- Securities User Guide

- Define a Deal preference Class

- Process Deal Preference Class

11.1 Process Deal Preference Class

This topic describes the systematic instructions to process deal preference class.

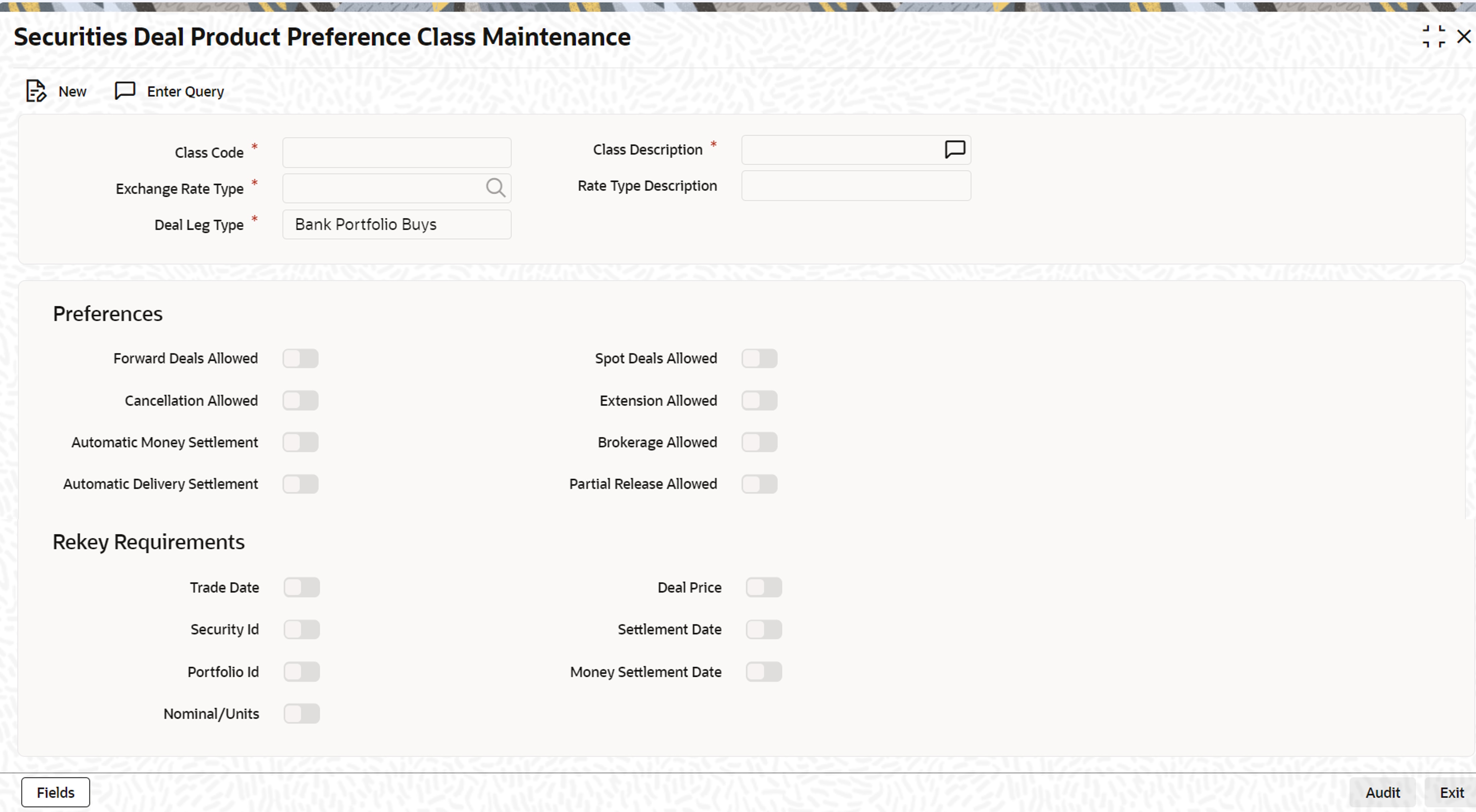

- On the Home page, specify SEDXDPCL in the text box, and click next arrow.

Security Deal Product Preference Class Maintenance screen is displayed.

Figure 11-1 Security Deal Product Preference Class Maintenance

Description of "Figure 11-1 Security Deal Product Preference Class Maintenance" - On the Security Deal Product Preference Class Maintenance screen, specify the fields.

For more information on fields, refer to the below table.

After you have defined a deal preference class, click save icon from the toolbar to save the record. Click Exit to exit the screen. You will be returned to the Application Browser.

Table 11-1 Security Deal Product Preference Class Maintenance Screen

Field Description Class Code

In Oracle Banking Treasury Management, each Deal Preference Class that you maintain is identified by a unique ten-character code called a Class Code. You can follow your convention for devising this code, however, one of the characters of the code should necessarily be a letter of the English alphabet.

Description

Specify a short description that will enable you to identify the deal preference class easily.

The short description that you specify is for information purposes only and will not be printed on any customer correspondence.

Deal Leg Type

Each deal type has characteristic features that are unique to the type. Certain deals also have two legs, a buy, and a sell leg. A deal preference class that you set up can cater to a particular leg (buy or sell) of a deal. You can indicate the deal leg type for which you are setting up preferences. You can select one of the following from the pick-list:

- Bank sell

- Bank buy

- Customer sell

- Customer buy

- Standalone lodge

- Standalone withdraw

- SKL to SKL transfer

- Block securities

By indicating the leg type, you restrict the application of the class to products of the same type. For instance, you can associate a Deal Preference Class of the Leg Type Bank sell, only with products that cater to the selling of securities by the bank.

Exchange Rate Type

Specify the exchange rates that are to be used when a deal involving a foreign currency, is processed. This is done, by specifying the Rate Type to be used in a deal. When a deal involves a currency conversion, the Rate Type that you defined will be picked up by default and applied. This defaulted rate type can be changed at the time of processing a deal. You can define an exchange rate variance (the upper and lower limit), within which the exchange rate can differ from the rate type that is defaulted.

Brokerage Allowed

You can choose to allow or disallow brokers, for a deal that you enter. Brokerage is applicable only for the bank to buy or sell the type of deals. As a preference, you can indicate whether the brokerage is applicable to the class you are defining. If you allow brokerage, you can enter deals that may or may not involve brokers. If you disallow brokerage for the product, then the product cannot be associated with deals that are struck through a broker. To allow brokers, check against this option. To disallow brokers, leave it unchecked. When a deal involving a broker is processed, the brokerage applicable to the broker will be picked up and applied from the Brokerage maintenance

Automatic Money Settlement

Money settlement for security deals can be liquidated automatically or manually. While setting up a deal preference class, you can indicate the mode of monetary settlement. It could be one of the following:

- Manual

- Automatic

Check against this option, to indicate that money settlement should be automatic. Leave it unchecked to indicate manual settlement. If you specify the automatic mode of money settlement, deals involving a product to which the class is applied will be automatically settled, on the settlement date.

If the money settlement date falls on a holiday

If the money settlement date of a deal falls on a holiday, the deal will be settled depending on your specifications, in the Branch Parameters screen.

Extension Allowed

Choose to allow extension of the Settlement Date for deals involving a product to which, a preference class is applied. Check against this option, to allow extension of the settlement date. Leave it unchecked to disallow extension. This feature is useful when you need to extend the settlement date for the deal.

You need not enter a new deal for the extension period but simply amend the settlement date of the deal to a future date. For example, the settlement date of a deal is 1 April. You need to extend the settlement date of the deal by two days. If you have allowed the extension of the deal for the product, you can settle the contract on 3 April.

Rekey Requirements

All operations on a deal, (input, amendment, modification, etc.) have to be authorized by a user other than the person who carried out the operation. They need to be authorized before the End of Day operation commences. Authorization is a method of checking the entries made by a user. As a cross-checking mechanism to ensure that the right deal is invoked for authorization, you can specify that the values of certain fields should be entered, before the other details are displayed. The complete details of the deal will be displayed only after the values to these fields are entered. The fields for which the values have to be given are called the re-key fields. You can specify any or all of the following as re-key fields:

- Trade date

- Security ID

- Deal price

- Settlement date

- Portfolio ID

- Money Settlement date

- Nominal/Units

If no re-key fields have been defined, all details of the deal will be displayed when the authorizer calls the deal for authorization.

The re-key option also serves as a means of ensuring, the accuracy of inputs. For example, suppose that a user enters a deal to sell 100 units of a bond that belongs to the customer portfolio PF01. The deal involves a product for which the re-key field assigned is the Portfolio ID.

Now, the user makes a mistake and enters the Portfolio ID as PF02. The authorizer selects the deal for authorization and indicates the re-key field of Portfolio ID as PF01. The details of the deal will not be displayed. When this happens, the authorizer can inform the user of the mistake and it can be rectified.

The deal details will not be displayed if:

- The value in the field that has to be rekeyed, has been entered wrongly at the time of deal definition.

- The re-key value is entered wrongly at the time of authorization.

It could also be that the user had correctly captured the Portfolio ID as PF01 but the authorizer made an error while entering the re-key value. In such a case also, the details of the deal will not be displayed for authorization.

Other Preference

Specify the following:

- Forward deals allowed - whether forward deals can be entered into, by using a product to which the class is applied

- Cancellation allowed - whether deals entered using a product, to which the class is associated, can be canceled

- Spot deals allowed - whether spot deals can be entered using a product, to which the class is applied

- Partial release allowed - whether partial delivery of securities is allowed, for the deals involving a product, to which the class is applied. This preference is applicable only if the leg type that you selected is Block securities.

Parent topic: Define a Deal preference Class