- Securities User Guide

- Define Portfolio

- Specify Advice to be Generated

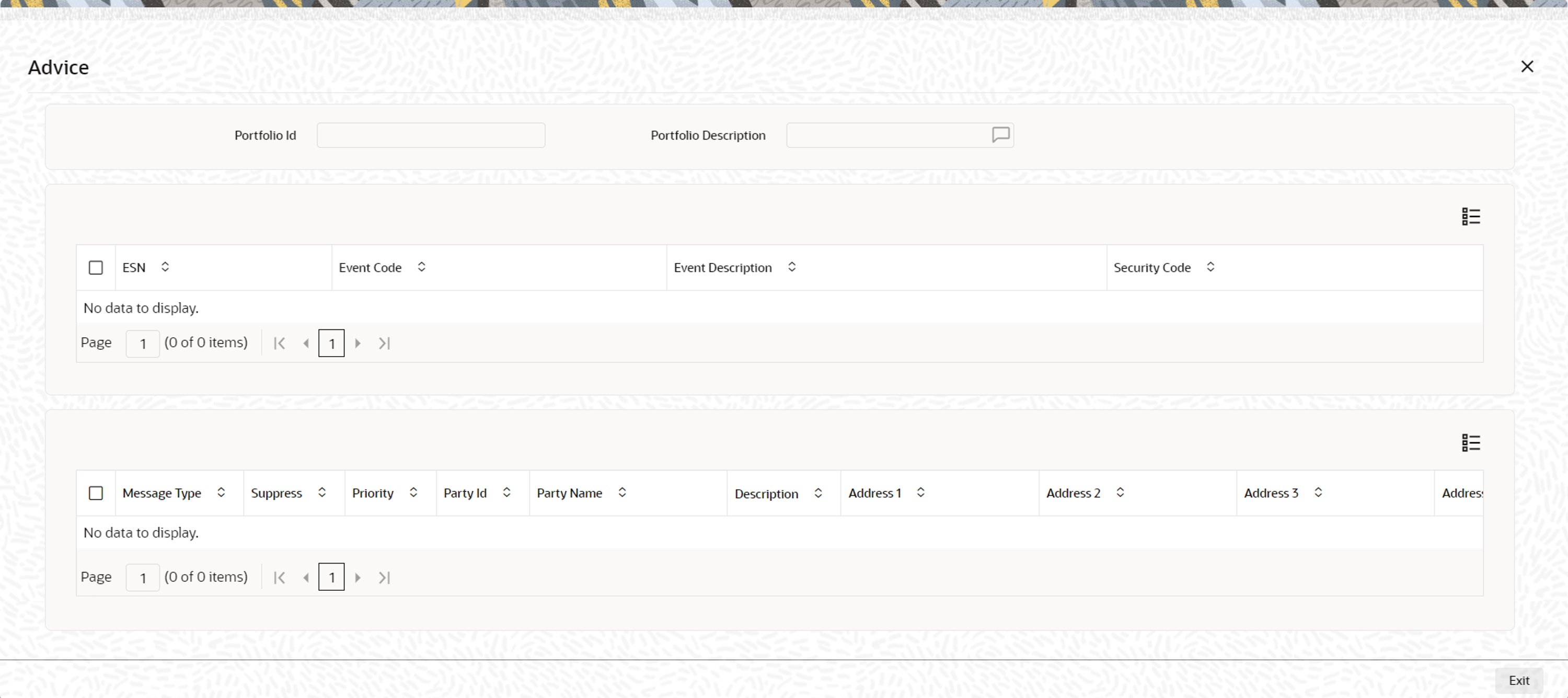

20.4 Specify Advice to be Generated

This topic describes the systematic procedure to specify advice to be generated.

The advices that can be generated, for the events that occur during the life cycle of securities in a portfolio, are defined for the product to which the portfolio is associated.

- On the Portfolio Definition screen, click Advices.

Advices screen is displayed.

Highlight an event, to view the advices associated with it. The address, to which an advice should be delivered, is picked up by default, based on the media and address maintained for the party. The party type to whom an advice should be sent is also picked up automatically, based on the type of portfolio you are entering and the parties involved.

Suppressing the generation of an advice

By default, all advices defined for a product will be generated for the portfolios to which it is associated. If any of the advices are not applicable to the portfolio being created you can suppress its generation.

Priority

For a payment message by SWIFT, you have the option to change the priority with which a message should be delivered. By default, the priority of an advice is marked as Normal. You have the option to priorities a payment message to one of the following options:

- Normal

- Medium

- High

After selecting the advices to be generated for the portfolio, click add icon to save the entries that you made. Click delete icon to reject the entries that you have made. In either case, you will be returned to the Portfolio Definition screen.

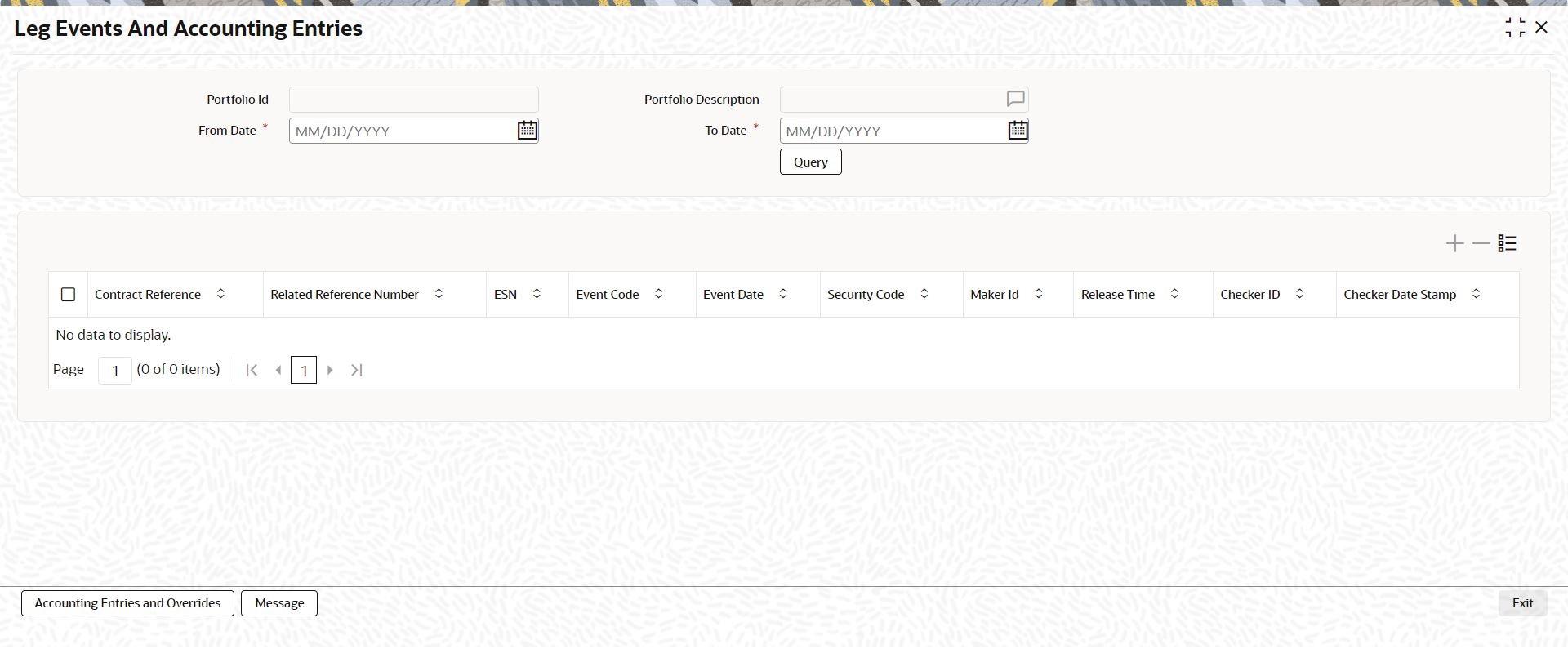

- On the Portfolio Definition screen, click Events.

