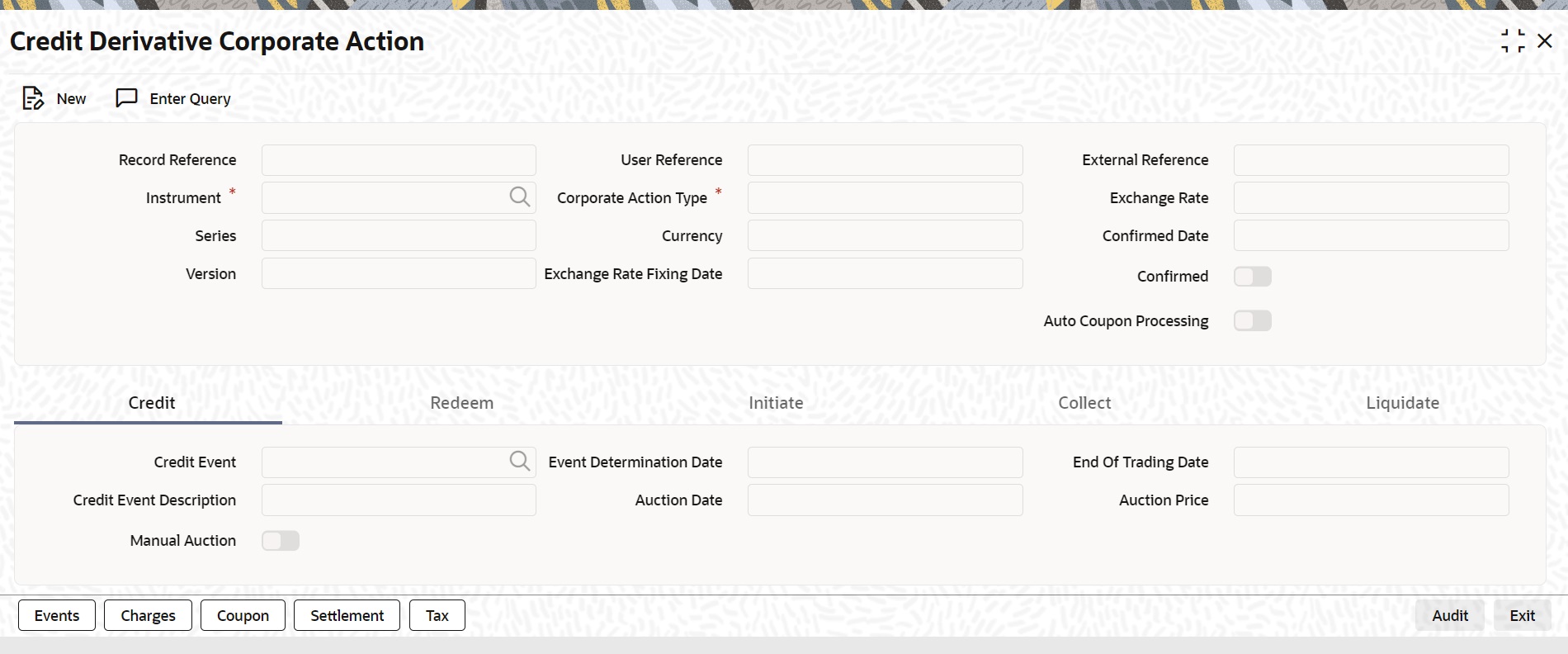

29.10 Credit Derivative Corporate Action

This topic describes the systematic instructions to process credit derivative corporate action.

- The DSDCDCAP is automatically populated as per coupon and redemption schedule of security definition in DSDTRONL. A new corporate action can also be processed from this screen; any such changes will amend the redemption schedule of the instrument.

- A new corporate action processed would be for credit event processing. It would be at instrument ID level altering redemption schedule of the instrument in DSDTRONL and the positions held in instrument across portfolios.

- If security is marked with the end of trading status, security status is changed to close in DSDTRONL, and all the defaulted corporate actions after the end of trading status dates would be marked as closed. This action would be a part of the BOD activity at the end of the trading status date.

- Below would be the sections in the screen used:

- Main section - Common to all corporate action type

- Credit - To be used when corporate action type is Redemption

- Redeem - To be used when corporate action type is Redemption

- Initiate - To be used when corporate action type is coupon

- Collect - To be used when corporate action type is coupon

- Liquidate - To be used when corporate action type is coupon

- Main section fields would be enabled for all types of corporate action. Redeem section fields would be enabled when corporate action type is redemption or credit event. Fields in other section would be disabled if the corporate action type is chosen/defaulted with a value not relevant to the section.

- The subsystem in the screen would be as below:

- Events

- Charges

- Coupon

- Settlement

- Tax

- The subsystem reference might be taken from existing screen SEDXCAMN with the below changes:

- Coupon- Portfolio ID, Safe keeping location and safekeeping account fields to be removed from the filter section but to be present in results section.

- Tax- Issuer tax tab to be removed.

- Internal security ID to be replaced with CD Instrument label

- Events recorded under the event subsystem is (no setup required):

- CDET - Credit event determination

- AUCT - Credit event auction

- EOTR - End of trading

- Each event can trigger multiple times so event date would also be triggered against each event with ESN (Event sequence number).

Parent topic: Credit Default Index