- Securities User Guide

- Process Security Deal

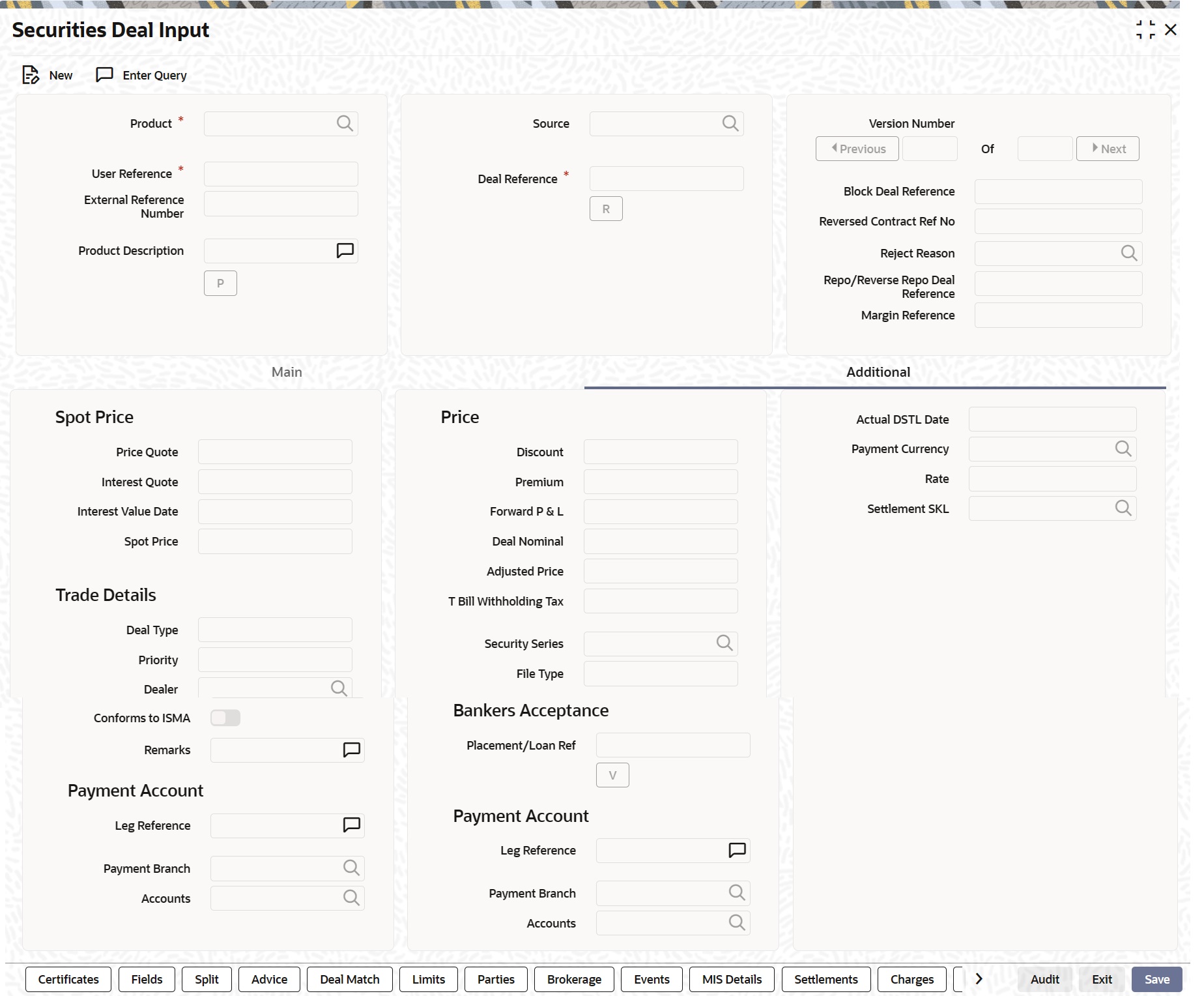

- Securities Deal Input Screen

- Process Securities Data Input Screen

- Additional Details

21.1.1.2 Additional Details

To recall in the Main details screen you have captured details regarding the deal. In the Additional Details screen you can define details like the spot price details, the settlement 22-16 currency, the settlement SKL, exchange rates for deals in a foreign currency and other such details.

