- Securities User Guide

- Price Details Maintenance

- Maintain Price Details

4.1 Maintain Price Details

This topic describes the systematic instruction to maintain price details.

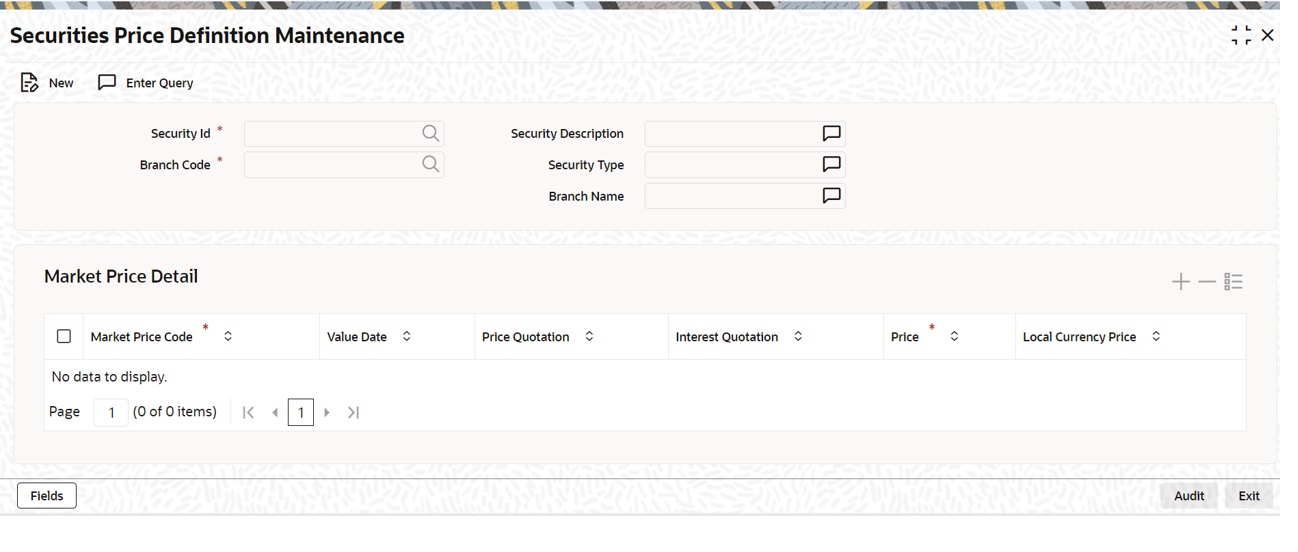

- On Home page, type SEDXMRAT in the text box, and click next arrow.

Securities Price Definition Maintenance screen is displayed.

Figure 4-1 Securities Price Definition Maintenance

Description of "Figure 4-1 Securities Price Definition Maintenance" - On the Securities Price Definition Maintenance screen, specify the fields.

If you are maintaining details of the market price for new security, click on new from the toolbar. The Market Definition detailed screen will be displayed without any details. To modify or update the existing prices as of different Value dates, click on the unlock button. Enter the value date and the new price in the respective fields and save the record. If you are calling a market price maintenance record that has already been defined, choose the Summary option under Market Price. From the Summary screen, double click on a record to open it.

For more information on fields, refer to the below table.

Table 4-1 Securities Price Definition Maintenance - Field Description

Field Description Price Code The price code indicates the price of a market place. Each price code you define is unique. If the security is quoted in different markets, its value would be different in each market. You can capture these prices using different price codes.

The price code assigned to each security is used to identify the particular market price of the security for revaluation. All the price codes defined in this screen are picked up and displayed in the pick list available for the Revaluation Price Code field of the Security Definition screen. You can specify the revaluation price code for each security while defining it.

If you are defining the revaluation price for the security, you can choose any one of the price codes as the revaluation code. Let’s assume you choose SERL03. This code will be picked up exclusively for revaluation. Each security code is associated with a market code. At the time of entering a deal, specify the security code, and the price code linked to the market will be picked up and defaulted.

Price Quotation Method You can specify the price quotation method to be used for the security for which you are defining the price. The details that you maintain here are specific to the price quotation method used for the particular security. You can choose any of the following methods for calculating the price:

Absolute Price

Here the market value of the security is quoted as the actual price of the security.

%Price

Here the security price is quoted as,% Price = (Market price / Face value) x 100

For example, the Face value of security A is USD1000. The market value of the same security is USD900. If the price quotation method specified is Absolute Price then the price of the security will be quoted as USD900. For the same security, if you choose to apply the% Price method, then the price of the security will be: 900 / 1000) x 100 =90%

You will quote the% price of the security as 90.

Premium/Discount is the differential between the face value of the bond and the price at which it is sold. If you were to specify the Discount/Premium method then the security would be quoted at a discount of USD100 (USD1000 – USD900 = USD100). If the market price of the security were to be USD1100 then the security would be quoting at a premium of USD100.

Security type The Security type details are populated based on the selected Security ID.

Table 4-2 Example

Security Market Place Price Price Codes Reliance

NSE - Delhi

3000 Rs.

SERL01

Reliance

BSE - Bombay

3020 Rs.

SERL02

Reliance

OTC- Bombay

3010 Rs.

SERL03

Reliance

CSE - Calcutta

3025 Rs.

SERL04

If you are defining the revaluation price for the security, you can choose any one of the price codes as the revaluation code. Let’s assume you choose SERL03. This code will be picked up exclusively for revaluation. Each security code is associated with a market code. At the time of entering a deal, specify the security code, and the price code linked to the market will be picked up and defaulted.

Parent topic: Price Details Maintenance