- Securities User Guide

- Maintain Safe Keeping Locations

- Maintain Safe Keep Location

6.1 Maintain Safe Keep Location

This topic describes the systematic instructions to maintain safe keep location.

Specify User ID and Password, and login to Home page.

- On the Home page, specify SEDXSKLC in the text box and click next.

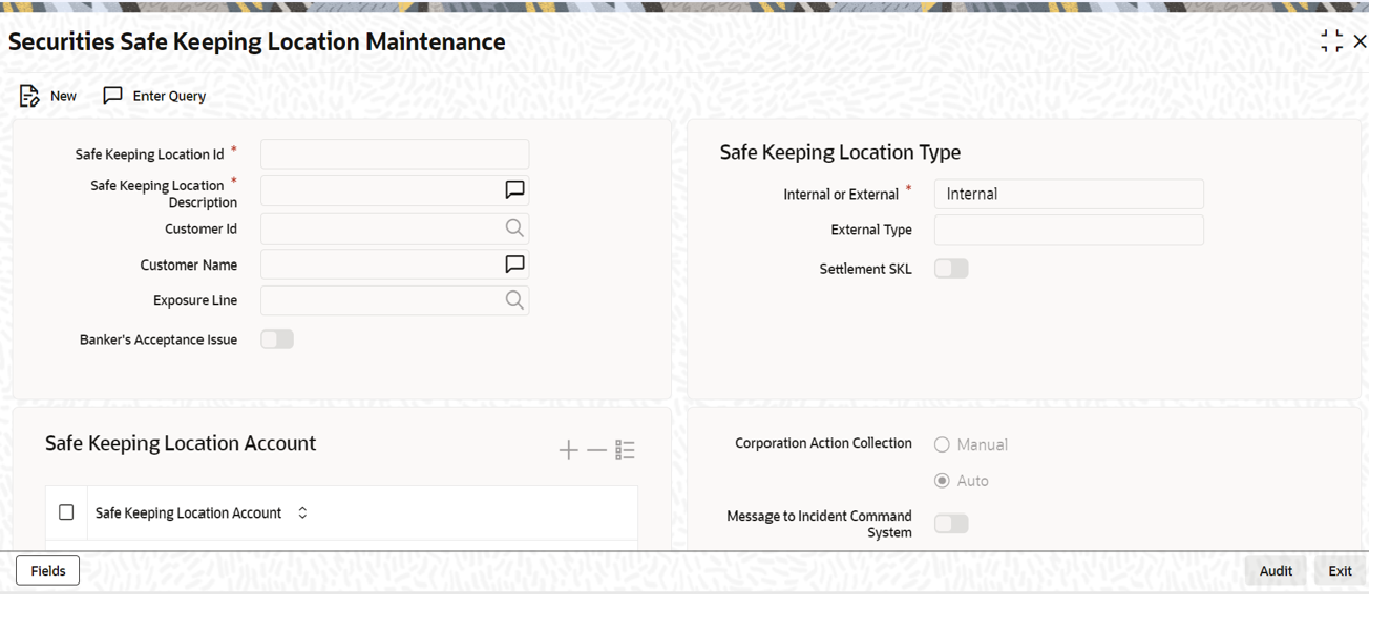

The Securities Safe Keeping Location Maintenance screen is displayed.

Figure 6-1 Securities Safe Keeping Location Maintenance

Description of "Figure 6-1 Securities Safe Keeping Location Maintenance" - On the Securities Safe Keeping Location Maintenance screen, specify the fields.

If you are maintaining details of a new safekeeping location, click on new icon from the toolbar. The Safe Keeping Location detailed screen will be displayed without any details. If you are calling a safekeeping location maintenance record that has already been defined choose, the Summary option under SK Location Maintenance. From the Summary screen, double click on a record to open it.

For more information on fields, refer to the below table.

Table 6-1 Securities Safe Keeping Location Maintenance- Field Description

Field Description Safe Keeping location Identification Every safe keeping location that you define needs to be assigned a unique identification code. This ID is in turn linked to a single or to multiple accounts depending on the number of accounts you want to link, to a specific safe keeping location.