For forward deals you should also indicate spot price details. The spot price details that you specify will determine the calculation of forward profit that you have made or the loss that you have incurred in a forward deal.

- On the Securities Deal Input screen, click

Additional.

Security Deal Input- Additional screen is displayed.

- On Additional, specify the details as required.

For information on fields, see the below table:

Table 21-5 Field Description

Field Description Spot Price and Spot Date

The spot price refers to the price at which the security is currently quoted in the market. This price is compared with the deal price to determine the forward profit or loss. The market price of the security as maintained in the price code maintenance screen is defaulted. You have an option to change the default. The forward profit or loss is the difference between the deal price and the spot price and is calculated from the spot date of the deal to its settlement date. The spot date is calculated by adding the spot days specified for the market in which the security is traded to the trade date.

Spot date = Trade date + spot days

The forward profit or loss would be accrued from the spot date to the settlement date of the deal. The accrual of the forward profit and loss will be done based on the accrual preferences specified for the portfolio to which the security belongs. Even if you have indicated that no accrual should be done, on the settlement of the deal the accrual will be done automatically.

Note:

In case of forward deals Spot Price is defaulted from the market price maintenance and the spot price cannot be changed.

Payment Currency

If the currency of the security is different from the settlement currency, you should indicate the currency in which payment is made. All the components of the deal like the deal amount, the charges and tax that is levied will be settled in this currency. By default the security currency is taken to be the payment currency. If you indicate the settlement currency to be different from the security currency you should also indicate the exchange rate to be used for the conversion.

Price Details of the Deal

The following information of the price of the deal is displayed:

Interest Value Date

This is the number of days for which accrued interest has been calculated. The interest value date that you specified earlier is used in the calculation. For cum-coupon deals, this is the difference between the last coupon date and the interest date. For ex-coupon deals, the interest days is the difference between the settlement date and the ex-coupon date.

Discount

This is the amount of rebate in the purchase or sale price of the deal, as compared to the nominal price of the security.

Premium

This is the price or amount paid by the buyer in addition to the nominal amount.

Forward P & L

The forward profit or loss is the amount of profit made or the loss incurred in the deal. It is the variance between the deal price and the spot price of the security.

Deal Nominal

The deal nominal refers to the net consideration of the deal. The sum of all the components of a deal is the net value of the deal.

Adjusted Price

This is the price of interest-bearing instruments exclusive of the interest component. Interest bearing instruments can be quoted as flat or plus accrued. The adjusted price is applicable only for flat quoted instruments. The price of such instruments tends to increase during the period nearing the interest payment date and subsequently falls after the interest payment date. The adjusted price is thus the deal price stripped of the interest component.

