5.15 FX Linkage

This topic describes the FX forward contracts linking to external application.

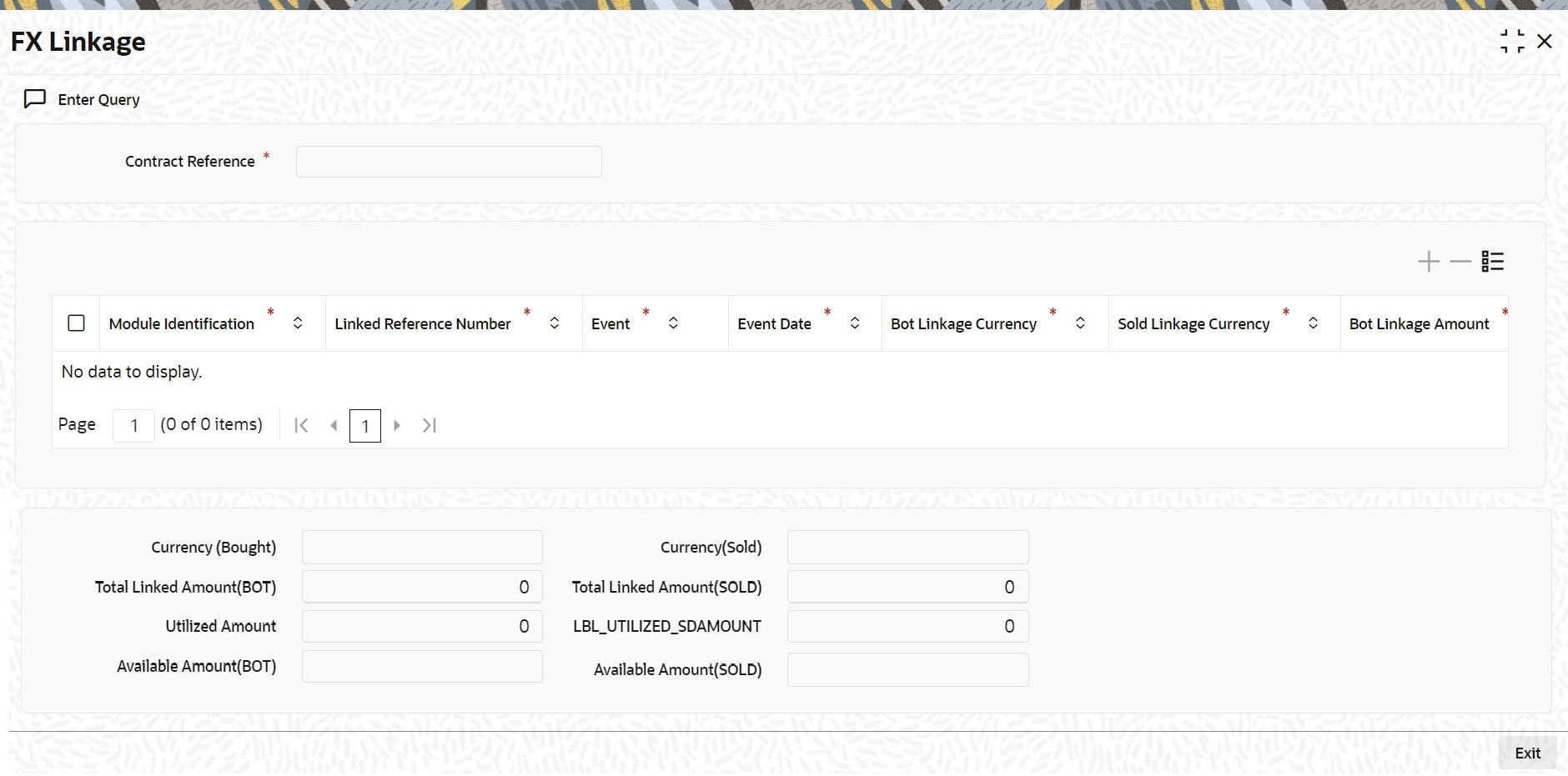

- On the Foreign Exchange Contract Online screen, click FX Linkages button.

FX Linkage screen is displayed.

- Following details will be defaulted by the system:

For more information on the fields, refer to the below table.

Table 5-11 FX Linkage - Field Description

Field Description Module Identification

The system displays the external module id.

Linked Reference Number

The system displays the external reference number for which you are maintaining the linkage.

Event

The system displays the event. It can be any of the following:

- Linkage

- De-linkage

- Utilization

- De-Utilization event

Event Date

The system defaults the date of the event

Bot Linkage Currency

The system defaults the bought linkage currency

Bot Linkage Amount

The system defaults the bought linkage amount

Sold Linkage Currency

The system defaults the sold linkage currency.

Sold Linkage Amount

The system defaults the sold linkage amount

Utilization Amount

The system defaults the bought or sold amount liquidated for the contract linked.

Reject Reason

The system defaults the reject reason for payment reversal during DUTL operation

Total Linked Amount (BOT)

The system derives the total bought linked amount

Total Linked Amount (SOLD)

The system derives the total sold linked amount

Total Utilized Amount (BOT)

The system defaults the total bought amount liquidated for the contract linked.

Total Utilized Amount (SOLD)

The system defaults the total sold amount liquidated for the contract linked.

Available Amount (BOT)

The system derives and defaults this amount as the difference between FX transaction bought amount and the amount already linked to any external application contract.

Available Amount (SOLD)

The system derives and defaults this amount as the difference between FX transaction sold amount and the amount already linked to any external application contract.

The external application OBTF can select the following FX transactions:

- Active and authorized forward FX transactions not marked for auto liquidation.

- The FX forward contract cannot be a part of a combination product.

- FX forward contract cannot have NDF feature

- The settlement for the FX contract should not be through CLS.

- FX contracts having netting agreement with counterparty should not be allowed.

- FX contract should have the same bought and sold value date i.e., split value dates are not allowed.

- Option date is mandatory for the forward FX deal, which is to be attached as linkage to external transactions.

- Once the FX deal amount is fully availed the FX deal should not be available in LOV fetch and cannot be linked further towards other transactions.

- Once the FX deal amount is fully utilized the FX deal should not be available in LOV fetch and cannot be linked further towards other transactions.

Parent topic: Processing of Contract