- Securities User Guide

- Credit Default Index

- Credit Derivative Instrument Product Definition

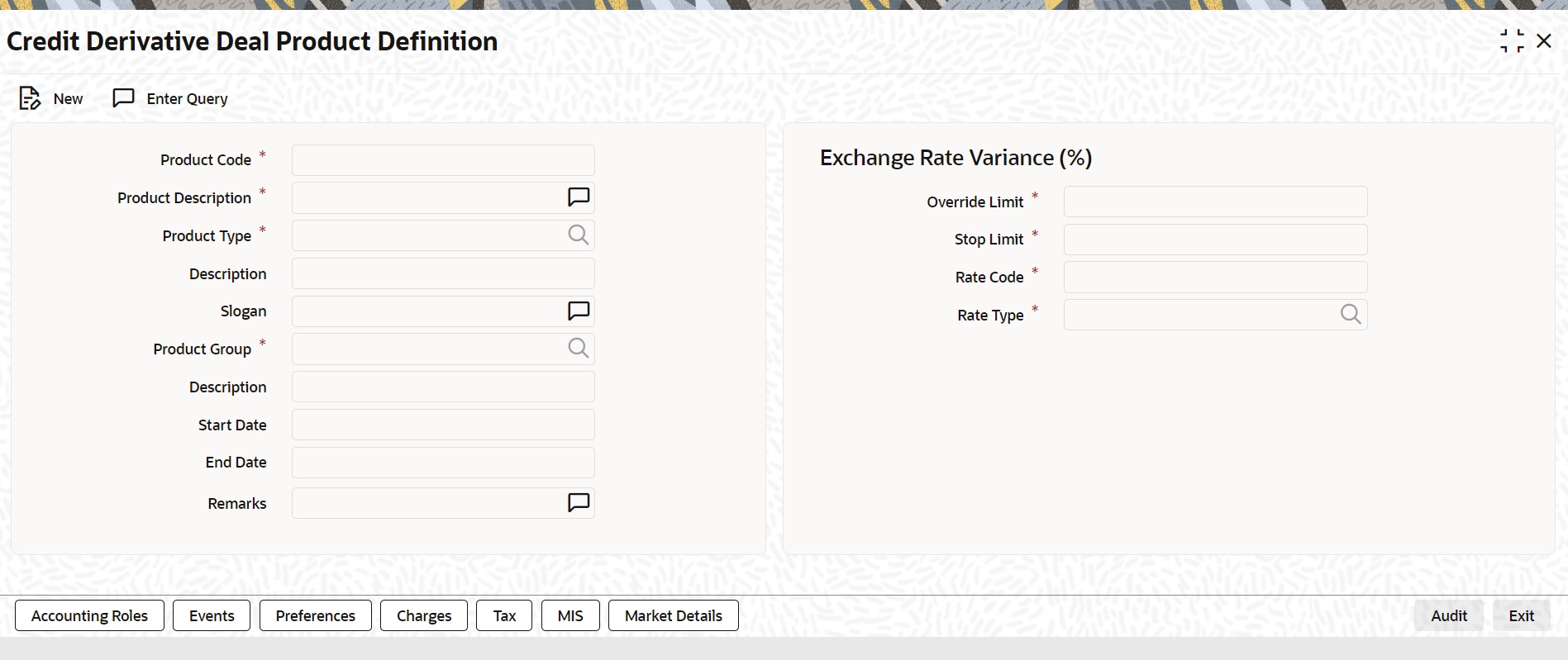

29.3 Credit Derivative Instrument Product Definition

This topic describes the systematic instruction to define credit derivative instrument product.

- On the Homepage, type DSDINPRD in the text box, and click the next arrow.

Credit Derivative Instrument Product Definition screen is displayed.

Figure 29-3 Credit Derivative Instrument Product Definition

Description of "Figure 29-3 Credit Derivative Instrument Product Definition" - On the Credit Derivative Instrument Product Definition screen, specify the details as required.

For field information, see the below table:

Table 29-2 Credit Derivative Instrument Product Definition

Field Description Product Code

Specify the product code. Alternatively, you can select the product code from the list.

Product Description

Security Product Code describes that you choose to Allowed/Disallowed list.

Product Type

The product type identifies the basic nature of a product. A securities product that you create can belong to Credit derivative.

Slogan

Specify a marketing punch line associated with the product combination. This slogan is printed on all the advices that are sent to the customers involved in a deal involving this product combination.

Product Group

Each product combination is classified under a specific group. Select a group code from the list of values displayed.

Product Group Description

Specify the description of the chosen Product Group as required.

Start Date

Specify the Start date as required.

End Date

Specify the End date as required

Remarks

Provide the remarks as required.

Exchange Rate Variance(%)

Define the market price variance that you would like to allow for a security product. This variance is expressed in terms of a percentage. For a special customer or in special cases, you may want to use an exchange rate (a special rate) that is greater than the exchange rate maintained for a currency pair. The variance is referred to as the Exchange Rate Variance. When creating a product, you can express an Exchange Rate Variance Limit in terms of a percentage. This variance limit would apply to all portfolios associated with the portfolio product.

Over Limit

If the variance between the default rate and the rate input varies by a percentage that is between the Override Limit and the Rate Stop Limit, you can save the transaction (involving the portfolio) by providing an override.

Stop Limit

If the variance between the default rate and the rate input varies by a percentage greater than or equal to the Rate Stop Limit, you cannot save the transaction involving the portfolio.

Rate Code

While processing a contract, you need to indicate this code to make the rate applicable to the contract. Specify a valid rate code to identify the rate you are defining. The adjoining option list displays all the valid rate code maintained in the system. You can select the appropriate from the list of option from the drop down. The options available are:

- Mid Rate

- Buy/Sell Rate

Rate Type

Select the Rate type from the list of values displayed as required.

This topic has the following sub-topics: