B.3 Explanation of Terms Associated with IRO Markets/Transactions

This topic describes the terms associated with IRO Markets or Transactions.

Option Buyer (holder)

This is the party that obtains, on payment of a fee, the right to lend or borrow (notionally) a pre-determined quantity of money at a specified rate of interest for a specified period starting from a specified date. In effect, she obtains the right to compensation in the event of a future adverse movement in a floating benchmark interest rate, which can, for example, be the USD 6-month LIBOR.

Option Seller (writer)

This is the party that enters into an obligation, in return for a fee, to provide compensation to the option buyer in the event of a future adverse movement in a floating benchmark interest rate.

Example

On May 02, 2003, Sarah Williams buys a Put IRO from Options Bank, giving her the right to lend 1 million USD at 5% for the period July 01, 2003 to December 31, 2003. The benchmark rate is 6-M LIBOR. On June 27, 2003, when rate fixation takes place for the period July 01 – December 31, 2003, 6-M USD LIBOR is 4%. Options Bank has to pay Sarah Williams a sum of:

1,000,000 X ((0.05-0.04) X (183/360)) = 5,083.33 USD

Had USD LIBOR for the period July 01 – December 31, 2003 been 5.5%, Sarah Williams can not have exercised the Call IRO.

Notional principal / Contract amount

This is the underlying principal amount, based on which payments or receipts for an IRO are calculated. It is ‘notional’, since the IRO contract contains no obligation for either counterparty to lend or borrow funds at the contracted rate. In the previous example, the notional principal is 1,000,000 USD.

Premium

This is the upfront fee or price paid by the option buyer to the option writer. This is sometimes expressed as a percentage of the notional principal / contract amount. The premium is usually payable on the same day when the option deal is struck, or within two business days from the deal date.

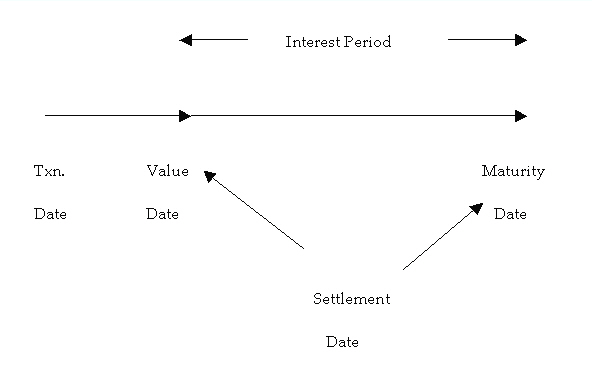

Transaction date / Deal date / Trade date

This is the business day on which the option deal is entered into.

Interest period

The interest period or the contract period is the duration for which the underlying interest rate is to apply and is the tenor basis on which the settlement amount is computed. This is the period between the value date and the maturity date. In the previous example, the interest period is between July 01 and December 31, 2003.

Value date / Effective date

This is the business day which is the first day of the interest period. In the previous example, July 01, 2003 is the value date.

Maturity date

This is the last day of the interest period. In the previous example, December 31, 2003 is the maturity date.

Settlement date

This is the date on which the settlement is effected. The settlement date can either be the value date (for deals settling in advance) or the maturity date (for deals settling in arrears).

Fixing date / Strike date / Exercise date

This is the date on which the strike and reference rates (both are defined later in this document) are compared and the settlement amount is arrived at. This is usually either the same date as the value date or a couple of days prior to the value date.

The above dates are depicted in the figure given below:

Figure B-2 Example

Reference / Underlying rate

This is the rate against which the strike rate is compared to determine the payable or receivable amount. Typically, the reference rate is a benchmark market interest rate, such as the LIBOR.

Strike rate / Exercise rate

This is the rate mentioned in the option contract, against which the reference rate as on the day of exercise is compared. If the reference rate is below or above the strike rate (depending on whether the option is a put or a call), payment is required to be made to the option buyer by the option writer. An option holder ‘strikes’ (exercise her option) at this rate, or a rate lower (if put) or higher (if call) than this rate.

In the previous example, the strike rate is 5%.

Intrinsic value

The intrinsic value of an IRO contract on any given day is the pay-off to the option holder if the option is exercised on that day. Refer to the pay-off diagrams earlier in this section.

Time value

Apart from the intrinsic value, the value of an option also contains another – a probabilistic – component, which is based on a forecast of the possible movement of the reference / underlying rate over the time left till maturity. This component of the option’s value – called the time value – is a function of the volatility of the underlying and the time to expiry. Time value is determined by Oracle Banking Treasury Management as the user-entered fair value of the option, less its intrinsic value.

Settlement amount

This is the amount payable by the writer to the holder on the settlement date when the option is exercised. The exact quantum of the settlement amount is shown below. As can be seen, the strike rate is compared to the reference rate on the settlement date. The settlement date can be the maturity date of the contract (end of the interest period) or the value date of the contract (beginning of the interest period). If the contract is settled on the value date, the amount that changes hands is the discounted present value of the settlement amount.

Table B-76 Accounting Role - Amount Tag

| Option Type | Settlement on Maturity Date | Settlement on Value Date |

|---|---|---|

|

Put |

P * N * (S-R)/(Y*100) |

[P * N * (S-R)/(Y*100)] / [1 + (R*N/Y*100)] |

|

Call |

P * N * (R–S)/(Y*100) |

[P * N * (R–S)/(Y*100)] / [ 1 + (R*N/Y*100)] |

Where:

P = notional principal (which is contractually agreed);

N= number of days in the contract period (as per the contract);

S = strike rate (contractually agreed);

R = reference rate (value of the benchmark, say, LIBOR, as on the rate fixing date)

Y = number of days in the year (this depends on day count convention)

In-the-money, Out-of-the-money and at-the-money

An option is said to be in-the-money if the settlement amount is positive, that is, the strike rate is more favorable than the reference rate and the IRO is exercised. If the reference rate is more favorable than the strike rate, the IRO is not exercised and is said to be out-of-the money. If the reference rate is exactly equal to the strike rate, the IRO is said to be at-the money.

Note:

The pay-off to the option holder is the settlement amount, less the upfront premium that she pays when entering into the option contract.

The IRO terminology mentioned above is applicable to COs as well. While understanding these terms for COs, you have to read them in context.