1.8.2 Define Securities and Derivative Taxation Schemes

A contract that you enter into could consist of one or more tax components (a Stock Exchange tax, a Local tax, etc.). You can define each of these components as a tax class, and associate each with a tax rule. A tax rule identifies the method in which a tax component is calculated.

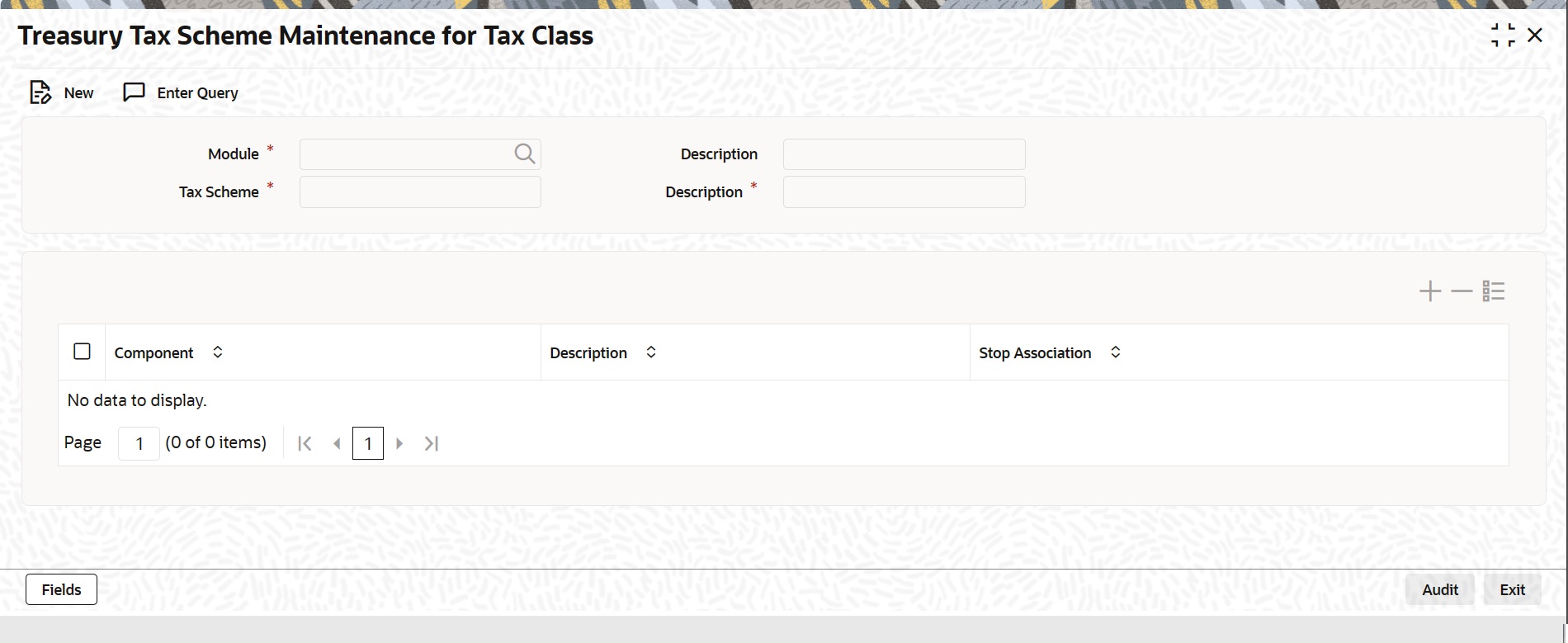

A tax scheme is composed of one or more tax classes. For instance, a Transaction Level Tax Scheme would be composed of one or more transaction level tax classes. By associating a Tax Scheme with a product, you can calculate all the tax components for the contracts entered under the product at one stroke. Tax schemes can be built in the Tax Scheme Maintenance screen.