1.5 Treasury Branch Parameters Maintenance

This topic describes the systematic instructions to maintain branch parameters.

- On the Home page, enter the STDTRBRN in the text box, and click next arrow.

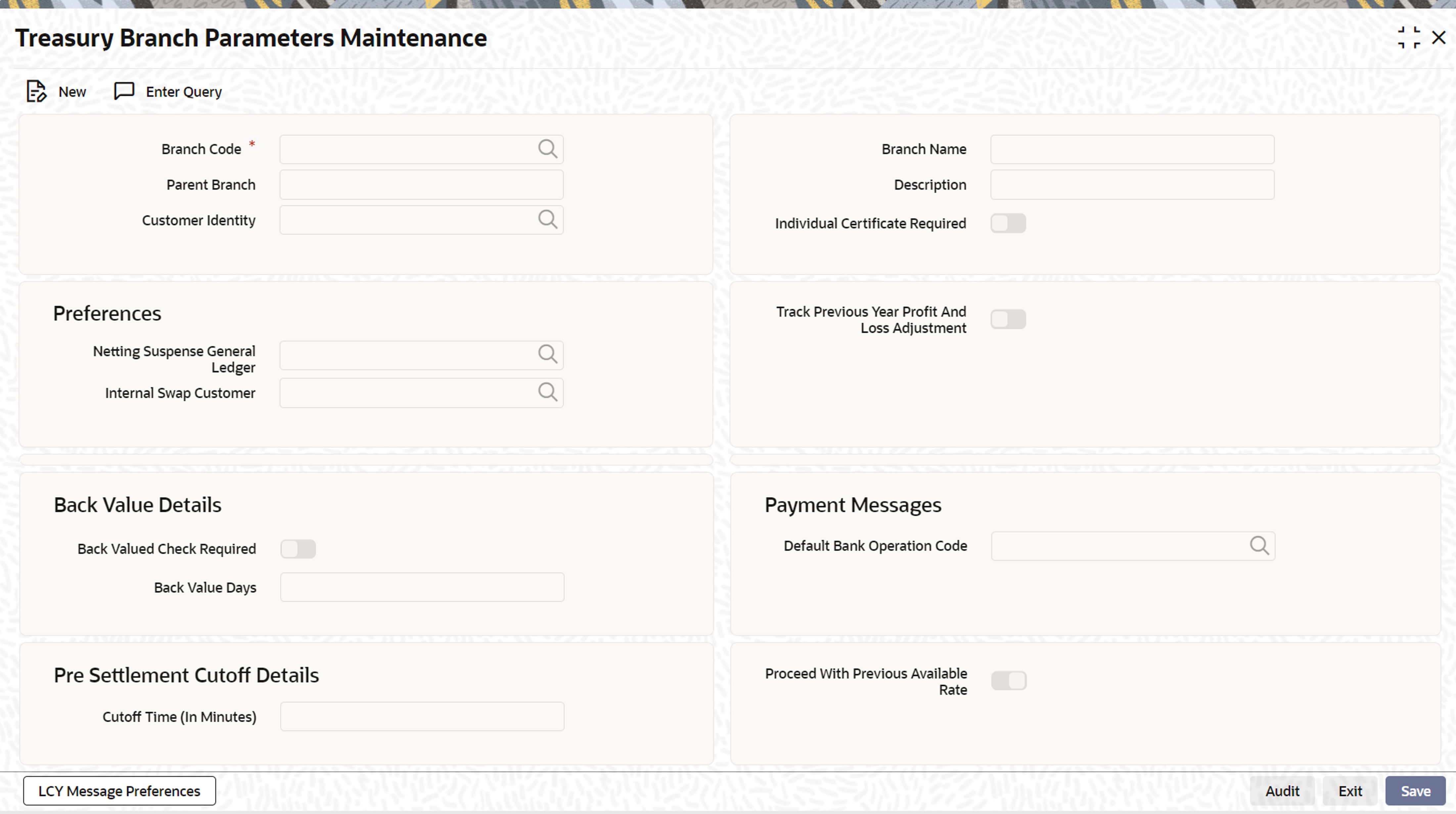

The Treasury Branch Parameters Maintenance screen is displayed.

Figure 1-2 Treasury Branch Parameters Maintenance

Description of "Figure 1-2 Treasury Branch Parameters Maintenance" - On the Treasury Branch Parameters Maintenance screen,

specify the fields.

For more information on fields, refer to the below table.

Table 1-2 Treasury Branch Parameters Maintenance- Field Description

Field Description Branch Code Select the branch code from the available list of values.

Parent Branch Specify the name of the parent branch.

This is the name of the office or branch, the code of which is input.

Customer Identity Select the customer identity number of the branch from the available list of values.

Branch Name Displays the branch name for the selected branch code.

Individual Certificate Required Select the Individual Certificate Required check box, if individual certificate is required for the branch.

Netting Suspense General Ledger Select the general ledger code from the available list of values.

The net amount of the settlement is transferred through the Nostro accounts.

