- Securities User Guide

- Maintain and Process Corporate Actions

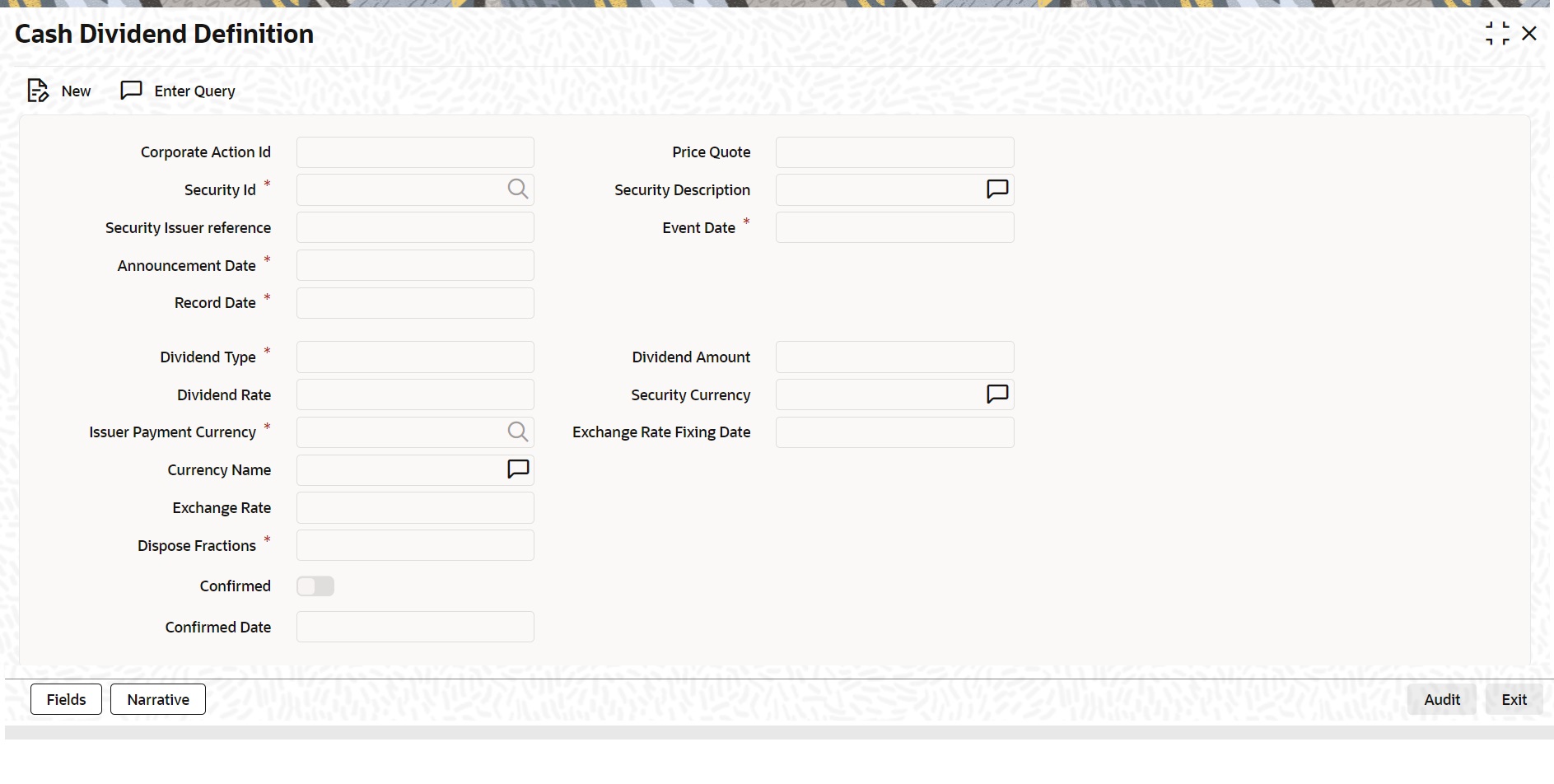

- Process Cash Dividend

19.8 Process Cash Dividend

This topic describes the systematic instruction to process dividend.

The details of a cash dividend declaration can be captured through the Cash Dividend Definition screen. Through this screen, you can capture relevant details such as the dividend type (rate or amount), the issuer payment currency, the exchange rate, and the rate-fixing date.

- On the Home page, specify SEDXCDVD in the text box, and click next arrow.

Click the new icon on the tool bar to create the icon.

Cash Dividend Definition screen is displayed.

- On the Cash Dividend screen, specify the fields.

The details of a cash dividend declaration can be captured through the Cash Dividend Definition screen. Through this screen, you can capture relevant details such as the dividend type (rate or amount), the issuer payment currency, the exchange rate, and the rate-fixing date.

Table 19-11 Cash Dividend Definition - Field Description

Field Description Corporate Action Identification

This is the system generated ID to uniquely identify the declaration of Cash Dividend.

External Corporate Action Identification

This is the Id assigned to the event at the time of the event declaration. Enter the Id associated with the event to uniquely identify it.

Security Identification

Specify the security Id of the equity type for which the cash dividend event is to be defined.

The description associated with the specified code will be displayed in the adjacent field.

Security Issuer Reference

Indicate the issuer reference for the cash dividend event.

Announcement Date

This is the date on which the issuer would have declared the cash dividend event.

Enter the announcement date of the event.

Event Date

Enter the date on which the cash payment will be made by the issuer.

Record Date

Enter the date on which the issuer determines the beneficiary eligible for the dividend based on the registered owner of the securities. The Record Date is computed from the ex days set up defined for the local market of issue.

Dividend Type

Indicate the type in which the dividend amount should be declared. It could be a percentage of the face value of the security, or it could be the amount per unit of the security.

Dividend Amount

Indicates amount per unit.

Specify the amount per unit to be used in calculating the cash dividend.

Dividend Rate

This field indicates the rate as a percentage of the face value. Enter a percentage of the face value to be used in calculating the cash dividend.

Issuer Payment Currency

Indicate the currency in which the issuer will make the cash payment. Click the adjoining option list for a list of valid currency codes. Select the appropriate.

Dispose Fractions

Indicate how fractions should be handled. Refer Dispose Fractions Available Options for available options.

Confirmed

Check this box to indicate that the occurrence of the event is confirmed.

Confirmed Date

Select the check-box, and save the record the confirmed date will default with the current date.

Exchange Rate and Exchange Rate Fixing Date

When the issuer payment currency is different from the security currency, the exchange rate between the security currency and the payment currency has to be indicated. Along with this, the date on which the exchange rate will be announced should also be entered.

Table 19-12 Dispose Fractions Available Options

Term Definition Retain

Fractions will be retained as they are

Round Up

Entitlement will be rounded up to the next full integer

Round Down

Entitlement will be rounded down to the previous full integer

Round Standard

Entitlement will be rounded up to the next full integer if the fraction is greater than 0.5. Else it will be rounded down to the previous full integer

Parent topic: Maintain and Process Corporate Actions