- Tax User Guide

- Build Tax Components

- Tax Components as Classes

- Furnish the Rate Values for a Code

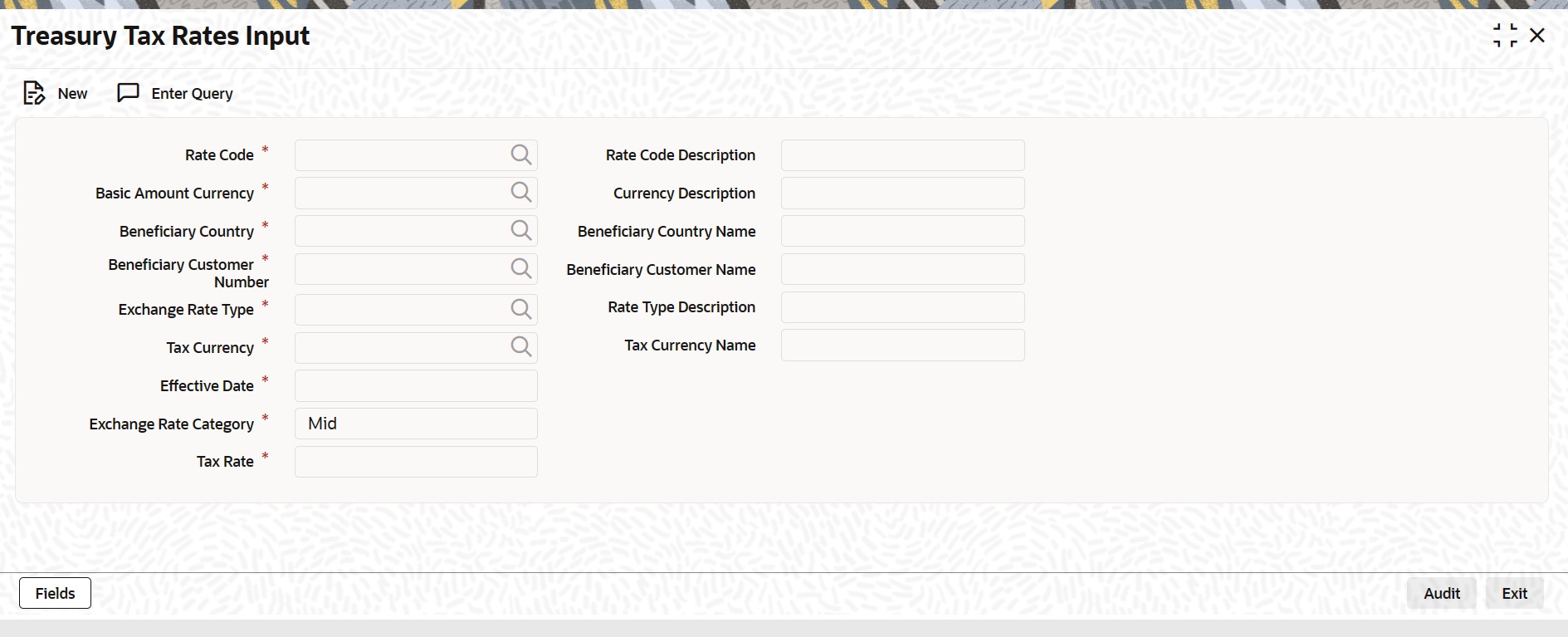

1.7.5 Furnish the Rate Values for a Code

The actual rate values for a rate code can be maintained in the Tax

Rates Input screen.

Specify User ID and

Password and login to Home

screen.

- On Home screen, type TADTRRAT in the text box, and click next.Treasury Tax Rates Input screen displays.

- On Treasury Tax Rates Input screen, specify the fields.For more information on fields, refer to the field description table.

Note:

The fields which are marked in red asterisk are mandatory.Table 1-17 Tax Rates Input - Field Description

Field Description Rate Code Specify the rate code. Rate Code Description The system displays the rate code description. Basis Amount Currency The basis (the coupon amount, the cash dividend amount, etc.) on which a tax is calculated, is referred to as the Basis Amount. You can specify the currency of the Basis Amount. Currency Description The system displays the currency description. Beneficiary Country Issuer Tax Rates are specific to markets. When maintaining a rate value for a code, you have to identify the market for which you are defining the rate. Beneficiary Country Name The system displays the beneficiary country name. Beneficiary Customer Number You can maintain unique tax rates for issuers of securities. When you maintain a security, the system applies the tax rate defined for the issuer. If you have not maintained a rate for an issuer, the system applies the rate maintained for the country to which issuer belongs. Beneficiary Customer Name The system displays the beneficiary customer name. Exchange Rate Type and Category If you specify a Basis Amount Currency that is different from the Tax Currency, you have to indicate the type of rate (standard, spot, cash, etc.), and the rate category (mid, buy, or sell rate) that should be used in the currency conversion. Rate Type Description The system displays the rate type description. Tax Currency You can specify the currency in which the tax should be applied. Tax Currency Name The system displays the tax currency name. Effective Date The date on which a rate becomes effective is referred to as the Effective Date. For a code and Effective Date, you can maintain a rate. Tax Rate In this field, you can enter the actual rate value for a Code, for an Effective Date. When you associate a rate code with an issuer tax class, the rates corresponding to Effective Dates will be picked up and applied. - Click the Exit button to close the screen.

Parent topic: Tax Components as Classes