Leg Events, Accounting Entries & Overrides screen is displayed.

Figure 20-7 Leg Events Accounting Entries Overrides

Description of "Figure 20-7 Leg Events Accounting Entries Overrides"Accounting entry details

Highlight the event to view its accounting entries. All the accounting entries that were passed and the overrides that were encountered for the event will be displayed. The following information is displayed for each accounting entry:

- Branch

- Account

- Dr/Cr indicator

- The amount tag

- The date on which the entry was booked

- Value Date

- The deal currency

- Amount in deal currency

- The foreign currency equivalent (if applicable)

- The exchange rate that was used for the conversion

- Amount in local currency

- All the overrides that were encountered for the event will also be displayed

Click the Exit button to exit the screen. You will be returned to the Application Browser.

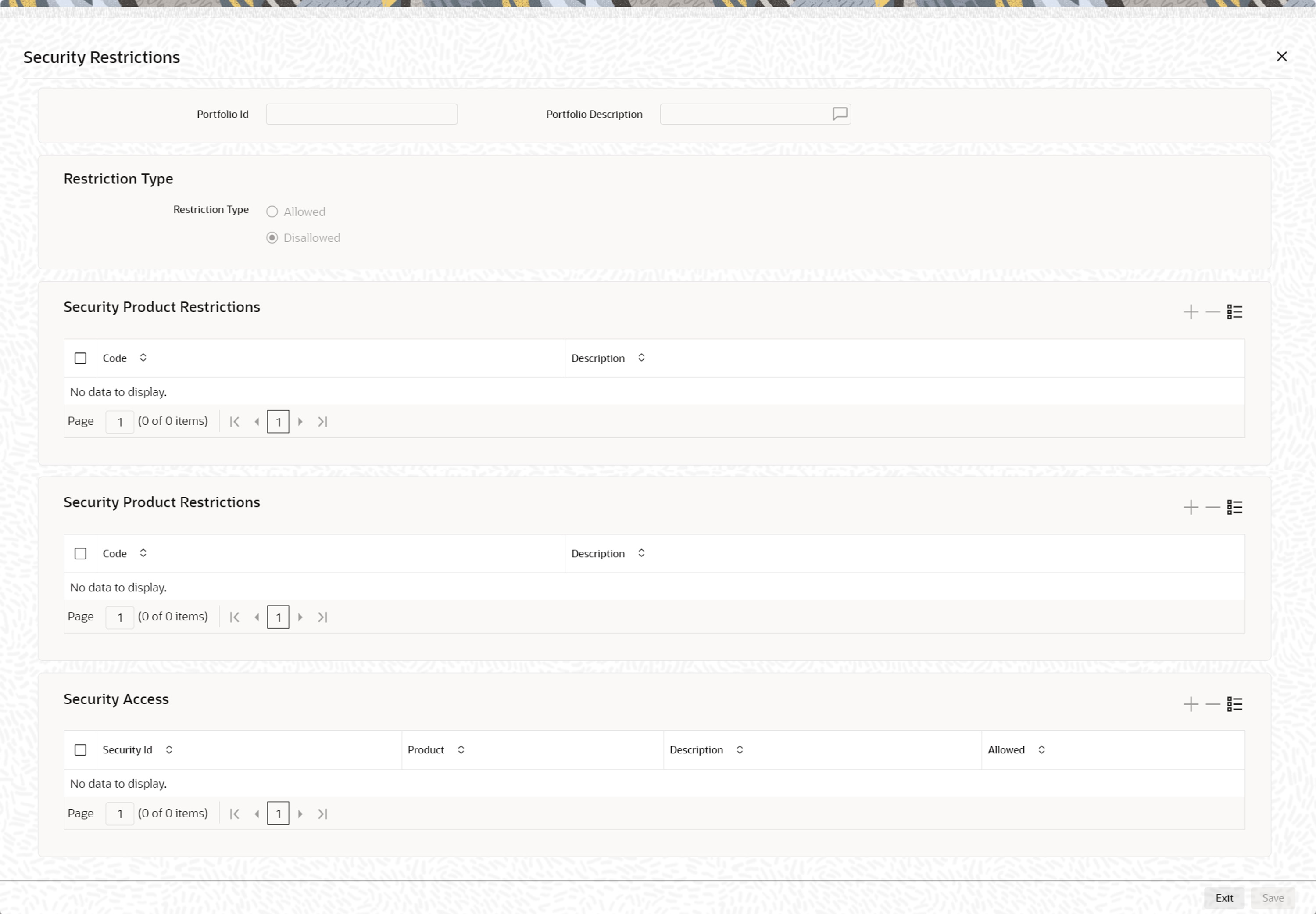

- On the Portfolio Definition screen, click Security Restriction.

Security Restrictions screen is displayed.

- On the Security Restriction screen, specify the fields.

From the head office of your bank, you can establish certain controls over the securities that a portfolio can trade in. These controls are achieved by specifying restrictions. The security restrictions maintained for the portfolio product associated with a portfolio will by default apply. You can use the defaulted restrictions or define security restrictions for a portfolio.

Table 20-7 Security Restriction - Field Description

Field Description Restriction Type

Specify security restrictions in the form of an allowed or disallowed list. You can indicate whether you are maintaining an allowed or a disallowed list type by choosing the appropriate option under the field Restriction type.

When you set up security restrictions, the securities that do not figure in the allowed list cannot be traded with. If you have maintained a disallowed list, securities that do not figure in it can be involved in deals linked to the product.

Allowed/Disallowed

Under Security Restriction, you will see a column displayed.

- An Allowed or Disallowed list (depending on the restriction type you are maintaining).

Exempting specific securities from an allowed or disallowed list

You can exempt specific securities, from the restriction specified for the product to which they belong. Click the add icon and select a security code from the pick-list. You can choose to Allow or Disallow the security that you have selected by choosing the appropriate option under Restriction Type. Click the delete icon to remove security from the list. For example, suppose that you have maintained the following security products in Oracle Banking Treasury Management: Table 21.7: Product

You are maintaining security restrictions for a portfolio. You have indicated the restriction type as Allowed. For this portfolio, you have moved the Security product SECA to the allowed list. This in effect means that you have, Allowed SECA for the portfolio. Disallowed SECB for the portfolio. You want to disallow security EQ 3 and allow security BD 1. In Oracle Banking Treasury Management this is achieved thus: Follow the same procedure for the security ID, BD1 and indicate that it is allowed for the portfolio. Thus you have allowed the securities EQ 1, EQ 2, and BD 1 for the portfolio.

Confirming your specifications

After you have defined restrictions, click Exit to delete your specifications. You will be returned to the Portfolio Definition screen.

Table 20-8 Product

Product Code Products linked to it SECA

EQ 1

EQ 2

EQ 3

SECB

BD1

BD2

BD3

You are maintaining security restrictions for a portfolio. You have indicated the restriction type as Allowed. For this portfolio, you have moved the Security product SECA to the allowed list. This in effect means that you have, Allowed SECA for the portfolio. Disallowed SECB for the portfolio. You want to disallow security EQ 3 and allow security BD 1. In Oracle Banking Treasury Management this is achieved thus: Follow the same procedure for the security ID, BD1 and indicate that it is allowed for the portfolio. Thus you have allowed the securities EQ 1, EQ 2, and BD 1 for the portfolio.

Parent topic: Define Portfolio