4.7.7 Securities Collateral Assignment

Securities Collateral can be transferred using ‘Collateral Assignment Process’ function.

- This function is used for stand-alone securities margin transfer for the selected Agreement, Portfolio or Contract

- Applicable only when Securities Collateral is allowed for the selected Agreement, Portfolio or Contract

The details that can be captured for processing Securities Collateral Assignment include,

- Securities that are transferred as part of this collateral transaction

- Quantity of each security, the price considered for valuing the security and Haircut applied

- Portfolio and Custodial (SKL) details for transferring the security

- Can specify whether the securities collateral assigned as part of this transaction should be transferred individually or netted with other securities collateral or market transactions

- Settlement Parties to be used as intermediaries for delivery Securities, as agreed with the collateral party

The following details are displayed for each security transferred.

- Accrued interest, Nominal, Premium / Discount automatically calculated using quantity and price input for the security

- Collateral value calculated after applying hair cut applicable for the security

- Important attributes and quotation preferences defined for the security master

User can view the details for,

- Margin currency, Margin calculated and current balance of security collateral already available for the selected Agreement or Portfolio or Contract

- Value of security collateral transferred as part this transaction

- Block deal or Security deal created for transferring the security provided as collateral, while querying the collateral assignment transaction

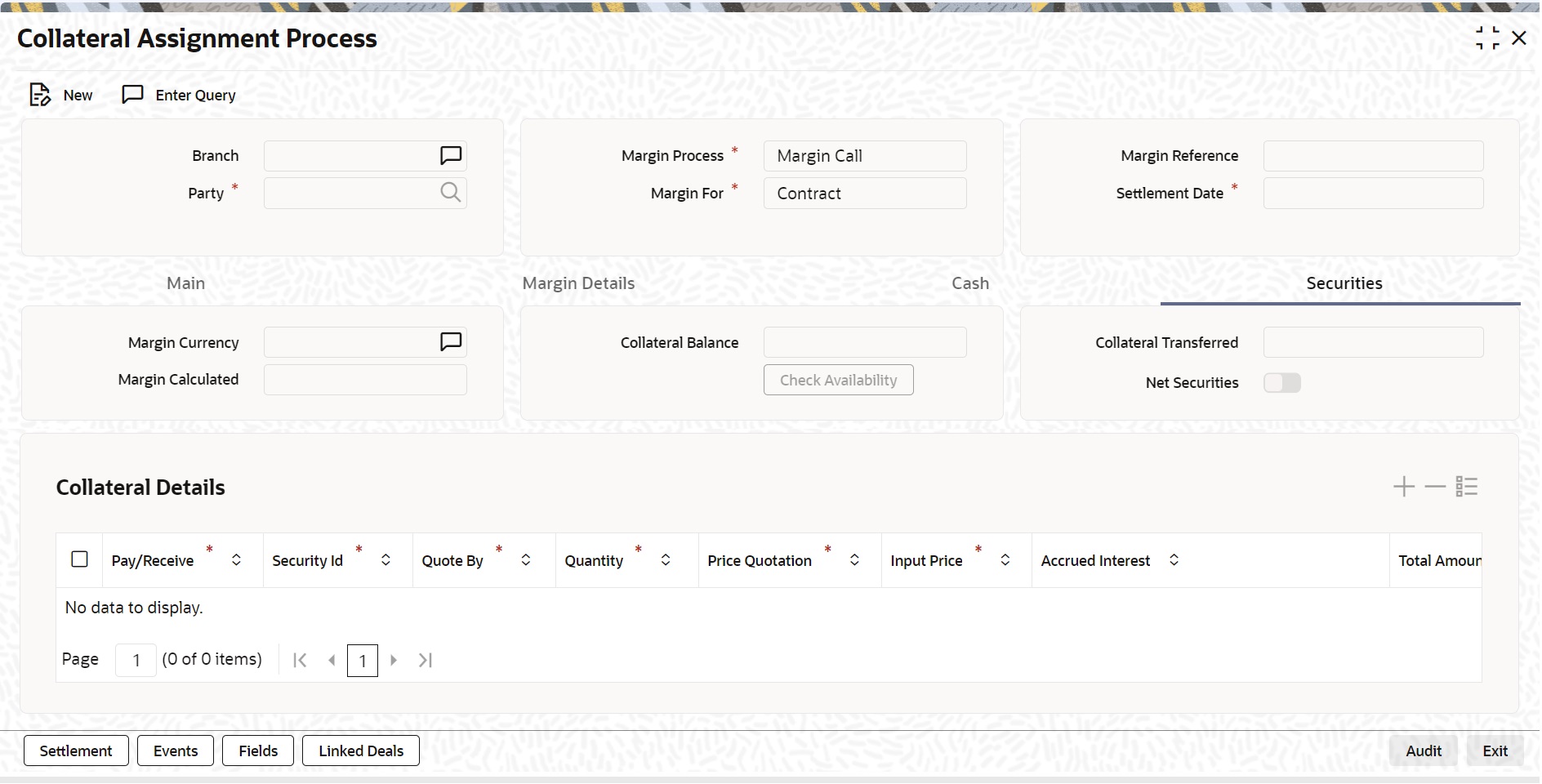

Click the Securities tab of the Collateral Assignment Process (SRDMRONL) function to initiate securities collateral assignment

Figure 4-8 Collateral Assignment Process - Securities

The following table describes the fields captured to initiate a Securities Collateral Assignment.

