29.3.2 Credit Derivative Instrument Definition

- On the Home page, type DSDTRONL in the text box, and click the next arrow.

Credit Derivative Instrument Definition screen is displayed.

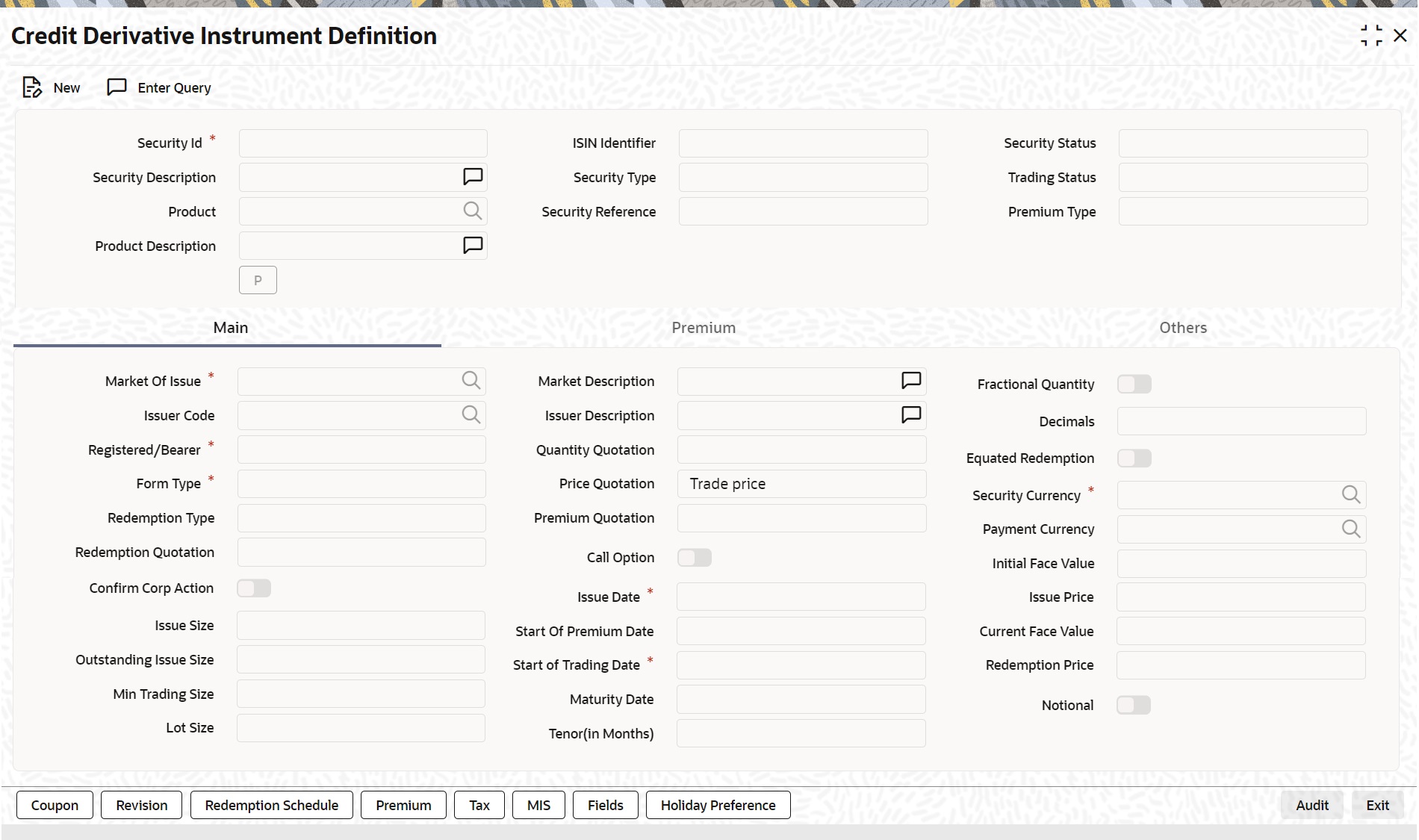

Figure 29-8 Credit Derivative Instrument Definition

Description of "Figure 29-8 Credit Derivative Instrument Definition" - On the Credit Derivative Instrument Definition screen, specify the details as required.

Following are the field descriptions:

Table 29-6 Credit Derivative Instrument Definition - Field Descriptions

Field Description Tenor (in Months)

Tenor of the instrument is displayed to determine the maturity date.

WARNING:

Tenor must be greater than zero and cannot be a fraction.

If the maturity date is null, and the tenor value is available, then the maturity date is derived on save, and both tenor and maturity are stored in the database.

If maturity value is given, the tenor is not available, the maturity date is saved, and tenor remains null.

If both maturity and tenor are given, the Maturity date is saved, and tenor will become null

Notional

Select this check box to indicate that the instrument is booked against contingent asset / liability in the portfolio.

