- Securities User Guide

- Maintain and Process Corporate Actions

- Process Interest Coupon

- Process Interest Rate Revision Details

19.4.1 Process Interest Rate Revision Details

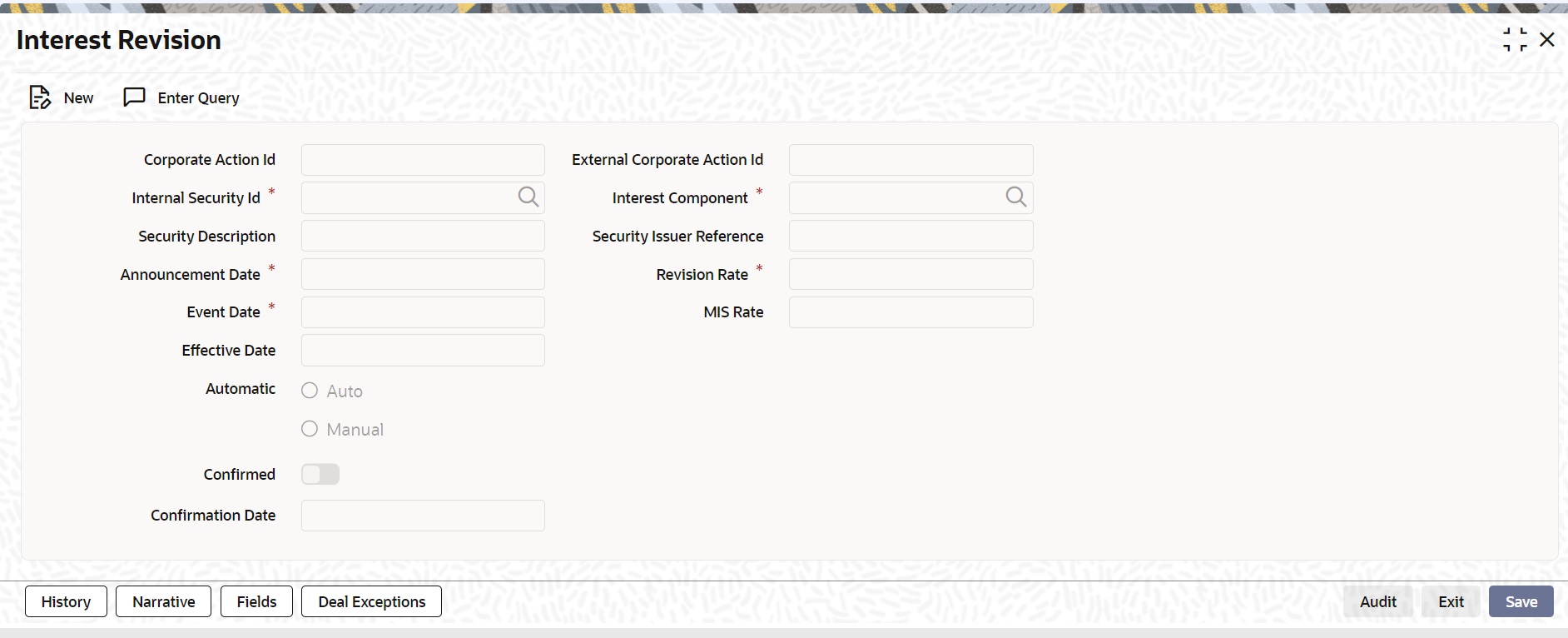

This topic describes the systematic instruction to process Interest Rate Revision Details.

You can capture the interest rate revision details for a security that has already been defined, through the Interest Revision screen. You can capture details like the date on which the interest rate was announced, the date on which the interest rate revision would be processed and the value date of rate revision.

Apart from the interest revision schedules created as part of instrument definition, you can additionally create an Ad-hoc rate revision record.

- On the Home page, specify SEDXRVND in the text box, and click next arrow.

Interest Revision screen is displayed

- On the Interest Revision screen, specify the fields.

To enter interest rate remission details, click new icon on the toolbar. If you are calling an interest revision record that has already been created, click on Summary view. From the summary screen you can choose to open an existing record. The details of the record that you have created will be displayed in a tabular form.

Note:

Interest revision screen for a security id and effective date will have two records one for positive and another for negative interest component

For a positive interest component corresponding to a corporate action id, the system to allow input of negative revision rate for a manual corporate action record.

All operations in revision screen such as new, open, close, unlock, copy, and reopen should be allowed only in the Positive Interest component record and the Negative interest component should be meant for query only.

The system supports the auto propagation of details and records the status of the positive component to negative components automatically.

Interest Revision screen does not support the manual rate revision, and hence the RFR Interest components are not fetched.

Table 19-6 Interest Revision -Field Description

Field Description Corporate Action Identification

This is the system generated ID to uniquely identify the interest revision.

External Corporate Identification

This is the Id assigned to the event at the time of event declaration. Enter the Id associated with the event to uniquely identify it.

Issuer Reference

Indicate the issuer reference for the interest rate revision event.

Announcement Date

Enter the date on which the issuer would have declared the interest revision event.

Event Date

Each Rate Revision defined is having a event date from when it will be applicable. From this date the interest revision rate will be effective.

The system supports the back-dated/current-dated rate revisions by accepting the past date/current date in this field only for the current coupon period, which was earlier only for a future date

MIS Rate

For the Securities module you only have the option of maintaining a fixed rate for MIS refinancing.