Deal Type

Select the Deal type from the drop down list. The Deal Type can be

- Primary

- Secondary

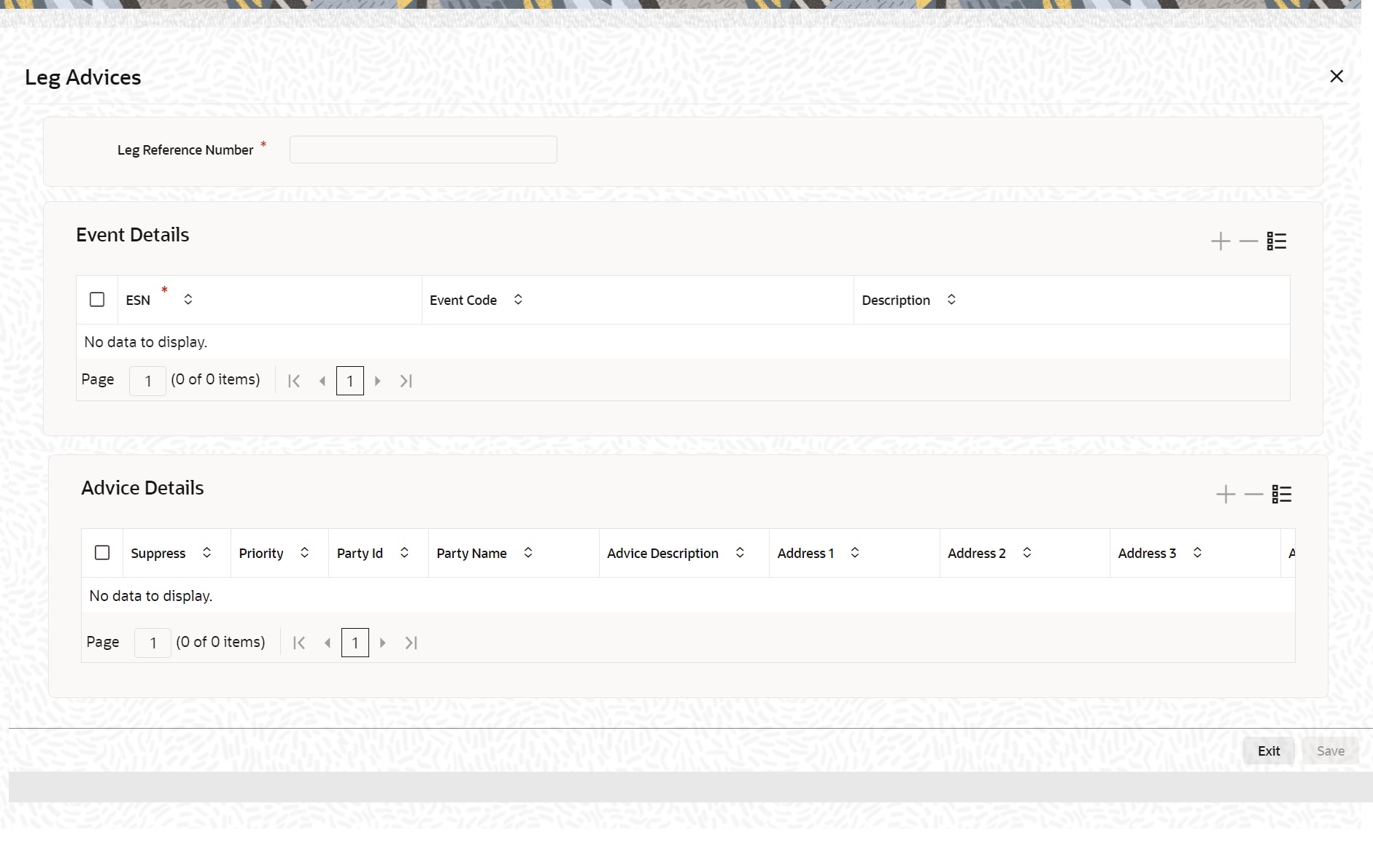

- On the Securities Deal Input screen, click

Advices.

Leg Advices screen is displayed.

- On Advice, specify the fields.

To recall, the advices that can be generated for the events that occur during the life-cycle of a deal are defined for the product to which the deal is associated.

The details of the advices applicable for an event are displayed in the Advices screen. The party type to whom a specific advice should be sent is picked up automatically based on the type of deal you are entering and the parties involved in the deal.

Choose the event for which you want to view advice details. The address of the party who is the recipient of the message will be picked up by default, based on the media and address maintenance for the party. You can change either of them. For a payment message by SWIFT, you also have the option to change the priority of the message.

Table 21-6 Field Description

Field Description Suppressing the generation of an advice

By default, all the advices defined for a product will be generated for the deals involving it. If any of the advices are not applicable to the deal you are processing, you can suppress its generation.

Indicating the generation priority

For a payment message by SWIFT, you also have the option to change the priority with which the message should be generated. By default, the priority of all advices is marked as 'Normal'. You have the option to priorities a payment message to one of the following options:

- Normal

- Medium

- High

Indicating the medium of generation

The medium through which advice is transmitted and the corresponding address will be picked up based on the address and media maintained for the customer who is the recipient of the message.