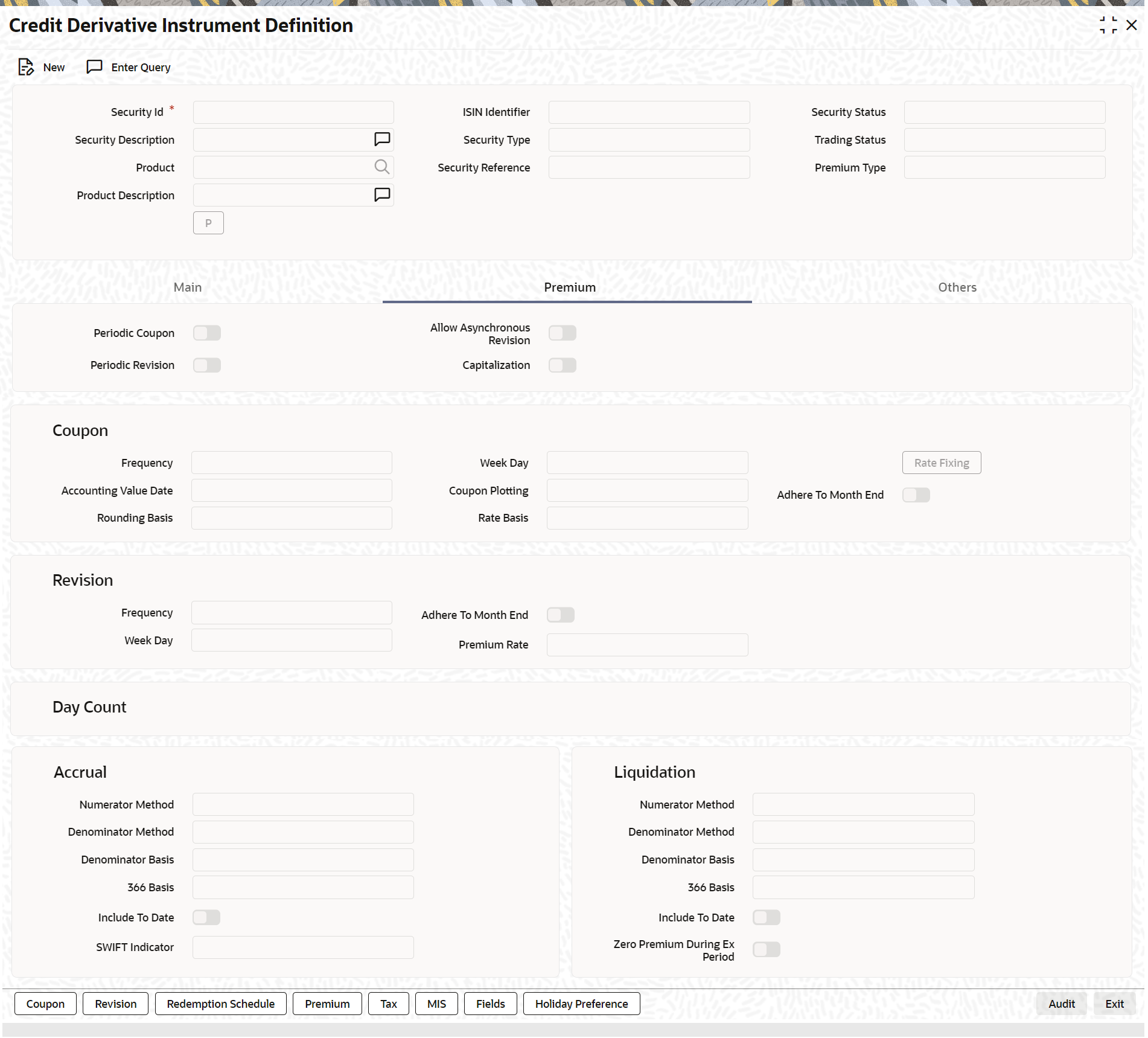

- On the Credit Derivative Instrument Definition screen, click Premium.

Credit Derivative Instrument Definition screen with the Premium Details is displayed.

Figure 29-9 Credit Derivative Instrument Definition with Premium tab details

Description of "Figure 29-9 Credit Derivative Instrument Definition with Premium tab details" - On the Premium tab screen, specify the details as required.

