- Securities User Guide

- Define Attributes of a Portfolio Product

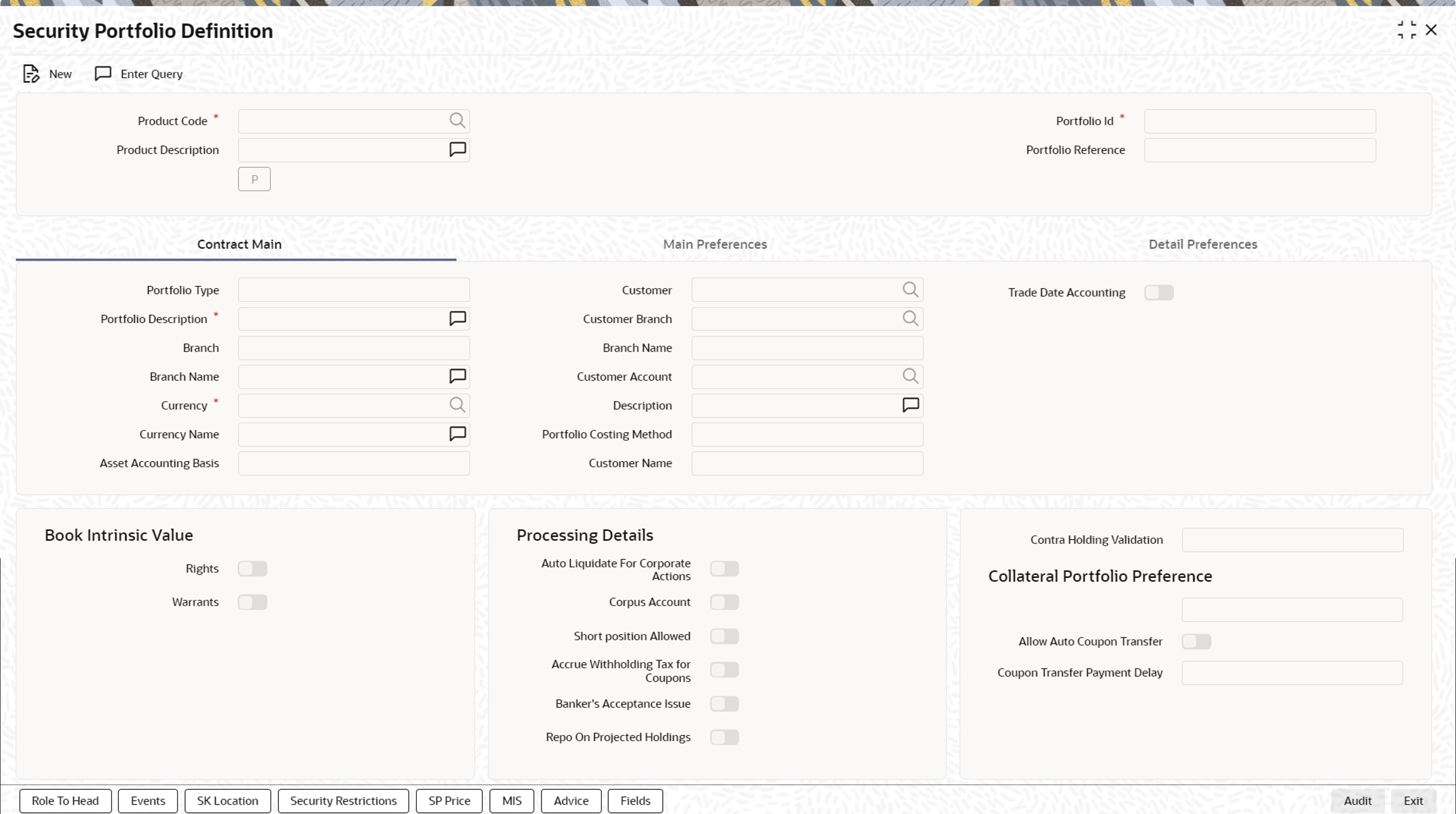

- Process Security Portfolio Process Definition

15.1 Process Security Portfolio Process Definition

This topic describes the systematic procedure to define attributes of a portfolio product.

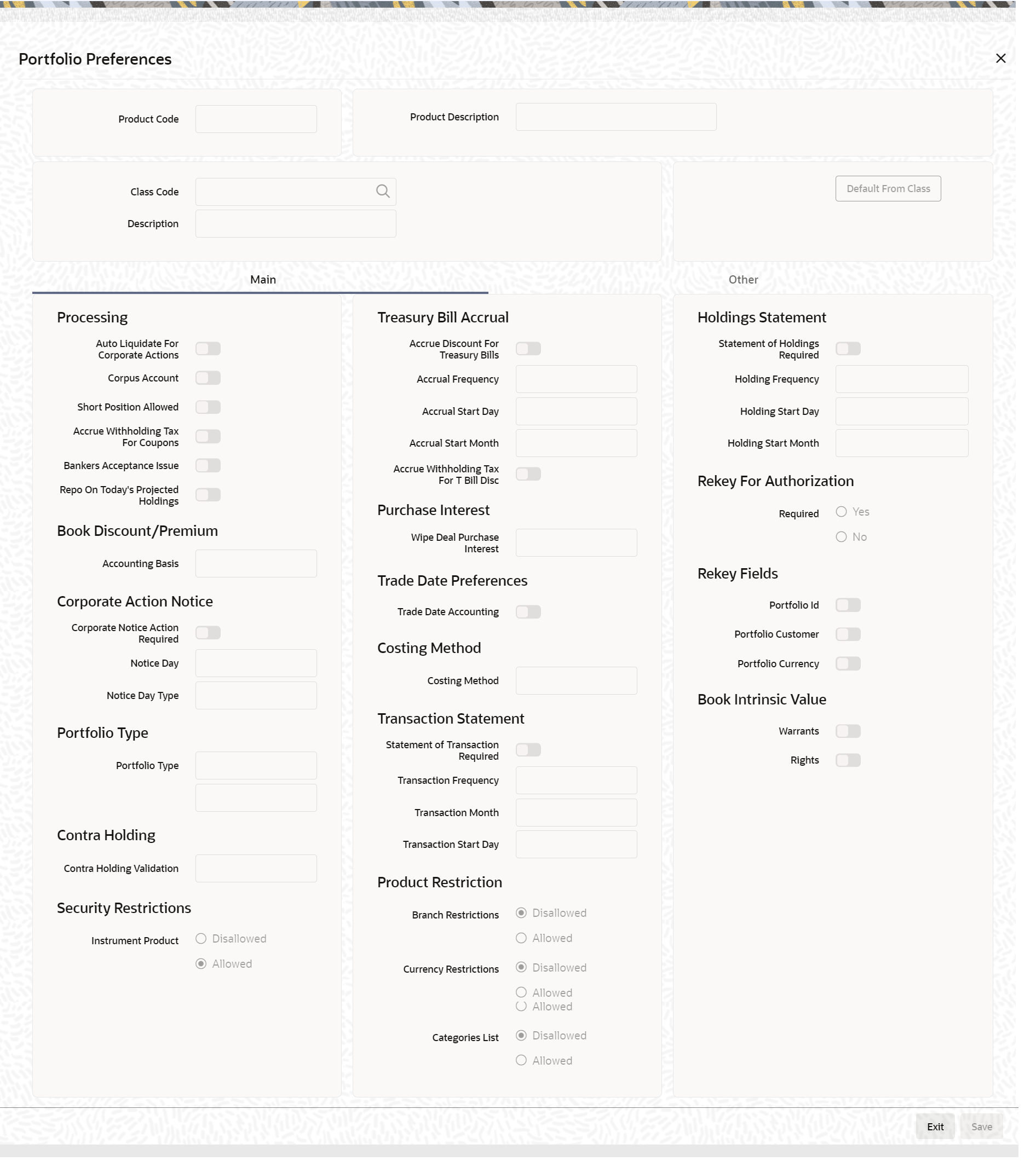

- On the Home page, specify SEDPFPRD in the text box, and click next arrow.

Securities Portfolio Product Definition screen is displayed.

Figure 15-1 Securities Portfolio Product Definition

Description of "Figure 15-1 Securities Portfolio Product Definition" - On the Security Portfolio Product Definition screen, specify the fields.

For any product you create in Oracle Banking Treasury Management, you can define generic attributes, such as interest details, tax details, etc., by clicking on the appropriate icon in the horizontal array of icons in this screen. For a Portfolio product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in this chapter. You can define the attributes specific to a Portfolio product in the SP Product Definition Main screen and the SP Product Preferences screen. In these screens, you can specify the product type and set the product preferences respectively.

