- Securities User Guide

- General Maintenance

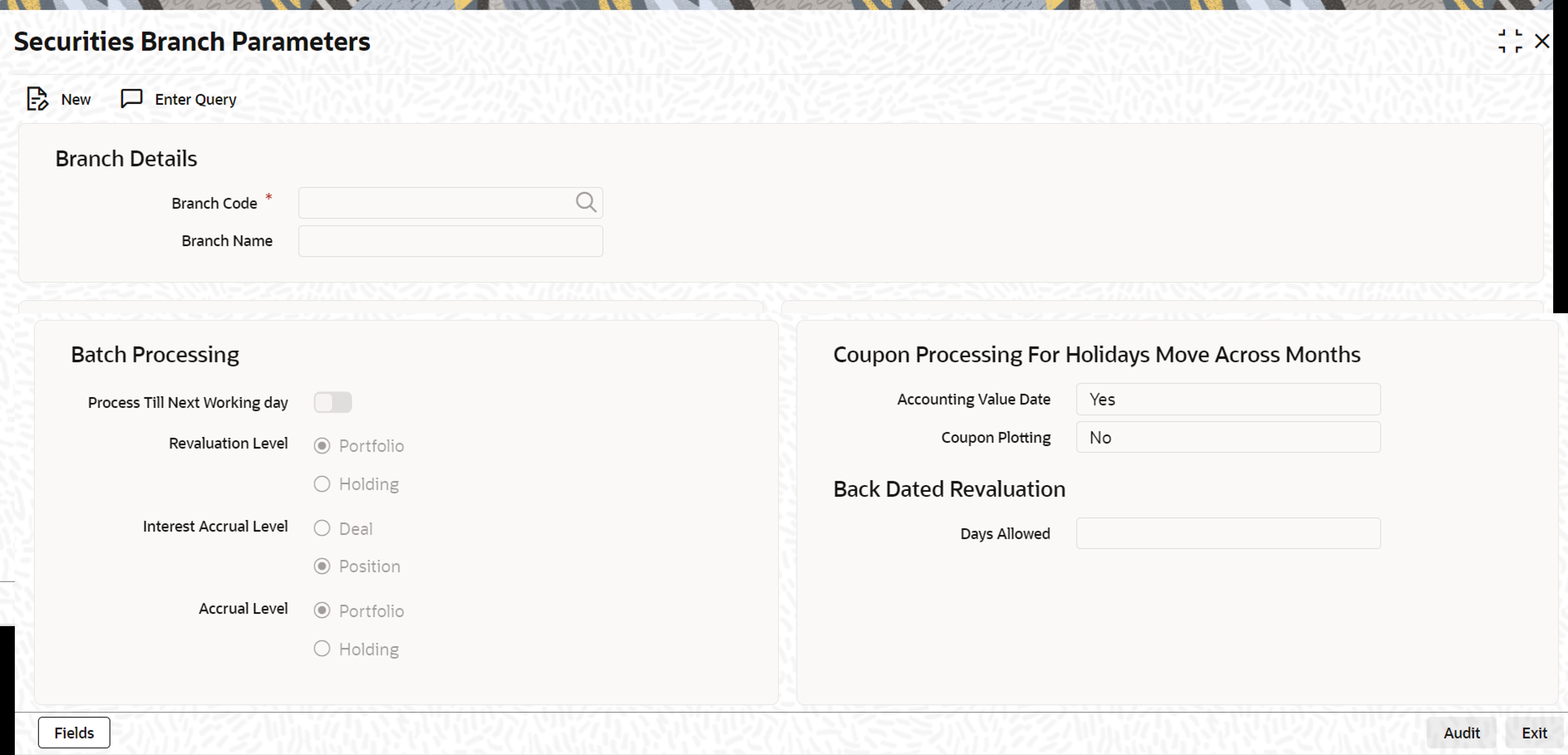

- Branch Parameters

- Define Branch Parameters

3.5.1 Define Branch Parameters

- On the Home page, specify SEDXBRPM in the text box, and click the arrow next t.

The Securities Branch Parameters screen is displayed.

- On the Securities Branch Parameters screen and specify the fields.

For more information on fields, refer to the below table.

The events, for which you had indicated automatic processing, are triggered off during the Batch Process. You can specify preferences for the automatic events that fall on a holiday, in the Branch Parameters screen.

Table 3-3 Securities Branch Parameters - Field Description

Field Description Batch process Parameter You have the option to specify when the batch process, must process automatic events falling due on a holiday. It could be either:

- As part of the EOD on the last working date before the holiday.

