- Securities User Guide

- Maintain and Process Corporate Actions

- Process Dividends

- Process Bonus to Cash Conversion Details

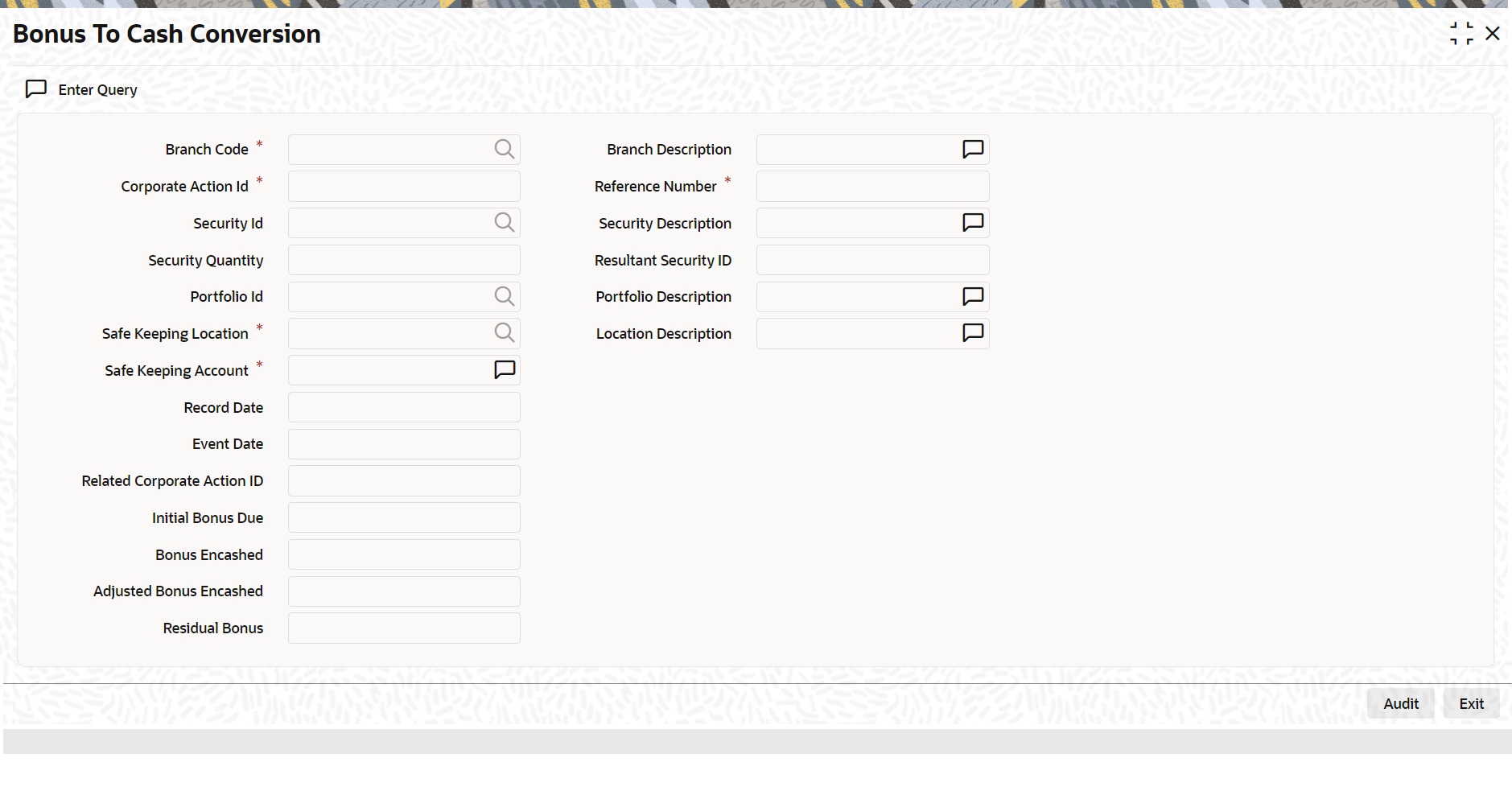

19.9.1 Process Bonus to Cash Conversion Details

When you specify that stock is to be converted to cash, in the Stock Dividend definition screen, details of that event will be picked up and stored as, a Bonus to Cash conversion record. You are only allowed to maintain some additional stock to cash conversion details, such as the bonus to be en cashed, the total bonus en cashed, the residue bonus due. This is maintained so on in the Bonus to Cash conversion screen. Invoke this screen by clicking on Bonus to Cash and then on the Detail option, under Securities CA Maintenance.

This is invoked from the Application Browser. To view the details of a previously created record, go to the Summary View screen. The details of existing records are displayed in a tabular form. Highlight the record you want to view and double click it.

- On the Home page, specify SEDXBNCS in the text box, and click next arrow.

Bonus to Cash Conversion screen is displayed.

- On the Bonus to Conversion screen, specify the fields.

In the Bonus to Cash conversion, the main screen enters the security ID, the portfolio ID, and the SK location Id from where bonus due, is to be received.

Table 19-13 Bonus to Cash Conversion - Field Description

Field Description Branch Code

Specify the Branch Code

Corporate Action ID

This is the system generated ID to uniquely identify the declaration of Stock Dividend. This value is defaulted.

Reference Number

This is the system generated ID to uniquely identify the Corporate action of Stock to cash conversion.

Security Id

This is the security Id of the equity for which the bonus to cash details are being maintained.

The description associated with the specified code is displayed in the adjacent field.

Security Quantity

This is the quantity of security for which the bonus was declared.

Resultant Security Id

The resultant security Identification to which shares have been awarded is defaulted here.

Portfolio Id

This is the portfolio ID of the equity for which the bonus to cash conversion details are being defined.

Stock Keeping Location

This is the SK location where the security is lodged and for which cash payment is to be received.

Stock Keeping Account

This is the account number which is to be credited when the payment due is received.

Record Date

The record date is defaulted from the Stock Dividend definition screen.

Event Date

The event date is defaulted from the Stock Dividend definition screen.

Stock to Cash Action Id

The stock to cash action Id assigned in the Stock Dividend screen is defaulted in this screen.

Initial Bonus Due

This field indicates the bonus amount that is due to be paid.

Bonus Encashed

You can choose to convert either a part of or the entire bonus that is due. Specify the amount to be encashed, in the Bonus to be Encashed field.

If you choose to encash only a part of the amount due, then the residue bonus will be automatically calculated and displayed, in the Residue Bonus Due field. Assume that you have a holding of 500 units in a particular security. Bonus is declared in the ratio of 2:1. Therefore, you are liable to get 250 units of shares free. If you indicate that bonus is to be encashed for 125 units only then the remaining 125 units, which need to be encashed, will be reflected in the Residual Bonus field. You can choose to encash them at a later date.

Adjusted Bonus Encashed

The adjusted bonus is calculated by the system and displayed in this field.

The calculations are such that, the net bonus encashed minus the adjusted bonus will be equal to the initial bonus.

Residual Bonus

If the bonus is encashed in parts then the residual amount due is displayed here.

Parent topic: Process Dividends