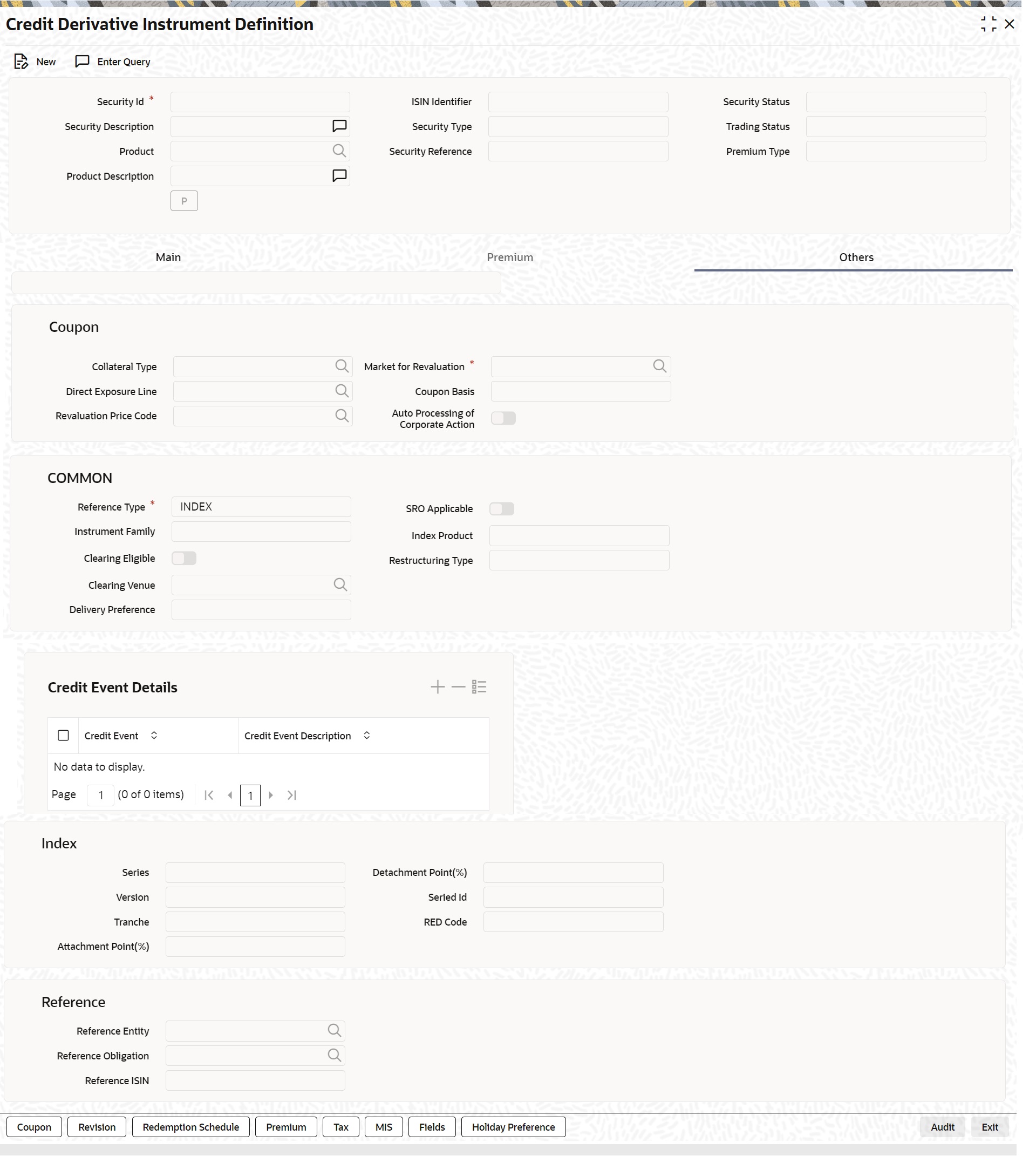

- On the Credit Derivative Instrument Definition screen, click Others.

Credit Derivative Instrument Definition screen with the Other Tab details is displayed.

Figure 29-10 Credit Derivative Instrument Definition with Other tab details

Description of "Figure 29-10 Credit Derivative Instrument Definition with Other tab details" - On the Other tab, specify the details as required.

For information on fields, see the below table:

Table 29-7 Other Description - Field Description

Feld Description Series

Specify the Series of the index instrument.

Note:

Disabled if reference type is SINGLENAME. The value has to be greater 0.

Version

Specify the Version of the index instrument.

Note:

Disabled if reference type is SINGLENAME. The value has to be greater 0.

Tranche

Exposure portion in the instrument.

Note:

Disabled if reference type is SINGLENAME.

Attachment point(%)

Payments are made by the protection seller (Instrument Buyer) when the losses are greater than the attachment point.

Note:

Disabled if reference type is SINGLENAME. The range allowed is between 0 to 100.

Detachment point(%)

Payments are made by the protection seller (Instrument Buyer) when the losses are greater than the attachment point.

Note:

Disabled if reference type is SINGLENAME. The range allowed is between 0 to 100.

Note:

Ensure the value is greater than attachment point (%).

Series ID

Unique combination of Series + Version + Tranche for confirmation purposes

Note:

Disabled if reference type is SINGLENAME. The range allowed is between 0 to 100.

RED code

For INDEX: Identifies the Series. (9 Chars).

For SINGLENAME: Identifies the Reference Entity and Obligation. (12 Chars).

Reference entity

Underlying Corporate or Sovereign Entity whose credit risk is transferred.

Not applicable for Index instruments.

Reference obligation

Preferred Security issued by the Reference Entity, to be delivered when Credit event happens.

Not applicable for Index instruments

Reference ISIN

ISIN identifier of the reference obligation

Parent topic: Credit Derivative Instrument Product Definition