- As part of the BOD process on the next working day after the holiday

Revaluation Level Revaluation entries can be passed at the portfolio level or the holding level.

- Portfolio: At the portfolio level, revaluation entries will be passed for the portfolio and currency combination.

- Holding: At the holdings, level entries will be passed for the net holdings for a portfolio, and security across SK locations and SK location accounts.

For example,

- PF1 - SE01

- PF1 - SE02

- PF1 - SE03

The security currency for SE01, SE02 and SE03 is USD. The security currency for SE04 is GBP.

If you indicate that revaluation should be passed at the holdings level, entries will be passes exclusively for the following combinations:

- PF1 + SE01

- PF1 + SE02

- PF1 + SE03

- PF1 + SE04

If you specify that entries should be passed at the portfolio level, then the revaluation entries will be made in the following manner:

- PF1 + SE01 + SE02 + SE03

- PF1 + SE04

Refer the Maintaining a Portfolio Preference class chapter of this User Manual for more details.

Specifying the Accrual level

- Portfolio: At the portfolio level, accruals will be passed for the portfolio and currency combination.

- Holding: At the holdings, level entries will be passed for net holdings of a portfolio and security across SK locations and SK location accounts.

Interest Accrual level

You can opt to accrue interest at a position level or at a deal level.

Position: At the position level, accrual happens for a combination of security and portfolio

Deal Matching: Deal level interest accrual is done for every individual buy deal for the same combination of security and portfolioInterest accrual at deal level is for Bank Portfolios only.

Deal Level Interest Accrual

The interest accrual process pickups all the settled buy deals and passes accrual entries for each of them.

The deal level interest accrual will be done only for portfolios with the following costing methods:

- Deal Matching (DM)

- First in First Out (FIFO)

- Last in First Out (LIFO)

Deal level interest accrual cannot be done for portfolios with Weighted Average Costing (WAC) method since it would not be possible to determine the deals for which interest accrual should be stopped.

Revaluation

Though interest accrual occurs at deal level, the revaluation (REVL) entries will continue to be posted at the position level. The revaluation process will compare the current book value (cost of assets in your books) with the book value at the market place.

The price quote at the market place can be:

- Plus Accrued, in which case the value will be devoid of interest, which will be subsequently accrued.

- Flat Value, where the interest is built into the value. In this case, the system will arrive at the clean price of the asset.

Capitalization

Capitalization or compounding of interest on interest) will result in a new deal, and the face value would be considered as the coupon amount for the previous coupon period. Therefore, IACR for the new deal would be done with the new face value.

For Back Dated Deals

In the case of backdated deals, adjusting entries will be posted. As the IACR will be at a deal level, for a backdated buy deal, a consolidated IACR entry will be posted. For a backdated-sell deal, an adjustment IACR entry will be posted for the matched buy deals.

On the reversal of a sell deal, the interest accrual process will pass an adjustment entry for the relevant matched buy deals. This is illustrated in the example below.

Let us continue with the example discussed above. You have struck 3 deals (2 buys + 1 sell) for ‘10-year RBI Bonds’ (S1) for the Trading Portfolio (P1). Further, the 12 units sold comprise of 10 units from D1 and 2 units from D2. The other details of the deal are as follows:

- Coupon Period – 1st Jan to 30th Jan

- Coupon Amount – 1 USD per day per unit

- Interest Accrual Frequency - Daily

Coupon Accrued on D1 till 4th Jan = 40 USD (10 units* 1 USD* 4 days)

Accrual will not happen for D1 after 4th January as all the 10 units are sold out on 5th January.

Coupon Accrued on D2 till 4th January = 45 USD (15 units * 1 USD * 3 days)

After 4th January, for D2, accrual will happen only for the remaining 13 units (15 – 2 units sold = 13).

Now, on 10th January, the sell deal, D3 is reversed.

Between, 5th and 10th Jan, coupon accrued on D2 = 65 USD (13 units * 1 USD * 5 days)

Due to the reversal of the sell deal, the interest accrual process will pass accrual entries for the period 5th Jan to 10th Jan for the buy deals (D1 and D2):

D1 = 60 USD (10 units * 1 USD * 6 days)

D2 = 12 USD (2 units * 1 USD * 6 days)

Subsequently, interest accrual will continue for deals D1 and D2 till redemption/CPLQ. The accrual process will be zero based i.e. at deal level, the accrual process will do the following:

- Identify all the BUY deals

- Determine the current quantity (buy quantity – the sold quantity)

- Find the amount to be accrued from the Previous Coupon Date (PCD) to the accrual date i.e. if the PCD is 1st Jan, and the accrual date is 10th Jan, it will calculate interest to be accrued for the period 1st Jan to 10th Jan. This amount is, say A1.

