1 Overview of Collateral Margining and Settlement Netting

This chapter explains the Collateral-Netting process flows that need to be maintained in Oracle Banking Treasury Management application.

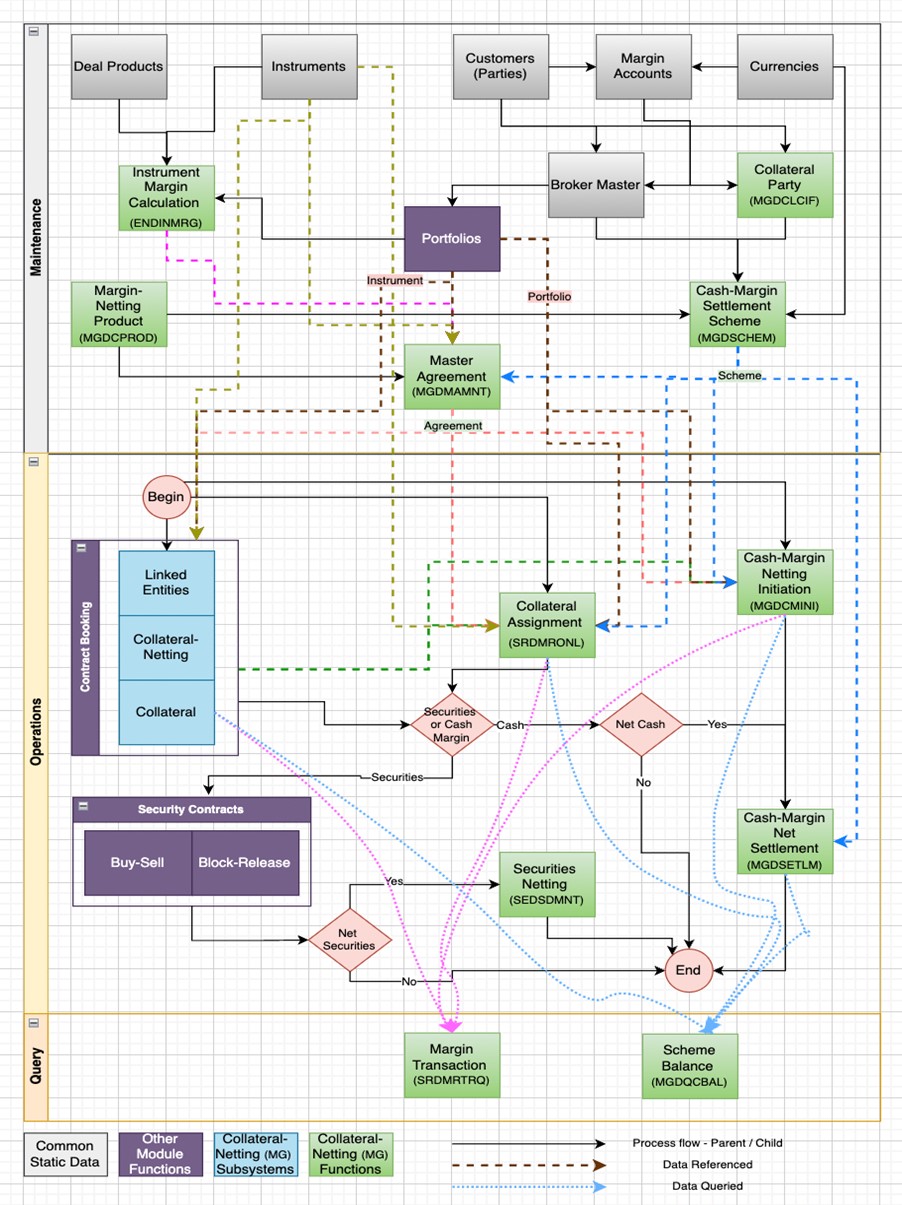

Figure 1-1 Collateral-Netting Process Flow

Table 1-1 Functions and Processes

| Function / Process | Description |

|---|---|

|

Maintenance: |

Following are the description for Maintenance function/ process. |

|

Collateral Party (MGDCLCIF) |

Any treasury customer can be configured as a collateral party using ‘Collateral Party Maintenance’ function. These preferences defined for the customer are used for collateral margining for the transactions booked with this customer as collateral party. The details that can be captured for Collateral Party include,

|

|

Instrument Margin Calculation Setup (ENDINMRG) |

Margin calculation setup can be defined for a Module, product or an instrument using ‘Instrument Margin Calculation Maintenance’ function. These preferences are used for the applicable transactions for calculating margin required for different margin types allowed. The details that can be captured for Margin Calculation Setup include,

|

|

Margin-Netting Product (MGDCPROD) |

Products can be defined with default preferences for Collateral Margining and Settlement Netting using ‘Margin-Netting Product Maintenance’ function. The advantage of defining a margin-netting product is that it allows to create a broad framework for margining and netting processes followed by the bank. These preferences defined for a product are applied by default on all settlement schemes and master agreements linked to the product. The details that can be captured for Margin-Netting Product include,

|

|

Cash-Margin Settlement Scheme (MGDSCHEM) |

Cash Settlement Schemes can be defined with default preferences for Cash Collateral Margining and Cash Settlement Netting using ‘Cash-Margin Settlement Scheme Maintenance’ function. These preferences defined for a scheme are applied by default on all cash settlements using this scheme. The details that can be captured for Cash-Margin Settlement Scheme include,

|

|

Master Agreement (MGDMAMNT) |

Master Agreements can be defined with default preferences for Collateral Margining and Settlement Netting using ‘Treasury Master Agreement Maintenance’ function. These preferences defined for a master agreement are applied by default on all transactions linked to the same agreement. The advantage of defining a master agreement is that it allows to create a broad framework for margining and netting for all transactions with a counterparty. The details that can be captured for Master Agreements include,

|

|

Operations: |

Following are the description for Operation function/ process. |

|

Linked Entities (Contract subsystem) |

While capturing the details for a contract, user can select any number of customers as Linked Entities for the contract. These are the parties that play different roles during the life cycle processing of the contract. These parties can be,

|

|

Collateral-Netting (Contract subsystem) |

While capturing the details for a contract, user can additionally capture the preferences for Collateral Margining and/or Settlement Netting, if applicable for the contract. These preferences can be captured individually for the contract if there are no existing agreements with the parties and the preferences are negotiated at the time of booking. Otherwise, agreements applicable for the contract are selected and only specific preferences were captured as override at the contract level. The details that can be captured for Collateral-Netting include,

|

|

Collateral Assignment (SRDMRONL) |

Collateral Margin transfer can be performed using ‘Collateral Assignment Process’ function, available specifically for transferring different types of Collateral as margin for different purposes for positions on different types of instruments. Both Cash and Securities can be transferred as collateral using this function. Collateral can be assigned for,

The details that can be captured for Collateral Assignment Process include,

|

User can view the details for,

|

|

|

Cash-Margin Netting Initiation (MGDCMINI) |

Net settlement of Cash components can be initiated by performing pre-netting for all transactions linked to an Agreement or Portfolio, using ‘Cash-Margin Netting Initiation’ function. All uninitiated cash margin transfers and unsettled deal cashflows of the contracts linked to the same Agreement or Portfolio are eligible for pre-netting can be netted based on the applicable preferences configured for the respective Agreement or Portfolio. Pre-netting operations can be initiated for,

The details that can be captured for Cash-Margin Netting Initiation include,

|

|

User can view the details for,

|

|

|

Cash-Margin Net Settlement (MGDSETLM) |

Net settlement of Cash components can be performed using ‘Cash-Margin Net Settlement’ function. All cashflows that are marked for netting, including cash margin transfers, can be settled together for the net amount.

The details that can be captured for Cash Net Settlement include,

User can view the details for,

|

|

Securities Netting (SEDSDMNT) |

Net settlement of Securities can be performed using ‘Securities Netting’ function. All security contracts that are marked for netting, including security contracts created for margin transfers, can be settled together for the net quantity. The details that can be captured for Securities Netting include,

|

|

Queries: |

Following are the description for Queries function/ process. |

|

Margin Transaction Query (SRDMRTRQ) |

All margin transactions that are authorized, including cash and securities margin transfers can be queried and viewed, using ‘Margin Transaction Query’ function. The filters that can be captured for querying margin transactions include,

User can view the details for,

|

|

Settlement Scheme Balance Query (MGDQCBAL) |

Net amount of cash that need to be settled for the selected settlement scheme can be queried and viewed, using ‘Settlement Scheme Balance Query’ function. User can view the details for,

|