* Indicates mandatory fields.

Table 4-6 Collateral Assignment Process - Securities

| Field | Description |

|---|---|

|

Margin Currency |

Displays the currency in which the margin required is calculated for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Margin Calculated |

Displays the maximum securities Margin calculated in Margin Currency, for the exposure determined as of the Process Date, for the Agreement or Portfolio or Contract selected for Collateral Assignment, for the selected Margin Type.

|

|

Collateral Balance |

Displays the balance of security collateral already available for the selected Agreement or Portfolio or Contract, before this collateral assignment transaction.

|

|

Collateral Transferred |

Displays the value of all the securities assigned as collateral for this transaction.

|

|

Net Securities |

Indicate whether the securities transferred as collateral should be net settled with other securities to be settled with the same party through the same SK Location.

|

|

Collateral Details |

Group of fields to capture the details for securities to be transferred as collateral. |

|

Pay / Receive |

Select the direction of the Securities collateral transfer.

|

|

Security Id |

Select the Security to be transferred as collateral.

|

|

Quote By |

Displays the Quantity quotation method followed for the security.

|

|

Quantity |

Enter the quantum of the selected Security to be transferred as collateral.

|

|

Price Quotation |

Displays the Price quotation method followed for the security.

|

|

Input Price |

Enter the price used for calculating the value of the selected Security to be transferred as collateral.

|

|

Accrued Interest |

Displays the interest accrued for the Security, from the previous coupon date till the settlement date of the collateral assignment transaction.

|

|

Total Amount |

Displays the total market value of the of the selected Security to be transferred as collateral.

|

|

Hair Cut % * |

Enter the Hair cut to be applied on the market value to arrive at the collateral value of the selected Security.

|

|

Include Interest |

Indicate whether Accrued Interest should be considered for calculating the collateral value for the selected Security to be transferred as collateral.

|

|

Collateral Value |

Displays the Collateral value calculated by applying the Hair cut specified on the market value of the selected Security.

|

|

Portfolio Id |

Select the Market Portfolio from which the selected Security is transferred as collateral.

|

|

SK Location |

Select the SK Location linked to the selected Market Portfolio, from where the selected Security is transferred as collateral.

|

|

SK Account |

Select the SK Account of the selected SK Location and linked to the selected Market Portfolio, from where the selected Security is transferred as collateral.

|

|

Settlement SKL |

Select the Settlement SKL through which selected collateral security would be settled.

|

|

Collateral Portfolio |

Select the Collateral Portfolio in which the security transferred as collateral is tracked.

|

|

Collateral SK Location |

Select the Collateral SK Location linked to the selected Collateral Portfolio, where the Security transferred as collateral is tracked.

|

|

Collateral SK Account |

Select the Collateral SK Account of the selected Collateral SK Location and linked to the selected Collateral Portfolio, where the Security transferred as collateral would be tracked.

|

|

Available Position |

Displays the position available for transfer in the selected security, portfolio and SK location. |

|

Deal Type |

Displays the type of the security deal created for transferring the selected security as collateral with the collateral party.

|

|

Deal Reference |

Displays the contract reference of the security deal created for transferring the selected security as collateral with the collateral party. |

|

Internal Deal Type |

Displays the type of the internal security deal created for transferring the selected security from market portfolio to collateral portfolio. |

|

Internal Deal Reference |

Displays the contract reference of the internal security deal created for transferring the selected security from market portfolio to collateral portfolio. |

|

Deal Version |

Displays the current version of the Security deal created for transferring the selected Security as collateral. |

|

Series |

Select the Series of the Security to be transferred as collateral.

|

|

Security Form |

Displays the format in which security is issued and traded. |

|

Interest Quotation |

Displays the Interest quotation method followed for the security.

|

|

Security Currency |

Displays the currency of the selected Security. |

|

Face Value |

Displays the current face value of the selected Security. |

|

Deal Quantity |

Displays the number of units of the selected Security that is transferred as collateral. |

|

Nominal Amount |

Displays the total Nominal Value, in Security Currency, of the selected Security that is transferred as collateral. |

|

Premium |

Displays the Premium amount, in Security Currency, considered in addition to the nominal amount, to arrive at the market value of the selected Security. |

|

Discount |

Displays the Discount amount, in Security Currency, considered as rebate from the nominal amount, to arrive at the market value of the selected Security. |

|

Fx Rate |

Displays the exchange rate to be used for calculating the Collateral value, when Security Currency is different from the Margin Currency.

|

On click of Check Availability button, system automatically checks the available balance in the Security as of the Settlement Date in the selected Portfolio and SK Location.

Parent topic: Main Criteria