4.7.1 Margin Details

User can default and view the margin preferences applicable for the Agreement, Portfolio or a specific Contract selected for which collateral is assigned.

- Displays the Collateral preferences defined for the Agreement, If Agreement is selected.

- Displays the Collateral preferences defined for the applicable Portfolio or Product, If Portfolio is selected.

- Displays the Collateral preferences defined for the contract, If Contract is selected.

- Displays the preferences from the linked agreement, if the contract uses Collateral Agreement

- If the preference for calculation type is ‘Internal’, can view the details about the margin calculated by Oracle Banking Treasury Management

- If the preference for calculation type is ‘External’, calculation fields value are not displayed

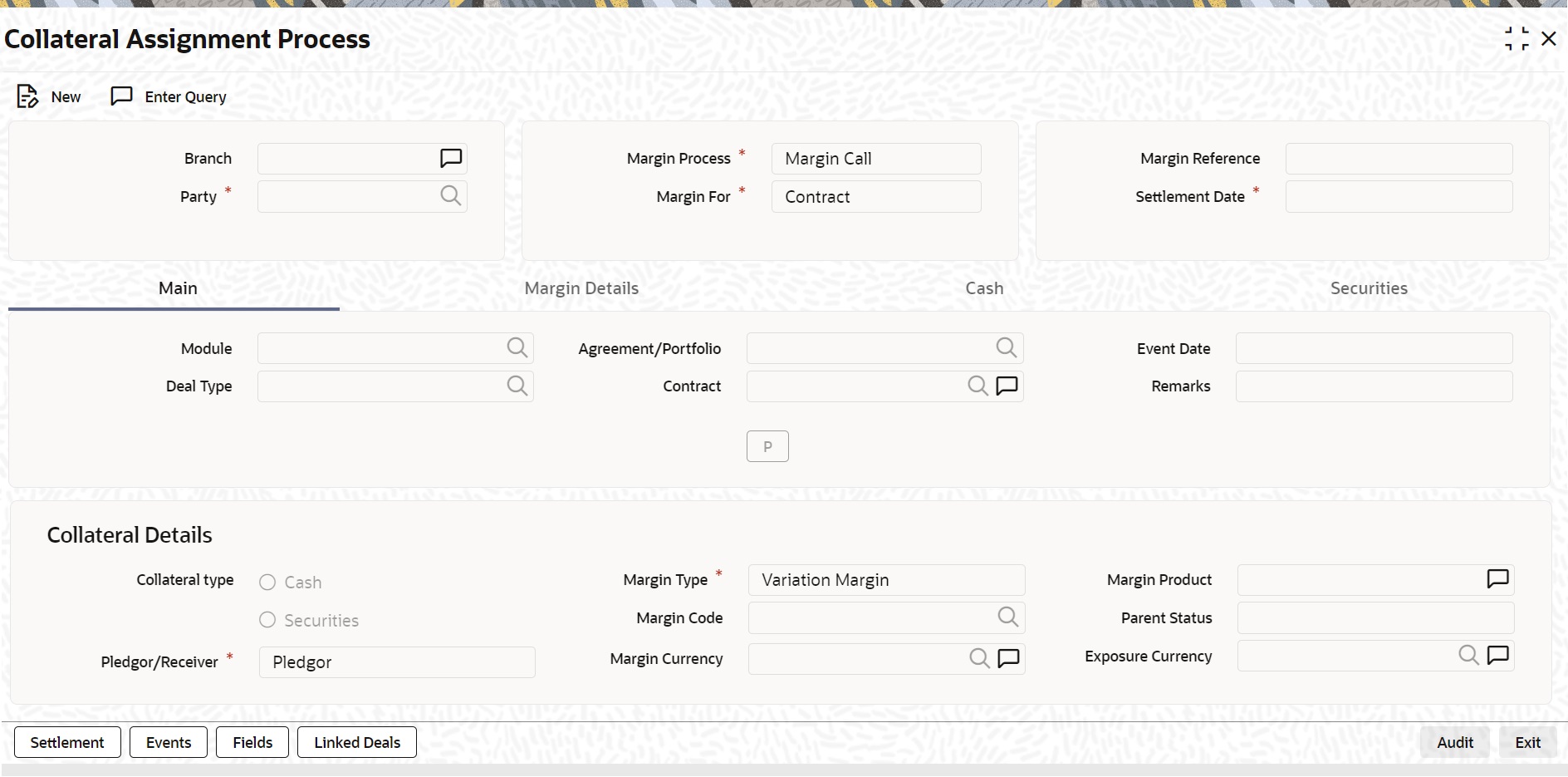

Click the Margin Details tab of the Collateral Assignment Process (SRDMRONL) function to open this screen.

Figure 4-2 Collateral Assignment Process – Margin Details

The following table describes the fields captured for processing securities margin for an agreement or contract.

* indicates mandatory fields.

Table 4-3 Collateral Assignment Process – Margin Details

| Field | Description |

|---|---|

|

Calculation Preferences |

Group of fields to display the margin calculation preferences applicable for the Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Calculation Setup |

Displays the margin calculation setup to be used, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Calculation Level |

Displays the level at which the exposure would be aggregated for margin calculation purposes for the Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Calculation Type |

Displays where the margin required is calculated for the Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Source |

Displays the system from which the collateral assignment is initiated. |

|

Calculation Method |

Displays the method that is used for calculating margin required for the Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Exposure Type |

Displays the amount to be considered as exposure for calculating margin required for the Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Offsetting Allowed |

Displays whether exposure booked in opposite directions within the same group can be offset, to arrive at the net exposure for margin calculation purposes for the Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Margin Calculation |

Group of fields to display the calculated margin required as on the Event Date for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type. |

|

Margin Currency |

Displays the currency in which the margin required is calculated for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Margin Required |

Displays the calculated Margin Required in Margin currency for the exposure determined as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Margin Available |

Displays the Margin already transferred and available in Margin Currency equivalent as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Excess |

Displays the additional Margin already available in excess of the Margin required as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type. |

|

Shortfall |

Displays the additional Margin to be transferred to meet the net Margin required as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type. |

|

Cash Margin Adjustment |

Group of fields to display the cash margin allowed based on the calculated margin required as on the Event Date for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type. |

|

Cash Margin Allowed |

Indicates whether collateral can be provided in Cash or Deposits, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Cash Margin Balance |

Displays the Cash Margin already transferred and available as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Minimum Cash % |

Displays the Minimum Cash % configured for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Minimum Cash |

Displays the Minimum Cash Margin required based on the total margin required as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Maximum Cash |

Displays the Maximum Cash Margin allowed based on the total margin required as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Security Margin Adjustment |

Group of fields to display the securities collateral allowed based on the calculated margin required as on the Event Date for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type. |

|

Securities Collateral Allowed |

Indicates whether collateral can be provided in Securities, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Securities Collateral Value |

Displays the value of Securities Collateral already transferred and available as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Minimum Securities % |

Displays the Minimum Securities % configured for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Minimum Security |

Displays the Minimum Securities Collateral required based on the total margin required as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Maximum Security |

Displays the Maximum Securities Collateral allowed based on the total margin required as of the Event Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

On click of the Default button, system automatically calculates and displays the margin details applicable for the collateral assignment transaction.

Parent topic: Main Criteria