5.23.1 Internal Swap Transactions

Define internal swap transactions through the Internal Swap Transactions screen. An Internal swap transaction is a combination of FX and MM transactions generated for a deal between the FX desk and MM desk.

- On the Home page, type FXDSWPIN in the text box, and click next arrow.

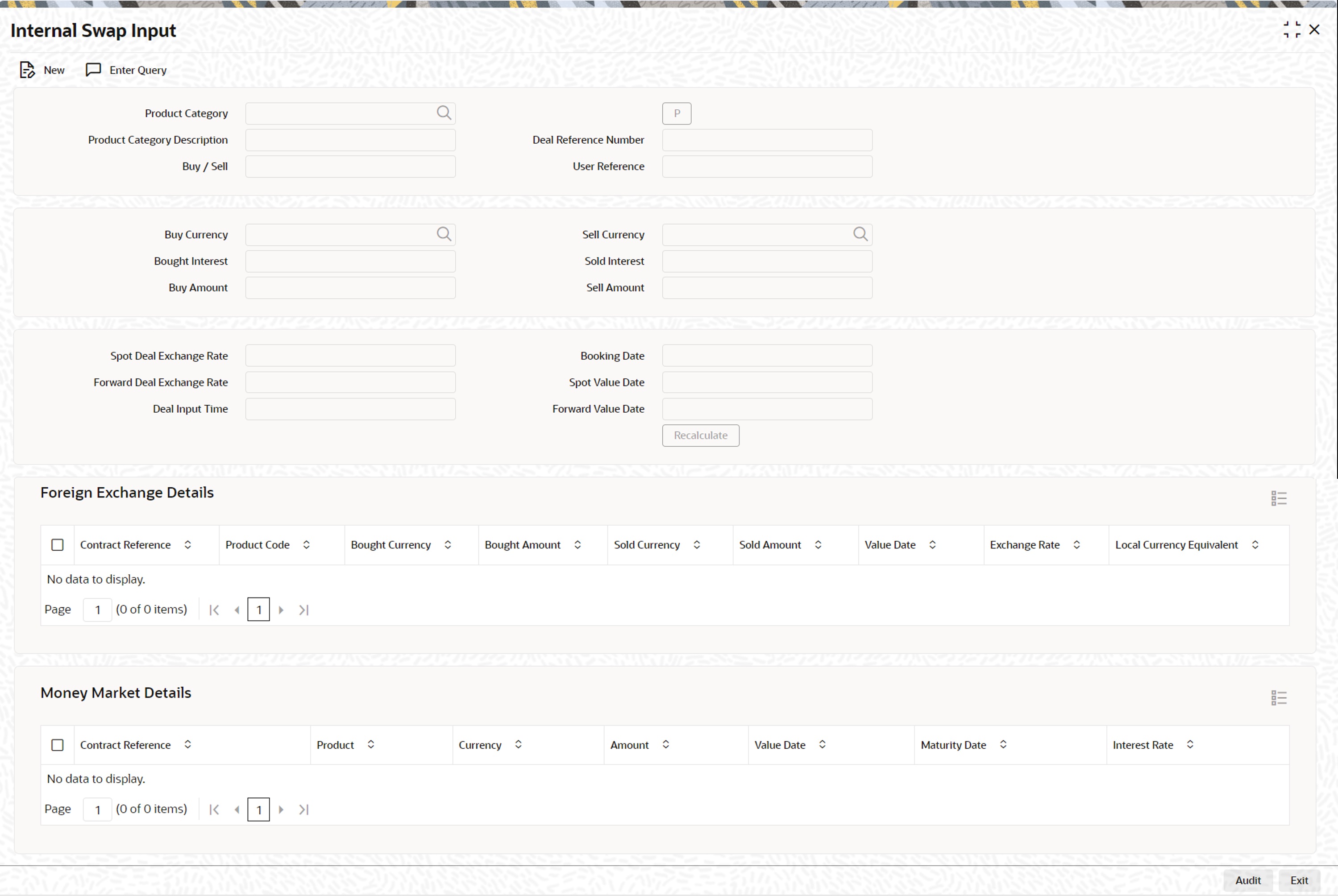

Internal Swap Input screen is displayed.

Figure 5-28 Internal Swap Input

Description of the illustration fxdswpin__cvs_main.jpg - Click New on the Internal Swap Input screen and specify the details as required. Click Save to save the details, or click Cancel.

For information on fields, refer to xref.

Table 5-25 Internal Swap Input - Field Description

Field Description Product Category

You need to specify a product category for an internal swap transaction. All valid (Open and authorized) internal swap product categories will be available for selection.

Deal Reference Number

This is a 16 digit system generated reference number that will be used to link all the generated transactions. This will be generated using the product category which has been selected. This is a display field.

User Reference No.

You need to specify a User Reference Number. It should not exceed 16 characters. The number cannot be modified once it has been authorized

Buy Sell Indicator

You need to select the Buy/Sell indicator from the option list provided.

Buy Currency

You need to specify a currency. This will be used as the bought currency for the FX Spot transaction, the sold currency for the FX forward transactions and the currency for the placement transaction.

Sell Currency

You need to specify a currency. This will be used as the sold currency for the sold currency of the FX spot transaction, the bought currency for the FX forward transaction and the currency for the borrow transaction.

Buy Amount

You need to specify an amount. This will be used as the bought amount for the FX Spot transaction and the amount for the Placement transaction.

Sell Amount

You need to specify an amount. This will be used as the sold amount for the FX Spot transaction and the amount for the borrowing transaction.

Bought Interest

Specify the positive or negative interest rate for the MM placement transaction. Enter this value if the buy/sell indicator is chosen as Buy. If the internal swap transaction is Sell, then the system calculates the interest rate as positive, negative, or zero during the processing of the transaction and displays the value in this field.

Sold Interest

Specify the positive or negative interest rate for the MM borrow transaction. Enter this amount if the Buy/Sell indicator is chosen as Sell. If the internal swap transaction is Buy, then the system calculates the interest rate as positive, negative or zero during the processing of the transaction and displays the value in this field.

Spot Deal Exchange Rate

Specify the exchange rate for the Spot FX transaction. If the amounts are specified, then the system will calculate the exchange rate.

Spot Value Date

This indicates the settlement date for the spot FX transaction and the value date for the MM borrow and placement transactions. The Application Date appears in this field by default and cannot be changed.

Forward Deal Exchange Rate

Specify the exchange rate for the forward FX transactions.

Forward Value Date

Specify the date that will be used as the settlement date for the Forward transactions and the maturity date for borrowing and placement transactions.

The screen will also display the individual transactions created in detail blocks upon authorization of the internal swap input transaction. Three FX transactions created will be created within a single block and two MM transactions will be created in the other.

Deal Input time

This field captures the deal execution time at the time of deal booking received from front office.

Format: YYYY-MM-DD HH:MM:SS:SSS (Default).

Here SSS is milliseconds.

Note: The above format can be changed in the user setting option based on requirement.

System throws an error when you give the wrong date or time format on modification.

The information displayed for the FX transactions will be as follows:

- FX Contract Reference Number

- Product Code

- Bought Currency

- Bought Amount

- Sold Currency

- Sold Amount

- Value Date

- Exchange Rate

The information displayed for the MM transactions will be as follows:

- MM Contract Reference Number

- Product Code

- Currency

- Amount

- Value Date

- Maturity date

- Interest Rate

Parent topic: Internal Swap Transactions Details