1.3 Price of Repo

This topic describes the price of repo feature.

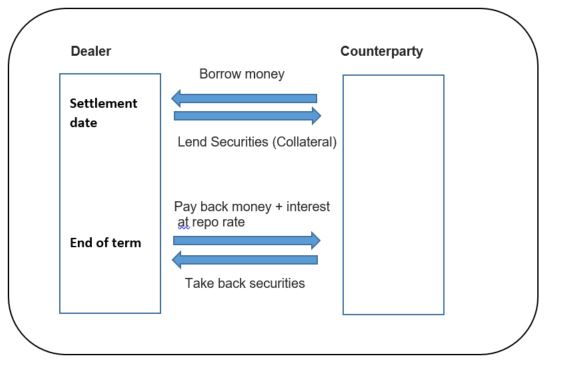

The repurchase price is simply the purchase price plus the repo interest where the purchase price is the cash paid by the cash lender, including any accrued interest. The user had to consider if there is a haircut or initial margin involved.

The repurchase price is simply:

Repo Price = Purchase Price + Repo Interest

* Purchase Price = Nominal Price * Dirty Price

* Repo Interest = (Repo rate for the days based on day count convention)

Repo interest is calculated on the purchase price

For Example:

Nominal Value: £5'000

Dirty Price: 1.5

Repo Rate: 1%

There is no initial margin/haircut, hence the purchase price is simply the full cash market value of the bond:

Purchase Price = £7'500 (=5000*1.5)

Repo Interest = £75 (£7'500*0.01)

Repo Price = £7'575 (= £7'500+£75)

The counterparty earns interest on the transaction in the form of the higher price of selling the securities back to the dealer. The counterparty also gets the temporary use of the securities.

The repo market is pivotal to the efficient working of almost all financial markets. Its importance reflects the wide range and fundamental nature of repos’ applications:

- Providing an efficient source of short-term funding

- Providing a more resilient money market

- Providing a secure and flexible home for short-term investment

- Facilitating central bank operations

- Financing leveraged investors and covering short investors

- Hedging primary debt issuance

- Supporting corporate bond investors

- Ensuring liquidity in the secondary debt-market

Parent topic: Introduction to Repo