You can, however, change either of these while processing a deal. Typically, if changed, both of them will be changed. Click Exit to reject the entries you have made or to exit from the screen. In either case, you will be taken back to the Securities Deal Input screen.

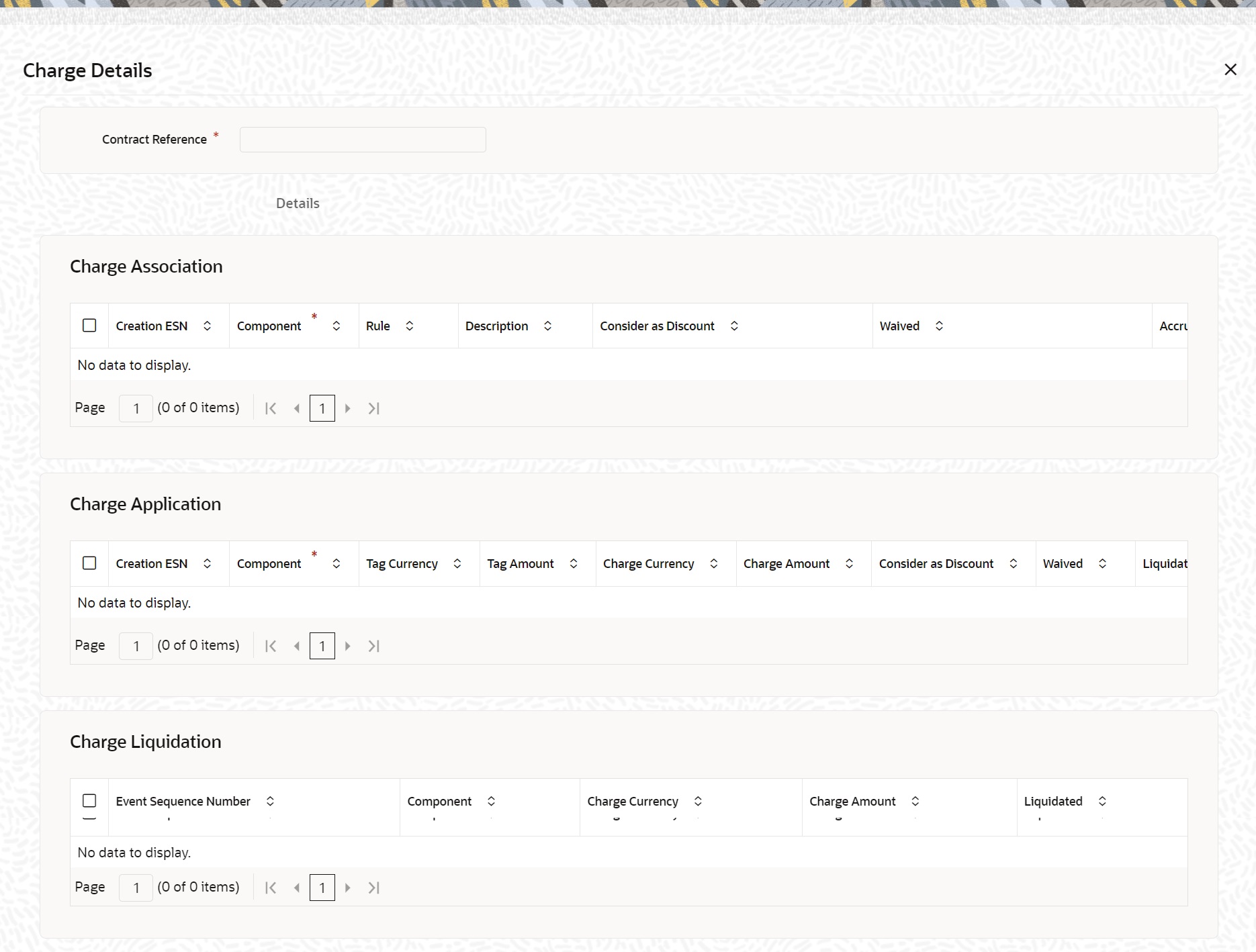

Levying Transaction Charges on a Deal

For each leg of the deal, you can specify the charges that you levy. Charges are applicable only for customer legs of a deal (customer buys, the customer sells, lodge, withdraw and block securities). The characteristic feature of a charge is that it is always booked in advance and is not accrued, as a charge is collected only when it is due. To recall, you have defined the attributes of a charge by defining a ‘Rule’. A rule identifies the basic nature of the charge. You have further defined a Charge class where you have enriched the attributes of a rule. We shall refer to these classes as components'. Each charge component, in turn, is linked to a deal product. All the charge components linked to a product default to the deals associated with it. Thus each time you enter a deal, you need not specify when and how charges should be collected. However, while capturing the details of a deal, you can choose to associate a component to the deal. Further, you can modify some of the attributes defined for the applicable component.

- On the Securities Deal Input screen, click Charges.

Charge Detail screen is displayed.

- On the Charge Detail screen, specify the fields.

The reference number of the deal leg for which you are defining charge details is displayed. The screen will contain a list of all the charge components applicable to the deal leg.

Table 21-7 Field Description - Charge Detail

Field Description Associating a charge component to a deal leg

All the charge components applicable to the deal leg you are processing will be displayed together with the rule that is linked to the component. In this section of the screen you can:

- Change the charge rule linked to the component

- Disassociate a charge component from the deal leg

Changing the charge rule linked to a component

The rule that is linked to a charge component is displayed next to the component. To link a new rule to the component. A list of all the charge rules maintained will be displayed. Select the appropriate rule from the pick list. The new rule will be made applicable to the charge component.

Disassociating a charge component from the deal leg

You can disassociate a charge component from the deal leg. In the 'Association' section of the Contract Charge screen, click against the waive option positioned next to the component. In this case, the charge component is attached to the deal leg but is not calculated.

Indicating the charge components to be applied to a deal leg

In the application section of the screen, you can indicate the charge components that should be applied to the deal leg. The list of components that is displayed depends on the charge components that you have associated to the deal leg. The following details of the component are also displayed:

- The basis component on which the charge is levied

- The currency of the basis amount

- The basis amount

- The charge amount and the

- The currency in which the charge amount is defined.

You can change the charge amount that is calculated using the class applicable to the component.

Waiving a charge on a deal leg

You also have the option to waive the component for the deal leg that you are processing. If, for some reason you want to waive the charge on the deal you are processing, you can do so by checking against the 'waiver' option in the application section of the screen. The charge will be calculated but not applied. You can waive a charge only if it is yet to be liquidated.

Consider as Discount

If the charge component is to be considered for discount accrual on a constant yield basis, ‘Consider as Discount’ option will be checked. You cannot modify this value. In case the charge currency is not equal to the contract currency and the contract currency is equal to the settlement account currency, the exchange rate as specified in the Settlements Screen will be used to convert Charge Amount to Contract Currency.

Charge liquidation

When a charge component that is applied to a deal is liquidated, the relevant accounting entries are passed. The contract charge screen displays:

- The charge components that have already been liquidated

- The amount that was liquidated

- The currency in which it was liquidated

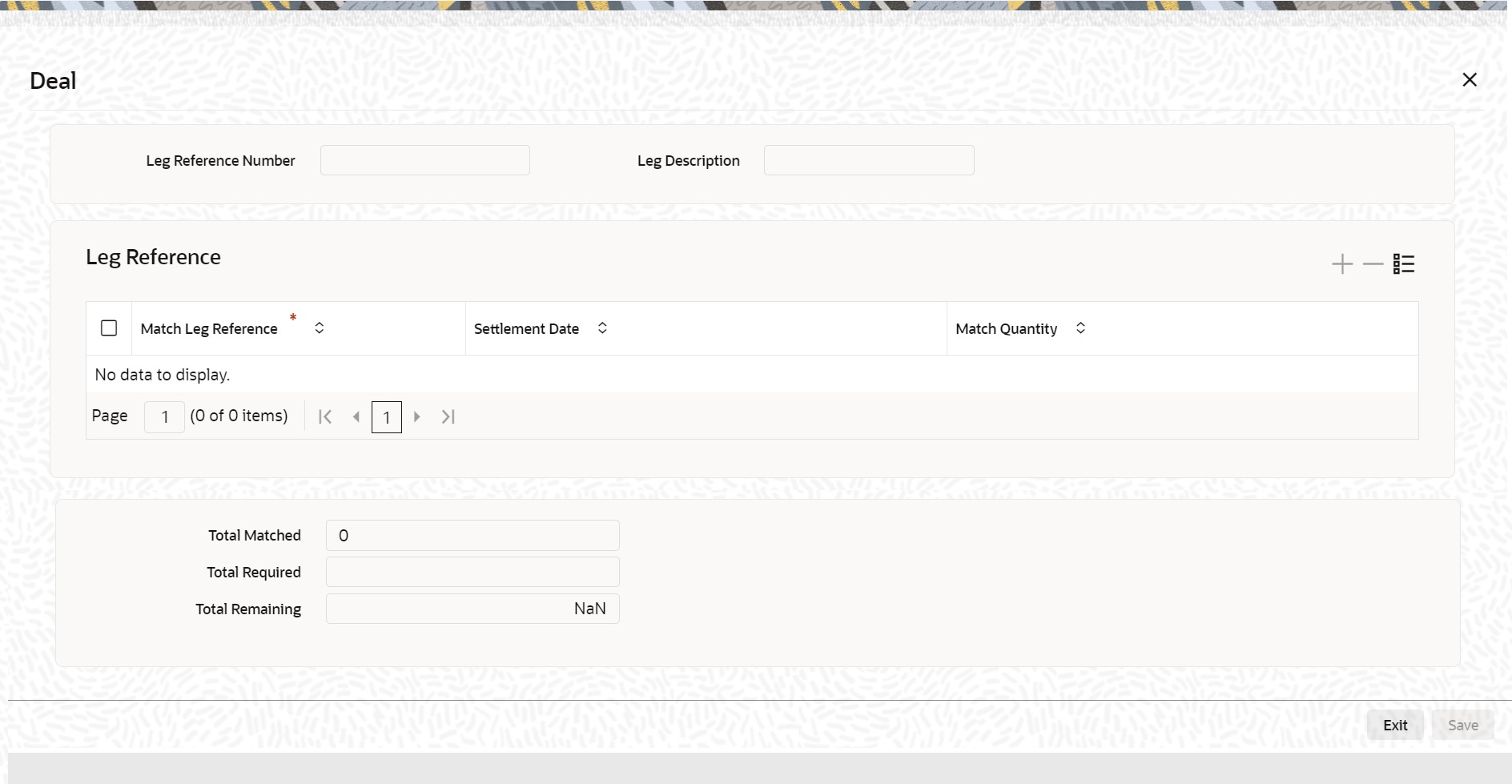

- On the Security Deal Input screen, click

Deal.

If the portfolio from which you are buying or selling involves deal matching, you should indicate against which of the earlier buy deals the selling dealer is to be matched. Click the Deal Match button from the Securities Deal Input screen to match the sell leg of a deal to the buy leg. Click this button from the buy leg section of the screen to indicate the matching preferences and from the sell leg section to view the matched details.

Deal screen is displayed.

- On the Deal screen, specify the details as required.

For information on field, see the below table:

Table 21-8 Deal - Field Description

Field Description For the sell leg

If you are processing the sell leg of securities deal, and if the portfolio from which you are selling involves the deal matching costing method, you should also match the sell leg to previous buys in the portfolio.

Procedure

Indicate the reference number of the bought deal, which you have selected for deal matching. In other words, indicate the buy deals done in the same security and portfolio to be matched with the sell leg of the deal. You can select a leg reference number from the pick list available. On indicating the match leg reference, you should also indicate the number of units or nominal that should be matched. Click add an icon to add the details of another buy leg to which you want to match the sell leg. Click the delete icon to cancel a buy leg that you have mapped to the sell leg. The summation displayed at the bottom of the screen contains the following information:

- The total quantity of securities that have been matched

- The number required to be matched

- The number yet to be to be matched

For the sell leg

While processing the sell leg of the deal, you can view details of the buy deals that have been matched to the sell leg. The reference number of the buy deal from which securities have been matched is displayed together with the number of units or nominal for which matching is done.

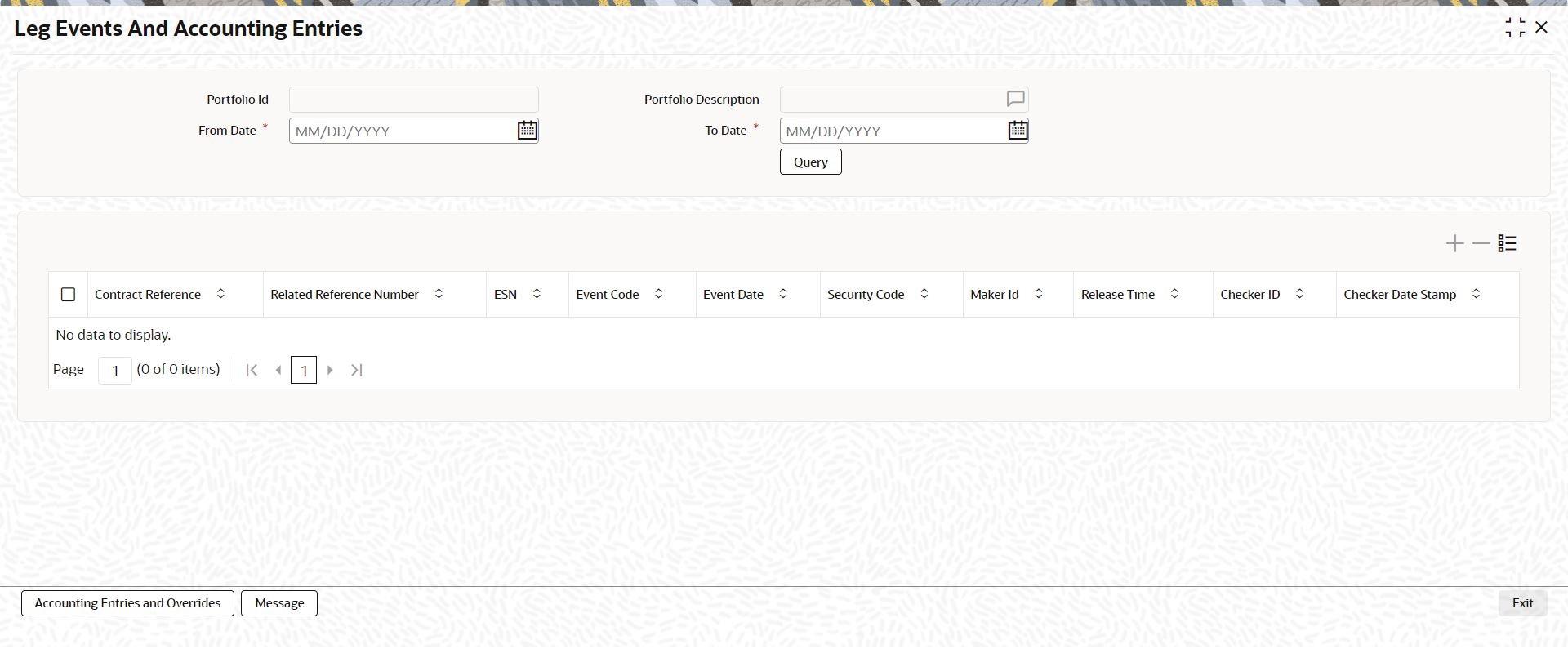

- On the Securities Deal Input Screen, click

Events.

Events screen is displayed.

Figure 21-9 Leg Events, Account Entries and Overrides

Description of "Figure 21-9 Leg Events, Account Entries and Overrides"Table 21-9 Event Details - Field Description

Field Description Accounting Entry Details

Highlight the event for which you want to view accounting entries. All the accounting entries that were passed and the overrides that were encountered for the event will be displayed. The following information is provided for each event:

- Branch

- Account

- Dr/Cr indicator

- Code

- The date on which the entry was booked

- Value Date

- The deal currency

- Amount in deal CCY

- The foreign currency equivalent (if applicable)

- The exchange rate that was used for the conversion

- Amount in local currency

- All the overrides that were encountered for the event will also be displayed.

Click Exit to exit this screen.

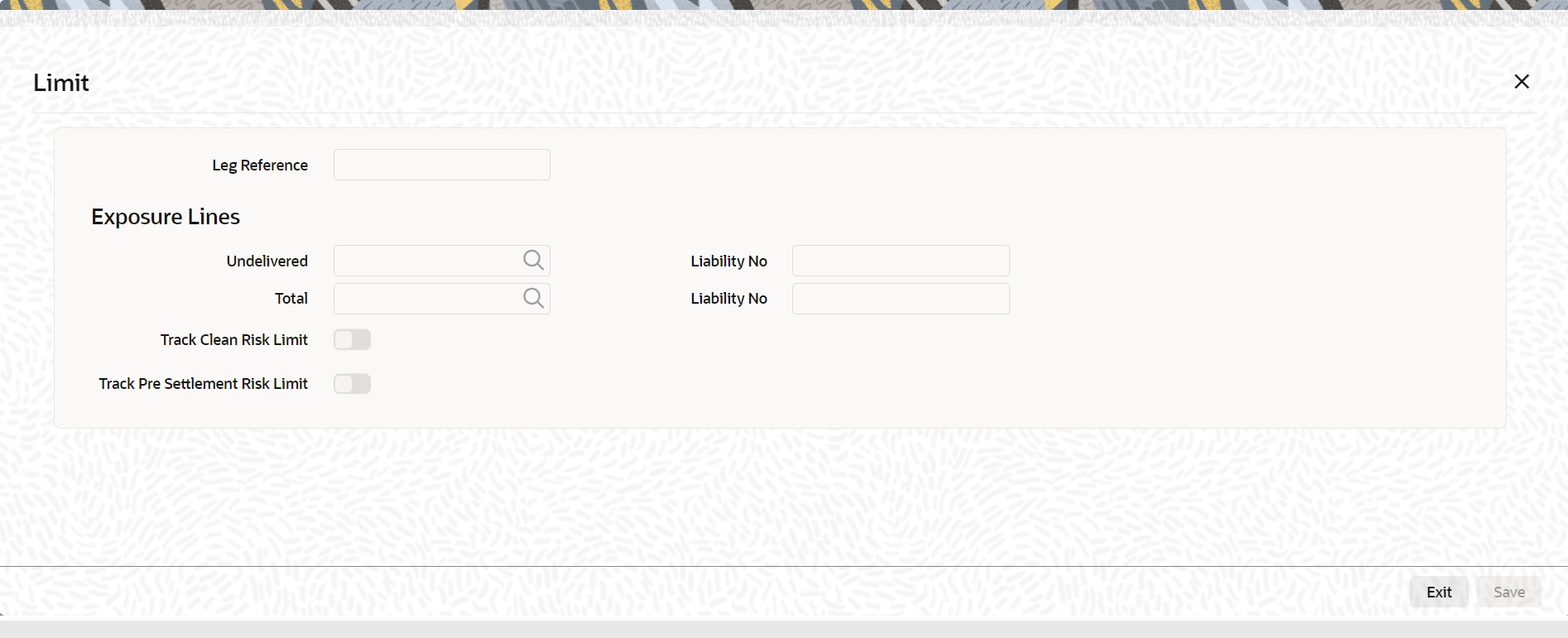

- On the Securities Deal Input screen, click Limits.

- On the Limits screen specify the fields.

In this screen you can indicate the credit lines under which you want to track your:

- Undelivered risk exposure

- Total exposure to the deal leg

Your undelivered risk arises only if you specified that the mode of security settlement for the deal is 'deliver free'. You can choose a credit line from the picklist available in this screen. Click ‘Exit’ button to delete the entries. In either case you will be returned to the Securities Deal Input screen.

Parent topic: Process Securities Data Input Screen