18.3 Specify the Yield Calculation Parameters for a Security

This topic describes the yield calculation parameters for a security.

For each Security, the Yield Calculation Parameters are defaulted from the market of an issue depending on whether it is a Bond or a T-Bill. You will be allowed to modify these details for a specific Security. Click the Yield button in the Security Definition screen. The Yield Calculation Parameters screen is displayed.

Table 18-7 Yield Calculation Parameters - Field Description

| Field | Description |

|---|---|

|

Specifying YTM method for T-Bills |

The basis for YTM calculation for T-Bills can either be:

If you enable the Use Bond Formula option, YTM is calculated using the effective interest formula (typically used for bonds). For Bonds and T-Bills with the effective interest method of YTM calculation, you need to specify the following details: |

|

Reinvestment Period Days |

The effective interest formula assumes that coupon payments are reinvested at the same rate as the yield of the T-Bill/Bond till the maturity of the security. You have to specify this period in terms of days. |

|

Annualizing Method |

For Bonds and for T-Bills with effective interest you need to specify the annualizing method. This is the method by which the System computes the periodic YTM from the deal YTM, which is annualized. The options available are:

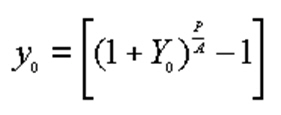

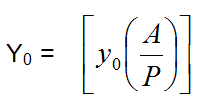

If the Annualizing method is Compound, the relationship between the periodic YTM and the deal YTM is computed as follows:  If the Annualizing method is Simple, it is computed as follows:  Where

Apart from these details you need to specify the Day Count Denominator and Numerator methods for all Bonds and T-Bills. |

|

Day Count Method Numerator |

Indicate the day count numerator, which is to be used to arrive at the number of days for yield calculation. The options available are:

|

|

Day Count Method Denominator |

Select the day count method to be used while calculating yield from the adjoining drop-down list. This list displays the following values:

Note: Values of Day Count Method Denominator maintained in ‘Yield Calculation Parameters’ screen is used in Yield calculation of T-Bills and Bonds. |

|

Premium/Discount for Current Interest Period |

Check this option to specify that the premium or discount should be accrued only for the current period. This option will be applicable only if the security is a Floating Rate Bond. Note: This option will be disabled if the bank level parameter COMMON_YLD_ACCR is set to ‘Y’. Asynchronous revision cannot be enabled if the Premium/Discount for Current Interest Period is checked and vice versa. |