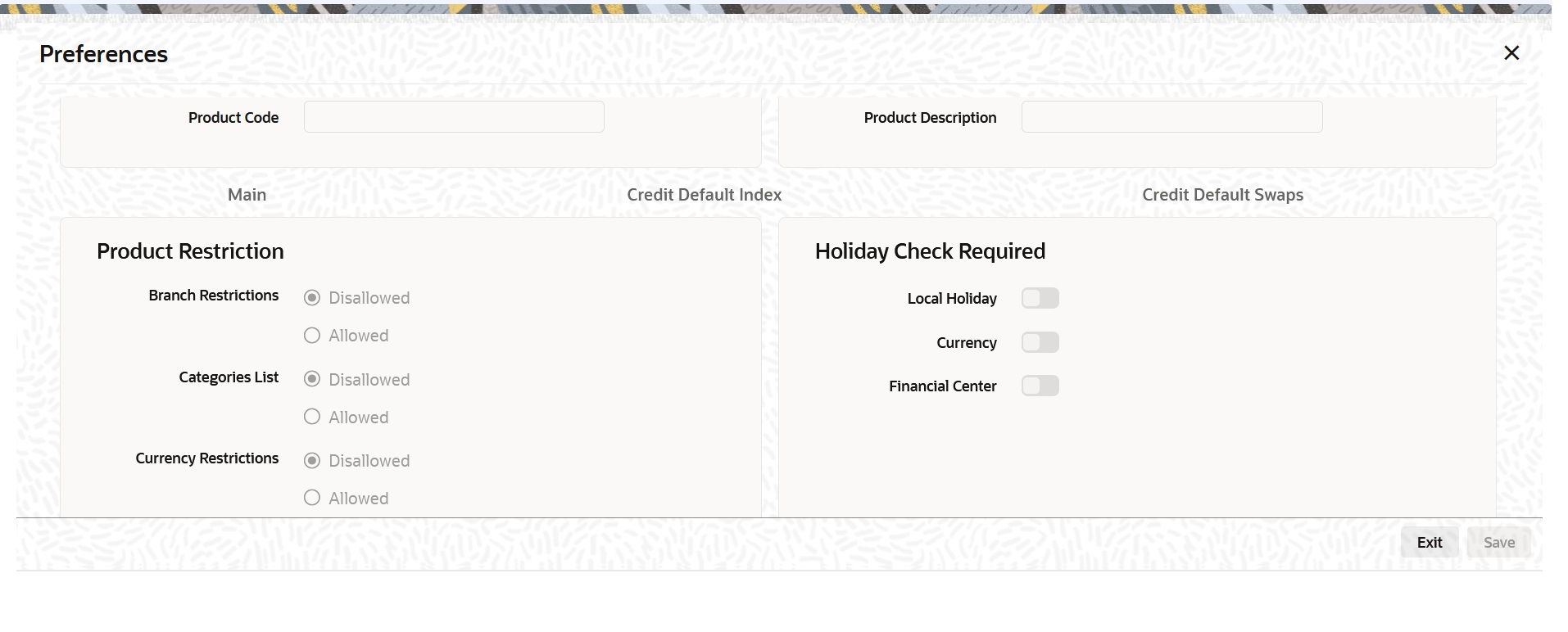

The Preferences screen is displayed.

- On the Preferences screen, click the Credit Default Swaps tab.

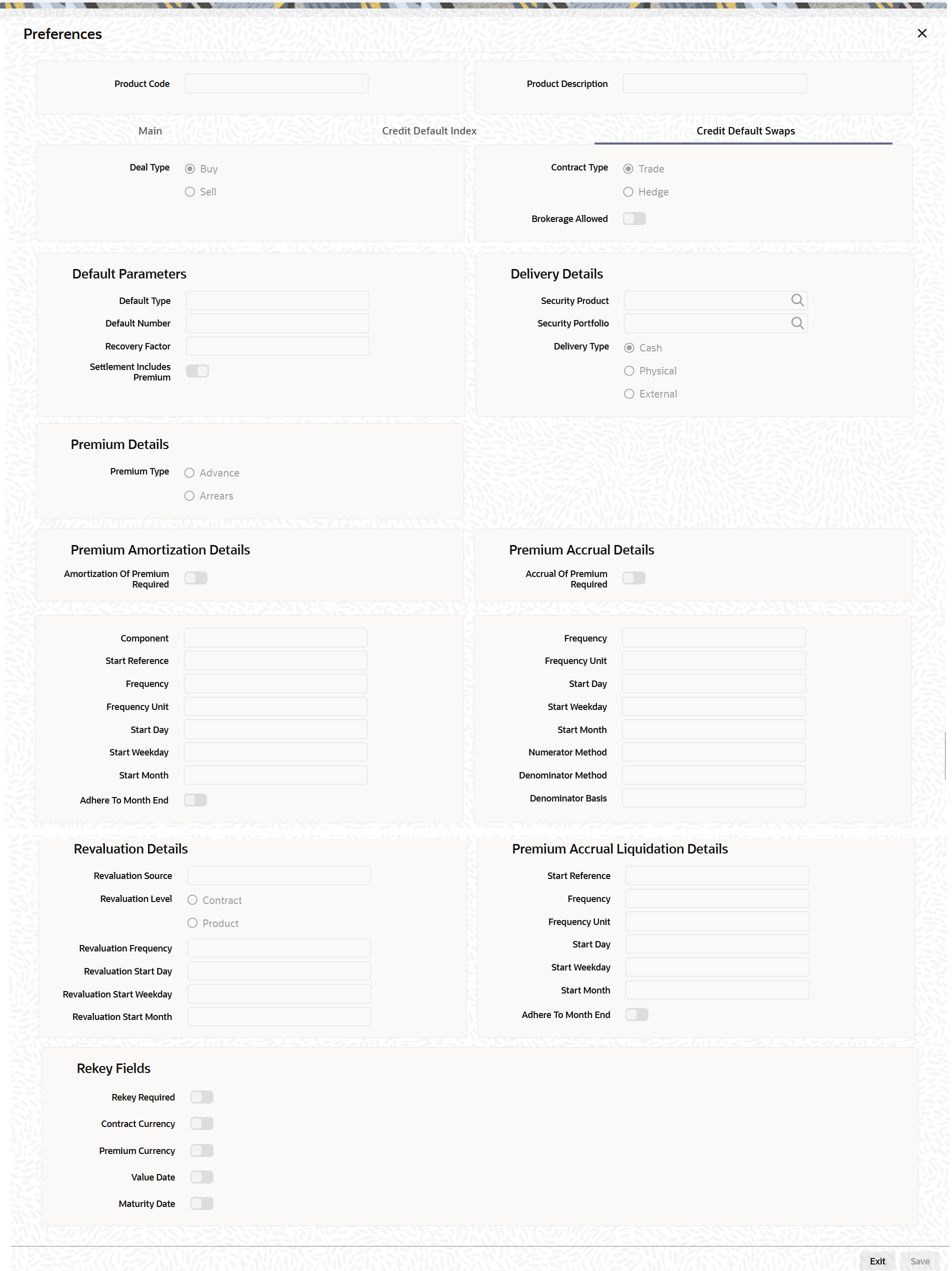

The Credit Default Swaps page is displayed.

Figure 6-3 Credit Default Swaps

Description of the illustration ot-prefrences.png - On the Credit Default Swaps tab, specify the fields, and click Ok.

For more information on the fields, refer to the below table.

Table 6-1 Credit Default Swap - Field Description

Field Description Deal Type Specify whether the deal product that bank is buying CDS or selling CDS.

Note:

The user can change this preference for a particular deal.Brokerage Allowed Select the Brokerage Allowed check box to involve brokerage.

Indicates that CDS deals for the selected deal product can involve brokerage.

Contract Type Select the Contract Type from the drop-down list. The available options are:

- Trade

- Hedge

Indicates whether the type of the contract is Trade deals or Hedge deals.

Note:

The user can change this preference for a particular deal.Table 6-2 Credit Default Swaps Tab - Default Parameters Field Description

Field Description Default Type Select the type of default with several underlying securities from the drop-down list. The drop-down list shows the following options:

- FIRST TO DEFAULT

- Nth TO DEFAULT

- LAST TO DEFAULT

Default Number Specify the default number in this field, if the Default Type is selected as Nth TO DEFAULT. Recovery Factor Specify the cash recovery percentage in this field. Settlement Includes Premium Select the Settlement Includes Premium check box to included premium in settlement for credit event exercise.

Indicates whether settlement for credit event exercise must include premium or the premium is suppressed with accrual reversed.

Table 6-3 Credit Default Swaps - Delivery Details Field Description

Field Description Security Product Click on the search icon and select the deal product from the security product list, to create a deal for Delivery Type as Physical. Security Portfolio Click on the search icon and select the portfolio from the list of values, to create underlying deal for physical settlement. Delivery Type Select the Delivery Type from the drop-down list. The available options are:

- Cash

- Physical

- External

Indicates whether settlement for credit event exercise must include premium or the premium is suppressed with accrual reversed.

Table 6-4 Credit Default Swaps - Premium Details Field Description

Field Description Premium Type Select the premium payment type from the drop-down list.

The available options are:

- Advance

- Arrears

Table 6-5 Credit Default Swaps - Premium Amortization Details Field Description

Field Description Amortization Of Premium Required Select the Amortization Of Premium Required check box, if premium amortization is required for PRAT event.

Indicates whether the premium amortization is required for PRAT event.

Note:

This field is applicable only if the Premium Type is selected as Advance.Component Specify the amount tag for amortization.

Note:

This field is applicable only if the user selected the Amortization of Premium Required field.Start Reference Specify the start reference date. This can either be the Value Date or the Calendar Date. If the user specifies Value Date as the Start Reference, the settlement schedule is calculated using the frequency and frequency units concerning the contract value date. If the start reference is the Calendar date, the settlement schedule is calculated based on the frequency, frequency units, Start Day, start weekday, and start month. Frequency Specify the frequency. The available options are:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

Frequency Units Specify the frequency units. The number of frequency units after which a schedule can repeat. For example, a monthly frequency with a frequency unit of 2 is effectively a bi-monthly schedule.

Start Weekday Specify the Start Weekday only if the Frequency is Weekly. Select any day from Sunday to Saturday. This is the day of the Week on which a schedule must start.

Start Day Select any day of the month from the 1st to the 31st. Indicate the Start Day, if the Frequency is selected as Daily or Weekly. This is the day on which a schedule must start. Start Month Specify the Start Month only in case of Quarterly, Half-yearly, and Yearly frequencies. This is the month from which a schedule must start. Adhere to Month End Select the Adhere to Month End check box, if the schedule must adhere to month ends.

Indicates whether a schedule must adhere to month ends, if the maturity date is a day less than the month-end date.

Table 6-6 Credit Default Swap - Premium Accrual Details Field Description

Field Description Accrual Of Premium Required Select the Accrual Of Premium Required check box, if premium amortization is required for PRAC event. Indicates whether the premium amortization is required for PRAC event.

Note:

This field is applicable, if the Premium Type is selected as Arrears.Frequency Specify the frequency.

The available options are:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

Frequency Units Specify the frequency units. The number of frequency units after which a schedule can repeat. For example, a monthly frequency with a frequency unit of 2 is effectively a bi-monthly schedule.

Start Day Select any day of the month from the 1st to the 31st. Indicates the Start Day, if the Frequency selected is Daily or Weekly. This is the day on which a schedule should start.

Start Weekday Specify the Start Weekday only if the Frequency is Weekly. Select any day from Sunday to Saturday. This is the day of the Week on which a schedule must start. Start Month Specify the Start Month only in case of Quarterly, Half-yearly and Yearly frequencies. This is the month from which a schedule must start. Numerator Method Select the method that is used to calculate the number of days between the schedule start and end dates for calculating the settlement amount from the adjoining drop-down list. The list displays the following values: - 30 EURO

- 30-US

- 30-ISDA

- 0-PSA

- Actual

- Actual-Japanese

Denominator Method Select the method that is used to calculate the number of days in a year for the calculation of the settlement amount from the drop-down list. The list displays the following values:

- Actual

- 365

- 360

Denominator Basis Specify whether the difference between the Strike Rate and the Reference Rate is to be taken for the whole year or for the schedule period during Settlement Amount calculation. The basis can either be Per Period or Per Annum.

Table 6-7 Credit Default Swaps - Premium Accrual Liquidation Details Field Description

Field Description Start Reference Specify the start reference date. This can either be the Value Date or the Calendar Date. If the user specifies Value Date as the Start Reference, the settlement schedule is calculated using the frequency and frequency units concerning the contract value date. If the start reference is the Calendar date, the settlement schedule is calculated based on the frequency, frequency units, Start Day, start weekday, and start month.

Note:

This field is applicable only if the user selected the Amortization of Premium Required field.Frequency Specify the frequency.

The available options are:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

Frequency Units Specify the frequency units. The number of frequency units after which a schedule can repeat. For example, a monthly frequency with a frequency unit of 2 is effectively a bi-monthly schedule.

Start Day Select any day of the month from the 1st to the 31st. Indicate the Start Day, if the Frequency selected is Daily or Weekly. The schedule must start on this day.

Start Weekday Specify the Start Weekday only if the Frequency is Weekly. Select any day from Sunday to Saturday. In this day of the Week, a schedule must start. Start Month Specify the Start Month only in case of Quarterly, Half-yearly and Yearly frequencies. This is the month from which a schedule must start. Adhere to Month End Select the Adhere to Month End check box, if the schedule must adhere to month ends.

Indicates whether a schedule must adhere to month ends, if the maturity date is a day less than the month-end date.

Table 6-8 Credit Default Swaps - Revaluation Details Field Description

Field Description Revaluation source Select the option from the displayed list. - Internal

- External

- None

Revaluation Level Select the Revaluation Level. The available options are: - Contract

- Product

Indicates the revaluation level.

Revaluation Frequency Specify the frequency with which a portfolio is revalued. The revaluation frequency can be one of the following:

Daily

Monthly

Quarterly

Half yearly

Yearly

Revaluation start day Specify the date on which revaluation must start during the month. Revaluation Start Weekday Specify the day to perform revaluation based on the revaluation frequency. Revaluation Start Month Specify the month based on revaluation frequency to perform revaluation. Rekey Required Select the Rekey Required check box, if the rekey value is required when the CDS contract is invoked for authorization. Contract Currency Select Contract Currency, if the currency is required when the CDS contract is invoked for authorization. Premium Currency Select Premium Currency, if the currency of premium is required when the CDS contract is invoked for authorization. Value Date Select Value Date, if the Value Date is required when the CDS contract is invoked for authorization. Maturity Date Select Maturity Date, if the Maturity date is required when the CDS contract is invoked for authorization.

Parent topic: Credit Default Swap