Description In addition to the SK Location ID, specify a title or a short description of the SK location you are defining. This will enable you to identify the SK location quickly.

The short description that you specify is for information purposes only and will not be printed on any customer correspondence.

Customer Identification You might be holding securities on behalf of your customer therefore it becomes necessary to maintain a customer profile concerning the securities held.

This information can be maintained in the Customer Information Maintenance (CIF) screen, which is part of the Core Entities module of Oracle Banking Treasury Management.

The Customer Ids available in the pick list are defaulted from the CIF maintenance screen. By linking a Credit Line to a Liability Number, you assign a limit, to the customer linked to the line. Every credit-seeking customer is linked to a liability number and the credit facilities granted to him are tracked against this liability number.

Note:

In the Customer Information Maintenance screen, you need to link customers to specific SK Locations. For this purpose you can create a customer category called Safe Keeping Locations. This can be created through the Customer Category detail screen. All the SK Locations that you have maintained can come under this category.

After defining the category, you only need to associate the liability number of the customer with the customer category. The customers thus defined can be linked to a credit line through the Limits maintenance screen.

For further details, on the Customer Information Maintenance screen, please refer to the Oracle Banking Treasury Management user manual Core Entities.

Customer Name The system displays the short name of the selected customer.

Exposure Line Select the limit line to track the total exposure to the SK Location. Exposure lines can be defined in the external limit system with a maximum limit beyond which the bank would not like to expose (bank or clients), to a particular SK Location.

Limit defined is calculated in terms of the market value of the securities held with this SK Location.

Banker’s Acceptance Issue User to indicate whether this SK location can be used for a Banker’s Acceptance portfolio.

By default, the Banker’s Acceptance Issue check box is not selected.

Safe Keeping Location Type Group of fields used to define the type of the SK Location.

Internal or External Select the type of the SK Location. This field cannot be amended after first authorization of the SK Location.- Can select ‘Internal’, if the SKL is for the custodial accounts maintained by the portfolio customers with the bank

- Can select ‘External’, if the SKL is for the custodial accounts maintained by the bank with external custodians and central security depositories (CSD/ICSD)

External Type Select the treasury customer of the External SK Location. For example, Euroclear, Cedel, etc. Can select ‘Other’ if the Custodians, Sub-Custodians or CSD/ICSD is not defined as a treasury customer in the system.

Settlement SKL Indicate whether this SK Location is a CSD/ICSD where settlement of the securities happens. This field cannot be amended after first authorization of the SK Location- If checked, then this SK Location is considered an CSD/ICSD and appear for selection as Settlement SKL in Securities deal booking and other applicable functions

- If unchecked, then this SK Location is considered as a custodian, sub custodian or depository participant and not appear for selection as Settlement SKL in other functions

Corporate Action Collection Indicate whether system should trigger collection events for corporate actions with this SK Location should be automatically triggered by the system.- If set to Auto, then collection events CPCD, DVCD etc. would be automatically triggered based on the preferences defined for the Instrument/Portfolio and considering the balances available for the instrument in this SKL on the event date

- If set to Manual, then collection events need to be manually trigged by the user using manual corporate action function

- By default, it is set to ‘Auto’

Message to Incident Command System Indicate whether the incident support team should be notified if any events and processes involving this SK Location fails. By default, this field is unchecked

Safe Keeping Location Account Specify the custodial accounts which is maintained for the SK Location customer, in which balances in securities will be tracked.- These SK Accounts will be appear for selection in Securities deal booking and other applicable functions, where this SK Location is selected.

- For SKL of type ‘External’, these are the custodial / demat accounts maintained by the bank with external custodians or CSD/ICSD

- For SKL of type ‘Internal’, these are the custodial / demat accounts maintained by the portfolio customers with the bank

- To add a new account, click the Add row button(+) and enter the new SK Account Number

- To delete an existing SK account, highlight the SK account number and click on the delete row button(-)

This topic contains the following subtopics: