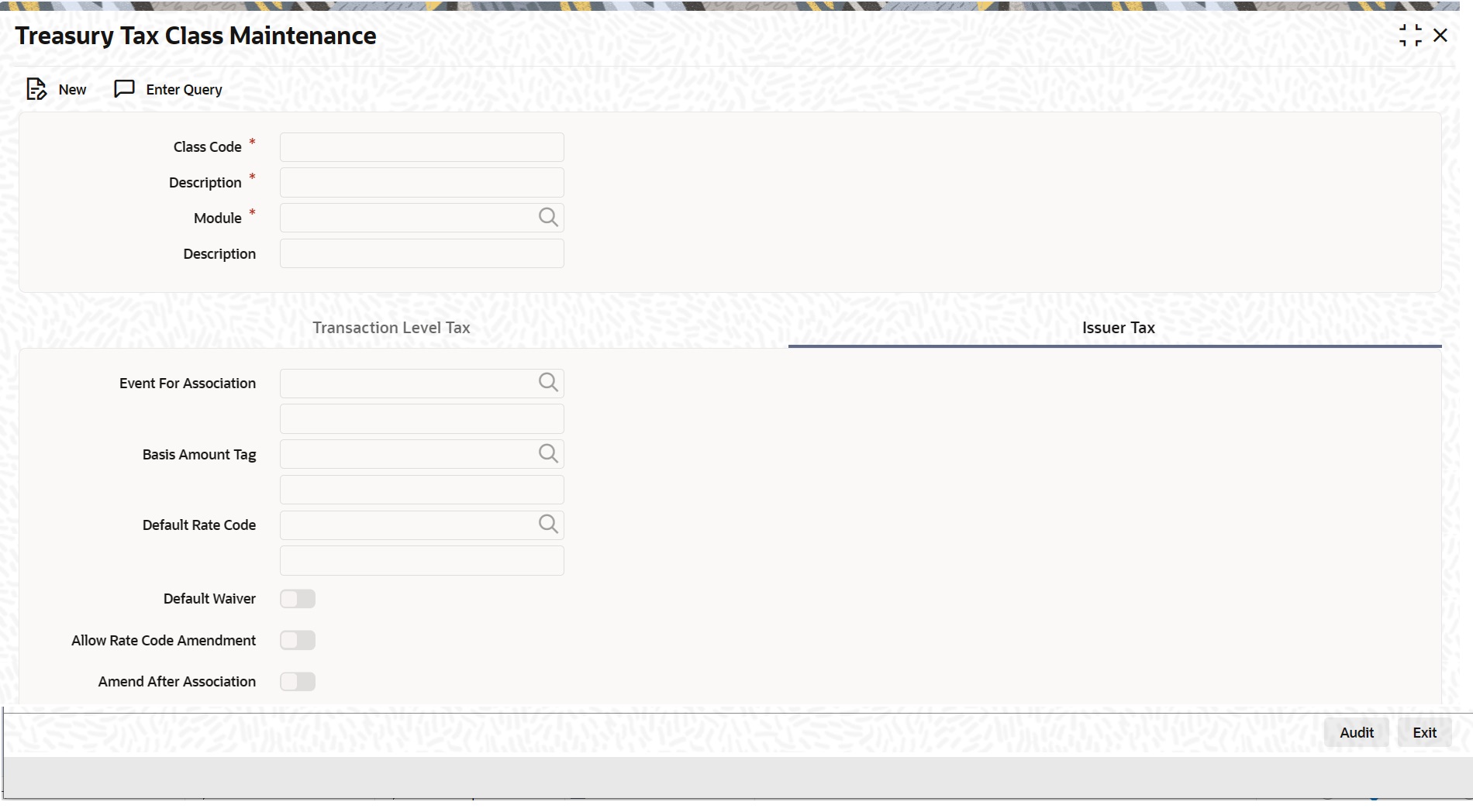

1.7.2 Define Issuer Taxes as Classes

An issuer tax can be levied on the coupon paid, or on a cash dividend. The issuer

of a security determines the tax. To process the tax levied on a security, you have to

maintain Issuer Tax classes.

Parent topic: Tax Components as Classes