For example, let us take the following two outstanding contracts entered into by bank A from bank B and both contracts settling on January 10, 1998. Bank A bought 1 Million USD from bank B in exchange for 35 Million INR and sold 1/2 million USD to bank B in exchange for 18 million INR.

The above contracts can be settled in either of the two ways given below, on the settlement date: Settle both contracts separately or Net the settlements of the two contracts.

Internal Swap Customer Specify an internal swap customer for processing internal swaps.

The names of all the customers of your bank will be displayed in the option-list provided. This will be a unique customer meant for processing internal swaps.

Back Value Days If you enable the Back Value Check Required option, you must indicate the number of calendar days up to which back-valued transactions can be allowed. During transaction processing you will be allowed to post back-valued transactions up to the specified date in the past (no check will be done).

Further, if the option is checked but you have not maintained the Back Value Days’ (maintained as NULL), the system interprets it to be ‘Zero’ days allowed (for back valued transactions). The restriction for the maximum period up to which back valued posting can be allowed, and made available on the transactions.

Default Bank Operation Code Select the default bank operation code from the available list of values for the required Payment Message.

Track Previous Year Profit and Loss Adjustment Select the Track Previous Year Profit and Loss Adjustment check box to track the previous year profit and loss adjustment.

Proceed with Previous Available rate By Default the Proceed with Previous Available rate is selected.

In this case during EOD processing, the system checks for rate availability for that particular effective date in the floating rate table and if rates are not available for that date, then rate revision event is applied on contracts with the previous latest rate available in the system.

When the check box is not enabled, then during EOD processing, the system skips Rate fixing and revision event process on respective contracts in case when the rate for that effective date is not available. Once rates are available/uploaded in system then user has an option to execute rate-fixing process on adhoc basis.

Back value Check Required Select the Back value Check Required check box to enable the back value check.

Default Bank Operation Code Select the default bank operation code from the available list of values.

Cutoff Time (In Minutes) Specify the cutoff time in minutes which is used for deciding whether the deal falls with the cut off or not in minutes. Validation is available to ensure that the value maintained in this field does not accept any decimal value or negative values.

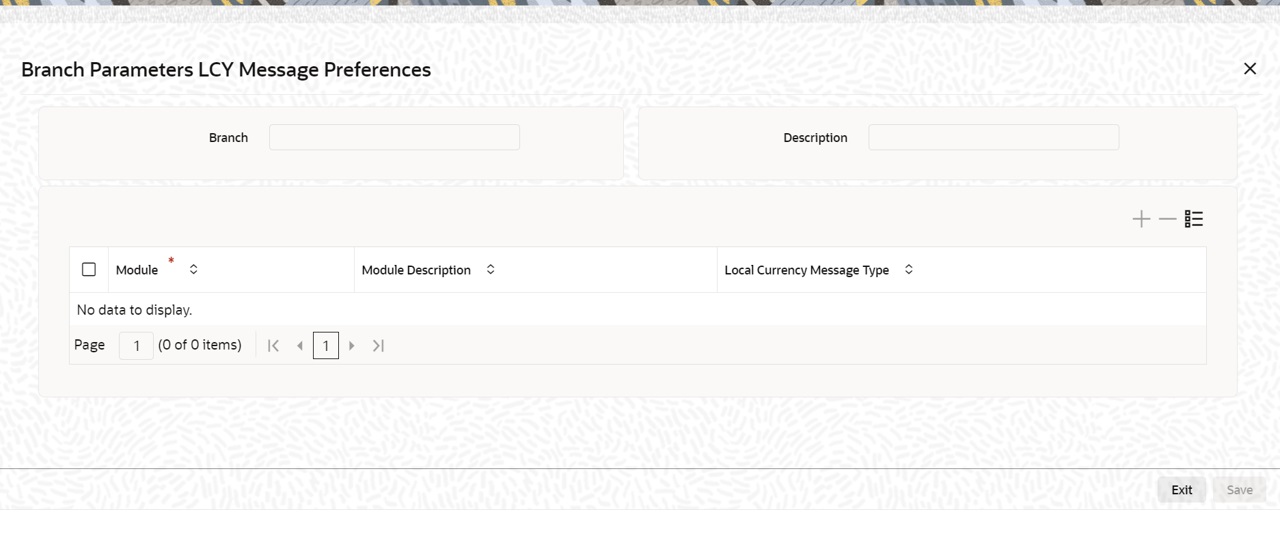

- On the Treasury Branch Maintenance screen, click LCY Message Preference available at the bottom of the screen.The Branch Parameters LCY Message Preferences screen is displayed.

Figure 1-3 Branch Parameters LCY Message Preferences

Description of "Figure 1-3 Branch Parameters LCY Message Preferences" - On Branch Parameters LCY Message Preferences, specify the fields.

For more information on fields, refer to the below table.

Table 1-3 Branch Parameters LCY Message Preferences- Field Description

Filed Description Branch Displays the branch code.

Description Displays the branch description.

Module Specify the module code.

Module Description Specify description of the module.

Local Currency Message Type Select the local currency message from the drop-down list, the available options are:

- Suppress LCY

- Generate LCY Message Through SWIFT

- General Local Payments

Parent topic: Core Maintenance