- Interest User Guide

- Interest

- Interest Details for the Product

- Product Definition Screen

1.9.1 Product Definition Screen

This topic describes the systematic instruction to define product details.

You can link more than one rule to a product. In the Product ICCB Details screen, in the Rule ID field, pick the rule you wish to link to the product. For an interest type of rule, all the interest related details have to be specified in the Product ICCB Details screen.

After you have defined an Interest Rule by allotting it a Rule ID and specifying the interest application factors, you can link it to a product.

For example, for a deposit, you can link a rule for the main interest and another interest type of rule for a commission you want to charge on the deposit. Besides this, you can have a rule for a charge. Thus, the product will have three rules linked to it. For the deposit, you can retain all these, or waive one or more, as per your requirement.

Note:

The system automatically builds a list of accounting roles depending on the Interest components that you define. For instance, if you have defined an interest component called CR01_INT, the following accounting roles will be generated:- CR01_INT_EXP

- CR01_INT_PAY

- CR01_INT_REC

- CR01_INT_RIA

- CR01_INT_PIA

- CR01_INT_AQP

- CR01_INT_AQR

- CR01_INT_ADJ

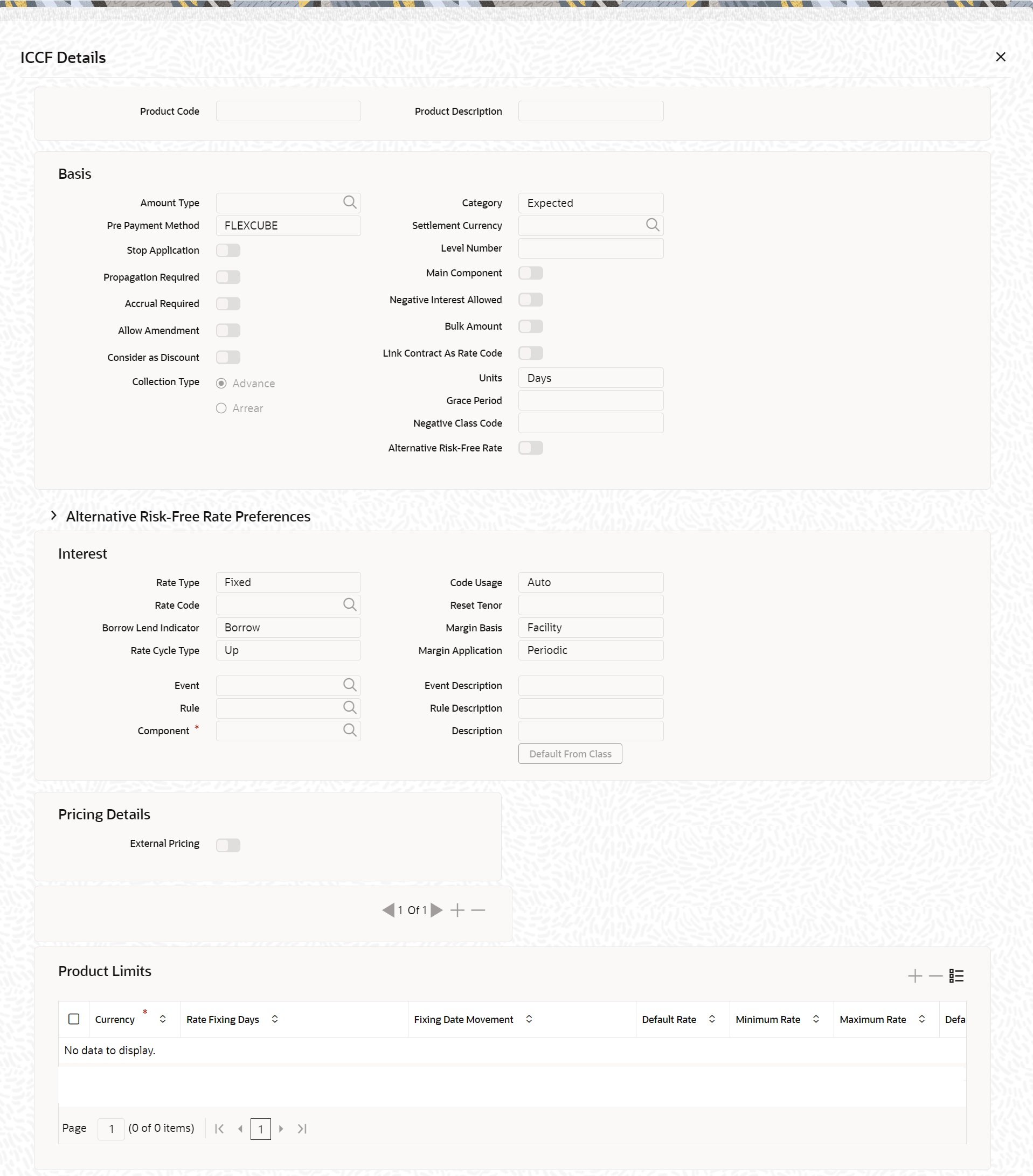

- Click Interest in the Product Definition screen.The ICCF Details screen is displayed.

- In the ICCF Details screen, specify the fields.The system dynamically adds a list of suffixes to the main interest component. Each of these suffixes stand for:

Table 1-14 Suffix and Description

Suffix Represents AQR Acquired interest receivable AQP Acquired interest payable REC Receivable EXP Expense INC Income PAY Payable RIA Received in Advance PIA Paid in Advance ADJ Adjustment A similar list of accounting roles will be built up for each component that you associate with the product.For detailed explanation on the fields, refer to the below table.Note:

Note Since you need to identify Accounting Roles (GL/SL Types) and map them to Account Heads (Actual GL/SLs) to post accounting entries for specific events, you will have to choose the appropriate accounting roles for each component and map them to corresponding Account Heads.Table 1-15 ICCF - Field Description

Field Description Amount Type

Specify the basis on which interest has to be calculated. By default, the principal will be taken as the basis.

Pre Payment Method

The prepayment method identifies the computation of the prepayment penalty for the contract.

Stop Application

Select this check box to stop application.

The attributes defined for a product will be automatically applied to all contracts involving the product. If, for some reason, the user want to stop applying the Interest Rule defined for the product on contracts that are to be initiated in the future (involving the product), the user could do so through the Product ‘ICCB Details’ screen.

In effect, stopping the application of a component for a product would be equivalent to deleting the component from the product. By specifying that the application of the component must be stopped, the user has the advantage of using the definition made for the component again, by making it applicable.

Propagation Required

Select this check box if the propagation is required.

If the interest amount collected from the borrower must be passed on to participants of the contract, check the 'Propagation Required' check box.

Accrual Required

Select this check box if the accrual is required.

Allow Amendment

A change to a contract (after it has been authorized) that involves a change in its financial details constitutes an Amendment on the contract. The user can indicate whether such an Amendment, called a Value Dated Change, must be allowed for the interest component being defined.

The user can amend the following through this function:

- Interest rate

- Rate code

- Spread

- Interest amount

Consider as Discount

While defining an interest, the user can indicate whether the interest component is to be considered for discount accrual on a constant yield basis or whether accrual of interest is required.

If the user select the Consider as Discount option the interest received against the component is used in the computation of the constant yield and subsequently amortized over the tenor of the associated contract.

Checking the Consider as Discount also indicates whether the interest component is to be considered for IRR computations.

The Consider as Discount option is not available if the amount category is Penalty.

Collection Type

Select the collection type. The options are:

- Advance

- Arrear

Category

If the interest rate type is Fixed or Floating, the Amount Basis Category specifies the type of balance that has to be considered for interest application. It could be any one of the following:

- Expected

- Overdue

- Normal

- Outstanding

If the Basis Amount Category is Expected, the balance on which interest has to be applied will be the Expected balance (the balance assuming that all the scheduled repayments defined for the contract are made on time).

If the Basis Amount Category is Overdue, the balance on which interest has to be applied will be the amount that is overdue, based on the repayment method defined for the contract. An example of this category is the application of penalty interest on the Principal amount or interest, when a repayment has not been made, as per the date specified for the contract.

Settlement Currency

Specify the currency in which the interest, charge or fee component gets settled. The currency mentioned here must exist in the currency table. By default it is the local currency.

Level Number

Grace Period and Level Number

The user can apply interest at various levels:

- Main interest on principal – Level 0 (Category: Expected)

- Interest on overdue interest – Level 1 (Category: Overdue)

- Interest on Level 1 interest – Level 2 (Category: Overdue) … and so on.

For each interest component, starting from Level 1 and belonging to ‘Overdue’ category, the user can also specify the number of grace days, beyond the main interest due date, after which that interest component becomes applicable. For each such component, the default value for the number of grace days is:

Number of grace days for the previous level + 30 days

The user can change this value, provided that the number of grace days for a component (level) does not exceed the number of grace days for any successive level. At any point, an amendment of the number of grace days for any or more interest components at the Product ICCB level will only affect new contracts.

For interest components of Level 0 and ‘Expected’ category, the default value for grace days is 0 – this cannot be changed.

Main Component

The user can define any number of interest type of components (tenor based components) for a product. If the user has defined more than one interest type of component, the user can specify the main interest component as ‘Main Component’. This will be the interest component that will be used for capitalization or amortization purposes if the repayment schedules are defined thus.

The details of this Main Component will be shown in the Contract Details screen and the user can change them there without having to invoke the Contract ICCB Details screen. Components other than the main component have to be processed through the Contract ICCB Details screen.

Bulk Amount

When a contract gets rolled over, the user may wish to split it into 2 contracts - one for the interest amount (I) and the other for the principal amount (P). If the user want the floating rate pickup for both the new contracts (tenor/amount) to be based on P+I of the original contract, check the 'Bulk Amount' check box. For example, if the principal amount is Rs.1000 and Interest accrued is Rs.100. Upon rollover, your bank may require two contracts, one for Rs.1000 (Principal contract) and the other for Rs.100(interest contract). Lets say the slab rate followed by your bank is:

- 0 – 1000 - 3%

- 1001 – 2000 - 4%

In the normal course, system would apply 3% interest rate on both the contracts of Rs.1000 and Rs.100 (since both fall within 0 -1000 slab). But if the ‘Bulk Amount’ option is chosen, then 4% is applied on both the contracts (as if a single contract of Rs.1100 is rolled over where system would have applied 4pct).

Link Contract As Rate Code

The user can use this field to indicate whether a fixed rate contract may be linked to the floating rate component, instead of a rate code. Check this box to indicate that a fixed rate contract may be linked.

Grace Period

The grace days that user specify for any level of interest in the Product ICCF screen will default to contracts entered under that product.

Alternative Risk-Free Rate

Select the Alternate Risk-Free Rate check box to enable the Alternate Risk Free-Rate preferences. Alternative Risk Free Rate Preferences

Select any one of the below RFR calculation methods:- Lookback

- Payment delay

- Lockout

- Interest Rollover

- Last Reset

- Last Recent

- Plain

- Index Value

The user can also select any one of below combination methods:- Lookback and Lockout

- Lookback and Payment Delay

- Lockout and Payment Delay

- Lookback, Lockout, and Payment delay

Note:

For more information on RFR calculation method for each type, click the attached RFR calculation method Worksheet.The user can select Lookback as RFR preference if the Rate Method is In-Arrears. The observation period for the interest rate calculation starts and ends a certain number of days prior to the Interest period. As a result, you can choose the interest payment to be calculated prior to the end of the interest period.

Lookback Days

This field is relevant if 'Rate Method' is 'In-Arrears' or bearing and RFR method is Lookback.

Lockout The user can select Lockout as RFR preference if the Rate Method is In-Arrears.

Lockout means that the RFR is frozen for a certain number of days prior to the end of an interest period (lockout period).

During this time, the RFR of lockout period days is applied for the remaining days of the interest period. As a result, the averaged RFR can be calculated a couple of days before the end of the Interest period.

Lockout Days This field will only be relevant if 'Rate Method' is 'In-Arrears' or bearing and RFR method is Lockout.

Payment Delay Days This field will only be relevant if 'Rate Method' is 'In-Arrears' or bearing and RFR method is Payment delay. Number of days by which the interest (or installment) payments are delayed by a certain number of days and are thus due a few days after the end of an interest period.

Interest Rollover Rollover method can be used as a combined method along with one each of In-arrears & In-advance methods. Payments are set in advance and any missed interest relative to in arrears is rolled over into the next payment period. This option combines a first payment (installment payment) known at the beginning of the interest period with an adjustment payment known at the end.

The difference between Principal Adjustment option and this option is that the adjustment payment is delayed. The adjustment payment can be made a few days later or at the end of the next accrual period

Last Reset This field is relevant only if 'Rate Method' is 'In-Advance' and 'Rate Convention' is Last reset. In this option, interest payments are determined on the basis of the averaged RFR of the previous period.

Last Recent This field is relevant only if 'Rate Method' is 'In-Advance' and 'Rate Convention' is Last reset. In this option, interest payments are determined on the basis of the averaged RFR of the previous period.

Plain This field is relevant if Rate Method is In-Arrears or bearing and RFR method is Plain. System uses averaged RFR over current interest period, paid on first day of next interest period.

Rate Compounding User can select the rate compounding to be applied for each calculation period. When enabled, system opts for rate compounding instead of amount compounding, the amount difference comes into effect only if any pre-payment is done.

For more information on Rate Compounding, refer to the attached RFR Rate Observation Shift worksheet.

Index Value Select the Index Value check box to use the RFR index rate.

The RFR Index measures the cumulative impact of compounding RFR on a unit of investment over time.

Index Value supports below RFR preferences:

- 1. Arrear Method

- Lookback

- Lockout

- Payment Delay

- Plain

- Advance Method

- Last Reset

- Last Recent

For more information on RFR Index Value, refer to the attached RFR Index value calculation worksheet.

Observation Shift Select the Observation Shift check box to apply observation Shift to RFR calculation.

The observation shift mechanism provides the rate to be calculated and weighted by reference to the Observation Period rather than the relevant interest period. Observation Shift Currently supports below RFR Methods and combination.- Lookback

- Lockout

- Lookback and Lockout combination

For more information on RFR Observation Shift , refer to the attached RFR Rate Observation Shift worksheet.

Compounding Preferences Speicfy the Compounding Preferences details. Computation Calendar Select the Computation Calendar from the drop-down list, when RFR is selected for interest. The available options are:- Currency

- Financial Center

Financial Center This field is mandatory if the Financial Center is selected as computation calendar.

Select the code of Financial Center from the displayed list of values.

Base Computation Method Select the Base Computation Method from the drop-down list. It is either simple or compounded.

Spread\Margin Computation Select the Spread\Margin computation method. It can be maintained as either Simple or compounded.

Spread Adjustment Select the Spread adjustment method and it is maintained as either Simple or compounded.

RFR Rounding Unit Specify the Rounding Units value to round daily index value to the nearest whole number and use it for interest calculation.

It is applicable only when RFR index value is used.

Rate Type

The Rate Type indicates whether the interest is a Fixed Rate, a Floating Rate or a Special amount. When creating a product, the user must specify the Rate Type through the ‘Product - ICCB Details’ screen.

If the Rate Type is a Floating Rate, the user must also specify the Rate Code to which the product has to be linked.

Rate Code

Each Rate Code corresponds to a rate defined for a combination of Currency, Amount (if it is necessary) and an Effective Date. These details are maintained in the Floating Rates table.

This rate will be applied to contracts involving the product.

Borrow Lend Indicator

Floating rates are defined with a borrow or a lend tag attached to them. Here, the user indicate the nature of the floating rate that needs to be picked up for the interest component.

The options available are:

- Borrow

- Lend

- Mid

Rate Cycle Type

For floating type of interest components and fixed type with rate code attached, the user can indicate the manner in which floating rates must be applied.

The preference that the user specify here is used when an interest component does not fit into any direct parameter defined for the floating rate code. The options available are:

- Up – Choose this option to indicate that the rate of the upper tenor slab must be used.

- Down - Choose this option to indicate that the rate of the lower tenor slab must be used

- Interpolate - Choose this option to indicate that the rate must be interpolated between the rates of the upper and lower slabs

- Round Off - Choose this option to indicate that the tenor of the component must be rounded off to the nearest whole number. The rate defined for the derived tenor will be applied to the component

Event

An interest event indicates when the interest component whose attributes are being defined has to be applied.

Rule

Rule associated to the Interest component

Component

The component for which the user are entering details together with its description.

Code Usage

The user must specify the method in which the rates in the Floating Rates table have to be applied. It could either be automatic application (meaning the rate has to be applied every time it changes), or periodic application (meaning the rate has to be applied at a regular frequency, defined for each contract involving the product).

Reset Tenor

Enter the tenor for which the floating rate (when applied automatically) needs to be picked up from the floating rates table, for contracts using this product. This field is applicable to floating type of interest components and fixed type with rate code attached.

Margin Basis

Indicate the basis for the interest margin and the method for applying the interest margin on the selected interest component for contracts using this product.

The user need to specify how the system must obtain the interest margin (if any) that must be applied on the selected interest component at the time of fixing the interest rate for contracts using the product. The available options are:

- Facility - The system defaults the margin from the borrower facility contract with which the drawdown is linked.

- Tranche - The system defaults the margin from the borrower tranche contract with which the drawdown is associated.

- Drawdown - If this option is chosen, the user must enter the applicable margin when the interest rate is fixed.

- This component which the user select is excluded from all the processing including liquidation and this calculation type is only used for margin application.

- After defining this component, booked formula for main interest component needs to be modified by replacing INTEREST_RATE with INTEREST_RATE + MARGIN_RATE. By doing this the interest gets calculated based on resolved interest rate (i.e. including floating rate and spread if applicable) and the margin.

- Customer - If this option is chosen, then the margin will be applicable to all draw down contracts under the selected customer.

Margin Application

Margin Application can be periodic or automatic

Event Description

Defaults event description

Rule Description

Defaults Rue description

Description

Defaults Component description

Pricing Details Specify the Pricing Details External Pricing

Check this box for external pricing of interest component.

Product Limits Specify the Product Limits details. Currency

Specify the currency for which limits are maintained

Rate Fixing Days

Defaults fixing days from Rate fixing maintenance screen. User will be able to modify the same.

Fixing Date Movement

Defaults fixing date movement from Rate fixing maintenance screen. User will be able to modify the same

Default Rate

Specify the default rate on contract creation. User will be able to modify the same.

Minimum Rate

Specify the minimum rate on contract creation. If the interest rate specified for a contract is less than this minimum rate, the minimum rate is applied on the contract

Maximum Rate

Specify the maximum rate on contract creation. If the interest rate specified for a contract is greater than this maximum rate, this rate will be applied on the contract.

Default Spread

Specify the default spread for a Floating rate type on contract creation

Minimum spread

Specify the minimum spread for a floating rate type product. If the spread specified during contract processing is less than the value specified as the minimum spread, this value will be picked up as the spread.

Maximum Spread

Specify the maximum spread for a floating rate type product. if the spread specified during contract processing is more than the value specified as maximum spread, this value will be picked up as the spread.

Interest Basis

This field indicates how the system must consider the tenor basis upon which interest is computed over a schedule or interest period, in respect of the interest component being associated with the product.

Denominator Basis

This field indicates the interest methods which have their interest basis set to ACTUAL i.e. 30(EURO)/ACTUAL, 30(US)/ACTUAL and ACTUAL/ACTUAL. Denominator Basis is used to specify how the month of February is treated when the denominator is 'Actual'. There are two types of denominator basis methods:- Per Interest Basis – Here the computation would be done based on ACT/ACT–ISMA Interest Method. In this case, the '366 Basis' field will not be applicable.

- Per Annum (A) – Here the interest calculation will depend on the value the user specify for 366 Basis

366 Basis

This is applicable only if the Denominator Basis is set to 'Per Annum'. The user can select one of the following values here:

- Leap Year

- Leap Date - computation would be done based on ACT/ACT - FRF Interest Method

No of Interest Period

This is applicable if the Denominator Basis is 'Per Interest Period'. Here the user can specify the number of Interest periods (Schedules) in the financial year.

Parent topic: Interest Details for the Product