4.7.5 Cash Collateral Assignment

Cash Collateral can be transferred using Collateral Assignment Process function.

- This function is used for stand-alone cash margin transfer for the selected Agreement, Portfolio or Contract

- Applicable only when Cash Collateral is allowed for the selected Agreement, Portfolio or Contract

The details that can be captured for processing Cash Collateral Assignment include,

- Margin currency, Margin Account, Margin amount to be transferred and whether it is paid or received by the bank

- Can indicate whether the cash transferred as collateral should be net settled with other cash components to be settled with the same party

- If netting is applicable, can capture the Settlement scheme for netting, settlement amount and FX rate used for converting the margin amount in margin currency to Settlement amount in settlement currency

- Settlement details (SSI) to be used for funds transfer, as agreed with the collateral party

User can view the details for,

- Margin Account currency and branch

- Margin calculated and the current balance in the Margin account

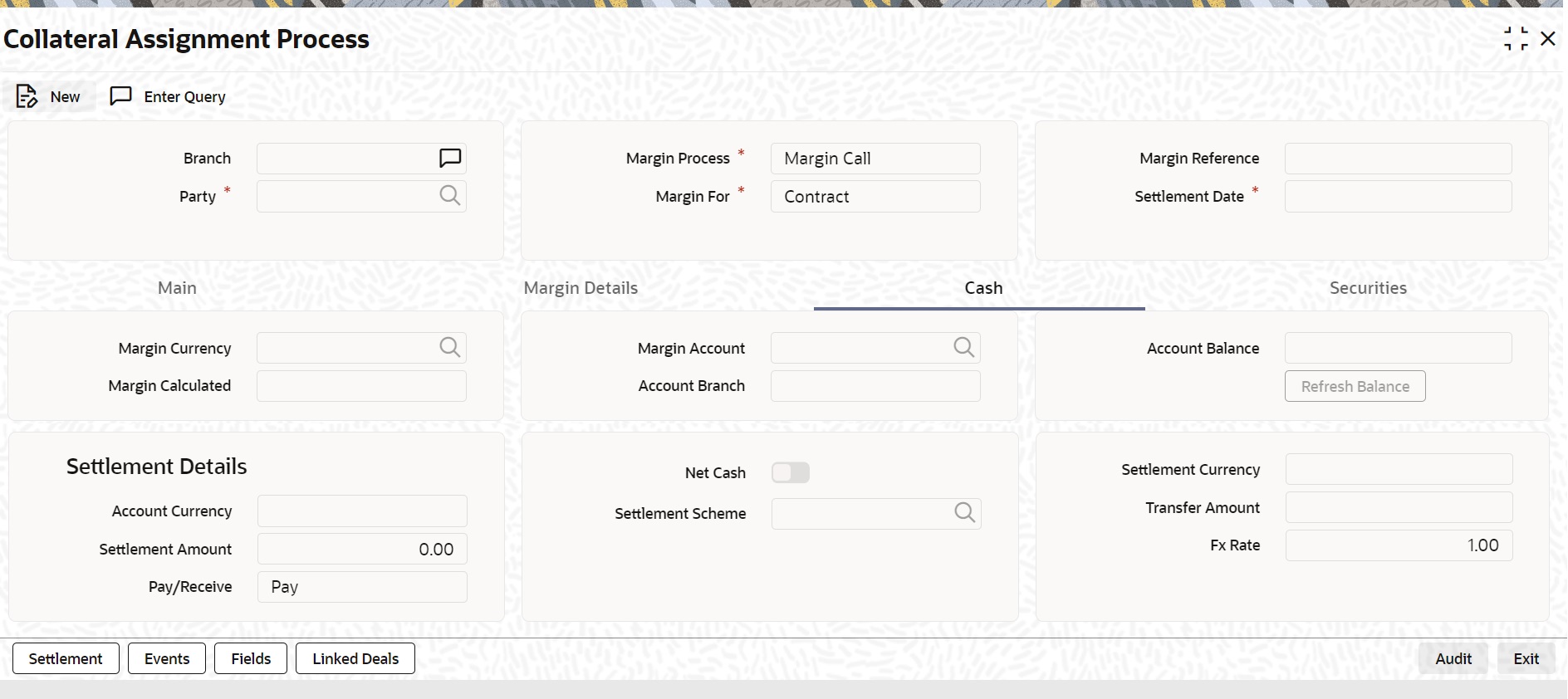

Click the Cash tab of the Collateral Assignment Process (SRDMRONL) function to initiate cash collateral assignment

Figure 4-6 Collateral Assignment Process - Cash

The following table describes the fields captured to initiate a Cash Collateral Assignment.

* Indicates mandatory fields.

Table 4-5 Collateral Assignment Process - Cash

| Field | Description |

|---|---|

|

Margin Currency |

Displays the currency in which the margin required is calculated for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Margin Calculated |

Displays the maximum cash Margin calculated in Margin Currency, for the exposure determined as of the Process Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Margin Account |

Select the Margin Account to which the cash margin is transferred, for the selected Margin Type.

|

|

Account Branch |

Displays the branch to which the selected Margin Account belongs to.

|

|

Account Balance |

Displays the current balance in the Margin Account before this collateral assignment transaction.

|

|

Settlement Details |

Group of fields to capture the details for cash margin amount to be settled. |

|

Account Currency |

Displays the currency of the selected Margin Account.

|

|

Margin Transferred |

Enter the Margin Call amount in Account CCY to be transferred as of the Settlement Date, for the selected Margin Type.

|

|

Pay / Receive |

Select the direction of the Margin Call to be transferred.

|

|

Net Cash |

Indicate whether the cash margin transferred should be net settled with other cash components to be settled with the same party.

|

|

Settlement Scheme |

Select the Settlement Scheme for which pre-netting is initiated.

|

|

Settlement Currency |

Displays the currency of the settlement scheme selected, in which the settlement happens.

|

|

Settlement Amount |

Displays the Margin Call amount to be transferred in Settlement Currency.

|

|

Fx Rate |

Enter the exchange rate to be used when Account Currency is different from the Settlement Currency of the Scheme.

|

Click the Refresh Balance button to update the Cash tab’s current margin account balance automatically.

Parent topic: Main Criteria