- Find the amount already accrued for the deal i.e. interest accrued for the period 1st Jan to 9th Jan i.e. before the actual accrual date, 10th Jan. The interest accrued is said, A2.

- Pass the accrual entry for A1-A2.

Note:

For a deal level interest accrual, the accrual of the Withholding Tax will also happen at the deal level. However, interest accrual will not happen for unsettled deals. For deal level interest accrual, the IACR (Interest Accrual) event and the associated accounting entries will continue to be maintained at the portfolio product level.

Days Allowed

Specify the number of days allowed for back dated revaluation. This field is required to maintain during creation of branch parameter setup and is not modifiable after authorization of record.

Table 3-4 For the Events SPLP & SPSP

Accounting Roles Amount Tags Debit/Credit Indicator iccfcomp01_RCPY

iccfcomp01_PUCM

Dr

SEC BRIDGE GL

ccfcomp01_PUCM

Cr

SEC BRIDGE GL

iccfcomp01_PUEX

Dr

iccfcomp01_RCPY

iccfcomp01_PUEX

Cr

Table 3-5 For the Events SSLP & SSSP

Accounting Roles Amount Tags Debit/Credit Indicator SEC BRIDGE GL

iccfcomp01_SOCM

Dr

iccfcomp01_RCPY

iccfcomp01_SOCM

Dr

iccfcomp01_RCPY

iccfcomp01_SOEX

Dr

SEC BRIDGE GL

iccfcomp01_SOEX

Cr

Table 3-6 For the Event IACR

Accounting Roles Amount Tags Debit/Credit Indicator iccfcomp01_RCPY

iccfcomp01_IA

Dr

Iccfcomp01_I

iccfcomp01_IA

Cr

PAYABLE

iccfcomp01_ILIQ

Dr

iccfcomp01_RCPY

iccfcomp01_ILIQ

Cr

At the end of the coupon liquidation event, CPLQ, the balance in the interest receivable head (iccfcomp01_RCPY) would be zero. The following example will illustrate this.

The following deal details are available:

- Coupon Period – 1st January 2003 to 30-Jan-2003

- Previous Coupon Date (PCD) – 1st January 2003

- Next Coupon Date (NCD) – 30th January 2003

- Ex Date – 26th January 2000 (the issuer will pay interest to the holders of the securities as on the Ex. Date or the Record Date).

- Interest amount – 1$per day per unit

- Accrual Frequency – Daily

Now on 10th Jan, you buy 20 units of a bond S1 at PUCM amt of 200$i.e. the interest accrued for the period 1st Jan (PCD) to 10th Jan will be tracked as a receivable from the issuer of the units (200 $= 20 * 1*10)

The following entries would be passed as part of event SPLP (amount tag IntComp_PUCM):

Table 3-7 SPLP entries

Dr IntComp_Rcpy (Interest Receivable) 200 $ Cr

Sec Bridge GL

200 $

- - - Interest accrued on EOD of 26th Jan (for the period from 11th Jan to 26th Jan) = 320 USD (16days * 20 units * 1 USD).

The following entries will be passed for this amount as part of event IACR (amount tagIntComp_IA):

Table 3-8 IACR entries

Dr IntComp_Rcpy (Interest Receivable) 320 $ Cr

IntComp_IA (Accrued Interest)

320 $

- - - On 27th Jan, you decide to sell 15 units at the SOEX amount of 60 $. This is the sold interest after the Ex. Date/Record Date i.e. the interest on 15 units for the period from 27th Jan to 30th Jan. The following entries will be passed for this amount as part of event SSLP (amount tag IntComp_SOEX):

Table 3-9 SEOEX entries

Dr IntComp_Rcpy (Interest Receivable) 60 $ Cr

Sec Bridge GL (Intcomp_SOEX)

60 $

- - - Interest accrued on the remaining 5 units for the same period i.e. from 27th Jan to 30 Jan =20 USD (5 units * 1 USD * 4 days)

Therefore, Interest accrued on EOD of 30th Jan = 320 + 20 = 340 USD

Table 3-10 Entries

Dr IntComp_Rcpy (Interest Receivable) 5 $ Cr

IntComp_Rcpy

5 $

- - - Table 3-11 600 USD table

Dr Payable 600$ Cr

IntComp_Rcpy

600 $

- - -

Parent topic: Branch Parameters