- Tax User Guide

- Build Tax Components

- Tax Rules

- Process the Tax Rule Maintenance Screen

1.4.1 Process the Tax Rule Maintenance Screen

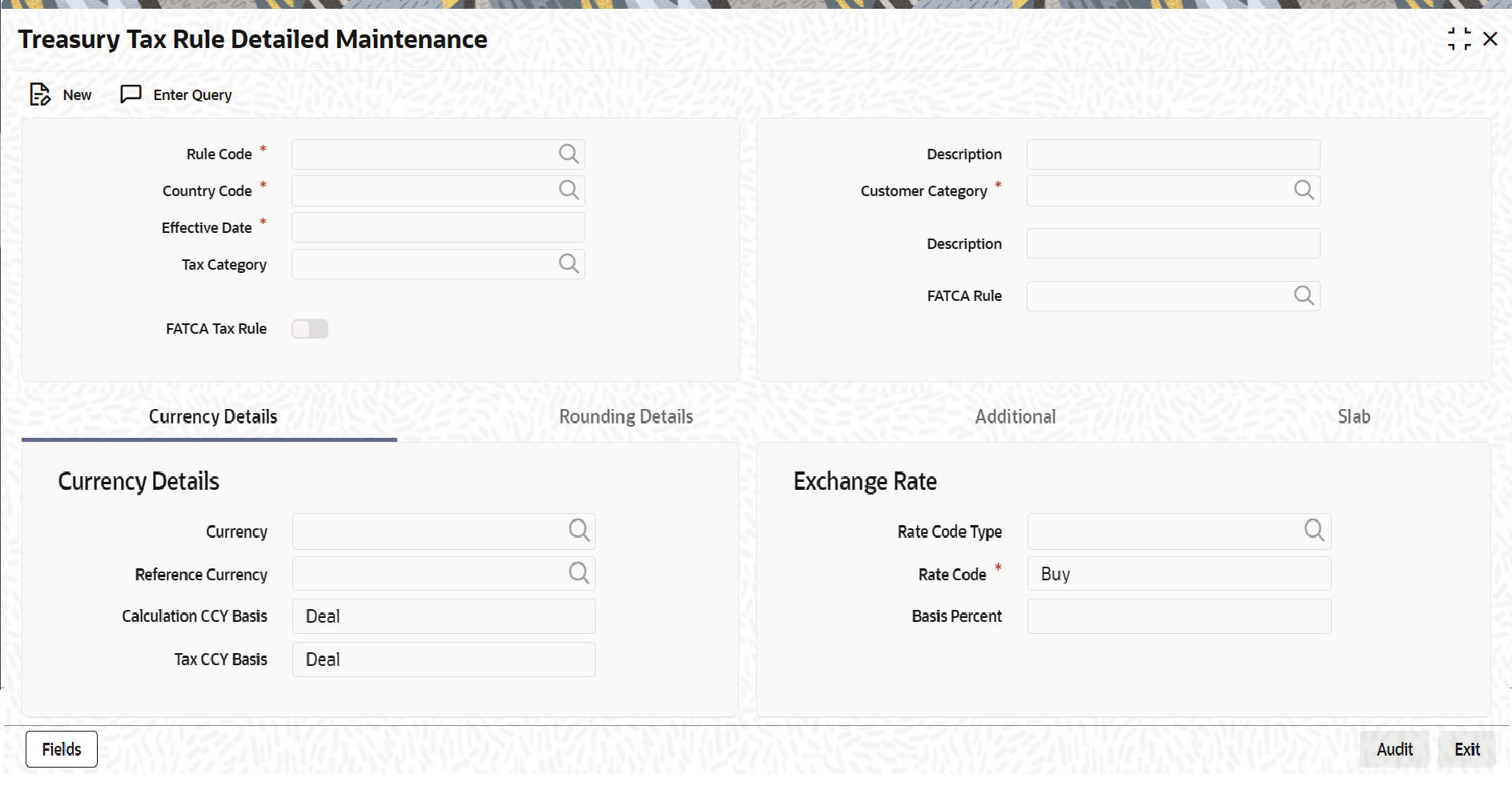

- On Home screen, type TADTRRDE in the text box, and click next.Treasury Tax Rule Detailed Maintenance screen displays.

Figure 1-4 Treasury Tax Rule Detailed Maintenance

Description of "Figure 1-4 Treasury Tax Rule Detailed Maintenance" - On Tax Rule Detailed Maintenance screen, specify the fields.For more information on fields, refer to the field description table.

Note:

The fields which are marked in red asterisk are mandatory.Rule Code:This is the code by which the tax rule is identified. If you are defining a new tax rule, enter its code in this field. You can specify the attributes for this tax rule in the rest of the fields. If you select an existing tax rule from the Tax Rule Summary View table, the code is displayed in this field.

Table 1-3 Operation and Description

Operation Description Modify All the details of the selected tax rule are displayed. Except for the Tax Rule Code, you can modify the input in any of the fields. Delete All the details of the selected tax rule are displayed. You can delete the record only if its addition has not been authorized. Copy Except for the Tax Rule Code, the other details related to the tax rule are displayed which can be changed. Enter the Code for the new rule before you save the tax rule. Close All the details of the selected tax rule are displayed. If you confirm the closure, the tax rule record will be closed. A closed record will continue to exist in the system but cannot be used. To use a closed record, you should reopen it. Reopen All the details of the selected tax rule are displayed. If you confirm the reopening of the record, it will become available for use again. Print The details of the selected tax rule are displayed on the screen and then directed to the printer. Authorize The details of the tax rule will be displayed. You can authorize the record if the following conditions are true:- The record has some activity unauthorized.

- You have rights for authorization.

- You did not initiate the activity that is pending authorization.

Table 1-4 Tax Rule Maintenance - Field Description

Field Description Description The System displays the description. Customer Category Customer categories are maintained by your bank in the customer maintenance module. These could be categories like banking, corporate, brokers, financial institutions etc. You can choose the customer category for which the tax rule is being defined. You could also choose to define the tax rule for all categories of customers. Country Code You can apply specific tax rules based on the country of residence of the customer. Thus individual tax rules for each combination of customer category, country code with an effective date can be maintained. Select the country code for the customer from the option list. Based on the country of residence of the customer, specific tax rules can be applied. Tax Category Various Tax categories (open and authorized) are maintained in the system. Specify the tax category from the option list provided for the given Tax Rule. If the tax category is not maintained, then the tax booked under this Tax Rule will not be considered for tax waiver/tax allowance processing. However, normal tax processing, as it happens today in Oracle FLEXCUBE, will continue to happen. Effective Date Every tax rule is associated with an Effective Date. On the specified Effective Date, the rule becomes applicable. When more than one rule is linked to a Tax Scheme, a rule will be applied till the next rule for the same component, with a different Effective Date, is encountered. FATCA Tax Rule Check this box to indicate that the tax rule maintained is a FATCA tax rule.

This field is enabled only if the FATCA Applicable field at bank level is enabled.

If the tax rule is marked as a FATCA tax rule, then the system will create a FATCA withholding rule using FATCA withholding rule maintenance which will be linked to the tax rule. At the time of tax computation, the system will first evaluate the withholding rule. Based on the outcome of the withholding rule, the system will compute the tax.

FATCA Rule Specify the FATCA validation rule that needs to be applied to evaluate the FATCA tax. - Click the Exit button to close the screen.

Parent topic: Tax Rules