For further information on the generic attributes that you can define for a product, refer the following Oracle Banking Treasury Management User Manuals under Modularity:

- Product Definition

- Interest

- Settlements

Table 15-1 Securities Portfolio Product Definition - Field Description

Field Description Product type

The first attribute that you define for a portfolio product is its type. You can broadly classify portfolio products into three types:

- Customer Portfolio

- Bank Portfolio

- Issuer Portfolio

- Collateral Portfolio

If the bank issues securities (e.g., Central Bank issuing government bonds), it can maintain a portfolio for the securities it issues. This is an Issuer Portfolio. Under each product type, you can create any number of products.

Note:

Bank can create a Collateral Portfolio to hold security (pledged and received) as a part of Repo or a Reverse Repo transaction. Also, All Bank Portfolio Validations are applicable to Collateral portfolio.

Exchange Rate Variance

For a special customer, or in special cases, you may want to use an exchange rate (a special rate) that is greater than the exchange rate maintained for a currency pair.

The variance is referred to as the Exchange Rate Variance. When creating a product, you can express an Exchange Rate Variance Limit in terms of a percentage. This variance limit would apply to all portfolios associated with the portfolio product.

Override Limit

If the variance between the default rate and the rate input varies by a percentage that is between the Override Limit and the Rate Stop Limit, you can save the transaction (involving the portfolio) by providing an override.

Stop Limit

If the variance between the default rate and the rate input varies by a percentage greater than or equal to the Rate Stop Limit, you cannot save the transaction involving the portfolio.

- On the Securities Portfolio Product Definition screen, click preference.

Product Preference screen is displayed.

- On the Product Preference screen, specify the fields.

Preferences are the options that are available to you for defining the attributes of a product. The following are examples of portfolio preferences.

- The Preferred Costing Method (Weighted Average, Deal Matching, FIFO, FILO)

- The Revaluation details (Basis, LOCOM Basis, Method, Frequency, and Start Date)

- The Forward Profit and Loss Accrual details

- The Premium/Discount Accrual details

- The Redemption Premium Accrual details

- Corporate Action Notice details

All portfolios maintained under a portfolio product will inherit the preferences that you define for the product.

Accrual Method

- 30(Euro)/360

- 30(US)/360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/364

- 30(US)/364

- Actual/364

Note:

The values of the accrual method maintained in this screen get defaulted in portfolio creation for the selected product.

Table 15-2 Field Description

Field Description Trade Date Accounting

Check this box to indicate that the accounting events for Securities position movement (SPLP, SSLP, SPSP or SSSP) should be triggered on the trade date itself for the portfolios defined using the product.

Branch Restrictions

Indicate whether you want to create a list of allowed branches or disallowed branches by choosing one of the following options:

- Disallowed

- Allowed

Categories List

Indicate whether you want to create a list of allowed customers or disallowed customers by choosing one of the following options:

- Disallowed

- Allowed

Currency Restrictions

Indicate whether you want to create a list of allowed currencies or disallowed currencies by selecting one of the following options:

- Disallowed

- Allowed

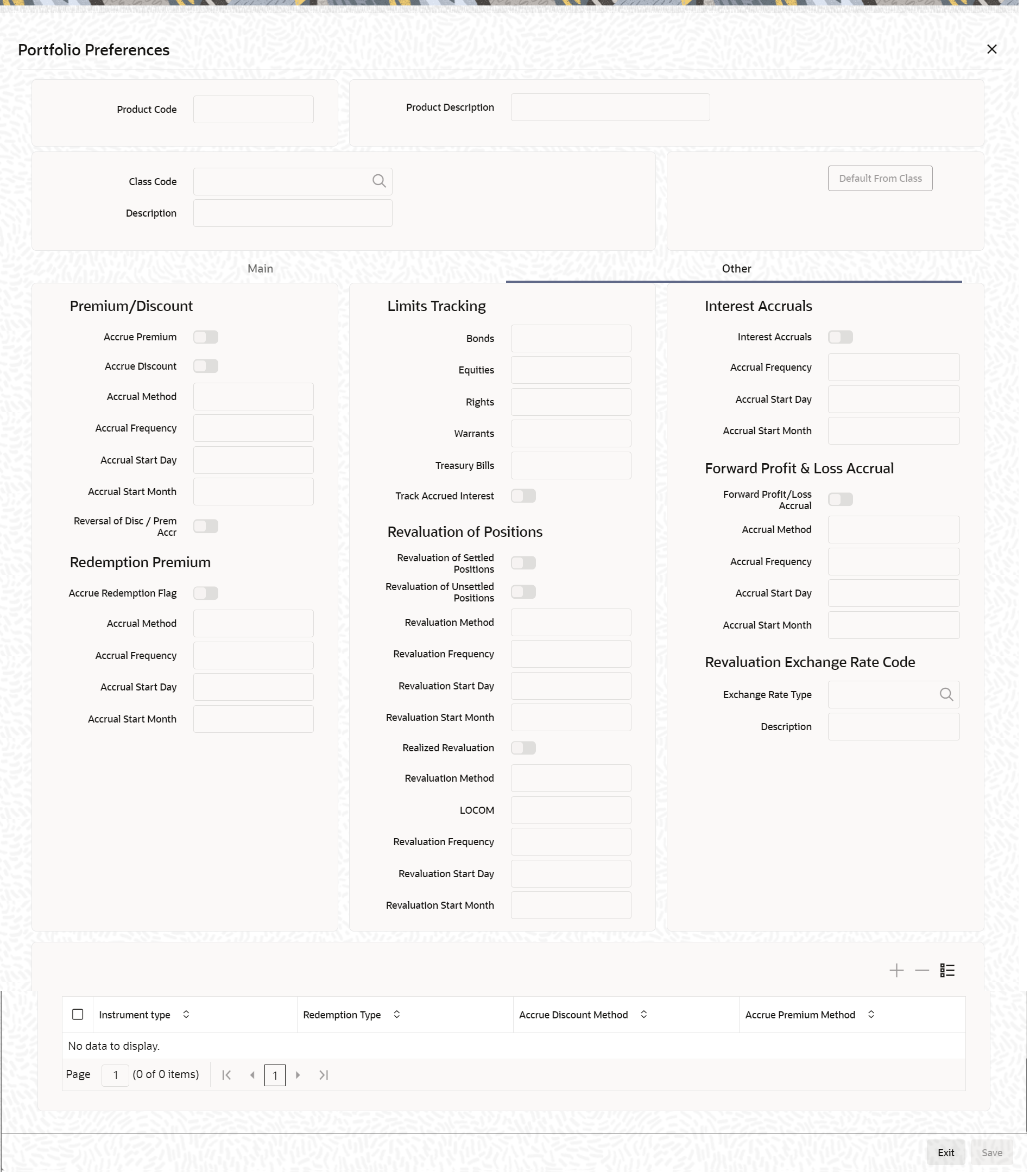

- On the Portfolio Preference screen, click Other.

Portfolio Preference screen is displayed.

- On the Portfolio Preference screen, specify the fields.

Table 15-3 Field Description

Field Description Accrue Discount Method Specify the accrue discount method. If you select the redemption type as bullet, then the system will allow you to select the discount method as constant yield /exponential / straight line/ weighted moving average. However, for any other type of redemption, you can select only the type as constant yield.

Accrue Premium Method Specify the accrue premium method. If you select the redemption type as bullet, then the system will allow you to select the discount method as constant yield /exponential / straight line/ weighted moving average. However, for any other type of redemption, you can select only the type as constant yield.

Reversal of Disc/Prem Accr Check this box to indicate that the premium or discount that has been accrued using the ‘Weighted Moving Average’ method should be reversed. If this is checked, the amortization accrual done using the ‘Weighted Moving Average’ method is reversed on the following BOD. During EOY, discount/premium accrual will be realized, that is, accrual will not be reversed as part of the same EOD/BOD batch (SEAUTDLY). This value is defaulted from the portfolio class level to the portfolio product level, where you can amend it. From the portfolio product level, it is defaulted to the portfolio definition level. Here too, you can amend it. The value at the portfolio definition level is considered as the final value and the reversal is determined by it.

When defining a portfolio product, you can choose to specify preferences for the product, either by

- Associating the product with a Portfolio Preference Class that you have defined

- Entering your preferences specifically for the portfolio product

If you would like to associate a portfolio preference class to a product, choose the ‘Default From Class’ button in the Portfolio Product Preferences screen. A list of the Portfolio Preference Classes that you have maintained will be displayed. Choose the preference class that is applicable to the product that you are creating.

For detailed information on each of the attributes, please refer to the chapter called Maintaining a Portfolio Preference Class of this User Manual.

Parent topic: Define Attributes of a Portfolio Product