- Securities User Guide

- Credit Default Index

- CD Portfolio Definition

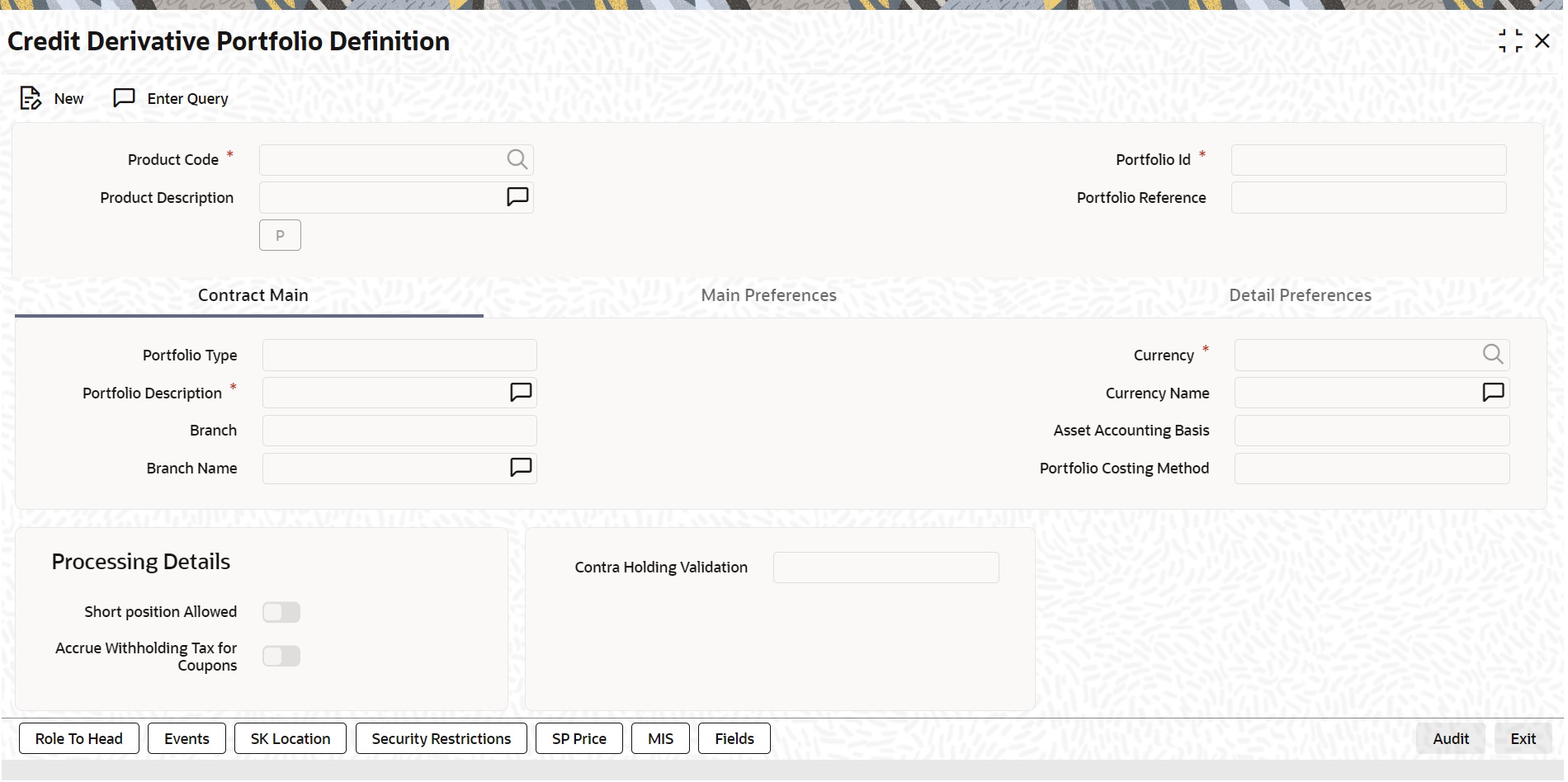

29.7 CD Portfolio Definition

This topic describes the systematic instructions for CD portfolio definition.

- On the Homepage, type DPDPFONL in the text box, and click the next arrow.

Credit Derivative Portfolio Definition screen is displayed.

Figure 29-29 Credit Derivative Portfolio Definition

Description of "Figure 29-29 Credit Derivative Portfolio Definition " - On the Credit Derivative Portfolio Definition screen, specify the details as required.

For more information, see: the Process Portfolio Definition Details

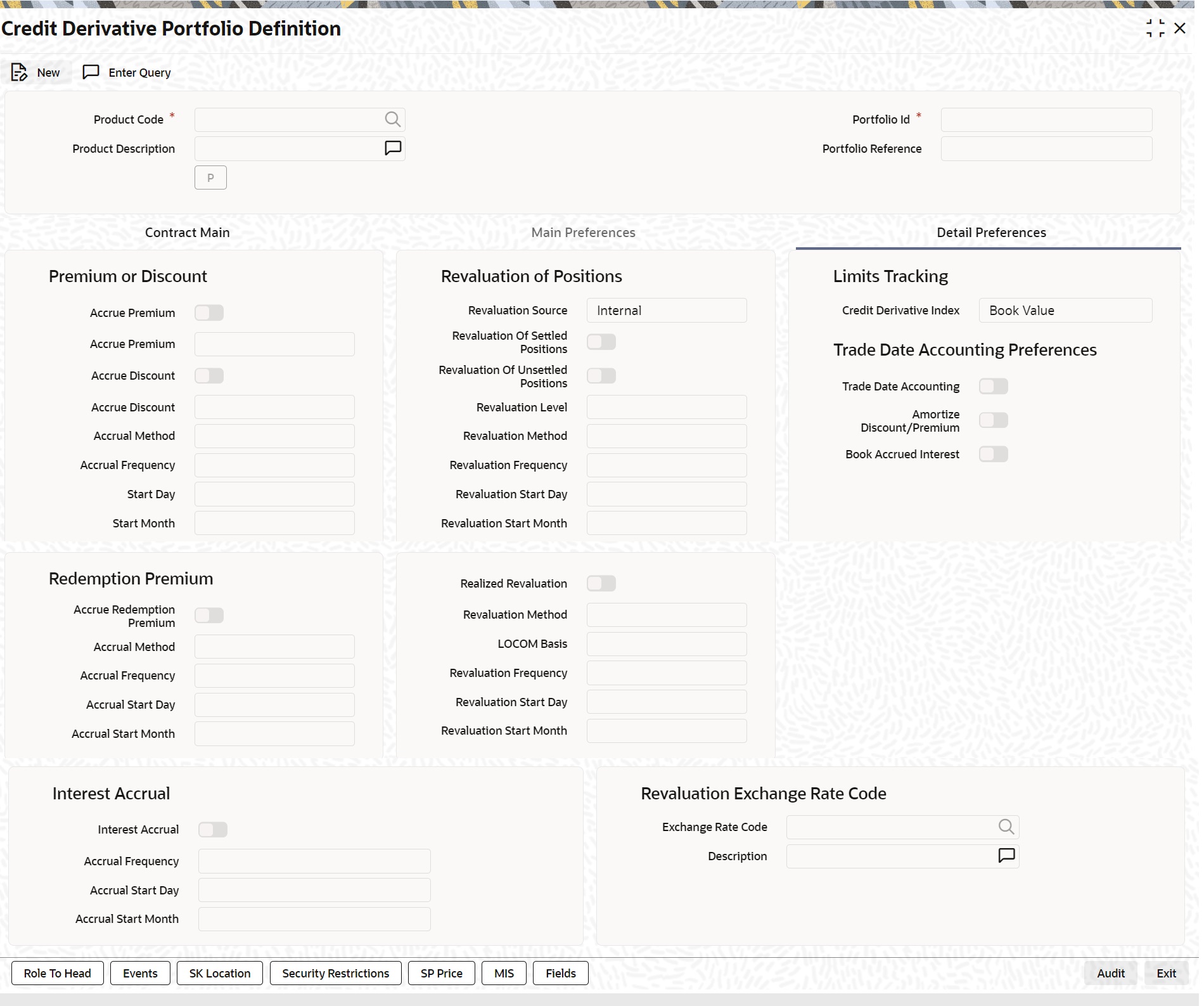

- Click the Detail Preferences tab to update the relevant details.

On the Detail Preferences tab, specify the details as required.

Figure 29-30 Credit Derivative Portfolio Definition - Detail Preferences

Description of the illustration dpdpfonl_cvs_detail_preferences_tab.jpg - On the Detail Preferences tab, specify the details as required.

The below is the field description

Table 29-11 Detail Preferences Tab

Field Description Trade Date Accounting Preferences

Specify the following details:

Trade Date Accounting

Check this box to indicate that the nominal and discount premium entries should be recognized on trade date.

Amortize Discount/Premium for each Deal

It indicates that the entries gets posted on trading profit or loss which is a delta of discount, premium and accrued entries.

This is only applicable for Non-Accrual accounting Basis.

Note: This field gets defaulted from the product level. The system does not allow you to modify it.

Book Accrued Interest on Trade Date

Check this box to indicate that the Accrued Interest(PUCM/PUEX/SOCM/SOEX) should be recognized on trade date.

Parent topic: Credit Default Index