Confirmed

Check this box to indicate if the occurrence of the event is confirmed.

Confirmation Date

When you select the check-box, and save the record the confirmation date will be defaulted with the current date.

Internal Security Id

You have to indicate the code or ID of the bond type for which you are defining the interest revision rate. The Security ID or Code is picked up from the Security Definition screen. This short description of the security is for information purposes only and will not be printed on any customer correspondence.

Interest Component

Specify the component of the security for which you are defining the interest revision rate. At the time of defining a security, you can maintain different interest components for the security. The interest component(s) maintained will be reflected in the pick list available for this field.

Effective Date

Each rate that is defined for a Security ID and Interest Component combination should have an Effective Date associated with it. This is the date from which the interest revision rate will be effective. Once a rate comes into effect, it will be applicable till another Effective Date is defined for the same Security ID and interest component combination. When you save a record the effective date gets defaulted with the Event Date of Rate Revision and the confirmation date gets defaulted with the rate fixing date.

Automatic

While specifying the interest revision rate, you can indicate whether the interest revision for the particular security is to be automatic or manual. If an automatic revision is specified, then revised rates will be applied and liquidations made as part of the Beginning of Day process. Otherwise, revisions will have to be made manually by you.

Revision Rate

The revision rate that you enter here will be effective as of the Value date defined.

The system allows you to capture the back dated rate revision only for the coupons which are not collected manually/automatically.

Note:

In Interest Revision screen, changes are done not to fetch RFR Interest components as no manual rate revision is supported.

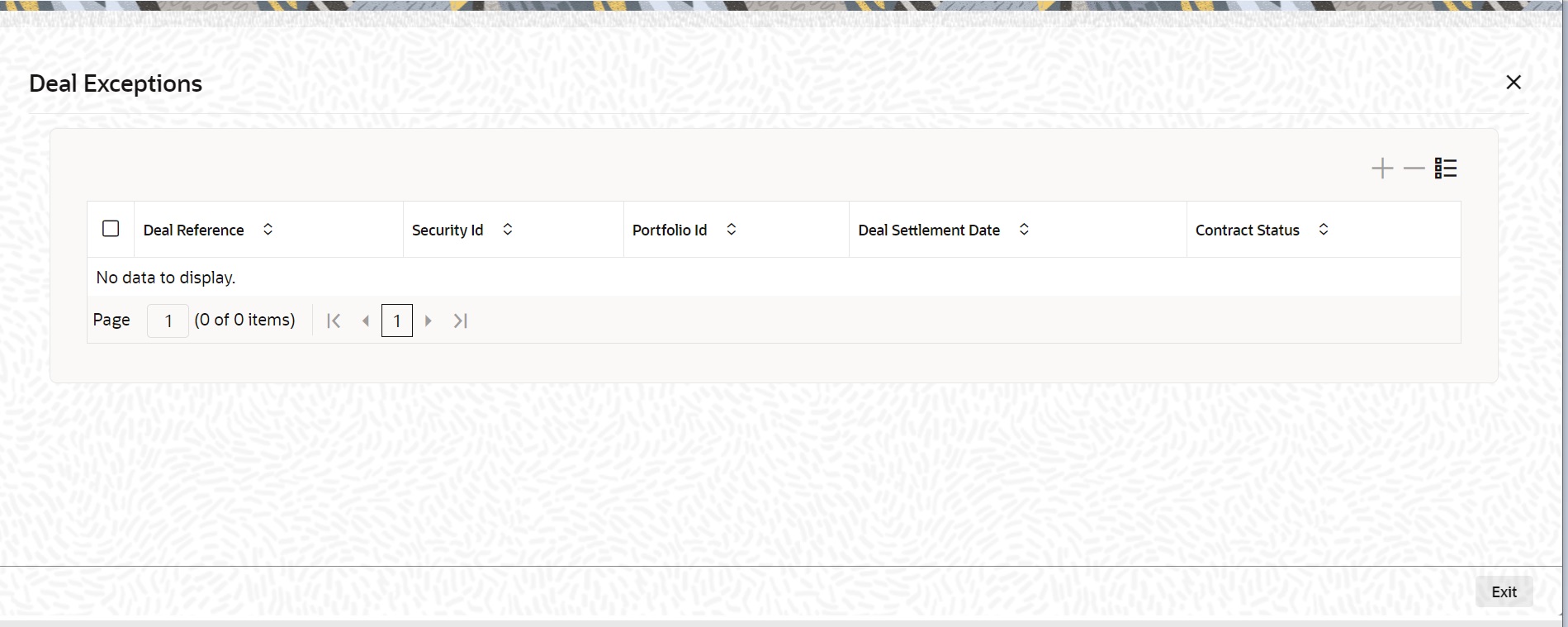

- On the Interest Revision screen, click Deal Exceptions.

Deal Exceptions screen is displayed.

- On the Deal Exceptions screen, view the following details:

For more information on these fields, refer to the below table.

Table 19-7 Deal Exceptions - Field Description

Field Field Description Deal Reference

The system displays the deal reference number which are affected by the rate revision.

Security ID

The system displays the security id.

Portfolio Id

The system displays the portfolio Id.

Deal Settlement Date

The system displays the deal settlement date.

Contract Status

The system displays the contract status.

This topic has the following sub-topics: