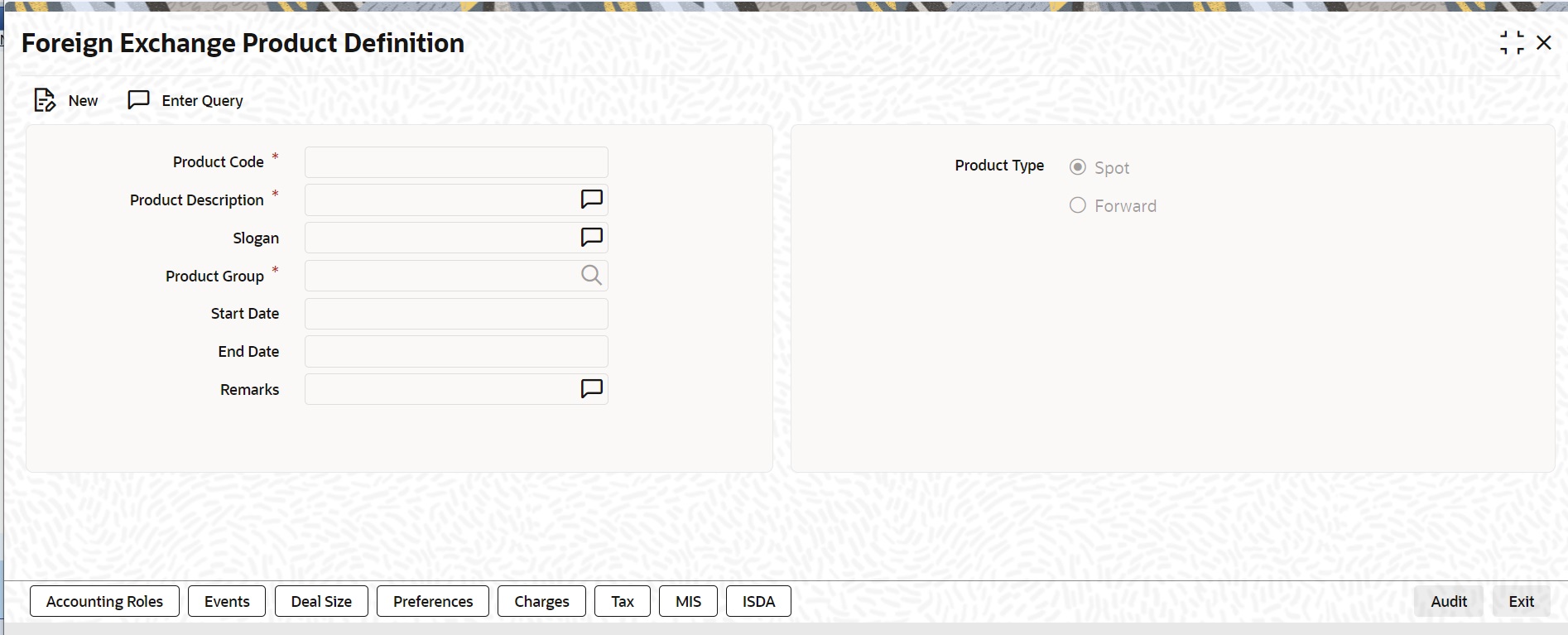

| Product Code |

A product code identifies a product throughout Oracle Banking Treasury Management. This code should be four characters in length.

When defining a new product, you should enter a code that is unique across the different modules of Oracle Banking Treasury Management. For instance, if you have used MM01 for a product in the Money Market module, you cannot use it as a product code in any other module.

|

| Product Description |

In the Description field, therefore, suitably describe the product code so that it can be easily identified. This description will be displayed along with the code throughout Oracle Banking Treasury Management.

Otherwise, it may be difficult to recognize a product just by its code.

|

| Product Type |

Product categories are referred to as ‘product types.’ When you create a product, you must specify the ‘type’ to which it belongs. For instance, you should specify the money market product type as ‘Placement’ if you are defining a placement product, and ‘Borrowing’ if you are defining a borrowing product. Similarly, in the Teller module, if you are setting up a Cash product, choose the ‘Cash’ option in the Product Type field. If you are setting up a product to process Traveller’s Checks, choose the ‘Others’ option in the Product Type field.

|

| Product Group |

Products can be categorized into groups based on the common elements that they share. You must associate a product with a group. This would facilitate retrieval of information of a class of products at one stroke.

For example, you can group all products involving travelers’ checks into a product group. You can group all products involving deposits into a product group.

|

| Slogan |

You can enter a marketing punch line for every product you create. This slogan will be printed on all advices that are sent to customers who avail of the product. For example, if you set up a borrowings product called Money Multiplier, you could enter the slogan ‘Watch your money grow with Money Multiplier.’

|

| Start Date and End Date |

A product can be defined to be active over a specific period. When you create a product, you can specify a ‘Start Date’ and ‘End Date’ for it. The product can only be used within the specified period (i.e. within the Start Date and End Date).

If you do not specify the Start Date, the branch date will be displayed as the Start Date.

If you do not specify an End Date for a product, it can be used for an indefinite period.

The start and end dates of a product come in handy when you are defining a product that you would like to offer over a specific period. For example, you have a promotional scheme for three months - ‘Special Interest Rate for Savings Bank Accounts’ - wherein you would like to pay higher interest on monthly minimum credit balances that exceed USD 20,000. This scheme is open between 1 October 1998 and 31 December 1998, and the rate of interest that you would like to pay on the balance is 5% - more than what you normally pay, that is, 2.5%.

Since the scheme ends on 31 December 1998, all those who have maintained monthly minimum credit balances exceeding USD 20,000 (for the period between 1 October 1998 and 31 December 1998) would be eligible for the higher rate of interest.

Note: If you do not specify an End Date, the product can be used till it is closed.

|

| Remarks |

When creating a product, you can enter information about the product intended for your bank’s internal reference. This information will not be printed on any correspondence with the customer.

|